FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

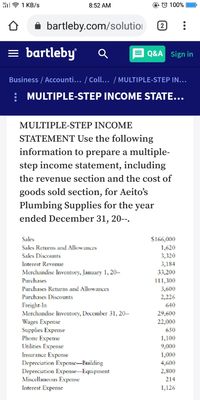

Question

Use the following information to prepare a multiplestep income statement, including the revenue section and the cost of goods sold section, for Aeito's Plumbing Supplies for the year ended December 31, 20--.

Transcribed Image Text:il7 1 KB/s

8:52 AM

O © 100%

bartleby.com/solutioi

2

= bartleby

Q&A Sign in

Business / Accounti... / Coll... / MULTIPLE-STEP IN...

: MULTIPLE-STEP INCOME STATE...

MULTIPLE-STEP INCOME

STATEMENT Use the following

information to prepare a multiple-

step income statement, including

the revenue section and the cost of

goods sold section, for Aeito's

Plumbing Supplies for the year

ended December 31, 20--.

$166,000

1,620

3,320

3,184

33,200

Sales

Sales Returns and Allowances

Sales Discounts

Interest Revenue

Merchandise Inventory, January 1, 20--

Purchases

111,300

Purchases Returns and Allowances

3,600

Purchases Discounts

2,226

Freight-In

Merchandise Inventory, December 31, 20--

Wages Expense

Supplies Expense

Phone Expense

Utilities Expense

Insurance Expense

Depreciation Expense-Building

Depreciation Expense-Equipment

Miscellaneous Expense

Interest Expense

640

29,600

22,000

650

1,100

9,000

1,000

4,600

2,800

214

1,126

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- USE THE BELOW INCOME STATEMENT AND INFORMATION TO ANSWER THE NEXT FOUR QUESTIONS AND COMPLETE THE INCOME STATEMENT. Net Sales Cost of Goods Sold Selling Expenses Administrative Expenses Interest Expenses Other Expenses Income before Taxes Income Tax Expenses Net Income ● ● MY Company Income Statement December 31, 2018 (Amounts in thousands) Use the following ratio data to complete FS Company's income statement. Inventory turnover is 4 (beginning inventory was $895: ending inventory was $758). Inventory turnover = cost of goods sold / Average inventory Rate of Return on Sales is 0.15 O $10,500 (a) $2,561 $458 (b) $554 $2,046 (c) (d)arrow_forwardwhy both the "beginning inventory" and "ending inventory" figures both appear on the Income Statement of the worksheet for the Periodic Inventory Method.arrow_forwardHow would you record this transaction in a journal entry? Accepted a sales return from Eastern for an item having an original gross sales price of $6000. The original sale to eastern occurred in November with terms 2/15, n/30.arrow_forward

- The following transactions pertain to Year 1, the first-year operations of Rooney Company. All inventory was started and completed during Year 1. Assume that all transactions are cash transactions. 1. Acquired $4,900 cash by issuing common stock. 2. Paid $660 for materials used to produce inventory. 3. Paid $1,900 to production workers. 4. Paid $1,078 rental fee for production equipment. 5. Paid $90 to administrative employees. 6. Paid $106 rental fee for administrative office equipment. 7. Produced 340 units of inventory of which 190 units were sold at a price of $13 each. Required Prepare an income statement and a balance sheet in accordance with GAAP.arrow_forwardThe cost of merchandise sold and merchandise inventory is determined from the inventory cost flow assumption. To illustrate, beginning inventory, purchases and sales of shoes are shown below for Grant Co., using a perpetual inventory system. 1. In the table below, fill in the March 24 quantity, unit cost, and total cost in the spaces provided for determining Cost of Merchandise Sold (COMS) and Merchandise Inventory under the FIFO cost flow assumption, assuming 32 shoes are sold on March 24. Determine the COMS and Merchandise inventory final balances. If units are in inventory or are listed under cost of merchandise sold at two different costs, enter the units that were purchased earliest first. 2. In the table below, fill in the March 24 quantity, unit cost, and total cost in the spaces provided for determining Cost of Merchandise Sold (COMS) and Merchandise Inventory under the LIFO cost flow assumption, assuming 32 shoes are sold on March 24. Determine the COMS and Merchandise…arrow_forwardPlease helparrow_forward

- How do you calculate the total amount to be assigned to the ending inventory and cost of goods sold December 31 under each of the following methods?arrow_forwardCrosby Company owns a chain of hardware stores throughout the state. The company uses a periodic inventory system and the retail Inventory method to estimate ending inventory and cost of goods sold. The following data are available for the three months ending March 31, 2021: Beginning inventory. Net purchases Net markups Net markdowns Net sales Beginning inventory Net purchases Net markups Required: Complete the table below to estimate the LIFO cost of ending inventory and cost of goods sold for the three months ending March 31, 2021, using the information provided. Assume stable retail prices during the period (Round ratio calculation to 2 decimal places (i.e.. 0.1234 should be entered as 12.34%.). Enter amounts to be deducted with a minus sign.) Cost $180,000 630,000 Net markdowns Goods available for sale (excluding beg. inventory) Goods available for sale (including beg inventory) Cost-to-retail percentage (beginning) Cost-to-retail percentage (current) sales Estimated ending…arrow_forwardRequired information [The following information applies to the questions displayed below.] Valley Company's adjusted account balances from its general ledger on August 31, its fiscal year-end, follows. It categorizes the following accounts as selling expenses: sales salaries expense, rent expense-selling space, store supplies expense, and advertising expense. It categorizes the remaining expenses as general and administrative. Adjusted Account Balances Merchandise inventory (ending) Other (non-inventory) assets Total liabilities Common stock Retained earnings Dividends Sales Sales discounts Sales returns and allowances Cost of goods sold Sales salaries expense Rent expense-Selling space Store supplies expense Advertising expense Office salaries expense Rent expense-Office space Office supplies expense Totals Debit $ 41,000 164,000 Invoice cost of merchandise purchases Purchases discounts received Purchases returns and allowances Costs of transportation-in 8,000 4,291 18,509 108, 210…arrow_forward

- I need help please with accountingarrow_forwardThe cost accountant for Sunset Fashions has compiled the following information for last quarter's operations: Administrative costs Merchandise inventory, April 1 Merchandise inventory, June 30 Merchandise purchases Miscellaneous store costs Sales commissions Sales revenue Store lease Utilities Transportation-in costs Wages and benefits Required: 1. Prepare a cost of goods sold statement. 2. Prepare an income statement. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare an income statement. SUNSET FASHIONS Income Statement For the Quarter Ended June 30 Sales revenue Cost of goods sold Gross margin Store rent Operating loss $ $ $ 232,000 55,000 45,500 1,790,000 23,400 134,400 3,126,000 53,000 57,900 124,400 770,000 $ 3,126,000 1,923,900 1,202,100 53,000 68,400arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education