Allocate the service department costs of company R using the reciprocal-services method in combination with the dual-allocation approach.

Explanation of Solution

Reciprocal-services method: The term reciprocal service refers to the circumstances under which two or more service departments provide services to each other. Under this method, in order to reflect the reciprocal provision of services among all other service departments, a system of simultaneous equations is established. When once it is established, “all other service departments’ costs are allocated among the departments that use the various service departments’ output of services”. Moreover, this is the only cost allocation method that fully accounts for the reciprocal provision of services among departments.

Allocate the service department costs of company R using the reciprocal-services method in combination with the dual-allocation approach as follows:

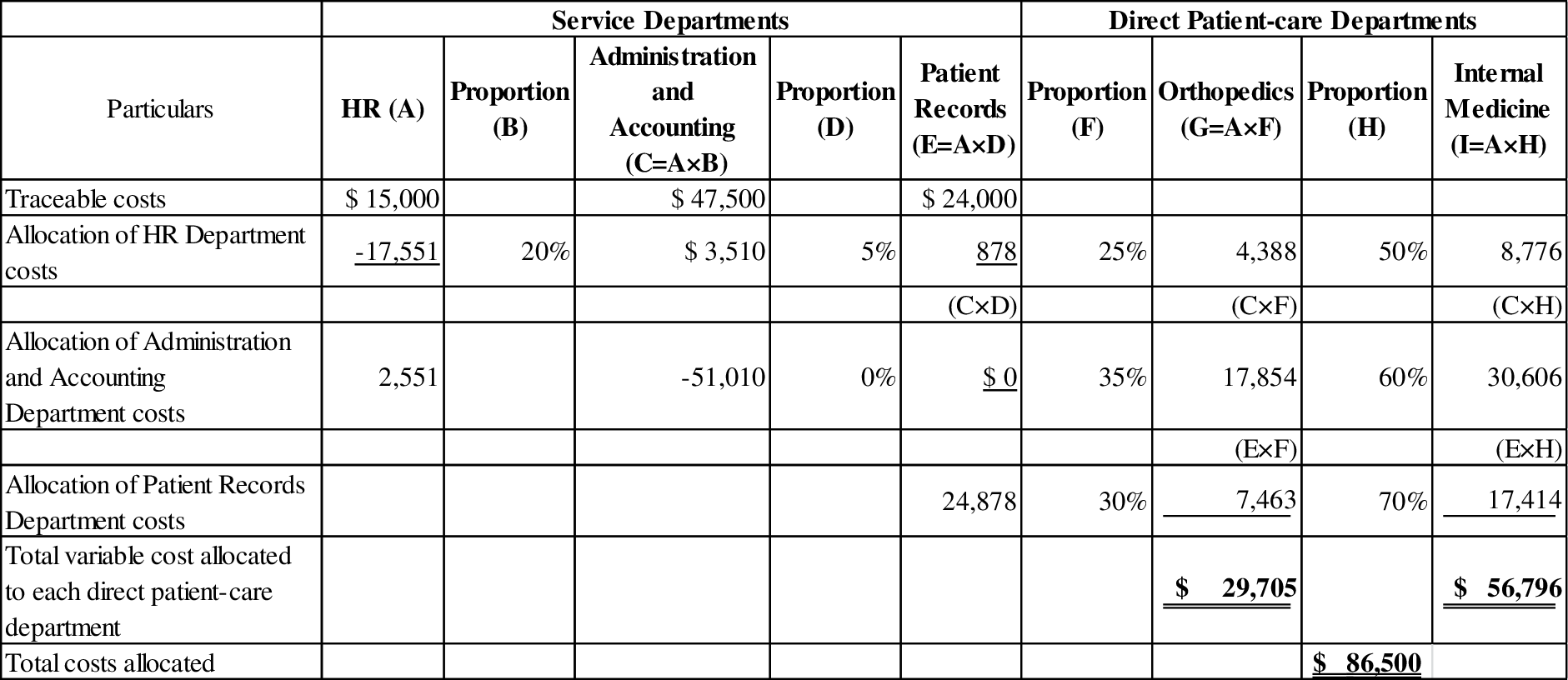

Variable costs under short-run proportions:

Table (1)

Working note (1):

Assume that:

- The total variable cost of Human resources is denoted as H.

- The total variable cost of Administration and Accounting is denoted as A, and

- The total variable cost of patient records is denoted as R.

The equations are as follows:

Now, Substitute equation (3) in equation (2).

Then, Substitute the computed value of H in equation (1) and (3):

Equation (1):

Equation (3):

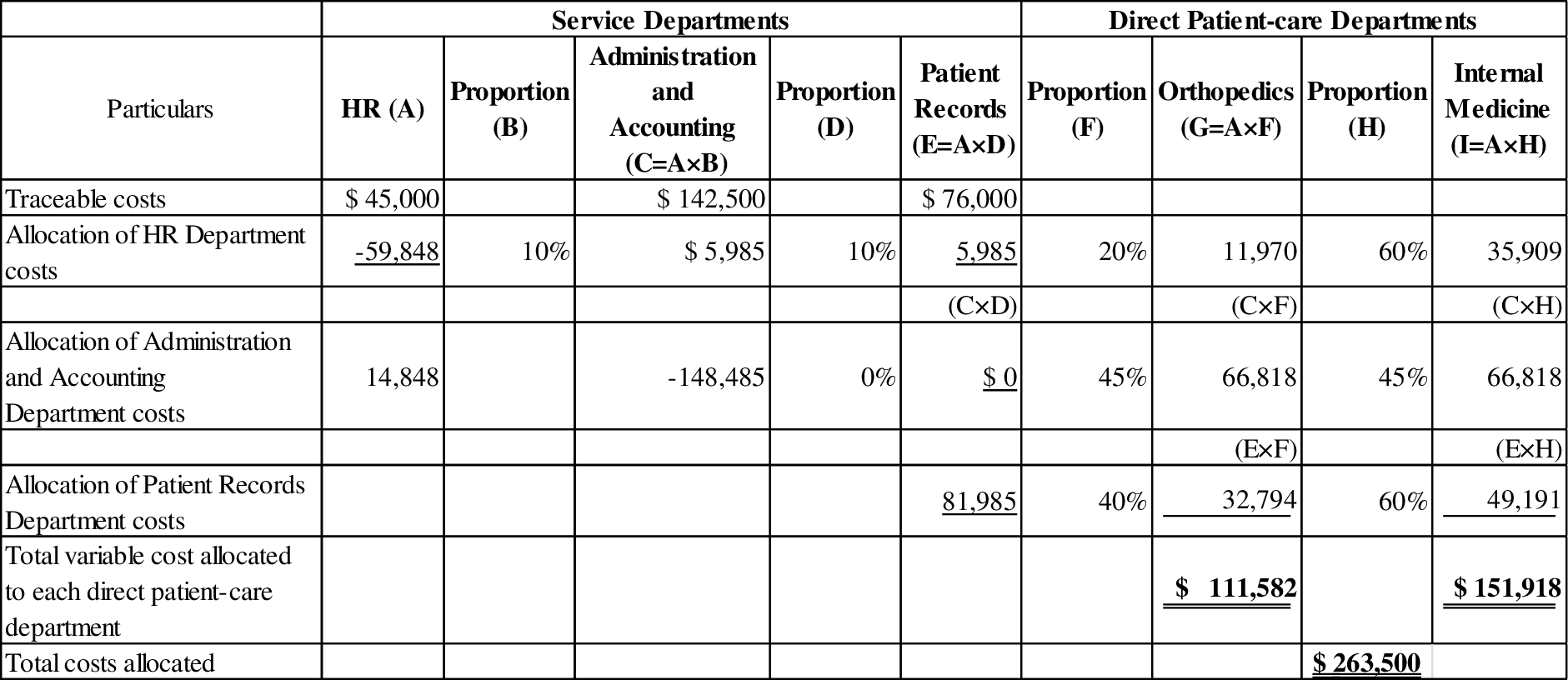

Fixed costs under long-run proportions:

Table (2)

Working note (2):

Assume that:

- The total variable cost of Human resources is denoted as H.

- The total variable cost of Administration and Accounting is denoted as A, and

- The total variable cost of patient records is denoted as R.

The equations are as follows:

Now, Substitute equation (6) in equation (5).

Then, Substitute the computed value of H in equation (4) and (6):

Equation (4):

Equation (6):

Total cost allocated:

| Particulars | Orthopedics | Internal Medicine |

| Variable costs | $ 29,705 | $ 56,796 |

| Add: Fixed costs | $ 111,582 | $ 151,918 |

| Total costs | $ 141,286 | $ 208,714 |

| Grand total | $350,000 | |

Table (3)

Want to see more full solutions like this?

Chapter 17 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Part 1: Allocate the costs of the 3 service departments using the direct method. Part 2: Allocate the costs of the 3 service departments using the step method, with the order determined by the greater percentage usage. Part 3: Allocate the costs of the 3 service departments using the reciprical method. Part 4:What is one strength and one drawback of each of the methods?arrow_forwardAllocate the two support departments’ costs to the two operating departments using the reciprocal method. Use (a) linear equations and (b) repeated iterations.arrow_forwardDirect Method Seattle Western University has provided the following data to be used in its service department cost allocations: Required: Using the direct method, allocate the costs of the service departments to the two operating departments. Allocate the Administration cost on the basis of student credit-hours and the Facility Services cost on the basis of space occupied.arrow_forward

- Discuss two different criteria Mr. Smith can use to determine the sequence for allocating support department costs using the step-down method.arrow_forwardAllocate the two support departments’ costs to the two operating departments using the following methods: The Algebraic/reciprocal method?arrow_forwardUnk The costs of the Accounting Department at Central Hospital would be considered by the Surgery Department to be: A. a) direct costs. B. b) indirect costs. C. c) incremental costs. D. d) opportunity costs. E. e) sunk costs.arrow_forward

- Lackawanna Community College has three divisions: Liberal Arts, Sciences, and Business Administration. The college's comptroller is trying to decide how to allocate the costs of the Admissions Department, the Registrar's Department, and the Computer Services Department. The comptroller has compiled the following data for the year just ended. Department Annual Cost Admissions $ 118,000 Registrar 197,000 Computer Services 420, 000 Division Budgeted Enrollment Budgeted Credit Hours Planned Courses Requiring Computer Work Liberal Arts 1,100 31,000 12 Sciences 850 28,750 25 Business Administration 750 22,750 25 Required: 1. Distribute the departmental costs to the college's three divisions based on the allocation base given. 2. Choose the better allocation base for distributing the cost to the following departments:Recuired: Dustroule the depurtmerital costs to the collegels three dwaish based on the allocation bus ghen Chose the betier aliscation base for distr buting the cost to the…arrow_forward1. Allocate the support departments' costs to the operating departmens using the direct method. 2. Rank the support departments based on the % of their services provided to other support departments. Use this ranking to allocate the support departments' costs to the operating departments based on the step-down method. 3. How could you have ranked teh support departments differently?arrow_forwardZamboanga Hospital plans to use the activity-based costing to assign hospital indirect costs to the care of patients. The hospital has identified the following activities and activity rates for the hospital indirect costs: (Refer to image) Determine the activity cost associated with Patient 2. a. P1,388 b. P 908 c. P1,816 d. P4,555arrow_forward

- There are four steps in the two-stage cost allocation process using ABC. Which of the following not one of those steps? Select a cost driver for each activity cost pool. O Identify and classify activities. Identify the volume-based cost driver. O Form activity cost pools and assign indirect costs to each pool.arrow_forwardMack Precision Tool and Die has two production departments, Fabricating and Finishing, and two service departments, Repair and Quality Control. Direct costs for each department and the proportion of service costs used by the various departments for the month of March follow: Department Fabricating Finishing Repair Quality Control Direct Costs Repair $ 149,600 112, 200 48,300 90,300 Required A 0 0.8 Required B Proportion of Services Used by Quality Control Fabricating Required: Use the step method to allocate the service costs, using the following: 0.2 0 a. The order of allocation starts with Repair. b. The allocations are made in the reverse order (starting with Quality Control). Complete this question by entering your answers in the tabs below. 0.6 0.1 Cost Allocation To: Finishing 0.2 0.1 Use the step method to allocate the service costs, using the following: The order of allocation starts with Repair. Note: Amounts to be deducted should be indicated by a minus sign. Do not round…arrow_forwardUse the information below or using Exhibit 12.14 on page 577 in Zelman to answer the following questions. Calculate the per unit cost of an initial visit using both the conventional and ABC approaches. Calculate the per unit cost of a regular visit using both the conventional and ABC approaches. Calculate the per unit cost of an intensive visit using both the conventional and ABC approaches. Exhibit 12-14 Basic data and calculation of unit costs using a conventional approach Total Cost by Visit Type Basic Data A B C D Initial Regular Intensive Total (Given) (Given) (Given) (A + B + C) 1 Number of visits 8,000 26,000 8,600 42,600 2 Direct materials (etc.) $40,000 $50,000 $65,000 $155,000 3 Direct labor $100,000 $120,000 $280,000 $500,000…arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub