Bo Vonderweidt, the production manager for Sportway Corporation, had requested to have lunch with the company president. Vonderweidt wanted to put forward his suggestion to add a new product line. As they finished lunch, Meg Thomas, the company president, said, “I’ll give your proposal some serious thought, Bo. I think you’re right about the increasing demand for skateboards. What I’m not sure about is whether the skateboard line will be better for us than our tackle boxes. Those have been our bread and butter the past few years.”

Vonderweidt responded with, “Let me get together with one of the controller’s people. We’ll run a few numbers on this skateboard idea that I think will demonstrate the line’s potential.”

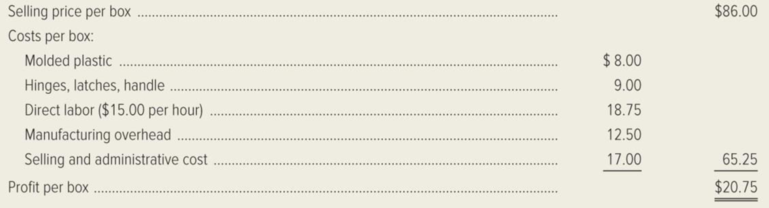

Sport way is a wholesale distributor supplying a wide range of moderately priced sports equipment to large chain stores. About 60 percent of Sport way’s products are purchased from other companies while the remainder of the products are manufactured by Sport way. The company has a Plastics Department that is currently manufacturing molded fishing tackle boxes. Sport way is able to manufacture and sell 8,000 tackle boxes annually, making full use of its direct-labor capacity at available work stations. The selling price and costs associated with Sport way’s tackle boxes are as follows:

Because Sport way’s sales manager believes the firm could sell 12,000 tackle boxes if it had sufficient manufacturing capacity, the company has looked into the possibility of purchasing the tackle boxes for distribution. Maple Products, a steady supplier of quality products, would be able to provide up to 9,000 tackle boxes per year at a price of $68.00 per box delivered to Sport way’s facility.

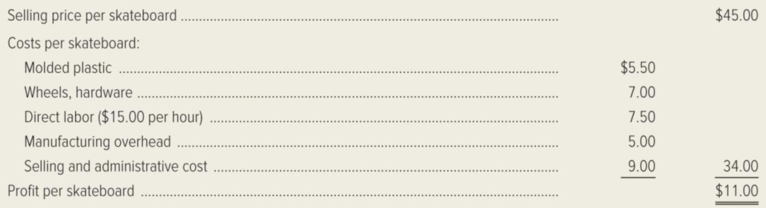

Bo Vonderweidt, Sport way’s production manager, has come to the conclusion that the company could make better use of its Plastics Department by manufacturing skateboards. Vonderweidt has a market study that indicates an expanding market for skateboards and a need for additional suppliers. Vonderweidt believes that Sport way could expect to sell 17,500 skateboards annually at a price of $45.00 per skateboard.

After his lunch with the company president, Vonderweidt worked out the following estimates with the assistant controller.

In the Plastics Department, Sport way uses direct-labor hours as the application base for manufacturing

Required: In order to maximize the company’s profitability, prepare an analysis that will show which product or products Sport way’s Corporation should manufacture or purchase.

- 1. First determine which of Sport way’s options makes the best use of its scarce resources. How many skateboards and tackle boxes should be manufactured? How many tackle boxes should be purchased?

- 2. Calculate the improvement in Sport way’s total contribution margin if it adopts the optimal strategy rather than continuing with the status quo.

1.

Identify the option that makes the best use of Corporation S’s scarce resources.

Explanation of Solution

Contribution Margin: The process or theory which is used to judge the benefit given by each unit of the goods produced is called as contribution margin.

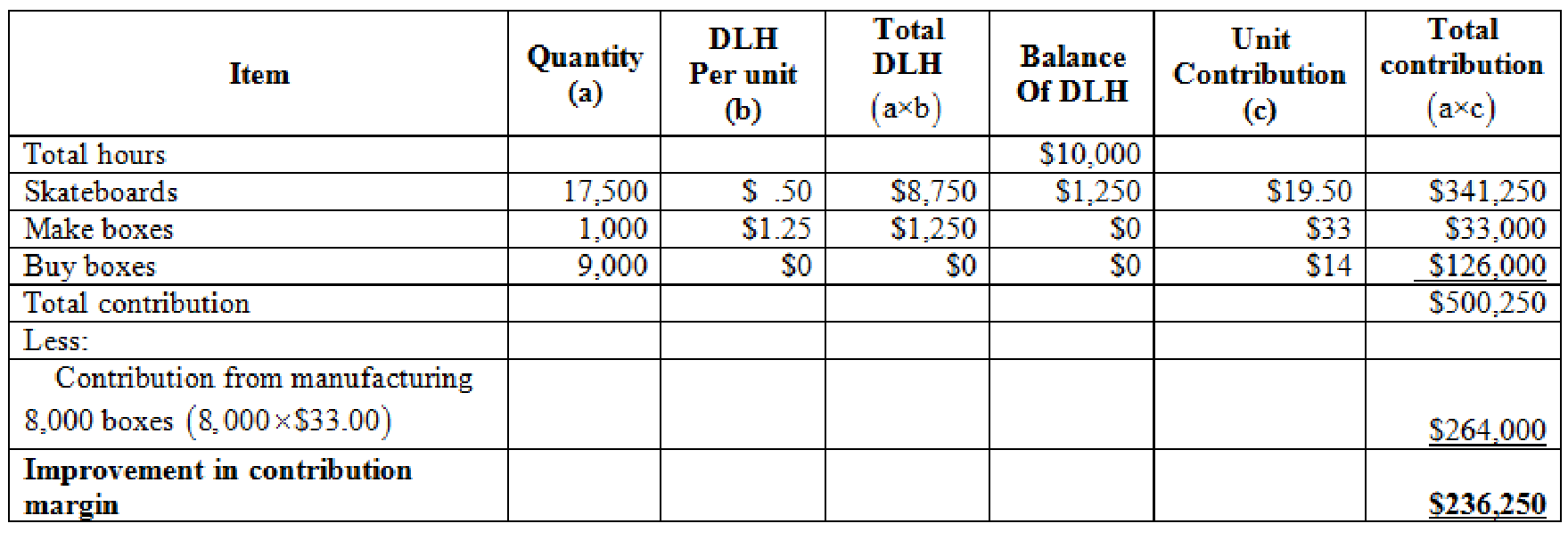

- Corporation S must purchase 9,000 tackle boxes from Company M, manufacture 17,500 skateboards, and manufacture 1,000 tackle boxes, In order to maximize the company’s profitability.

- This mixture of purchased and manufactured goods increases the contribution per direct-labor hour available.

The analysis supporting this conclusion is prepared as follows:

| Purchased | Manufactured | ||

| Particulars | Tackle Boxes | Tackle Boxes | Skate- boards |

| Selling price | $86 | $86 | $45 |

| Less: | |||

| Material | ($68) | ($17) | ($12.50) |

| Direct labor | $0 | ($18.75) | ($7.50) |

| Manufacturing overhead | $0 | (7)($6.25) | (9)($2.50) |

| Selling and administrative cost | (4.00) | ($11) | (3.00) |

| Contribution margin | $14 | $33 | $19.50 |

| Direct-labor hours per unit | $0 | (1)$1.25 | (8)$.5 |

| Contribution per hour | $0 | $26.40 | $39 |

Table (1)

Working notes:

Trackle boxes:

(1)Calculate direct-labor hours:

(2)Calculate the overhead per direct-labor hour:

(3)Calculate the capacity:

(4)Calculate the total overhead:

(5)Calculate the total variable overhead:

(6)Calculate variable overhead per hour:

(7)Calculate the variable overhead per box:

Skateboards:

(8)Calculate direct-labor hours:

(9)Calculate variable overhead:

Note: In computing the contribution margin, $6.00 of fixed overhead cost per unit for distribution should be subtracted from the selling and administrative cost.

2.

Compute the improvement in Corporation S’s contribution margin if it adopts the optimal strategy rather than continuing with the status

Explanation of Solution

The following table displays the improvement in the total contribution margin of the company if it manufactures 17,500 skateboards and 1,000 tackle boxes, instead of manufacturing 8,000 tackle boxes:

The optimal use of Corporation S’s available direct-labor hours (DLH):

Figure (1)

Want to see more full solutions like this?

Chapter 14 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Harriet Moore is an accountant for New World Pharmaceuticals. Her duties include tracking research and development spending in the new product development division. Over the course of the past six months, Harriet has noticed that a great deal of funds have been spent on a particular project for a new drug. She hears “through the grapevine” that the company is about to patent the drug and expects it to be a major advance in antibiotics. Harriet believes that this new drug will greatly improve company performance and will cause the company’s stock to increase in value. Harriet decides to purchase shares of New World in order to benefit from this expected increase. Required What are Harriet’s ethical responsibilities, if any, with respect to the information she has learned through her duties as an accountant for New World Pharmaceuticals? What are the implications of her planned purchase of New World shares?arrow_forwardAs a recent hire of B-Well, your job is to evaluate whether the company should open a traditional grocery store in Astoria or start online shopping option instead. Before deciding which project to undertake, the Board of Directors has already agreed that they will hire a consultant to verify their decision. The consultant is charging $16, 580 total. They have also agreed that they will hire an NYC marketing agency to promote B-Well's reputation. They are not sure what the charge will be for the marketing services. For now, they just have to decide which project they will undertake. Brick & Mortar Store. B-Well Health Mart has to rent and renovate a space in Astoria. The estimates for the up-front renovation costs range from $2,250,000 to $2,650,000 to be depreciated over the life of the project using straight-line with a zero salvage value. There is a foreclosed warehouse in the area that their lenders are offering at a large discount since the lenders are losing money on it. The…arrow_forwardDanielle Hastings was recently hired as a cost analyst by CareNet Medical Supplies Inc. One of Danielle’s first assignments was to perform a net present value analysis for a new warehouse. Danielle performed the analysis and calculated a present value index of 0.75. The plant manager, Jerrod Moore, is very intent on purchasing the warehouse because he believes that more storage space is needed. Jerrod asks Danielle into his office and the following conversation takes place: Jerrod: Danielle, you’re new here, aren’t you? Danielle: Yes, I am. Jerrod: Well, Danielle, I’m not at all pleased with the capital investment analysis that you performed on this new warehouse. I need that warehouse for my production. If I don’t get it, where am I going to place our output? Danielle: Well, we need to get product into our customers’ hands. Jerrod: I agree, and we need a warehouse to do that. Danielle: My analysis does not support constructing a new warehouse. The numbers don’t lie; the warehouse does…arrow_forward

- Imagine Industries, is a multinational firm that designs and produces tourist merchandise for major destinations worldwide. The company's board of directors is meeting to discuss changes that might be needed in the company's operations. At the end of the meeting, the board plans to examine Imagine industries' company issues on ability to produce enough output, new production process the company could use to create its product and issues relating to selection of a new location for production operations. b. Proposed to the board of directors of Imagine Industries, any TWO (2) potential ways to finance their business operations.arrow_forwardHirsch has been given 20 minutes at an upcoming meeting to pitch his idea for a process-improvement program to the rest of the Metropolis leadership team. What should he do before he gives the pitch? How should Hirsch organize this pitch and what information should he include?arrow_forwardYou are a manager at Percolated Fiber, which is considering expanding its operations in synthetic fiber manufacturing. Your boss comes into your office, drops a consultant’s report on your desk, and complains, "We owe these consultants $1 million for this report, and I am not sure their analysis makes sense. Before we spend the $25 million on the new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in thousands of dollars) for the project: Project year 1 2 … 9 10 Sales revenue 30,000 30,000 30,000 30,000 - Cost of goods sold 18,000 18,000 18,000 18,000 =Gross profit 12,000 12,000 12,000 12,000 - Gen, sales and admin expenses 2,000 2,000 2,000 2,000 - Depreciation 2,500 2,500 2,500 2,500 =Net operating income 7,500 7,500 7,500 7,500 - Income tax 2,625 2,625 2,625 2,625 =Net Income…arrow_forward

- Hello, may you please help me with the following.. Mary Martell is a finance intern at a big corporation that was given the task to evaluate the profitability of a new, state of the art production line. She found that the project has a negative NPV. This is bad news for Sarah Pearl, who is the head of the manufacturing department and the proponent of the project. Mary delivered the news to her boss, Winston Rodriguez, who called Sarah and gave her the news: “Hello Sarah this is Winston from the finance department. The new inter confirmed what we all knew in the department: the net present value of your proposal is negative and therefore we need to reject the project. To be honest, we already had reached that conclusion but we wanted an outside opinion and gave Mary the task of evaluating the project. Sorry, but the project is a no.” Sarah later sent an email to Winston: “Winston, please, don’t kill my project.” She then asked the following questions: “Why is the NPV so important?…arrow_forwardVince Malloy and Katy Smith, both systems personnel at Shamrock Steelworks, are designing a new expenditure cycle system. Vince has worked for Shamrock for 12 years and has been involved in many systems development projects. Katy recently began working for Shamrock. She has 4 years of experience in systems development with another comparably sized organization. Yesterday, Vince and Katy met to determine their plan for approaching the conceptual system design. Following is an excerpt of some dialogue that occurred in that meeting.Katy: I really think that the new system can be designed more efficiently if we use an object-oriented design approach. Further, future enhancements and maintenance will be easier if we use an object approach.Vince: The method you are suggesting is a creation of modules. I do not have a problem with that concept in general. I just prefer using a top-down approach to design the system. We have been using that system for the past 12 years, and it has worked out…arrow_forwardYou are a manager at Percolated Fiber, which is considering expanding its operations in synthetic fiber manufacturing. Your boss comes into your office, drops a consultant's report on your desk, and complains, "We owe these consultants $1.2 million for this report, and I am not sure their analysis makes sense. Before we spend the $19 million on new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in millions of dollars): All of the estimates in the report seem correct. You note that the consultants used straight-line depreciation for the new equipment that will be purchased today (year 0), which is what the accounting department recommended. The report concludes that because the project will increase earnings by $6.864 million per year for ten years, the project is worth $68.64 million. You think back to your halcyon days in finance class and realize there is more work to be done! First,…arrow_forward

- your employer is a large local softdrink manufacturer that has started looking into importing cans, as local can manufacturers have had major service issues over the last 12 months. put forward a proposal to your board of directors discussing a proposed import processarrow_forwardYou are a manager at Northern Fibre, which is considering expanding its operations in synthetic fibre manufacturing. Your boss comes into your office, drops a consultant's report on your desk, and complains, "We owe these consultants $1.1 million for this report, and I am not sure their analysis makes sense. Before we spend the $20 million on new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in millions of dollars): Sales revenue - Cost of goods sold = Gross profit - General, sales, and administrative expenses - Depreciation = Net operating income Income tax = Net income 1 26.000 15.600 2 26.000 15.600 10.400 10.400 1.600 1.600 2.000 2.000 6.800 2.38 4.420 6.800 2.38 4.420 ... 9 26.000 15.600 10.400 1.600 2.000 6.800 2.38 4.420 10 26.000 15.600 10.400 1.600 2.000 6.800 2.38 4.420 All of the estimates in the report seem correct. You note that the consultants used straight-line depreciation for the new…arrow_forwardYou are a manager at Northem Fibre, which is considering expanding its operations in synthetic fibre manufacturing. Your boss comes into your office, drops a consultant's report on your desk, and complains, "We owe these consultants $1.3 million for this report, and I am not sure their analysis makes sense. Before we spend the $24 million on new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in millions of dollars): 2 10 Sales revenue 29.000 17.400 29.000 29.000 29.000 - Cost of goods sold = Gross profit - General, sales, and administrative expenses - Depreciation = Net operating income 17.400 17.400 17.400 11.600 1.920 2.400 11.600 11.600 11.600 1.920 1.920 1.920 2.400 2.400 2.400 7.2800 7.2800 7.2800 7.2800 - Income tax 2.548 2.548 2.548 2.548 = Net income 4.732 4.732 4.732 4.732 All of the estimates in the report seem correct. You note that the consultants used straight-line depreciation for the new…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education