(a):

Calculate the present worth without considering the inflation.

(a):

Explanation of Solution

Table-1 shows the cash flow of different alternatives.

Table-1

| Alternative | A | B |

| First cost (C) | -31,000 | -48,000 |

| Annual cost (AM) per year | -28,000 | -19,000 |

| Salvage value (SV) | 5,000 | 7,000 |

| Time period (n) | 5 | 5 |

The interest rate (i) is 10%, and the inflation rate (f) is 3%.

The present worth (PW) for Alternative A can be calculated as follows:

The present worth is -$134,038.9. The present worth for Alternate A can be calculated using a spreadsheet as follows:

= - PV(10%,5,-28000,5000) – 31000

The above spreadsheet function gives the value of -$134,37.42.

The present worth (PW) for Alternative B can be calculated as follows:

The present worth is -$115,678.9. Since the present worth of the cost is lower for Alternate B, select Alternate B. The present worth for alternate B can be calculated using a spreadsheet as follows:

= - PV(10%,5,-19000,7000) - 48000

The above spreadsheet function gives the value of -$115,678.5.

(b):

Calculate the present worth with considering the inflation.

(b):

Explanation of Solution

The real interest rate (if) can be calculated as follows:

The real interest rate is 13.3%.

The present worth (PW) for Alternative A can be calculated as follows:

The present worth is -$126,086.8. The present worth for Alternate A can be calculated using a spreadsheet as follows:

= - PV(13.3%,5,-28000,5000) - 31000

The above spreadsheet function gives the value of -$126,87.79.

The present worth (PW) for Alternative B can be calculated as follows:

The present worth is -$115,678.9. Since the present worth of the cost is lower for Alternate B, select Alternate B. The present worth for Alternate B can be calculated using a spreadsheet as follows:

= - PV(13.3%,5,-19000,7000) - 48000

The above spreadsheet function gives the value of -$110,591.83.

(c):

Calculate the interest rate that makes both the alternates equal.

(c):

Explanation of Solution

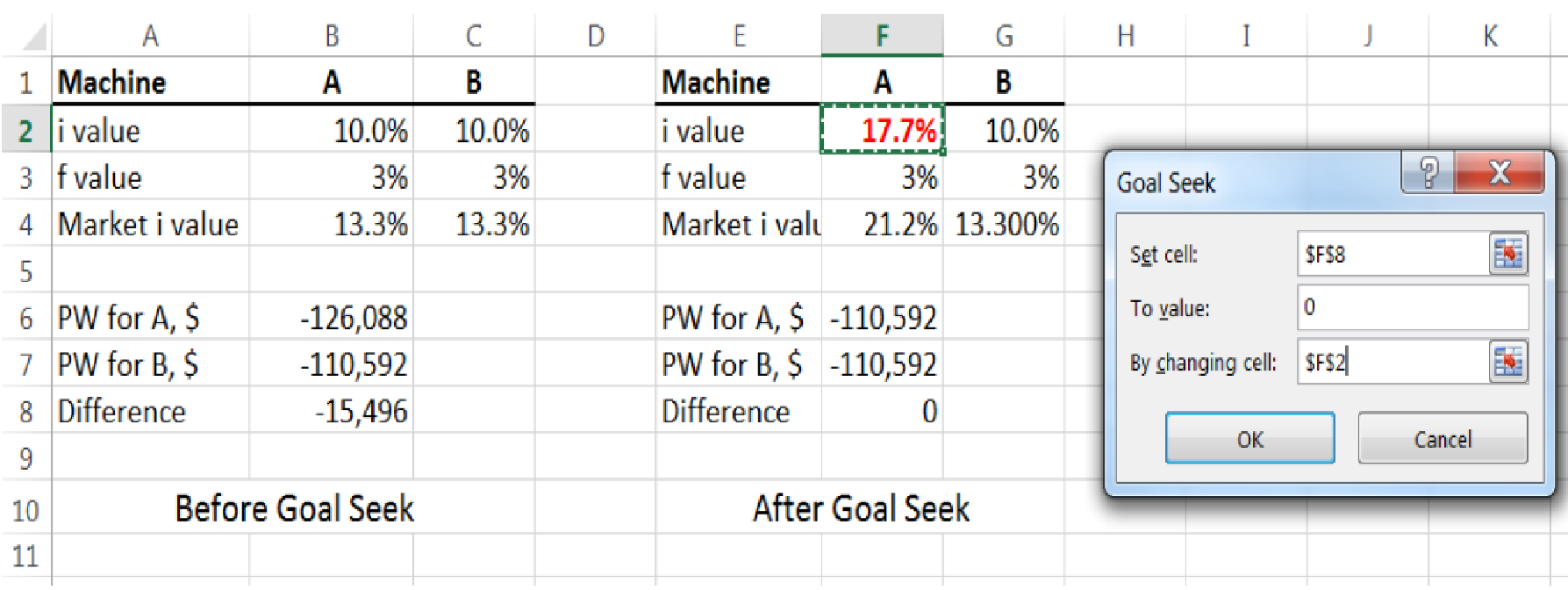

The interest rate that makes both alternates’ present worth equal can be calculated using the spreadsheet as follows:

Want to see more full solutions like this?

Chapter 14 Solutions

Engineering Economy

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education