Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 14, Problem 2MAD

Analyze CSR initiatives at Boxwood Company

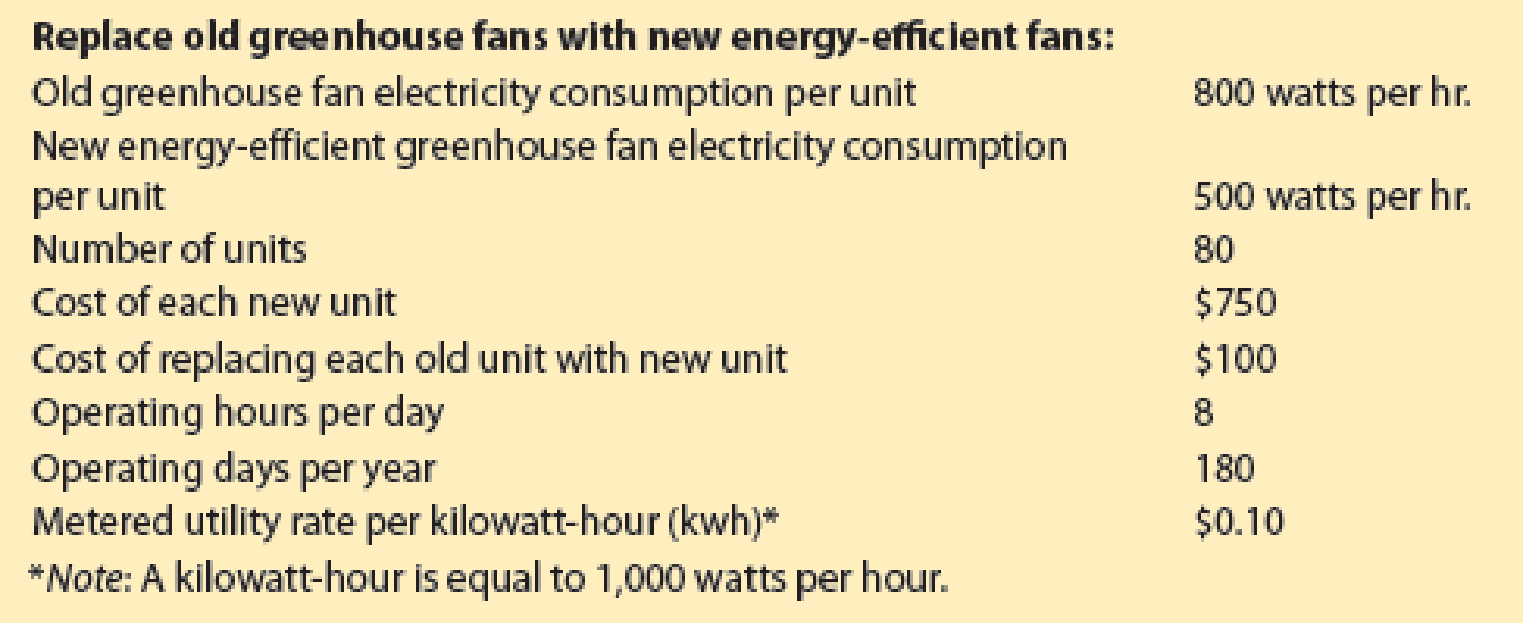

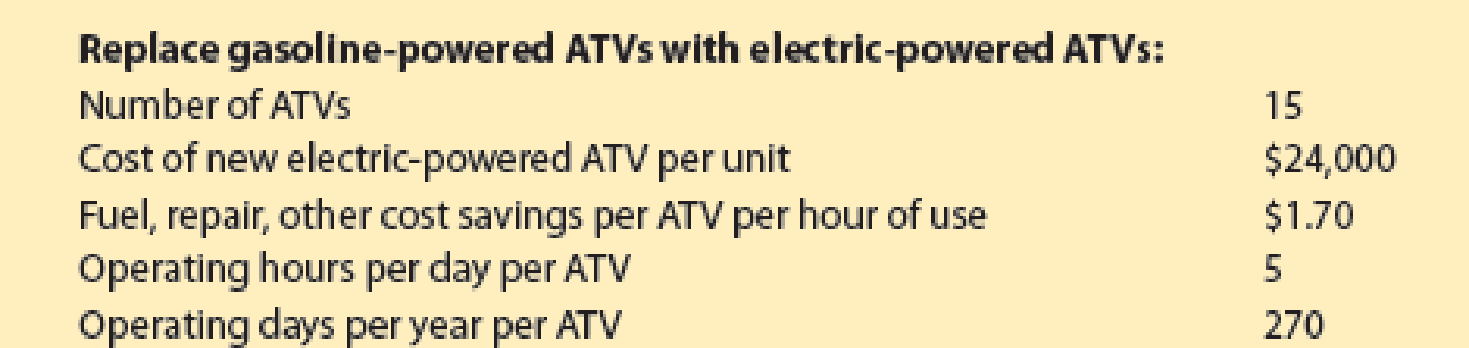

Boxwood Company is a wholesale plant nursery that is considering implementing two CSR initiatives. Information about these initiatives is summarized as follows:

- A. Determine which performance perspectives each CSR initiative would best fit under on the balanced scorecard.

- B. Determine the initial investment cost of each initiative.

- C. Determine the yearly cost savings of each initiative.

- D. Determine how many years it will take for each initiative to pay off its initial investment cost.

- E. Assuming that the new fans have an estimated useful life of 25 years and that the ATVs have an estimated useful life of 8 years, determine which initiatives should be adopted.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Required information.

[The following information applies to the questions displayed below)

The following information is provided for each Investment Center.

Investment Center

Cameras

Phones

Computers

Income

$ 4,500,000

1,500,000

800,000

Average Assets

$ 20,000,000

12,500,000

10,000,000

Compute return on investment for each investment center. Which center performed the best based on return on investment?

Complete this question by entering your answers in the tabs below.

Return on

Performance

Investment Based on ROI

Compute return on investment for each investment center.

Note: Round your final answer to 1 decimal place.

Investment Center

Cameras

Phones

Computers

Income

$ 4,500,000 $

1,500,000

800.000

Average Assets

20,000,000

12,500,000

Return on

Investment

%

%

10,000,000

%

Russell Trent was recently tasked with evaluating projects for Stan's No Touch Car Wash. The company recently decided to use NPV as its primary criterion for approving projects. To be selected, a project must have a positive NPV.

Russell is currently evaluating a project with the following estimated investment requirements ($ millions) by year (starting in year 0):

\

Investment Year

Investment

0

16

1

10.1

2

12.5

The estimated revenues ($ millions) from the project, expected to begin at time 2, are given in the table below:

Investment Year

Investment

0

11.1

1

11.3

2

8.2

3

14.3

4

11.9

To account for the different risk characteristics throughout the project's life, Russell has determined that a hurdle rate of 23% should be used beginning at time 0, while 37% should be used beginning in period 4.

Determine the NPV for the project.

NPV=

Make a Decision: Analyze CSR initiatives at Gree Manufacturing (from Chapter 14)Obj. 5 Green Manufacturing is a traditional manufacturing company located in the midwestern United States. The company's operations manager is developing a strategy to become more CSR-oriented. In an effort to evaluate possible areas where CSR initiatives can be implemented, the manager has gathered the following data regarding three potential CSR activities: Initial Added CostVariable CostVariable SavingsRecycle and reuse production materials$ 5,000$0.10 per lb. of recycled material$0.15 per lb. of recycled materialAdd solar panels as a source of power 700,000$ 1,000 per year$ 33,000 per yearReplace assembly room light fixtures with natural light 120,000$ 180 per month$ 220 per month The recycling activity would carry on indefinitely. The solar panels would have a useful life of 30 years. The replacement of assembly room light fixtures with natural light is assumed to have an 80-year effect.a.…

Chapter 14 Solutions

Managerial Accounting

Ch. 14 - How does a strategic performance measurement...Ch. 14 - What is the difference between a leading indicator...Ch. 14 - Prob. 3DQCh. 14 - Prob. 4DQCh. 14 - What do strategy maps show, and how do they add...Ch. 14 - Prob. 6DQCh. 14 - Prob. 7DQCh. 14 - Prob. 8DQCh. 14 - How is sustainability distinguishable from...Ch. 14 - How can the balanced scorecard be used to address...

Ch. 14 - 72 Inc. has developed a balanced scorecard with...Ch. 14 - Bluetiful Inc. has the following strategic...Ch. 14 - Moses Moonrocks Inc. has developed a balanced...Ch. 14 - Prob. 4BECh. 14 - Lonnies Shipping Co. is considering switching to...Ch. 14 - Henrys Cafe is a local restaurant that is growing...Ch. 14 - American Express Company is a major financial...Ch. 14 - Eat-n-Run Inc. owns and operates 10 food trucks...Ch. 14 - Prob. 4ECh. 14 - Prob. 5ECh. 14 - The following is the balanced scorecard for Smith...Ch. 14 - Grand Grocery developed a balanced scored with six...Ch. 14 - Coulson and Company is a large retail business...Ch. 14 - Rizzo Goal Inc. produces and sells hockey...Ch. 14 - Silver Lining Inc. has a balanced scorecard with a...Ch. 14 - Two departments within Cougar Gear Inc. are...Ch. 14 - Sunny Nights Inc. is completely powered by the...Ch. 14 - Instructions 1. Label each element of the balanced...Ch. 14 - Strategic initiatives and CSR Get Hitched Inc. is...Ch. 14 - Prob. 3PACh. 14 - Instructions 1. Based on the balanced scorecard...Ch. 14 - Strategic initiatives and CSR Blue Skies Inc. is a...Ch. 14 - Eye Swear Inc. has a balanced scorecard that...Ch. 14 - Den-Tex Company is evaluating a proposal to...Ch. 14 - Analyze CSR initiatives at Boxwood Company Boxwood...Ch. 14 - Analyze CSR initiatives at Green Manufacturing...Ch. 14 - Prob. 1TIFCh. 14 - Blake McKenzie Tax Services is a company serving...Ch. 14 - Young Manufacturing Company is a startup...Ch. 14 - The fundamental concept behind strategic...Ch. 14 - Which of the following statements regarding the...Ch. 14 - The balanced scorecard provides an action plan for...Ch. 14 - Which of the following statements best describes...Ch. 14 - A sign of the successful implementation of a...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Spencer Enterprises is attempting to choose among a series of new investment alternatives. The potential investment alternatives, the net present value of the future stream of returns, the capital requirements, and the available capital funds over the next three years are summarized as follows: Develop and solve an integer programming model for maximizing the net present value. Assume that only one of the warehouse expansion projects can be implemented. Modify your model from part (a). Suppose that if test marketing of the new product is carried out, the advertising campaign also must be conducted. Modify your formulation from part (b) to reflect this new situation.arrow_forwardKeating Hospital is considering two different low-field MRI systems: the Clearlook System and the Goodview System. The projected annual revenues, annual costs, capital outlays, and project life for each system (in after-tax cash flows) are as follows: Assume that the cost of capital for the company is 8 percent. Required: 1. Calculate the NPV for the Clearlook System. 2. Calculate the NPV for the Goodview System. Which MRI system would be chosen? 3. What if Keating Hospital wants to know why IRR is not being used for the investment analysis? Calculate the IRR for each project and explain why it is not suitable for choosing among mutually exclusive investments.arrow_forwardPrepare the financial section of a business case for the Cloud-Computing Case that is listed above this assignment in Canvas. Assume that this project will take eight months to complete (in Year 0) and will cost $600,000. The costs to implement some of the technologies will be $300,000 for year one and $200,000 for years two and three. Estimated benefits will start in year 1 at$400,000 and will be $600,000 for years 2 and 3. There is no benefit in year 0. Use the business case spreadsheet template (business_case_financials.xls) template provided below this assignment in Canvas to calculate the NPV, ROI, and the year in which payback occurs. Assume a 7 percent discount rate for the template. notes* Payback occurs in the first year that there is a positive value for cumulative benefits - costs. (*Negative values are presented in parenthesis) Financial Analysis for Project Name Created by: Date: Note: Change the inputs, shown in green below (i.e. interest rate, number of…arrow_forward

- Prepare the financial section of a business case for the Cloud-Computing Case that is listed above this assignment in Canvas. Assume that this project will take eight months to complete (in Year 0) and will cost $600,000. The costs to implement some of the technologies will be $300,000 for year one and $200,000 for years two and three. Estimated benefits will start in year 1 at $400,000 and will be $600,000 for years 2 and 3. There is no benefit in year 0. Use the business case spreadsheet template (business_case_financials.xls) template provided below this assignment in Canvas to calculate the NPV, ROI, and the year in which payback occurs. Assume a 7 percent discount rate for the template. notes* Payback occurs in the first year that there is a positive value for cumulative benefits - costs. (*Negative values are presented in parenthesis) What I have so far is attached I need to make it so Pay back occurs in year 3 where there is positive cumulative benefits - costs.arrow_forwardThe city of Columbus has identified three options for a public recreation area suitable for informal family activities and major organized events. As with most alternatives today, there are benefits, disbenefits, costs, and some savings. These have been estimated with the help of an external planning consultant and are identified in the table below. In each case, these are annualized over a 10-year planning horizon. Solve, a. Determine the B/C ratio for each project. Can you tell from these ratios which option should be selected? b. Determine which option should be selected using the incremental B/C ratio. c. Determine which option should be selected using B − C for each option. d. At what value of Option 2 costs are you indifferent between Option 1 and Option 2?arrow_forwardMartin Weir is evaluating a new project to determine viability for Jonathon's Restaurant's. As part of the new Jonathon's PMO, Marty is responsible for preparing project justifications and he must evaluate the project's cash flows and investment potential. As a first step, Marty developed a table of revenues and investments (see below) that he plans to use in calculating a variety of performance metrics including NPV. Marty understands that a project's discount rate may not be constant throughout the life of the project and he plans to use 0.32 as the initial discount rate, switching to 0.19 beginning in year 4 to more accurately represent the cash costs and imputed risk over time. Assume all cash flows occur at the end of the specified year and calculate all cash flow values and discounted cash flow values to three decimal places. Round discounted values to 3 decimal places before performing subsequent calculations. investment Reveune 13.8 0 14.9 20.3 12.3 27.5 17.6 24.9…arrow_forward

- Midwest Mfg. uses a balanced scorecard as part of its performance evaluation. The company wants toinclude information on its sustainability efforts in its balanced scorecard. For each of the sustainabilityitems below, indicate the most likely balanced scorecard perspective it relates to. Label your answers usingC (customer), P (internal process), I (innovation and learning), or F (financial). Number of solar panels installedarrow_forwardUsing ROI and RI to evaluate investment centers XTreme Sports Company makes snowboards, downhill skis, cross-country skis, skateboards, surfboards, and inline skates. The company has found it beneficial to split operations into two divisions based on the climate required for the sport: Snow Sports and Non-snow Sports. The following divisional information is available for the past year: XTreme’s management has specified a 13% target rate of return. Calculate each division’s profit margin ratio. Interpret your results.arrow_forwardThe management of Brawn Engineering is considering three alternatives to satisfy an OSHA requirement for safety gates in the machine shop. Each gate will completely satisfy the requirement, so no combinations need to be considered. The first costs, operating costs, and salvage values over a 5-year planning horizon are shown below. Show the comparisons and internal rates of return used to make your decision:arrow_forward

- Analyze CSR initiatives at Green Manufacturing Green Manufacturing is a traditional manufacturing company located in the midwestern United States. The company’s operations manager is developing a strategy to become more CSR-oriented. In an effort to evaluate possible areas where CSR initiatives can be implemented, the manager has gathered the following data regarding three potential CSR activities: Initial added cost Variable cost Variable savings Recycle and reuse production material $5,000 $0.10 per lb. of recycled material $0.15 per lb. of recycled material Add solar panels as a source of power 700,000 $1,000 per year $33,000 per year Replace assembly room light fixtures with natural light 120,000 $180 per month $220 per month The recycling activity would carry on indefinitely. The solar panels would have a useful life of 30 years. The replacement of assembly room light fixtures with natural light is assumed to have an 80-year…arrow_forwardCOST-BENEFIT ANALYSIS Listed in the diagram for Problem 7 are some probability estimates of the costs and benefits associated with two competing projects. a. Compute the net present value of each alternative. Round the cost projections to the nearest month. b. Repeat step (a) for the payback method. c. Which method do you think provides the best source of information? Why?arrow_forwardAnalyze CSR initiatives at Green Manufacturing Green Manufacturing is a traditional manufacturing company located in the midwestern United States. The companys operations manager is developing a strategy to become more CSR-oriented. In an effort to evaluate possible areas where CSR initiatives can be implemented, the manager has gathered the following data regarding three potential CSR activities: The recycling activity would carry on indefinitely. The solar panels would have a useful life of 30 years. The replacement of assembly room light fixtures with natural light is assumed to have an 80-year effect. A. Identify which CSR activities Green Manufacturing should implement. B. For each CSR activity you recommend, identify an appropriate related performance metric.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Why do we need accounting?; Author: EconClips;https://www.youtube.com/watch?v=weCXE2wIl90;License: Standard Youtube License