Managerial Accounting

17th Edition

ISBN: 9781260247787

Author: Ray H. Garrison, Eric W. Noreen, Peter C. Brewer

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 15, Problem 7F15

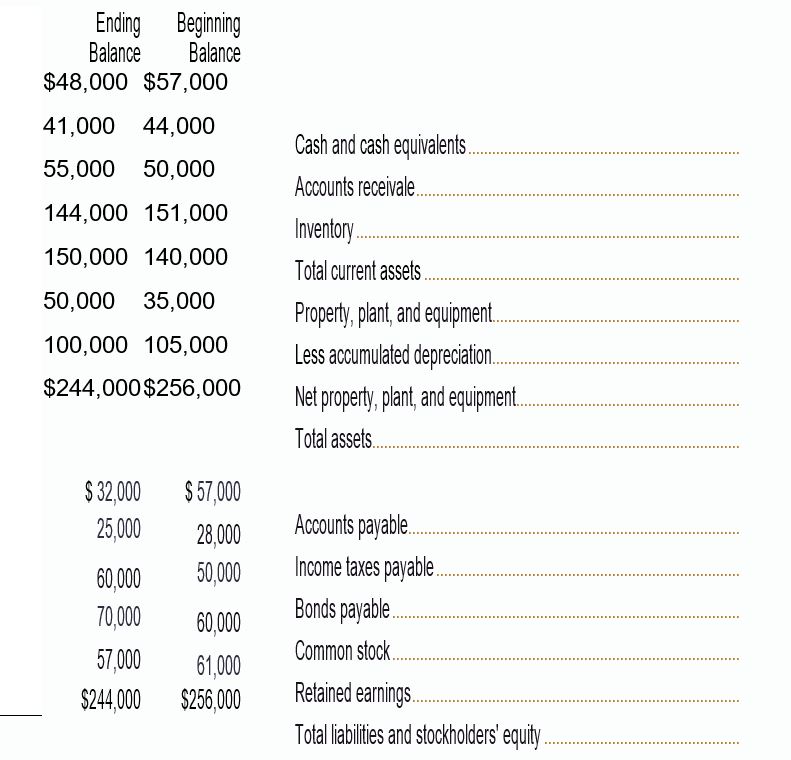

Ravenna Company is a merchandiser that uses the indirect method to prepare the operating activities section of its statement of

During the year Ravenna paid a $6,000 cash dividend and it sold a piece of equipment for $3,000 that had originally cost $6,000 and had accumulated depreciation of $4,000. The company did not retire any bonds or repurchase any of its own common stock during the year.

Required:

7. What is the combined amount and direction (+ or -) of the inventory and accounts payable adjustments to net income in the operating activities section of the statement of cash flows? What does this amount represent?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The company did not dispose of any property, plant, and equipment during the year. Its net income for the year was $4,600 and its

cash dividends were $4,000. The company did not issue any bonds-payable or purchase any of its own common stock during the

year. Its net cash provided by (used in) operating activities and net cash provided by (used in) financing activities are:

Burgess also provided the following information:

The company sold equipment that had an original cost of $13 million and accumulated depreciation of $8 million. The cash proceeds from the sale were $8 million. The gain on the sale was $3 million.

The company did not issue any new bonds during the year.

The company paid a cash dividend during the year.

The company did not complete any common stock transactions during the year.

Required:

1. Using the indirect method, prepare a statement of cash flows for the year. (Enter your answers in millions not in dollars. List any deduction in cash and cash outflows as negative amounts.)

Comparative financial statements for Weaver Company follow:

During this year, Weaver sold some equipment for $10 that had cost $49 and on which there wasaccumulated depreciation of $30. In addition, the company sold long-term investments for $50 thathad cost $38 when purchased several years ago. Weaver paid a cash dividend this year and thecompany repurchased $109 of its own stock. This year Weaver did not retire any bonds.

Required:1. Using the direct method, adjust the company’s income statement for this year to a cash basis.2. Using the information obtained in (1) above, along with an analysis of the remaining balance sheetaccounts, prepare a statement of cash flows for this year.

Chapter 15 Solutions

Managerial Accounting

Ch. 15.A - Prob. 1ECh. 15.A - EXERCISE 14A-2 Net Cash Provided by Operating...Ch. 15.A - Prob. 3ECh. 15.A - Prob. 4ECh. 15.A -

PROBLEM 14A-5 Prepare and Interpret a Statement...Ch. 15.A - Prob. 6PCh. 15.A - PROBLEM 14A-7 Prepare and Interpret a Statement of...Ch. 15 - Prob. 1QCh. 15 - Prob. 2QCh. 15 - Prob. 3Q

Ch. 15 - Prob. 4QCh. 15 - Prob. 5QCh. 15 - Prob. 6QCh. 15 - Prob. 7QCh. 15 - Prob. 8QCh. 15 - Prob. 9QCh. 15 -

14-10 If the Accounts Receivable balance...Ch. 15 - Prob. 11QCh. 15 - Prob. 12QCh. 15 - Prob. 1F15Ch. 15 - Ravenna Company is a merchandiser that uses the...Ch. 15 - Prob. 3F15Ch. 15 - Prob. 4F15Ch. 15 - Prob. 5F15Ch. 15 - Prob. 6F15Ch. 15 - Ravenna Company is a merchandiser that uses the...Ch. 15 - Prob. 8F15Ch. 15 - Prob. 9F15Ch. 15 - Prob. 10F15Ch. 15 - Prob. 11F15Ch. 15 - Prob. 12F15Ch. 15 - Prob. 13F15Ch. 15 - Prob. 14F15Ch. 15 - Prob. 15F15Ch. 15 - Prob. 1ECh. 15 - EXERCISE 14-2 Net Cash Provided by Operating...Ch. 15 - Prob. 3ECh. 15 - Prob. 4ECh. 15 - Prob. 5ECh. 15 - Prob. 6ECh. 15 - Prob. 7PCh. 15 - Prob. 8PCh. 15 - Prob. 9PCh. 15 - Prob. 10PCh. 15 - Prob. 11PCh. 15 - Prob. 12PCh. 15 - Prob. 13PCh. 15 - Prob. 14P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Moore Company is preparing its statement of cash flows for the current year. During the year, the company retired two issuances of debt and properly recorded the transactions. These transactions were as follows: Paid cash of $12,700 to retire bonds payable with a face value of $15,000 and a book value of $13,300. Paid cash of $48,000 to retire bonds payable with a face value of $45,000 and a book value of $47,000. Required: Record, in journal entry form, the entries that Moore would make for the preceding transactions on its spreadsheet to prepare its statement of cash flows. If an amount box does not require an entry, leave it blank.arrow_forwardPrepare a Statement of Cash Flows A comparative balance sheet and an income statement for Burgess Company are given below: Burgess also provided the following information: 1. The company sold equipment that had an original cost of $13 million and accumulated depreciation of $8 million. The cash proceeds from the sale were $8 million. The gain on the sale was $3 million. 2. The company did not issue any new bonds during the year. 3. The company paid a cash dividend during the year. 4. The company did not complete any common stock transactions during the year. Required: 1. Using the indirect method, prepare a statement of cash flows for the year. 2. Assume that Burgess had sales of $3,800, net income of $135, and net cash provided by operating activities of $150 in the prior year (all numbers are staled in millions). Prepare a memo that summarizes your interpretations of Burgess’s financial performance.arrow_forwardBurgess also provided the following information: 1. The company sold equipment for $8 million that originally cost $13 million with accumulated depreciation of $8 million. The gain on the sale was $3 million. 2. The company did not issue any new bonds, pay a dividend, or complete any common stock transactions during the year. Required: 1. Using the indirect method, prepare a statement of cash flows. Note: Enter your answers in millions not in dollars. List any deduction in cash and cash outflows as negative amounts. Operating activities: Investing activities: Financing activities: Burgess Company Statement of Cash Flowsarrow_forward

- Ravenna Company is a merchandiser that uses the indirect method to prepare the operating activities section of its statement of cash flows. Its balance sheet for this year is as follows: Ending Balance Beginning Balance Cash $ 113,600 $ 136,600 Accounts receivable 89,800 96,800 Inventory 120,600 110,000 Total current assets 324,000 343,400 Property, plant, and equipment 318,000 308,000 Less accumulated depreciation 106,000 77,000 Net property, plant, and equipment 212,000 231,000 Total assets $ 536,000 $ 574,400 Accounts payable $ 70,400 $ 125,000 Income taxes payable 54,600 74,400 Bonds payable 132,000 110,000 Common stock 154,000 132,000 Retained earnings 125,000 133,000 Total liabilities and stockholders’ equity $ 536,000 $ 574,400 During the year, Ravenna paid a $13,200 cash dividend and it sold a piece of equipment for $6,600 that had originally cost…arrow_forwardRavenna Company is a merchandiser using the indirect method to prepare the operating activities section of its statement of cash flows. Its balance sheet for this year is as follows: Ending Balance Beginning Balance Cash and cash equivalents $ 89,000 $ 106,750 Accounts receivable 71,500 77,000 Inventory 96,000 87,500 Total current assets 256,500 271,250 Property, plant, and equipment 255,000 245,000 Less accumulated depreciation 85,000 61,250 Net property, plant, and equipment 170,000 183,750 Total assets $ 426,500 $ 455,000 Accounts payable $ 56,000 $ 99,500 Income taxes payable 43,500 57,000 Bonds payable 105,000 87,500 Common stock 122,500 105,000 Retained earnings 99,500 106,000 Total liabilities and stockholders’ equity $ 426,500 $ 455,000 During the year, Ravenna paid a $10,500 cash dividend and sold a piece of equipment for $5,250 that originally cost $12,000 and had accumulated depreciation of $8,000. The company did not retire any bonds or…arrow_forwardRavenna Company is a merchandiser using the indirect method to prepare the operating activities section of its statement of cash flows. Its balance sheet for this year is as follows: Ending Balance Beginning Balance Cash and cash equivalents $ 89,000 $ 106,750 Accounts receivable 71,500 77,000 Inventory 96,000 87,500 Total current assets 256,500 271,250 Property, plant, and equipment 255,000 245,000 Less accumulated depreciation 85,000 61,250 Net property, plant, and equipment 170,000 183,750 Total assets $ 426,500 $ 455,000 Accounts payable $ 56,000 $ 99,500 Income taxes payable 43,500 57,000 Bonds payable 105,000 87,500 Common stock 122,500 105,000 Retained earnings 99,500 106,000 Total liabilities and stockholders’ equity $ 426,500 $ 455,000 During the year, Ravenna paid a $10,500 cash dividend and sold a piece of equipment for $5,250 that originally cost $12,000 and had accumulated depreciation of $8,000. The company did not retire any bonds or…arrow_forward

- Ravenna Company is a merchandiser using the indirect method to prepare the operating activities section of its statement of cash flows. Its balance sheet for this year is as follows: Ending Balance Beginning Balance Cash and cash equivalents $ 89,000 $ 106,750 Accounts receivable 71,500 77,000 Inventory 96,000 87,500 Total current assets 256,500 271,250 Property, plant, and equipment 255,000 245,000 Less accumulated depreciation 85,000 61,250 Net property, plant, and equipment 170,000 183,750 Total assets $ 426,500 $ 455,000 Accounts payable $ 56,000 $ 99,500 Income taxes payable 43,500 57,000 Bonds payable 105,000 87,500 Common stock 122,500 105,000 Retained earnings 99,500 106,000 Total liabilities and stockholders’ equity $ 426,500 $ 455,000 During the year, Ravenna paid a $10,500 cash dividend and sold a piece of equipment for $5,250 that originally cost $12,000 and had accumulated depreciation of $8,000. The company did not retire any bonds or…arrow_forwardRavenna Company is a merchandiser using the indirect method to prepare the operating activities section of its statement of cash flows. Its balance sheet for this year is as follows: Ending Balance Beginning Balance Cash and cash equivalents $ 89,000 $ 106,750 Accounts receivable 71,500 77,000 Inventory 96,000 87,500 Total current assets 256,500 271,250 Property, plant, and equipment 255,000 245,000 Less accumulated depreciation 85,000 61,250 Net property, plant, and equipment 170,000 183,750 Total assets $ 426,500 $ 455,000 Accounts payable $ 56,000 $ 99,500 Income taxes payable 43,500 57,000 Bonds payable 105,000 87,500 Common stock 122,500 105,000 Retained earnings 99,500 106,000 Total liabilities and stockholders’ equity $ 426,500 $ 455,000 During the year, Ravenna paid a $10,500 cash dividend and sold a piece of equipment for $5,250 that originally cost $12,000 and had accumulated depreciation of $8,000. The company did not retire any bonds or…arrow_forwardRavenna Company is a merchandiser using the indirect method to prepare the operating activities section of its statement of cash flows. Its balance sheet for this year is as follows: Ending Balance Beginning Balance Cash and cash equivalents $ 89,000 $ 106,750 Accounts receivable 71,500 77,000 Inventory 96,000 87,500 Total current assets 256,500 271,250 Property, plant, and equipment 255,000 245,000 Less accumulated depreciation 85,000 61,250 Net property, plant, and equipment 170,000 183,750 Total assets $ 426,500 $ 455,000 Accounts payable $ 56,000 $ 99,500 Income taxes payable 43,500 57,000 Bonds payable 105,000 87,500 Common stock 122,500 105,000 Retained earnings 99,500 106,000 Total liabilities and stockholders’ equity $ 426,500 $ 455,000 During the year, Ravenna paid a $10,500 cash dividend and sold a piece of equipment for $5,250 that originally cost $12,000 and had accumulated depreciation of $8,000. The company did not retire any bonds or…arrow_forward

- Ravenna Company is a merchandiser using the indirect method to prepare the operating activities section of its statement of cash flows. Its balance sheet for this year is as follows: Ending Balance Beginning Balance Cash and cash equivalents $ 89,000 $ 106,750 Accounts receivable 71,500 77,000 Inventory 96,000 87,500 Total current assets 256,500 271,250 Property, plant, and equipment 255,000 245,000 Less accumulated depreciation 85,000 61,250 Net property, plant, and equipment 170,000 183,750 Total assets $ 426,500 $ 455,000 Accounts payable $ 56,000 $ 99,500 Income taxes payable 43,500 57,000 Bonds payable 105,000 87,500 Common stock 122,500 105,000 Retained earnings 99,500 106,000 Total liabilities and stockholders’ equity $ 426,500 $ 455,000 During the year, Ravenna paid a $10,500 cash dividend and sold a piece of equipment for $5,250 that originally cost $12,000 and had accumulated depreciation of $8,000. The company did not retire any bonds or…arrow_forwardRavenna Company is a merchandiser using the indirect method to prepare the operating activities section of its statement of cash flows. Its balance sheet for this year is as follows: Ending Balance Beginning Balance Cash and cash equivalents $ 89,000 $ 106,750 Accounts receivable 71,500 77,000 Inventory 96,000 87,500 Total current assets 256,500 271,250 Property, plant, and equipment 255,000 245,000 Less accumulated depreciation 85,000 61,250 Net property, plant, and equipment 170,000 183,750 Total assets $ 426,500 $ 455,000 Accounts payable $ 56,000 $ 99,500 Income taxes payable 43,500 57,000 Bonds payable 105,000 87,500 Common stock 122,500 105,000 Retained earnings 99,500 106,000 Total liabilities and stockholders’ equity $ 426,500 $ 455,000 During the year, Ravenna paid a $10,500 cash dividend and sold a piece of equipment for $5,250 that originally cost $12,000 and had accumulated depreciation of $8,000. The company did not retire any bonds or…arrow_forwardRavenna Company is a merchandiser using the indirect method to prepare the operating activities section of its statement of cash flows. Its balance sheet for this year is as follows: Ending Balance Beginning Balance Cash and cash equivalents $ 89,000 $ 106,750 Accounts receivable 71,500 77,000 Inventory 96,000 87,500 Total current assets 256,500 271,250 Property, plant, and equipment 255,000 245,000 Less accumulated depreciation 85,000 61,250 Net property, plant, and equipment 170,000 183,750 Total assets $ 426,500 $ 455,000 Accounts payable $ 56,000 $ 99,500 Income taxes payable 43,500 57,000 Bonds payable 105,000 87,500 Common stock 122,500 105,000 Retained earnings 99,500 106,000 Total liabilities and stockholders’ equity $ 426,500 $ 455,000 During the year, Ravenna paid a $10,500 cash dividend and sold a piece of equipment for $5,250 that originally cost $12,000 and had accumulated depreciation of $8,000. The company did not retire any bonds or…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License