Concept explainers

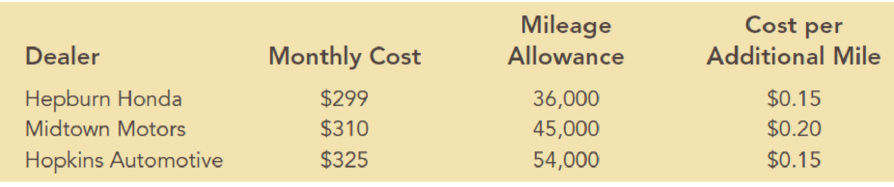

Amy Lloyd is interested in leasing a new Honda and has contacted three automobile dealers for pricing information. Each dealer offered Amy a closed-end 36-month lease with no down payment due at the time of signing. Each lease includes a monthly charge and a mileage allowance. Additional miles receive a surcharge on a per-mile basis. The monthly lease cost, the mileage allowance, and the cost for additional miles follow:

Amy decided to choose the lease option that will minimize her total 36-month cost. The difficulty is that Amy is not sure how many miles she will drive over the next three years. For purposes of this decision, she believes it is reasonable to assume that she will drive 12,000 miles per year, 15,000 miles per year, or 18,000 miles per year. With this assumption Amy estimated her total costs for the three lease options. For example, she figures that the Hepburn Honda lease will cost her 36($299) + $0.15(36,000 – 36,000) = $10,764 if she drives 12,000 miles per year, 36($299) + $0.15(45,000 – 36,000) = $12,114 if she drives 15,000 miles per year, or 36($299) + $0.15(54.000 – 36,000) = $13,464 if she drives 18,000 miles per year.

- a. What is the decision, and what is the chance

event ? - b. Construct a payoff table for Amy’s problem.

- c. If Amy has no idea which of the three mileage assumptions is most appropriate, what is the recommended decision (leasing option) using the optimistic, conservative, and minimax regret approaches?

- d. Suppose that the probabilities that Amy drives 12,000, 15,000, and 18,000 miles per year are 0.5, 0.4, and 0.1, respectively. What option should Amy choose using the

expected value approach? - e. Develop a risk profile for the decision selected in part (d). What is the most likely cost, and what is its

probability ? - f. Suppose that, after further consideration, Amy concludes that the probabilities that she will drive 12,000, 15,000, and 18,000 miles per year are 0.3, 0.4, and 0.3, respectively. What decision should Amy make using the expected value approach?

a.

Find the decision and the chance event faced by Amy.

Explanation of Solution

Here, the decision is based on selecting the best lease option. Thus the least option has three alternatives that are Hepburn Honda, Midtown Motors and Hopkins Automotive.

Here, the chance event is the number of miles Amy will drive.

b.

Find the payoff table for Amy’s problem.

Answer to Problem 3P

Thus, the payoff table for Amy’s problem is given as:

| Actual Miles Driven Annually | |||

| Decision | 12000 | 15000 | 18000 |

| Hepburn Honda | $10,764 | $12,114 | $13,464 |

| Midtown Motors | $11,160 | $11,160 | $12,960 |

| Hopkins Automotive | $11,700 | $11,700 | $11,700 |

Explanation of Solution

The payoff for any combination of alternative and the chance event is the sum of the total monthly charges and total additional mileage cost that is given as follows:

For the Hepburn Honda lease option:

36000 (12000miles×3yrs): 36($299)+$ 0.15×(36000-36000)=$10,764.45000 (15000miles×3yrs): 36($299)+$ 0.15×(45000-36000)=$12,114.54000 (18000miles×3yrs): 36($299)+$ 0.15×(54000-36000)=$13,464.

For the Midtown Motors lease option:

36000 (12000miles×3yrs): 36($299)+$ 0.20×(36000-45000)=$11,160.45000 (15000miles×3yrs): 36($299)+$ 0.20×(45000-45000)=$11,160.54000 (18000miles×3yrs): 36($299)+$ 0.20×(54000-45000)=$12,960.

For the Hopkins Automotive lease option:

36000 (12000miles×3yrs): 36($299)+$ 0.15×(36000-54000)=$11,700.45000 (15000miles×3yrs): 36($299)+$ 0.15×(45000-54000)=$11,700.54000 (18000miles×3yrs): 36($299)+$ 0.15×(54000-54000)=$11,700.

Thus, the payoff table for Amy’s problem is given as:

| Actual Miles Driven Annually | |||

| Decision | 12000 | 15000 | 18000 |

| Hepburn Honda | $10,764 | $12,114 | $13,464 |

| Midtown Motors | $11,160 | $11,160 | $12,960 |

| Hopkins Automotive | $11,700 | $11,700 | $11,700 |

c.

Find the decision using the optimistic, conservative and minimax regret approaches.

Answer to Problem 3P

The Hepburn Honda lease option gives the optimistic approach because it has the smallest minimum profit.

The Hopkins Automotive lease option gives the conservative approach because it has the smallest maximum profit.

The minimax regret is the Hopkins Automotive lease option because it minimizes the maximum regret.

Explanation of Solution

By using the decision tree in Part (a), the maximum and minimum profit based on the decisions Hepburn Honda, Midtown Motors and Hopkins Automotive.

| Decision | Maximum Profit | Minimum Profit |

| Hepburn Honda | $10,764 | $13,464 |

| Midtown Motors | $11,160 | $12,960 |

| Hopkins Automotive | $11,700 | $11,700 |

Optimistic approach:

The optimistic approach evaluates each decision alternative in terms of best payoff that can occur.

The Hepburn Honda lease option gives the optimistic approach because it has the smallest minimum profit (from the above table).

Conservative approach:

The conservative approach evaluates each decision alternative in terms of worst payoff that can occur.

The Hopkins Automotive lease option gives the conservative approach because it has the smallest maximum profit (from the above table).

Minimax Regret approach:

The minimax regret approach is the difference between the payoff associated with a particular alternative and payoff associated with the most decision that would yield the most desirable payoff for a given state of nature.

Regret or opportunity loss table:

| Decision | 12000 | 15000 | 18000 | Maximum Regret |

| Hepburn Honda | $0 | $954 | $1,764 | $1,764 |

| Midtown Motors | $396 | $0 | $1,260 | $1,260 |

| Hopkins Automotive | $936 | $540 | $0 | $936 |

The maximum regret for the decision Hepburn Honda is $1,764, Midtown Motors is $1,260 and Hopkins Automotive is $936.

Here, the Hopkins Automotive lease option has been selected because it minimizes the maximum regret.

d.

Find the expected value approach for the probabilities of 0.5, 0.4 and 0.1.

Answer to Problem 3P

The expected value approach results in Midtown Motors lease option.

Explanation of Solution

The formula to find expected value (EV) of decision alternative di is given as follows:

EV(di)=N∑j=1P(sj)Vij

Here, the expected value for the payoffs associated with each of Amy’s three alternatives:

EV(Hepburn Honda) =0.5($10,764)+0.4($12,114)+0.1($13,464) =$11,574.EV(Midtown Motors) =0.5($11,160)+0.4($11,160)+0.1($11,160) =$11,340.EV(Hopkins Automotive) =0.5($11,700)+0.4($11,700)+0.1($11,700) =$11,700.

The expected value approach results in Midtown Motors lease option because it has the minimum expected value of the three alternatives.

e.

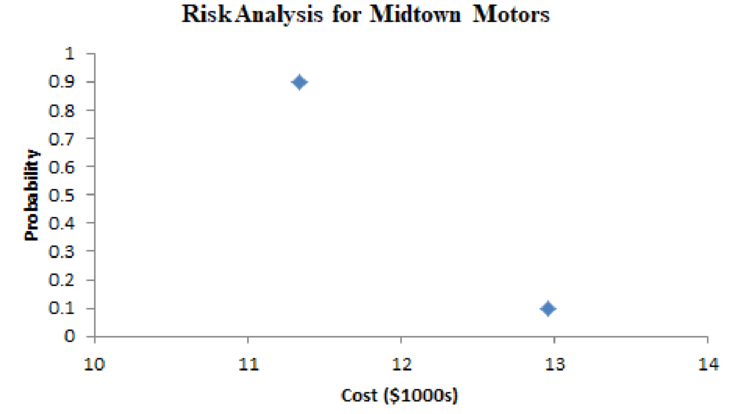

Find the most likely cost and its probability using risk analysis.

Answer to Problem 3P

The risk analysis for midtown motors, the most likely cost is $11,160 with the probability of 0.9.

Explanation of Solution

From the data in part (d).

The risk profile for the decision to lease from Midtown Motors is:

From the above risk analysis for midtown motors, the most likely cost is $11,160 with the probability of 0.9.

Here, there are only two unique costs on this graph because for the decision alternative (midtown motors) have two unique payoffs. The payoffs are associated with the three chance outcomes- the payoff (cost) associated with midtown motors lease is same for the two of the chance outcomes.

f.

Find the expected value approach for the probabilities of 0.3, 0.4 and 0.3.

Answer to Problem 3P

The expected value approach results in either Midtown Motors lease option or Hopkins Automotive lease option.

Explanation of Solution

The formula to find expected value (EV) of decision alternative di is given as follows:

EV(di)=N∑j=1P(sj)Vij

Here, the expected value for the payoffs associated with each of Amy’s three alternatives:

EV(Hepburn Honda) =0.3($10,764)+0.4($12,114)+0.3($13,464) =$12,114.EV(Midtown Motors) =0.3($11,160)+0.4($11,160)+0.3($11,160) =$11,700.EV(Hopkins Automotive) =0.3($11,700)+0.4($11,700)+0.3($11,700) =$11,700.

The expected value approach results in either Midtown Motors lease option or Hopkins Automotive lease option because both have the same minimum expected value of the three alternatives.

Want to see more full solutions like this?

Chapter 15 Solutions

Essentials of Business Analytics (MindTap Course List)

- Faye cuts the sandwich in two fair shares to her. What is the first half s1arrow_forwardQuestion 2. An American option on a stock has payoff given by F = f(St) when it is exercised at time t. We know that the function f is convex. A person claims that because of convexity, it is optimal to exercise at expiration T. Do you agree with them?arrow_forwardQuestion 4. We consider a CRR model with So == 5 and up and down factors u = 1.03 and d = 0.96. We consider the interest rate r = 4% (over one period). Is this a suitable CRR model? (Explain your answer.)arrow_forward

- Question 3. We want to price a put option with strike price K and expiration T. Two financial advisors estimate the parameters with two different statistical methods: they obtain the same return rate μ, the same volatility σ, but the first advisor has interest r₁ and the second advisor has interest rate r2 (r1>r2). They both use a CRR model with the same number of periods to price the option. Which advisor will get the larger price? (Explain your answer.)arrow_forwardQuestion 5. We consider a put option with strike price K and expiration T. This option is priced using a 1-period CRR model. We consider r > 0, and σ > 0 very large. What is the approximate price of the option? In other words, what is the limit of the price of the option as σ∞. (Briefly justify your answer.)arrow_forwardQuestion 6. You collect daily data for the stock of a company Z over the past 4 months (i.e. 80 days) and calculate the log-returns (yk)/(-1. You want to build a CRR model for the evolution of the stock. The expected value and standard deviation of the log-returns are y = 0.06 and Sy 0.1. The money market interest rate is r = 0.04. Determine the risk-neutral probability of the model.arrow_forward

- Several markets (Japan, Switzerland) introduced negative interest rates on their money market. In this problem, we will consider an annual interest rate r < 0. We consider a stock modeled by an N-period CRR model where each period is 1 year (At = 1) and the up and down factors are u and d. (a) We consider an American put option with strike price K and expiration T. Prove that if <0, the optimal strategy is to wait until expiration T to exercise.arrow_forwardWe consider an N-period CRR model where each period is 1 year (At = 1), the up factor is u = 0.1, the down factor is d = e−0.3 and r = 0. We remind you that in the CRR model, the stock price at time tn is modeled (under P) by Sta = So exp (μtn + σ√AtZn), where (Zn) is a simple symmetric random walk. (a) Find the parameters μ and σ for the CRR model described above. (b) Find P Ste So 55/50 € > 1). StN (c) Find lim P 804-N (d) Determine q. (You can use e- 1 x.) Ste (e) Find Q So (f) Find lim Q 004-N StN Soarrow_forwardIn this problem, we consider a 3-period stock market model with evolution given in Fig. 1 below. Each period corresponds to one year. The interest rate is r = 0%. 16 22 28 12 16 12 8 4 2 time Figure 1: Stock evolution for Problem 1. (a) A colleague notices that in the model above, a movement up-down leads to the same value as a movement down-up. He concludes that the model is a CRR model. Is your colleague correct? (Explain your answer.) (b) We consider a European put with strike price K = 10 and expiration T = 3 years. Find the price of this option at time 0. Provide the replicating portfolio for the first period. (c) In addition to the call above, we also consider a European call with strike price K = 10 and expiration T = 3 years. Which one has the highest price? (It is not necessary to provide the price of the call.) (d) We now assume a yearly interest rate r = 25%. We consider a Bermudan put option with strike price K = 10. It works like a standard put, but you can exercise it…arrow_forward

- In this problem, we consider a 2-period stock market model with evolution given in Fig. 1 below. Each period corresponds to one year (At = 1). The yearly interest rate is r = 1/3 = 33%. This model is a CRR model. 25 15 9 10 6 4 time Figure 1: Stock evolution for Problem 1. (a) Find the values of up and down factors u and d, and the risk-neutral probability q. (b) We consider a European put with strike price K the price of this option at time 0. == 16 and expiration T = 2 years. Find (c) Provide the number of shares of stock that the replicating portfolio contains at each pos- sible position. (d) You find this option available on the market for $2. What do you do? (Short answer.) (e) We consider an American put with strike price K = 16 and expiration T = 2 years. Find the price of this option at time 0 and describe the optimal exercising strategy. (f) We consider an American call with strike price K ○ = 16 and expiration T = 2 years. Find the price of this option at time 0 and describe…arrow_forward2.2, 13.2-13.3) question: 5 point(s) possible ubmit test The accompanying table contains the data for the amounts (in oz) in cans of a certain soda. The cans are labeled to indicate that the contents are 20 oz of soda. Use the sign test and 0.05 significance level to test the claim that cans of this soda are filled so that the median amount is 20 oz. If the median is not 20 oz, are consumers being cheated? Click the icon to view the data. What are the null and alternative hypotheses? OA. Ho: Medi More Info H₁: Medi OC. Ho: Medi H₁: Medi Volume (in ounces) 20.3 20.1 20.4 Find the test stat 20.1 20.5 20.1 20.1 19.9 20.1 Test statistic = 20.2 20.3 20.3 20.1 20.4 20.5 Find the P-value 19.7 20.2 20.4 20.1 20.2 20.2 P-value= (R 19.9 20.1 20.5 20.4 20.1 20.4 Determine the p 20.1 20.3 20.4 20.2 20.3 20.4 Since the P-valu 19.9 20.2 19.9 Print Done 20 oz 20 oz 20 oz 20 oz ce that the consumers are being cheated.arrow_forwardT Teenage obesity (O), and weekly fast-food meals (F), among some selected Mississippi teenagers are: Name Obesity (lbs) # of Fast-foods per week Josh 185 10 Karl 172 8 Terry 168 9 Kamie Andy 204 154 12 6 (a) Compute the variance of Obesity, s²o, and the variance of fast-food meals, s², of this data. [Must show full work]. (b) Compute the Correlation Coefficient between O and F. [Must show full work]. (c) Find the Coefficient of Determination between O and F. [Must show full work]. (d) Obtain the Regression equation of this data. [Must show full work]. (e) Interpret your answers in (b), (c), and (d). (Full explanations required). Edit View Insert Format Tools Tablearrow_forward

Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL

Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL Elementary AlgebraAlgebraISBN:9780998625713Author:Lynn Marecek, MaryAnne Anthony-SmithPublisher:OpenStax - Rice University

Elementary AlgebraAlgebraISBN:9780998625713Author:Lynn Marecek, MaryAnne Anthony-SmithPublisher:OpenStax - Rice University Algebra: Structure And Method, Book 1AlgebraISBN:9780395977224Author:Richard G. Brown, Mary P. Dolciani, Robert H. Sorgenfrey, William L. ColePublisher:McDougal Littell

Algebra: Structure And Method, Book 1AlgebraISBN:9780395977224Author:Richard G. Brown, Mary P. Dolciani, Robert H. Sorgenfrey, William L. ColePublisher:McDougal Littell Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning, Intermediate AlgebraAlgebraISBN:9781285195728Author:Jerome E. Kaufmann, Karen L. SchwittersPublisher:Cengage Learning

Intermediate AlgebraAlgebraISBN:9781285195728Author:Jerome E. Kaufmann, Karen L. SchwittersPublisher:Cengage Learning Algebra for College StudentsAlgebraISBN:9781285195780Author:Jerome E. Kaufmann, Karen L. SchwittersPublisher:Cengage Learning

Algebra for College StudentsAlgebraISBN:9781285195780Author:Jerome E. Kaufmann, Karen L. SchwittersPublisher:Cengage Learning