Advanced Accounting

14th Edition

ISBN: 9781260247824

Author: Joe Ben Hoyle, Thomas F. Schaefer, Timothy S. Doupnik

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 15, Problem 27P

March, April, and May have been in

Prepare

- a. Sold all inventory for $56,000 cash.

- b. Paid $7,500 in liquidation expenses.

- c. Paid $40,000 of the partnership’s liabilities.

- d. Collected $45,000 of the

accounts receivable . - e. Distributed safe cash balances: the partners anticipate no further liquidation expenses.

- f. Sold remaining accounts receivable for 30 percent of face value.

- g. Sold land, building, and equipment for $17,000.

- h. Paid all remaining liabilities of the partnership.

- i. Distributed cash held by the business to the partners.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

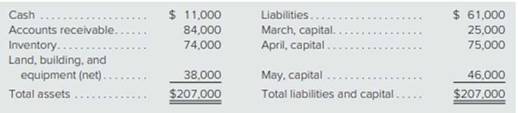

March, April, and May have been in partnership for a number of years. The partners allocate all profits and losses on a 2:3:1 basis, respectively. Recently, each partner has become personally insolvent and, thus, the partners have decided to liquidate the business in hopes of remedying their personal financial problems. As of September 1, the partnership’s balance sheet is as follows:

Prepare journal entries for the following transactions:

Sold all inventory for $56,000 cash.

Paid $7,500 in liquidation expenses.

Paid $40,000 of the partnership’s liabilities.

Collected $45,000 of the accounts receivable.

Distributed safe cash balances; the partners anticipate no further liquidation expenses.

Sold remaining accounts receivable for 30 percent of face value.

Sold land, building, and equipment for $17,000.

Paid all remaining liabilities of the partnership.

Distributed cash held by the business to the partners.

March, April, and May have been in partnership for a number of years. The partners allocate all profits and losses on a 2:3:1 basis,

respectively. Recently, each partner has become personally insolvent and, thus, the partners have decided to liquidate the business in

hopes of remedying their personal financial problems. As of September 1, the partnership's balance sheet is as follows:

Cash

Accounts receivable

Inventory

Land, building, and equipment (net)

Total assets

a. Sold all inventory for $73,000 cash.

b. Paid $12,600 in liquidation expenses.

$ 28,000

118,000

97,000

64,000

$ 307,000

c. Paid $57,000 of the partnership's liabilities.

d. Collected $68,000 of the accounts receivable.

Prepare journal entries for the following transactions: (Do not round intermediate calculations. If no entry is required for a

transaction/event, select "No journal entry required" in the first account field.)

Liabilities

March, capital

April, capital

May, capital

Total liabilities and capital

e.…

March, April, and May have been in partnership for a number of years. The partners allocate all profits and losses on a 2:3:1 basis, respectively. Recently, each partner has become personally insolvent and, thus, the partners have decided to liquidate the business in hopes of remedying their personal financial problems. As of September 1, the partnership’s balance sheet is as follows:

Cash

$

18,000

Liabilities

$

66,000

Accounts receivable

98,000

March, capital

32,000

Inventory

75,000

April, capital

82,000

Land, building, and equipment (net)

42,000

May, capital

53,000

Total assets

$

233,000

Total liabilities and capital

$

233,000

Prepare journal entries for the following transactions: (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Sold all inventory for $63,000 cash.

Paid $9,600 in liquidation expenses.

Paid $47,000 of the…

Chapter 15 Solutions

Advanced Accounting

Ch. 15 - Prob. 1QCh. 15 - Prob. 2QCh. 15 - Prob. 3QCh. 15 - Prob. 4QCh. 15 - What is the purpose of a statement of liquidation?...Ch. 15 - Prob. 1PCh. 15 - Prob. 2PCh. 15 - Prob. 3PCh. 15 - Prob. 4PCh. 15 - A partnership is considering possible liquidation...

Ch. 15 - What is a predistribution plan? a. A list of the...Ch. 15 - Prob. 7PCh. 15 - Prob. 8PCh. 15 - Prob. 9PCh. 15 - Prob. 10PCh. 15 - Prob. 11PCh. 15 - Prob. 12PCh. 15 - Prob. 13PCh. 15 - Prob. 14PCh. 15 - Prob. 15PCh. 15 - Prob. 16PCh. 15 - Prob. 17PCh. 15 - Prob. 18PCh. 15 - Prob. 25PCh. 15 - Prob. 26PCh. 15 - March, April, and May have been in partnership for...Ch. 15 - Prob. 28PCh. 15 - Prob. 29P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

What is liquidity?; Author: The Finance Storyteller;https://www.youtube.com/watch?v=XtjS7CfUSsA;License: Standard Youtube License