Financial Management: Theory & Practice

16th Edition

ISBN: 9781337909730

Author: Brigham

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 15, Problem 16SP

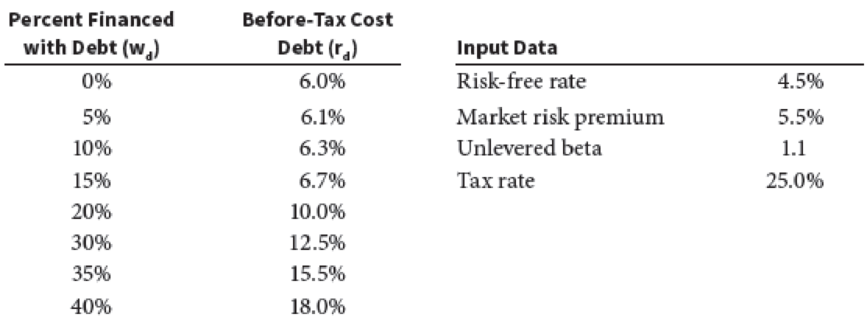

Start with the partial model in the file Ch15 P13 Build a Model.xlsx on the textbook’s Web site. Reacher Technology has consulted with investment bankers and determined the interest rate it would pay for different capital structures, as shown in the following table. Data for the risk-free rate, the market risk premium, an estimate of Reacher’s unlevered beta, and the tax rate are also shown. Reacher expects zero growth. Based on this information, what is the firm’s optimal capital structure, and what is the weighted average cost of capital at the optimal structure?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

(Capital asset pricing model) Grace Corporation is considering the following investments. The current rate on Treasury bills is

2.5

percent and the expected return for the market is

9

percent.

Stock

Beta

K

1.06

G

1.28

B

0.78

U

0.93

(Click

on the icon

in order to copy its contents into a

spreadsheet.)

a. Using the CAPM, what rates of return should Grace require for each individual security?

b. How would your evaluation of the expected rates of return for Grace change if the risk-free rate were to rise to

4

percent and the market risk premium were to be only

6

percent?

c. Which market risk premium scenario (from part a or

b)

best fits a recessionary environment? A period of economic expansion? Explain your response.

Question content area bottom

Part 1

a. The expected rate of return for security K, which has a beta of

1.06,

is

enter your response here%.

(Round to two decimal places.)

Part 2

The expected rate…

Calculate Johnson & Johnson's capital asset price model. It is recommended to use treasury security as the risk-free rate - pick which one (It would probably be best to use the 5- or 10-year Treasury note). Beta can be either calculated or you can use one from the internet. Yahoo Finance lists the most current beta under “key statistics.” As for the risk for the market, search the most recent. Usually, it is around 5% to 6%.

Conglomco has a beta of 0.32. If the market

return is expected to

be 12 percent and the risk-free rate is 5 percent,

what is Conglomco's required return? Use the

capital asset pricing model (CAPM) to calculate

Conglomco's required return.

Chapter 15 Solutions

Financial Management: Theory & Practice

Ch. 15 - Prob. 1QCh. 15 - What term refers to the uncertainty inherent in...Ch. 15 - Firms with relatively high nonfinancial fixed...Ch. 15 - “One type of leverage affects both EBIT and EPS....Ch. 15 - Why is the following statement true? Other things...Ch. 15 - Why do public utility companies usually have...Ch. 15 - Why is EBIT generally considered to be independent...Ch. 15 - If a firm went from zero debt to successively...Ch. 15 - Prob. 9QCh. 15 - Prob. 1P

Ch. 15 - Counts Accountings beta is 1.2 and its tax rate is...Ch. 15 - Ethier Enterprise has an unlevered beta of 1.0....Ch. 15 - Quillpen Company is unlevered and has a value of...Ch. 15 - Walkrun Inc. is unlevered and has a value of 400...Ch. 15 - Cruz Corporation has 100 billion of debt...Ch. 15 - Nichols Corporations value of operations is equal...Ch. 15 - Lee Manufacturings value of operations is equal to...Ch. 15 - Dye Trucking raised $150 million in new debt and...Ch. 15 - Schweser Satellites Inc. produces satellite earth...Ch. 15 - The Rivoli Company has no debt outstanding, and...Ch. 15 - Pettit Printing Company (PPC) has a total market...Ch. 15 - Beckman Engineering and Associates (BEA) is...Ch. 15 - F. Pierce Products Inc. is considering changing...Ch. 15 - A. Fethe Inc. is a custom manufacturer of guitars,...Ch. 15 - Start with the partial model in the file Ch15 P13...Ch. 15 - Assume you have just been hired as a business...Ch. 15 - Prob. 2MCCh. 15 - Prob. 3MCCh. 15 - To illustrate the effects of financial leverage...Ch. 15 - What happens to ROE for Firm U and Firm L if EBIT...Ch. 15 - What does capital structure theory attempt to do?...Ch. 15 - Prob. 7MCCh. 15 - Liu Industries is a highly levered firm. Suppose...Ch. 15 - How do companies manage the maturity structure of...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Your firm is planning to invest in an automated packaging plant. Harburtin Industries is an all-equity firm that specializes in this business. Suppose Harburtin's equity beta is 0.82, the risk-free rate is 5%, and the market risk premium is 5%. a. If your firm's project is all-equity financed, estimate its cost of capital. After computing the project's cost of capital you decided to look for other comparables to reduce estimation error in your cost of capital estimate. You find a second firm, Thurbinar Design, which is also engaged in a similar line of business. Thurbinar has a stock price of $18 per share, with 14 million shares outstanding. It also has $112 million in outstanding debt, with a yield on the debt of 4.5%. Thurbinar's equity beta is 1.00. b. Assume Thurbinar's debt has a beta of zero. Estimate Thurbinar's unlevered beta. Use the unlevered beta and the CAPM to estimate Thurbinar's unlevered cost of capital. c. Estimate Thurbinar's equity cost of capital…arrow_forward(Capital asset pricing model) Anita, Inc. is considering the following investments. The current rate on Treasury bills is 6 percent, and the expected return for the market is 14 percent. Using the CAPM, what rates of return should Anita require for each individual security? Stock H T P W (Click on the icon in order to copy its contents into a spreadsheet.) Beta 0.92 1.63 0.87 1.17 a. The expected rate of return for security H, which has a beta of 0.92, is%. (Round to two decimal places.)arrow_forwardThe risk-free rate is currently 3.3%, and the market return is 14.8%. Assume you are considering the following investments: Investment Beta A 1.54 B 1.16 C 0.51 D 0.11 E 2.14 . a. Which investment is most risky? Least risky? b. Use the capital asset pricing model (CAPM) to find the required return on each of the investments. c. Find the security market line (SML), using your findings in part b. d. On the basis of your findings in part c, what relationship exists between risk and return? Explain.arrow_forward

- Being Finance Manager of Salalah Textiles Industries, you need to invest an amount for OMR 50,000 in the investment market. Assume the market rate of return is 0.11, risk free rate of return is 2.75% and Beta is .73, then:Required:a) What should be required rate of return for your investment?b) Keeping the answer of question # 2a in mind, if different investment options are available with different returns in the investment market, for example:i. For investment in Project-A, 6.30% return is offered;ii. For investment in Project-B, 10.95% return is offered, andiii. For investment in Project-C, 5.65% return is offered.In above scenario, explain whether any why these investment options are overvalued or undervalued? Keeping the answer of question # 2a and 2b, what will be your investment decision (justify your answer with reasons)arrow_forwardBeing Finance Manager of Salalah Textiles Industries, you need to invest an amount for OMR 50,000 in the investment market. Assume the market rate of return is 0.11, risk free rate of return is 2.75% and Beta is .73, then:Required:a) What should be required rate of return for your investment?arrow_forwardImagineering, Inc., is considering an investment in CADCAM-compatible design software with the cash flow profile shown in the table below. Imagineering’s MARR is 18%/yr. Solve, a. What is the internal rate of return of this investment? b. What is the decision rule for judging the attractiveness of investments based on internal rate of return? c. Should Imagineering invest?arrow_forward

- (Capital Asset Pricing Model) Johnson Manufacturing, Inc., is considering several investments. The rate on Treasury bills is currently 7.5 percent, and the expected return for the market is 10.5 percent. What should be the expected rate of return for each investment (using the CAPM)? Security A B C D Beta 1.62 1.02 0.71 1.34 a. The expected rate of return for security A, which has a beta of 1.62, is%. (Round to two decimal places.)arrow_forwardUse the basic equation for the capital asset pricing model (CAPM) to work each of the following problems. a. Find the required return for an asset with a beta of 1.65 when the risk-free rate and market return are 8% and 14%, respectively. b. Find the risk-free rate for a firm with a required return of 11.366% and a beta of 1.29 when the market return is 10%. c. Find the market return for an asset with a required return of 7.711% and a beta of 0.89 when the risk-free rate is 4%. d. Find the beta for an asset with a required return of 6.552% when the risk-free rate and market return are 6% and 8.4%, respectively.arrow_forwardAssume that the risk-free rate, RF, is currently 8%, the market return, RM, is 12%, and asset A has a beta, of 1.10. (could be done on word document or excel). Draw the security market line (SML) Use the CAPM to calculate the required return, on asset A. Assume that as a result of recent events, investors have become more risk averse, causing the market return to rise by 2%, to be14%. Ignoring the shift in part c, draw the new SML on the same set of axes that you used before, and calculate and show the new required return for asset A.arrow_forward

- You look at the rate of returns, and the betas of different capital investment options. To determine which should be pursued, you will look at Internal Rate of Return, the Capital Asset Pricing Model (Security Market Line), and the Weighted Average Cost of Capital. The expected return on the market is 12%, and the risk-free rate is 5%. Project Z: return = 17.0%, beta = 1.81 Project X: return = 10.5%, beta = .90 Project W: return = 10.0%, beta = .55 Project Y: return = 14.0%, beta = 1.10 a. Which projects should be accepted using the CAPM(SML) rule? Project W should be Project Y should be Project X should be and Project Z should bearrow_forwardUse the basic equation for the capital asset pricing model (CAPM) to work each of the following problems. a. Find the required return for an asset with a beta of 1.63 when the risk-free rate and market return are 5% and 13%, respectively. b. Find the risk-free rate for a firm witha required return of 14.363% and a beta of 1.07 when the market return is 14%. C. Find the market return for an asset with a required return of 9.045% and a beta of 1.57 when the risk-free rate is 3%. d. Find the beta for an asset with a required return of 10.255% when the risk-free rate and market return are 6% and 9.7%, respectively. a. The required return for an asset with a beta of 1.63 when the risk-free rate and market return are 5% and 13%, respectively, is %.arrow_forwardHastings Entertainment has a beta of 0.65. If the market return is expected to be 11% and the risk-free rate is 4%, what is Hastings' required return? Use the capital asset pricing model.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License