Concept explainers

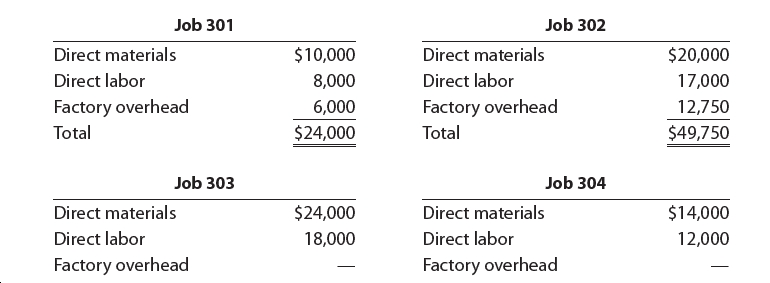

Old School Publishing Inc. began printing operations on January 1. Jobs 301 and 302 were completed during the month, and all costs applicable to them were recorded on the related cost sheets. Jobs 303 and 304 are still in process at the end of the month, and all applicable costs except factory

See Attachment

Journalize the summary entry to record each of the following operations for January (one entry for each operation):

a. Direct and indirect materials used

b. Direct and indirect labor used

c. Factory overhead applied to all four jobs (a single overhead rate is used based on direct labor cost)

d. Completion of Jobs 301 and 302

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

- Collegiate Publishing Inc. began printing operations on March 1. Jobs 301 and 302 were completed during the month, and all costs applicable to them were recorded on the related cost sheets. Jobs 303 and 304 are still in process at the end of the month, and all applicable costs except factory overhead have been recorded on the related cost sheets. In addition to the materials and labor charged directly to the jobs, $7,900 of indirect materials and $13,200 of indirect labor were used during the month. The cost sheets for the four jobs entering production during the month are as follows, in summary form: Job 301 Job 302 Direct materials $10,900 Direct materials $18,300 Direct labor 8,900 Direct labor 17,700 Factory overhead 5,785 Factory overhead 11,505 Total $25,585 Total $47,505 Job 303 Job 304 Direct materials $26,000 Direct materials $13,700 Direct labor 16,000 Direct labor 12,300 Factory overhead — Factory overhead — Required:…arrow_forwardAt the end of August, Carrothers Company had completed Jobs 50 and 56. Job 50 is for 200 units, and Job 56 is for 2,000 units. The following data relate to these two jobs: On August 4, raw materials were requisitioned for production as follows: 200 units for Job 50 at $12 per unit and 1,200 units for Job 56 at $10 per unit. During August, Carrothers Company accumulated 600 hours of direct labor costs on Job 50 and 1,100 hours on Job 56. The total direct labor was incurred at a rate of $12 per direct labor hour for Job 50 and $10 per direct labor hour for Job 56. The predetermined factory overhead rate is $15.00 per direct labor hour. a. Determine the balance on the job cost sheets for Jobs 50 and 56 at the end of August. Job 50 $fill in the blank 1 Job 56 $fill in the blank 2 b. Determine the cost per unit for Jobs 50 and 52 at the end of August. If required, round your answers to the nearest cent. Job 50 $fill in the blank 3 Job 56 $fill in the blank 4arrow_forwardOld School Publishing Inc. began printing operations on January 1. Jobs 301 and 302 were completed during the month, and all costs applicable to them were recorded on the related cost sheets. Jobs 303 and 304 are still in process at the end of the month, and all applicable costs except factory overhead have been recorded on the related cost sheets. In addition to the materials and labor charged directly to the jobs, $7,900 of indirect materials and $13,200 of indirect labor were used during the month. The cost sheets for the four jobs entering production during the month are as follows, in summary form: Job 301 Job 302 Direct materials $10,900 Direct materials $18,300 Direct labor 8,900 Direct labor 17,700 Factory overhead 5,785 Factory overhead 11,505 Total $25,585 Total $47,505 Job 303 Job 304 Direct materials $26,000 Direct materials $13,700 Direct labor 16,000 Direct labor 12,300 Factory overhead — Factory overhead — Required:…arrow_forward

- Ehrling Brothers Company makes jobs to customer order. During the month of July, the following occurred: Materials were purchased on account for $45,760. Materials totaling $40,880 were requisitioned for use in producing various jobs. Direct labor payroll for the month was $22,400 with an average wage of $14 per hour. Actual overhead of $8,850 was incurred and paid in cash. Manufacturing overhead is charged to production at the rate of $5.40 per direct labor hour. Completed jobs costing $59,000 were transferred to Finished Goods. Jobs costing $58,000 were sold on account for $ 73,750. Make the entry to record the revenue from the sale first, followed by the entry to record the cost of the jobs. Beginning balances as of July 1 were: Materials Inventory $1,300 Work-in-Process Inventory 3,400 Finished Goods Inventory 2,640 Required: Question Content Area 1. Prepare the journal entries for the preceding events. a. b. c.…arrow_forwardEntries for Factory Costs and Jobs Completed Old School Publishing Inc. began printing operations on January 1. Jobs 301 and 302 were completed during the month, and all costs applicable to them were recorded on the related cost sheets. Jobs 303 and 304 are still in process at the end of the month, and all applicable costs except factory overhead have been recorded on the related cost sheets. In addition to the materials and labor charged directly to the jobs, $1,540 of indirect materials and $18,640 of indirect labor were used during the month. The cost sheets for the four jobs entering production during the month are as follows, in summary form: Job 301 Job 302 Direct materials $15,940 Direct materials $7,450 Direct labor 6,100 Direct labor 3,200 Factory overhead 3,355 Factory overhead 1,760 Total $25,395 Total $12,410 Job 303 Job 304 Direct materials $21,480 Direct materials $4,590 Direct labor 6,800 Direct labor 900 Factory overhead Factory overhead Journalize the summary entry to…arrow_forwardCustom Cabinetry has one job in process (Job 120) as of June 30; at that time, its job cost sheet reports direct materials of $8,700, direct labor of $3,600, and applied overhead of $2,880. Custom Cabinetry applies overhead at the rate of 80% of direct labor cost. During July, Job 120 is sold (on credit) for $24,500, Job 121 is started and completed, and Job 122 is started and still in process at the end of July. Custom Cabinetry incurs the following costs during July. Job 120 Job 121 Job 122 Direct materials used $ 1,000 $ 6,100 $ 2,900 Direct labor used 3,800 4,000 3,900 1. Prepare journal entries for the following July transactions and events a through e.a. Direct materials used.b. Direct labor used.c. Overhead applied.d. Sale of Job 120.e. Cost of goods sold for Job 120. Hint: Job 120 has costs from June and July.2. Compute the July 31 balances of the Work in Process Inventory and the Finished Goods Inventory accounts. (There were no jobs in Finished Goods Inventory…arrow_forward

- I want answerarrow_forward[The following information applies to the questions displayed below.] At the end of June, the job cost sheets at Ace Roofers show the following costs accumulated on three jobs. At June 30 Direct materials Direct labor Overhead applied Additional Information a. Job 5 was started in May, and the following costs were assigned to it in May: direct materials, $6,000; direct labor, $1,800; and applied overhead, $900. Job 5 was finished in June. b. Job 6 and Job 7 were started in June; Job 6 was finished in June, and Job 7 is to be completed in July. c. Overhead cost is applied with a predetermined rate based on direct labor cost. The predetermined overhead rate did not change across these months. Job 5 $ 15,000 8,000 4,000 Total transferred cost Job 6 $ 33,000 14, 200 7,100 Job 7 $ 27,000 21,000 10,500 4. What is the total cost transferred to Finished Goods Inventory in June?arrow_forwardEntrepreneurial Publishing Inc. began printing operations on January 1. Jobs 301 and 302 were completed during the month, and all costs applicable to them were recorded on the related cost sheets. Jobs 303 and 304 are still in process at the end of the month, and all applicable costs except factory overhead have been recorded on the related cost sheets. In addition to the materials and labor charged directly to the jobs, $7,600 of indirect materials and $15,100 of indirect labor were used during the month. The cost sheets for the four jobs entering production during the month are as follows, in summary form: Job 301 Job 302 Direct materials $14,300 Direct materials $26,900 Direct labor 10,000 Direct labor 24,000 Factory overhead 6,500 Factory overhead 15,600 Total $30,800 Total $66,500 Job 303 Job 304 Direct materials $17,100 Direct materials $35,200 Direct labor 36,000 Direct labor 32,000 Factory overhead — Factory…arrow_forward

- Letena Company had only one job in process on July 1. The job had been charged with $1,000 of direct materials, $3,302 of direct labor and $5,382 of manufacturing overhead cost. The company assigns overhead cost to jobs using the predetermined overhead rate of $23.10 per labor-hour. During July, the following information on Letena's activities was recorded: Raw Materials: Beginning Balance $6,100 Purchased $70,000 Used in Production $69,600 Labor: Direct labor-hours worked during July 1,160 Direct labor cost incurred $15,400 Other information: Actual Manufacturing overhead incurred: $29,002 Work-in-Process Inventory, July 31: $13,200 Work-in-Process inventory on July 31 contains $2,921 of direct labor cost. The entry to dispose of the underapplied or overapplied manufacturing overhead for July would include a debit or credit of BLANK to the account Manufacturing Overhead.arrow_forwardCollegiate Publishing Inc. began printing operations on March 1. Jobs 301 and 302 were completed during the month, and all costs applicable to them were recorded on the related cost sheets. Jobs 303 and 304 are still in process at the end of the month, and all applicable costs except factory overhead have been recorded on the related cost sheets. In addition to the materials and labor charged directly to the jobs, $8,400 of indirect materials and $13,700 of indirect labor were used during the month. The cost sheets for the four jobs entering production during the month are as follows, in summary form: Job 301 Job 302 Direct materials $10,100 Direct materials $19,000 Direct labor 8,500 Direct labor 16,200 Factory overhead 5,950 Factory overhead 11,340 Total $24,550 Total $46,540 Job 303 Job 304 Direct materials $23,700 Direct materials $12,700 Direct labor 16,300 Direct labor 11,800 Factory overhead — Factory overhead — Required:…arrow_forwardCustom Cabinetry has one job in process (Job 120) as of June 30; at that time, its job cost sheet reports direct materials of $8,100, direct labor of $3,700, and applied overhead of $2,960. Custom Cabinetry applies overhead at the rate of 80% of direct labor cost. During July, Job 120 is sold (on credit) for $28,500, Job 121 is started and completed, and Job 122 is started and still in process at the end of July. Custom Cabinetry incurs the following costs during July. Job 120 Job 121 Direct materials used Direct labor used $ 1,500 3,500 $ 6,600 4,300 Job 122 $2,500 4,000 1. Prepare journal entries for the following July transactions and events a through e. a. Direct materials used. b. Direct labor used. c. Overhead applied. d. Sale of Job 120. e. Cost of goods sold for Job 120. Hint. Job 120 has costs from June and July. 2. Compute the July 31 balances of the Work in Process Inventory and the Finished Goods Inventory accounts. (There were no jobs in Finished Goods Inventory at June…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education