FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

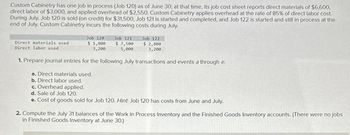

Transcribed Image Text:Custom Cabinetry has one job in process (Job 120) as of June 30; at that time, its job cost sheet reports direct materials of $6,600,

direct labor of $3,000, and applied overhead of $2,550. Custom Cabinetry applies overhead at the rate of 85% of direct labor cost.

During July, Job 120 is sold (on credit) for $31,500, Job 121 is started and completed, and Job 122 is started and still in process at the

end of July. Custom Cabinetry incurs the following costs during July.

Job 120

$ 1,800

3,200

Job 121

$ 7,500

5,000

Job 122

$ 2,800

3,200

1. Prepare journal entries for the following July transactions and events a through e.

a. Direct materials used.

b. Direct labor used.

c. Overhead applied.

d. Sale of Job 120.

e. Cost of goods sold for Job 120. Hint. Job 120 has costs from June and July.

Direct materials used

Direct labor used

2. Compute the July 31 balances of the Work in Process Inventory and the Finished Goods Inventory accounts. (There were no jobs

in Finished Goods Inventory at June 30.)

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Munabhaiarrow_forwardInstructions Collegiate Publishing Inc. began printing operations on March 1. Jobs 301 and 302 were completed during the month, and all costs applicable to them were recorded on the related cost sheets. Jobs 303 and 304 are still in process at the end of the month, and all applicable costs except factory overhead have been recorded on the related cost sheets. In addition to the materials and labor charged directly to the jobs, $7,800 of indirect materials and $11,100 of indirect labor were used during the month. The cost sheets for the four jobs entering production during the month are as follows, in summary form: Job 301 Direct materials $10,700 Direct materials $18,400 7,200 Direct labor Factory overhead 6,192 Factory overhead 14,104 $24,092 Total $48,904 Direct labor Total Job 303 Direct materials Direct labor Factory overhead Job 302 19,500 - Job 304 $25,900 Direct materials $15,900 Direct labor 10,100 16,400 Factory overhead Required: Journalize the Mar. 31 summary entries to…arrow_forwardDillon Products manufactures various machined parts to customer specifications. The company uses a job-order costing system and applies overhead cost to jobs on the basis of machine-hours. At the beginning of the year, the company used a cost formula to estimate that it would incur $4,339,600 in manufacturing overhead cost at an activity level of 571,000 machine-hours. The company spent the entire month of January working on a large order for 12,400 custom-made machined parts. The company had no work in process at the beginning of January. Cost data relating to January follow: a. Raw materials purchased on account, $321,00o. b. Raw materials used in production, $250,000 (80% direct materials and 20% indirect materials). c. Labor cost accrued in the factory, $174,000 (one-third direct labor and two-thirds indirect labor). d. Depreciation recorded on factory equipment, $63,800. e. Other manufacturing overhead costs incurred on account, $85,800. f. Manufacturing overhead cost was applied…arrow_forward

- At the end of May, Lockmiller Company had completed Jobs 275 and 310. Job 275 is for 5,000 units, and Job 310 is for 2,000 units. The following data relate to these two jobs: On May 7, Lockmiller Company purchased on account 12,000 units of materials at $6 per unit. During May, raw materials were requisitioned for production as follows: 8,400 units for Job 275 at $6 per unit and 2,150 units for Job 310 at $4 per unit. During May, Lockmiller Company accumulated 1,900 hours of direct labor costs on Job 275 and 2,600 hours on Job 310. The total direct labor was incurred at a rate of $34 per direct labor hour for Job 275 and $26 per direct labor hour for Job 310. Lockmiller Company estimates that total factory overhead costs will be $867,000 for the year. Direct labor hours are estimated to be 102,000. a. Determine the balance on the job cost sheets for Jobs 275 and 310 at the end of May. Job 275 $fill in the blank 1 Job 310 $fill in the blank 2 b. Determine the cost per unit…arrow_forwardCavy Company estimates that the factory overhead for the following year will be $1,699,200. The company has determined that the basis for applying factory overhead will be machine hours, which is estimated to be 28,800 hours. There are 1,660 machine hours for all of the jobs in the month of April. What amount will be applied to all of the jobs for the month of April?arrow_forwardJenkins Company uses a job order cost system with overhead applied to jobs on the basis of direct labor hours. The direct labor rate is $20 per hour, and the predetermined overhead rate is $15 per direct labor hour. The company worked on three jobs during April. Jobs A and B were in process at the beginning of April. Job A was completed and delivered to the customer. Job B was completed during April, but not sold. Job C was started during April, but not completed. The job cost sheets revealed the following costs for April: Job A Job B $1,200 8,400 8,400 Job C $12,200 2,200 10,400 Cost of Jobs in Process, 4/1/2016 Direct Materials Used 9,600 3,200 Direct Labor Applied Manufacturing Overhead Required: If no other jobs were started, completed, or sold, determine the balance in each of the following accounts at the end of April: a. Work in Process b. Finished Goods c. Cost of Goods Soldarrow_forward

- Jenkins Company uses a job order cost system with overhead applied to jobs on the basis of direct labor hours. The direct labor rate is $20 per hour, and the predetermined overhead rate is $15 per direct labor hour. The company worked on three jobs during April. Jobs A and B were in process at the beginning of April. Job A was completed and delivered to the customer. Job B was completed during April, but not sold. Job C was started during April, but not completed. The job cost sheets revealed the following costs for April: Cost of Jobs in Process, 4/1/2018 Direct Materials Used Direct Labor Applied Manufacturing Overhead Job A a. Work in Process b. Finished Goods c. Cost of Goods Sold $11,100 1,100 8,200 ? Job B $1,100 6,200 6,200 ? Job C $ - 6,300 2,100 ? Required: If no other jobs were started, completed, or sold, determine the balance in each of the following accounts at the end of April:arrow_forwardCollegiate Publishing Inc. began printing operations on March 1. Jobs 301 and 302 were completed during the month, and all costs applicable to them were recorded on the related cost sheets. Jobs 303 and 304 are still in process at the end of the month, and all applicable costs except factory overhead have been recorded on the related cost sheets. In addition to the materials and labor charged directly to the jobs, $7,900 of indirect materials and $13,200 of indirect labor were used during the month. The cost sheets for the four jobs entering production during the month are as follows, in summary form: Job 301 Job 302 Direct materials $10,900 Direct materials $18,300 Direct labor 8,900 Direct labor 17,700 Factory overhead 5,785 Factory overhead 11,505 Total $25,585 Total $47,505 Job 303 Job 304 Direct materials $26,000 Direct materials $13,700 Direct labor 16,000 Direct labor 12,300 Factory overhead — Factory overhead — Required:…arrow_forwardJob A3B was ordered by a customer on September 25. During the month of September, Jaycee Corporation requisitioned $2,700 of direct materials and used $4,200 of direct labor. The job was not finished by the end of September, but needed an additional $3,200 of direct materials and additional direct labor of $6,900 to finish the job in October. The company applies overhead at the end of each month at a rate of 150% of the direct labor cost incurred. What is the balance in the Work in Process account at the end of September relative to Job A3B? Multiple Choice $6,900 $5,900 $11,100 $13,200 $10,100arrow_forward

- At the end of August, Carrothers Company had completed Jobs 50 and 56. Job 50 is for 200 units, and Job 56 is for 500 units. The following data relate to these two jobs: On August 4, raw materials were requisitioned for production as follows: 400 units for Job 50 at $12 per unit and 900 units for Job 56 at $24 per unit. During August, Carrothers Company accumulated 500 hours of direct labor costs on Job 50 and 1,100 hours on Job 56. The total direct labor was incurred at a rate of $22 per direct labor hour for Job 50 and $22 per direct labor hour for Job 56. The predetermined factory overhead rate is $11.00 per direct labor hour. a. Determine the balance on the job cost sheets for Jobs 50 and 56 at the end of August. Job 50 $fill in the blank 1 Job 56 $fill in the blank 2 b. Determine the cost per unit for Jobs 50 and 52 at the end of August. If required, round your answers to the nearest cent. Job 50 $fill in the blank 3 Job 56 $fill in the blank 4arrow_forwardCavy Company estimates that the factory overhead for the following year will be $2,829,000. The company has determined that the basis for applying factory overhead will be machine hours, which is estimated to be 34,500 hours. There are 4,690 machine hours for all of the jobs in the month of April. What amount will be applied to all of the jobs for the month of April?arrow_forwardOld School Publishing Inc. began printing operations on January 1. Jobs 301 and 302 were completed during the month, and all costs applicable to them were recorded on the related cost sheets. Jobs 303 and 304 are still in process at the end of the month, and all applicable costs except factory overhead have been recorded on the related cost sheets. In addition to the materials and labor charged directly to the jobs, $8,000 of indirect materials and $12,400 of indirect labor were used during the month. The cost sheets for the four jobs entering production during the month are as follows, in summary form: See Attachment Journalize the summary entry to record each of the following operations for January (one entry for each operation):a. Direct and indirect materials usedb. Direct and indirect labor usedc. Factory overhead applied to all four jobs (a single overhead rate is used based on direct labor cost)d. Completion of Jobs 301 and 302arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education