A

To calculate: The expected profit based on the given expectation is to be determined.

Introduction:

The expected profit can be defined as the probability to get the certain profit times the profit on business.

Degree of leverage is used to measure the change that will occur in operating income of the company when there is any change in sales.

A

Answer to Problem 17PS

The expected profit is

Explanation of Solution

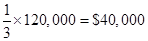

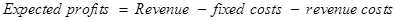

The following formula will be used for the calculation of the expected profit −

Equ (1)

Equ (1)

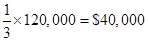

Given that −

Revenue = $120,000

Fixed costs = $30,000

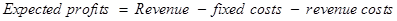

Revenue costs

Put the given values in Equ (1) −

Expected profit

B

To calculate: the degree of operating leverage based on the estimate of the fixed cost and expected profits.

Introduction:

The expected profit can be defined as the probability to get the certain profit times the profit on business.

Degree of leverage is used to measure the change that will occur in operating income of the company when there is any change in sales.

B

Answer to Problem 17PS

The degree of operating leverage is

Explanation of Solution

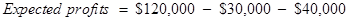

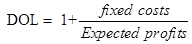

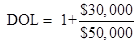

The following formula will be used for the calculation of the degree of the operating leverage −

Equ (2)

Equ (2)

Given that −

Fixed costs = $30,000

Expected profits = $50,000

Put the given values is Equ (2)

DOL =  Or

Or

The degree of operating leverage =

C

To calculate: the decrease in profits when sales are below 10% expectation.

Introduction:

The expected profit can be defined as the probability to get the certain profit times the profit on business.

Degree of leverage is used to measure the change that will occur in operating income of the company when there is any change in sales.

C

Answer to Problem 17PS

The decrease in profits is

Explanation of Solution

The following formula will be used for the calculation of the expected profit −

Equ (3)

Equ (3)

Given that −

DOL = 1.6

Given that −

Revenue = $120,000

Fixed costs = $30,000

Revenue costs

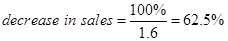

Decrement in sales =

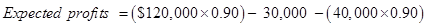

Put the given values in Equ (3)

The calculation of the profit after the decrement in sale can be given as −

Expected profit after the decrement in sale =

From the part (a), expected profit before decrement in sale

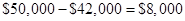

Then the decrease in profit =

D

To calculate: It is to be proved that the percentage decrease in profits equal to the DOL times 10% drop in sales.

Introduction:

The expected profit can be defined as the probability to get the certain profit times the profit on business.

Degree of leverage is used to measure the change that will occur in operating income of the company when there is any change in sales.

D

Answer to Problem 17PS

The percentage decrease in profit is

Explanation of Solution

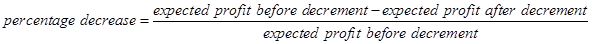

The following formula will be used for the calculation of the percentage decrease −

Equ (4)

Equ (4)

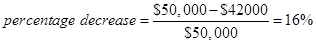

Put the calculated values in Equ (4)

The percentage decrease =  which prove that the decrease in profits equal to the DOL times

which prove that the decrease in profits equal to the DOL times  drop in sales.

drop in sales.

E

To calculate: The largest percentage shortfall in sales relative to the original expectation.

Introduction:

The expected profit can be defined as the probability to get the certain profit times the profit on business.

Degree of leverage is used to measure the change that will occur in operating income of the company when there is any change in sales.

E

Answer to Problem 17PS

The decrease in sales is

Explanation of Solution

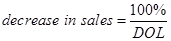

The following formula will be used for the calculation of the decrease in sales −

Equ (5)

Equ (5)

Given that −

DOL = 1.6

Put the given value in Equ (5)

The decrease in sales =

F

To calculate: The break-even sales at this point are to be determined.

Introduction:

The expected profit can be defined as the probability to get the certain profit times the profit on business.

Degree of leverage is used to measure the change that will occur in operating income of the company when there is any change in sales.

The break-even point can be defined as the point at which total cost and total revenue are equal to each other or even to each other.

F

Answer to Problem 17PS

The break-even sale is

Explanation of Solution

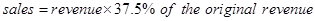

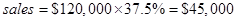

From the above the revenue which decreases by  and which is

and which is  of the original revenue.

of the original revenue.

The following formula will be used for the calculation of the break-even sales −

Equ (6)

Equ (6)

Put the given value in above Equ

Then the break-even sales = $45,000

G

To calculate: The profit at break-even level of sales to prove that the part (f) is correct.

Introduction:

The expected profit can be defined as the probability to get the certain profit times the profit on business.

Degree of leverage is used to measure the change that will occur in operating income of the company when there is any change in sales.

The break-even point can be defined as the point at which total cost and total revenue are equal to each other or even to each other.

G

Answer to Problem 17PS

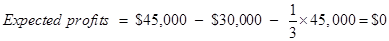

The expected profit at break-even level is $0.

Explanation of Solution

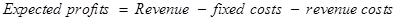

The following formula will be used for the calculation of the expected profit at the break-even level −

Equ (7)

Equ (7)

Given that −

Revenue = $45,000

Fixed costs = $30,000

Revenue costs

Put the given values is above Equ (7) −

The expected profit = $0, this shows that the answer of the part (f) is correct.

Want to see more full solutions like this?

Chapter 17 Solutions

INVESTMENTS(LL)W/CONNECT

- Required: 1. How many units would the company need to sell to earn a profit before taxes of $10,000? 2. If the company achieves its projections, what will be its degree of operating leverage?arrow_forwardFor a certain investment project, the net present worth can be expressed as functions of sales price (X) and variable production cost Y of PW= 12,550 (2X - Y) - 8000. The base values for X and Y arc $25 and $15, respectively. If the sales price is increased 15% over the base price, how much change in NPW can be expected?(a) 10% (b) 20% (c) 13.68% (d) 21.82%arrow_forwardFinally, assume that the new product line isexpected to decrease sales of the firm’s otherlines by $50,000 per year. Should this be considered in the analysis? If so, how?arrow_forward

- refer to below table ,Conduct a sensitivity analysis to determine the sensitivity of NPV to changes in the sales price, number of units sold, the variable costs per unit, fixed costs and the cost of capital. Set these variables’ values at 10% above and 10% below their base-case values. 2. Include a graph in your analysis with below table? 10% above Year Net Cash Flow (RM) Discount Rate (13.20%) Present Value (RM) 0 -1,217,800.00 1 -1217800 1 328,750.00 0.883392 290415.19 2 337,330.00 0.780382 263246.2 3 346,423.15 0.689383 238818.31 4 355,195.10 0.608996 216312.32 5 614,461.20 0.537982 330569.16 NPV 121561.19 10% below Year Net Cash Flow (RM) Discount Rate (10.80%) Present Value (RM) 0 -1,145,800.00 1 -1145800 1 184,000.00 0.902527 166064.98 2 185,395.00 0.814555 151014.45 3 189,459.85 0.735158 139282.93 4 193,936.89 0.6635 128677.14 5 448,143.25 0.598827 268360.17…arrow_forwardOgier Incorporated currently has $800 million in sales, which are projected to grow by 10% in Year 1 and by 5% in Year 2. Its operating profitability ratio (OP) is 10%, and its capital requirement ratio (CR) is 80%? What are the projected sales in Years 1 and 2? What are the projected amounts of net operating profit after taxes (NOPAT) for Years 1 and 2? What are the projected amounts of total net operating capital (OpCap) for Years 1 and 2? What is the projected FCF for Year 2?arrow_forwardYou are analyzing a project and have developed the following estimates: unit sales = 2,150, price per unit = $84, variable cost per unit = $57, fixed costs per year = $13,900. The depreciation is $8,300 a year and the tax rate is 35 percent. What effect would an increase of $1 in the selling price have on the operating cash flow?arrow_forward

- Consider the following information for Smart Products: total assets P1000; sales-P1540; net profit margin-12%; dividend payout ratio=40%; accounts payable=P308. If sales are forecast to increase 30%, the "short cut" estimate of external funds required (EFR) would be P________?arrow_forwardA business is considering a project which will cost them initially OMR 20,000. The sales expected for the two-year duration is OMR 20,000 per year. The variable costs are OMR 2,000 per year. Cost of capital is 10%. 1. Calculate the sensitivity of the project NPV to change in initial investment? 2. Calculate the sensitivity of the project NPV to change in expected sales?arrow_forwardYou are trying to value Lucid Motors using comparables analysis. You believe Lucid Motors should be valued similarly to TSLA and that TSLA is the only reasonable comparison. TSLA is currently trading at 10.7x Enterprise Value/Revenue. Lucid is expected to generate $2.2bn in revenues this year. How mucb should you be willing to value Lucid in terms of enterprise Value (assuming market is correct)? $20.6bn $23.5bn $15.4 bn $21.7 bnarrow_forward

- A project has fixed costs of $400 per year, depreciation charges of $400 a year, annual revenue of $3,600, and variable costs equal to two-thirds of revenues. a. If sales increase by 17%, what will be the percentage increase in pretax profits? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) b. What is the degree of operating leverage of this project? (Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forwardCan you answer these in Excel (and show any calculation formulas). See the attached image for the information. 1. What is the payack period, NPV, IRR? 2. What happens to the NPV and IRR if initial capital goes up 30%? 3. How much would the selling price have to increase to compensate for 30% in capital costs to the original level in 1.? 4. What is your recomendation?arrow_forwardKYY Inc. has the following data on its 2020 financial statement Total sales 2,000,000 Profit 360,000 Beginning total sales Ending total sales 1,500,000 2,100,000 A project proposal showed additional investment of 800,000 that would generate 1,000, sales and controllable contribution margin of 120,000. What is the return on investment (ROI) of the project proposal? Should the proposal be accepted?arrow_forward