To determine: The Offer Price per share.

Introduction:

The term dividends allude to that portion of proceeds of an organization which is circulated by the organization among its investors. It is the remuneration of the investors for investments made by them in the shares of the organization. A dividend policy is an organization's way to deal with disseminating revenues back to its proprietors or investors. In the event that an organization is in a development stage, it might conclude that it won't pay profits, but instead re-contribute its

Answer to Problem 1MC

Solution: The Offer Price per share is $39.17.

Explanation of Solution

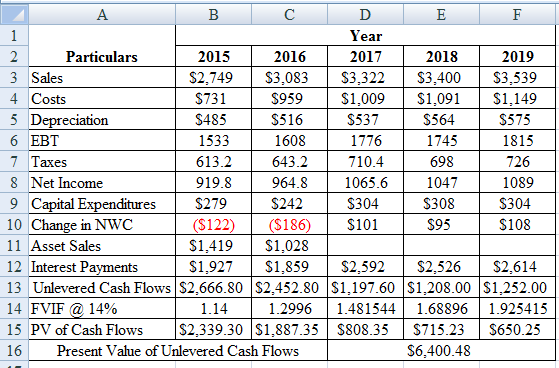

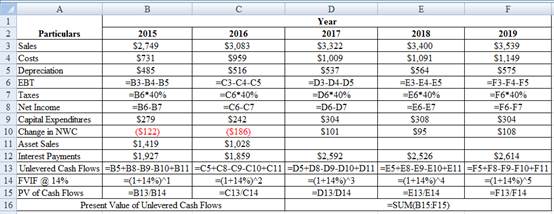

Determine the Present Value of Unlevered Cash Flows for the initial 5 years

Using a excel spreadsheet we calculate the present value of unlevered cash flows for the initial 5 years as,

Excel Spreadsheet:

Excel Workings:

Therefore the Present Value of Unlevered Cash Flows for the initial 5 years is $6,400.48

Determine the Unlevered Value of Cash Flow in Year 5

Therefore the Unlevered Value of Cash Flow in Year 5 is $12,341.14

Determine the Terminal Value at the end of Year 5

Therefore the Terminal Value at the end of Year 5 is $6,409.60

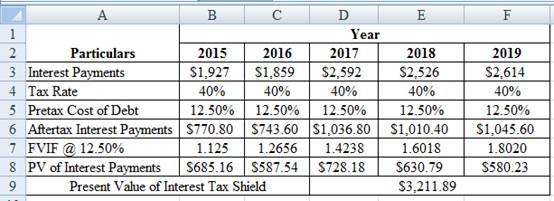

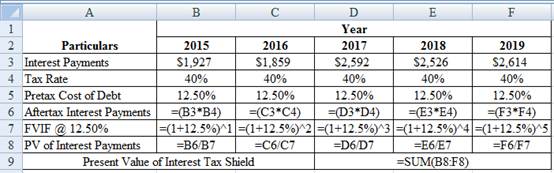

Determine the Present Value of Interest Tax Shield

Using a excel spreadsheet we calculate the present value of interest tax shield as,

Excel Spreadsheet:

Excel Workings:

Therefore the Present Value of Interest Tax Shield is $3,211.89

Determine the Levered

Therefore the Levered Cost of Equity using MM Proposition II with Corporate Taxes is 14.90%

Determine the WACC after Year 5

Therefore the WACC after Year 5 is 13.12%

Determine the Terminal Value of Levered Company after Year 5

Therefore the Terminal Value of Levered Company after Year 5 is $13,470.06

Determine the Interest Tax Shield after Year 5

Therefore the Interest Tax Shield after Year 5 is $1,128.92

Determine the Present Value of Interest Tax Shield after Year 5

Therefore the Present Value of Interest Tax Shield after Year 5 is $626.47

Determine the Value of Unlevered Cash Flows

Therefore the Value of Unlevered Cash Flows is $12,810.08

Determine the Value of Interest Tax Shield

Therefore the Value of Interest Tax Shield is $3,838.36

Determine the Offer Price per share

Therefore the Offer Price per share is $39.17,

Want to see more full solutions like this?

Chapter 18 Solutions

UPENN: LOOSE LEAF CORP.FIN W/CONNECT

- Yatta Net International has manufacturing, distribution, retail, and consulting divisions. Projects undertaken by the manufacturing and distribution divisions tend to be low-risk projects, because these divisions are well established and have predictable demand. The company started its retail and consulting divisions within the last year, and it is unknown if these divisions will be profitable. The company knew that opening these new divisions would be risky, but its management believes the divisions have the potential to be extremely profitable under favorable market conditions. The company is currently using its WACC to evaluate new projects for all divisions. If Yatta Net International does not risk-adjust its discount rate for specific projects properly, which of the following is likely to occur over time? Check all that apply. The firm will accept too many relatively risky projects. The firm will become less valuable. The firm will accept too many relatively safe…arrow_forwardAhorita Company manufactures wireless transponders for satellite applications. Ahorita has recently acquired Zelltech Company, which is primarily known for its software communications development but also manufactures a specialty transponder under the trade name “Z-Tech” that competes with one of Ahorita’s products. Ahorita will now discontinue Z-Tech and projects that its own product line will see a market share increase. Nonetheless, Ahorita’s management will maintain the rights to the Z-Tech trade name as a defensive intangible asset to prevent its use by competitors, despite the fact that its high-est and best use would be to sell the trade name. Ahorita estimates that the trade name has an internal value of $1.5 million, but if sold would yield $2 million. Answer the following with supporting citations from the FASB ASC:a. How does the FASB ASC Glossary define a defensive intangible asset?b. According to ASC Topic 805, “Business Combinations,” what is the measurement principle…arrow_forwardPronghorn Inc. manufactures a variety of consumer products. The company’s founders have run the company for 30 years and are now interested in retiring. Consequently, they are seeking a purchaser who will continue its operations, and a group of investors, Morgan Inc., is looking into the acquisition of Pronghorn. To evaluate its financial stability and operating efficiency, Pronghorn was requested to provide the latest financial statements and selected financial ratios. Summary information provided by Pronghorn is as follows. Pronghorn Inc.Income StatementFor the Year Ended November 30, 2021(in thousands) Sales (net) $ 30,510 Interest income 510 Total revenue 31,020 Costs and expenses Cost of goods sold 17,610 Selling and administrative expenses 3,560 Depreciation and amortization expense 1,900 Interest expense 910 Total costs and expenses 23,980 Income before taxes 7,040…arrow_forward

- Ahorita Company manufactures wireless transponders for satellite applications. Ahorita has recently acquired Zelltech Company which is primarily known for its software communications development, but also manufactures a specialty transponder under the trade name “Z-Tech” that competes with one of Ahorita’s products. Ahorita will now discontinue Z-Tech and projects that its own product line will see a market share increase. Nonetheless, Ahorita’s management will maintain the rights to the Z-Tech trade name as a defensive intangible asset to prevent its use by competitors, despite the fact that its highest and best use would be to sell the trade name. Ahorita estimates that the trade name has an internal value of $1.5 million, but if sold would yield $2 million. a. How does the FASB ASC glossary define a defensive intangible asset? b. According to ASC Topi 805 Business Combinations, what is the measurement principle that an acquirer should follow in recording identifiable assets…arrow_forwardBlakefield, Inc. has grown significantly over the past decade through innovation and acquisition. Information on several of its divisions follows. • The OlliePods division sells children's recreational shoes. The division's president is responsible for all short-run decisions on the manufacturing and sale of the shoes. • The Polyspreen division manufactures the main ingredient for the shoes produced by Olliepods. All Polyspreen output is transferred to the OlliePods division. . All long-run strategic decisions for the Olliepods and Polyspreen divisions are made by the staff at corporate headquarters. Monk Recreation, which operates a regional chain of retail sporting goods stores, is Blakefield's newest corporate acquisition. Blakefield managers have decided to retain all Monk Recreation employees, and all decision-making responsibility related to the sporting goods stores remains with those employees. ● (a) Classify each of the three divisions of Blakefield, Inc. as a cost center, a…arrow_forwardAhorita Company manufactures wireless transponders for satellite applications. Ahorita has recently acquired Zelltech Company which is primarily known for its software communications development, but also manufactures a specialty transponder under the trade name “Z-Tech” that competes with one of Ahorita’s products. Ahorita will now discontinue Z-Tech and projects that its own product line will see a market share increase. Nonetheless, Ahorita’s management will maintain the rights to the Z-Tech trade name as a defensive intangible asset to prevent its use by competitors, despite the fact that its highest and best use would be to sell the trade name. Ahorita estimates that the trade name has an internal value of $1.5 million, but if sold would yield $2 million. Answer the following with supporting citations from FASB ASC a. How does the FASB ASC glossary define a defensive intangible asset? b. According to ASC Topi 805 Business Combinations, what is the measurement principle…arrow_forward

- Stark and Company is a manufacturer that sells robots predominantly in the Asian market. Times have been tough for the auto industry and Stark and Company is no different. The company is under tremendous pressure to turn a profit. Several years ago, as analysts were predicting a large downturn in the robot industry, Stark decided to purchase a smaller niche robot maker in the hopes of capturing a different segment of the consumer market and to better learn the manufacturing processes of other robot makers. Starks still operates as two separate divisions, Classic and New Age, with each division manager employing a different manufacturing philosophy. The Classic manager is concerned with low input costs and quantity in production in addition to brand recognition and robot power. The New Age manager is concerned with quality and innovation in manufacturing, fuel-efficient and environmentally friendly robots. SAC continued to suffer losses even with the addition of the New Age division.…arrow_forwardThe OakTree Group is a 75-year old company founded in Hong Kong. The Group comprises of two majorbusinesses: a publishing business known as Fairmont Publishing and an insurance business namedGeneralife. The Group is currently organized in a decentralized manner with two businesses running asinvestment centers. However, with the recent retirement of many senior staff in OakTree, the CEO is verymuch concerned regarding the performance of the company under a new generation of leadership. In fact,the CEO is considering the possibility of restructuring the Group into a centralized structure.Fairmont Publishing is organized as a divisional structure with the presence of two divisions: Printed Mediaand Online Media. The following are summary financial information for 2019 and 2020: printed media Online Media 2019 2020 2019 2020 sale $18900 $19320 $25200 $26880 SG&A expenses $6590 $6520 $6092 $8564 Current assets $5670 $6600 $4050…arrow_forwardThe OakTree Group is a 75-year old company founded in Hong Kong. The Group comprises of two majorbusinesses: a publishing business known as Fairmont Publishing and an insurance business namedGeneralife. The Group is currently organized in a decentralized manner with two businesses running asinvestment centers. However, with the recent retirement of many senior staff in OakTree, the CEO is verymuch concerned regarding the performance of the company under a new generation of leadership. In fact,the CEO is considering the possibility of restructuring the Group into a centralized structure.Fairmont Publishing is organized as a divisional structure with the presence of two divisions: Printed Mediaand Online Media. The following are summary financial information for 2019 and 2020: Printed Media Online Media 2019 2020 2019 2020 sale $18900 $19320 $25200 $26880 SG&A expenses $6590 $6520 $6092 $8564 Current assets $5670 $6600 $4050…arrow_forward

- The OakTree Group is a 75-year old company founded in Hong Kong. The Group comprises of two majorbusinesses: a publishing business known as Fairmont Publishing and an insurance business namedGeneralife. The Group is currently organized in a decentralized manner with two businesses running asinvestment centers. However, with the recent retirement of many senior staff in OakTree, the CEO is verymuch concerned regarding the performance of the company under a new generation of leadership. In fact,the CEO is considering the possibility of restructuring the Group into a centralized structure.Fairmont Publishing is organized as a divisional structure with the presence of two divisions: Printed Mediaand Online Media. The following are summary financial information for 2019 and 2020: Printed Media Online Media 2019 2020 2019 2020 sale $18900 $19320 $25200 $26880 SG&A expenses $6590 $6520 $6092 $8564 Current assets $5670 $6600 $4050…arrow_forwardThe OakTree Group is a 75-year old company founded in Hong Kong. The Group comprises of two majorbusinesses: a publishing business known as Fairmont Publishing and an insurance business namedGeneralife. The Group is currently organized in a decentralized manner with two businesses running asinvestment centers. However, with the recent retirement of many senior staff in OakTree, the CEO is verymuch concerned regarding the performance of the company under a new generation of leadership. In fact,the CEO is considering the possibility of restructuring the Group into a centralized structure.Fairmont Publishing is organized as a divisional structure with the presence of two divisions: Printed Mediaand Online Media. The following are summary financial information for 2019 and 2020: Printed Media Online Media 2019 2020 2019 2020 sale $18900 $19320 $25200 $26880 SG&A expenses $6590 $6520 $6092 $8564 Current assets $5670 $6600 $4050…arrow_forwardThe OakTree Group is a 75-year old company founded in Hong Kong. The Group comprises of two majorbusinesses: a publishing business known as Fairmont Publishing and an insurance business namedGeneralife. The Group is currently organized in a decentralized manner with two businesses running asinvestment centers. However, with the recent retirement of many senior staff in OakTree, the CEO is verymuch concerned regarding the performance of the company under a new generation of leadership. In fact,the CEO is considering the possibility of restructuring the Group into a centralized structure.Fairmont Publishing is organized as a divisional structure with the presence of two divisions: Printed Mediaand Online Media. The following are summary financial information for 2019 and 2020: Printed Media Online Media 2019 2020 2019 2020 sale $18900 $19320 $25200 $26880 SG&A expenses $6590 $6520 $6092 $8564 Current assets $5670 $6600 $4050…arrow_forward

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub