The controller of Red Lake Corporation has requested assistance in determining income, basic earnings per share, and diluted earnings per share for presentation on the company’s income statement for the year ended September 30, 2020. As currently calculated, Red Lake’s net income is $540,000 for fiscal year 2019-2020.

Your working papers disclose the following opening balances and transactions in the company’s capital stock accounts during the year:

- 1. Common stock (at October 1, 2019, stated value $10, authorized 300,000 shares; effective December 1, 2019, stated value $5, authorized 600,000 shares):

Balance, October 1, 2019—issued and outstanding 60,000 shares

December 1, 2019—60,000 shares issued in a 2-for-l stock split

December 1, 2019—280,000 shares (stated value $5) issued at $39 per share

- 2. Treasury stock—common:

March 3, 2020—purchased 40,000 shares at $38 per share

April 1, 2020—sold 40,000 shares at $40 per share

- 3. Noncompensatory stock purchase warrants, Series A (initially, each warrant was exchangeable with $60 for 1 common share; effective December 1, 2019, each warrant became exchangeable for 2 common shares at $30 per share):

October 1, 2019—25,000 warrants issued at $6 each

- 4. Noncompensatory stock purchase warrants, Series B (each warrant is exchangeable with $40 for 1 common share): April 1, 2020—20,000 warrants authorized and issued at $10 each

- 5. First mortgage bonds, 5½%, due 2029 (nonconvertible; priced to yield 5% when issued): Balance October 1, 2019—authorized, issued, and outstanding—the face value of $1,400,000

- 6. Convertible debentures, 7%, due 2036 (initially, each $1,000 bond was convertible at any time until maturity into 20 common shares; effective December 1, 2019, the conversion rate became 40 shares for each bond): October 1, 2019—authorized and issued at their face value (no premium or discount) of $2,400,000

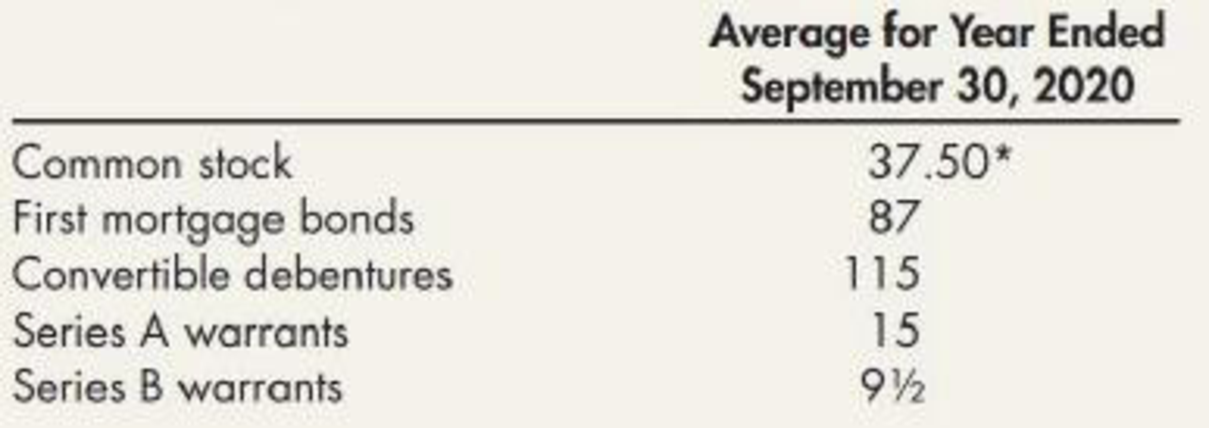

The following table shows the average market prices for the company’s securities during 2019-2020:

*$Adjusted for stock split

Required:

Prepare a schedule computing:

- 1. the basic earnings per share

- 2. the diluted earnings per share that should be presented on Red Lake’s income statement for the year ended September 30, 2020

A supporting schedule computing the numbers of shares to be used in these computations should also be prepared. Assume an income tax rate of 30%.

Want to see the full answer?

Check out a sample textbook solution

Chapter 16 Solutions

Intermediate Accounting: Reporting And Analysis

- provide correct answerarrow_forwardWrite down as many descriptions describing rock and roll that you can. From these descriptions can you come up with s denition of rock and roll? What performers do you recognize? What performers don’t you recognize? What can you say about musical inuence on these current rock musicians? Try to break these inuences into genres and relate them to the rock musicians. What does Mick Jagger say about country artists? What does pioneering mean? What kind of ensembles warrow_forwardRecently, Abercrombie & Fitch has been implementing a turnaround strategy since its sales had been falling for the past few years (11% decrease in 2014, 8% in 2015, and just 3% in 2016.) One part of Abercrombie's new strategy has been to abandon its logo-adorned merchandise, replacing it with a subtler look. Abercrombie wrote down $20.6 million of inventory, including logo-adorned merchandise, during the year ending January 30, 2016. Some of this inventory dated back to late 2013. The write-down was net of the amount it would be able to recover selling the inventory at a discount. The write-down is significant; Abercrombie's reported net income after this write-down was $35.6 million. Interestingly, Abercrombie excluded the inventory write-down from its non-GAAP income measures presented to investors; GAAP earnings were also included in the same report. Question: What impact would the write-down of inventory have had on Abercrombie's expenses, Gross margin, and Net income?arrow_forward

- Recently, Abercrombie & Fitch has been implementing a turnaround strategy since its sales had been falling for the past few years (11% decrease in 2014, 8% in 2015, and just 3% in 2016.) One part of Abercrombie's new strategy has been to abandon its logo-adorned merchandise, replacing it with a subtler look. Abercrombie wrote down $20.6 million of inventory, including logo-adorned merchandise, during the year ending January 30, 2016. Some of this inventory dated back to late 2013. The write-down was net of the amount it would be able to recover selling the inventory at a discount. The write-down is significant; Abercrombie's reported net income after this write-down was $35.6 million. Interestingly, Abercrombie excluded the inventory write-down from its non-GAAP income measures presented to investors; GAAP earnings were also included in the same report. Question: What impact would the write-down of inventory have had on Abercrombie's assets, Liabilities, and Equity?arrow_forwardNeed answer general Accountingarrow_forwardProvide correct answer of this question answer general Accountingarrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning