Concept explainers

Variance Computations with Missing Data

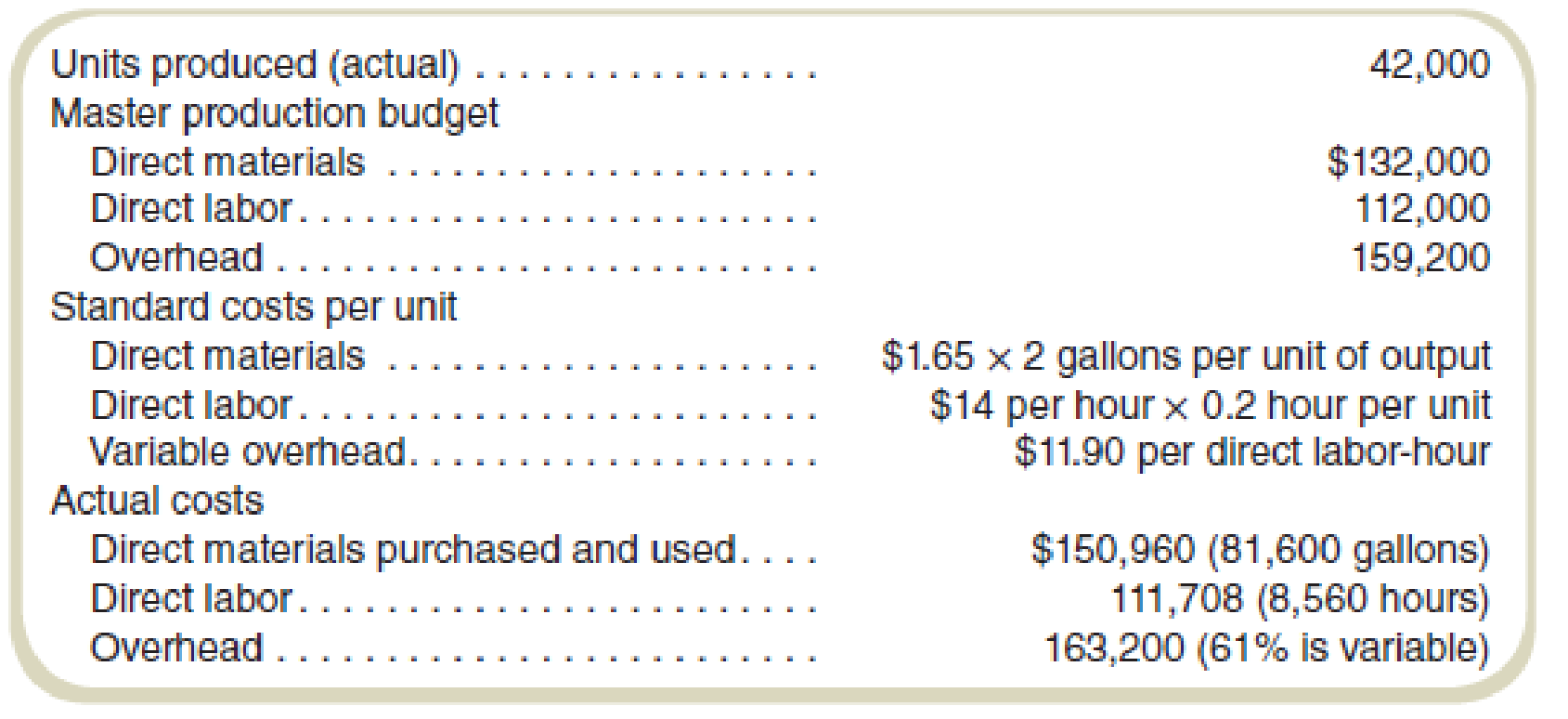

The following information is provided to assist you in evaluating the performance of the production operations of Studio Company:

Variable

Required

Prepare a report that shows all variable production cost price and efficiency variances and fixed production cost price and production volume variances.

Prepare a report showing variable production cost price and efficiency variances along with fixed production cost price and production volume variances.

Explanation of Solution

Price variance:

The price variance refers to the difference of the actual unit cost and standard unit cost of the product.

Efficiency variance:

The efficiency variance refers to the difference of the actual and budgeted quantities which have been purchased for a specific price.

Variable production cost will include direct material, direct labor, and variable overhead costs so price and efficiency variances will be computed for all three components. For fixed overhead cost variances with variable cost; price and production volume variances need to be calculated.

Compute the variable production cost variances:

For preparing variable product cost variance report, following missing components needs to be calculated first.

Standard Units Produced:

Actual direct material unit cost:

Actual labor cost per unit:

Standard total labor hours:

Actual variable overhead per actual labor hour:

The report showing variable production cost price and efficiency variances:

| Direct Material Variances | Amount |

| Price Variance | $16,320 |

| Efficiency Variance | $2,6400 |

| Total Variance | $18,960F |

| Direct Labor Variances | |

| Price Variance | $8,132 |

| Efficiency Variance | $7,840 |

| Total Variance | $2,92F |

| Variable Overhead Variance: | |

| Price Variance | $2,311 |

| Efficiency Variance | $6,664 |

| Total Variance | $4,353U |

Table: (1)

Compute the fixed overhead cost variance:

For calculating fixed production cost price and production volume variances, standard fixed overhead cost and fixed overhead applied to production need to be calculated.

Standard fixed overhead cost:

Applied fixed overhead to production:

The report showing fixed overhead cost variance with price and production volume variances:

| Fixed Overhead Variance | Amount |

| Price Variance | $ 1,280 |

| Production Volume Variance | $ 3,200 |

| Total Variance | $1,920F |

Table: (2)

Fixed overhead cost price variance is unfavorable being actual is more than the standard fixed overhead whereas production volume variance is favorable as applied fixed overhead to actual production is less than the budgeted.

Want to see more full solutions like this?

Chapter 16 Solutions

Fundamentals of Cost Accounting

- Suppose Chrysler Motors has 720 million shares outstanding with a share price of $68.25, and $30 billion in debt. If in three years, Chrysler has 750 million shares outstanding trading for $76 per share, how much debt will Chrysler have if it maintains a constant debt-equity ratio? Answer this Questionarrow_forwardBased on this informationarrow_forwardHi expert please give me answer general accounting questionarrow_forward

- Suppose Chrysler Motors has 720 million shares outstanding with a share price of $68.25, and $30 billion in debt. If in three years, Chrysler has 750 million shares outstanding trading for $76 per share, how much debt will Chrysler have if it maintains a constant debt-equity ratio?arrow_forwardAnsarrow_forwardWilson consulting is a consulting firmarrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College