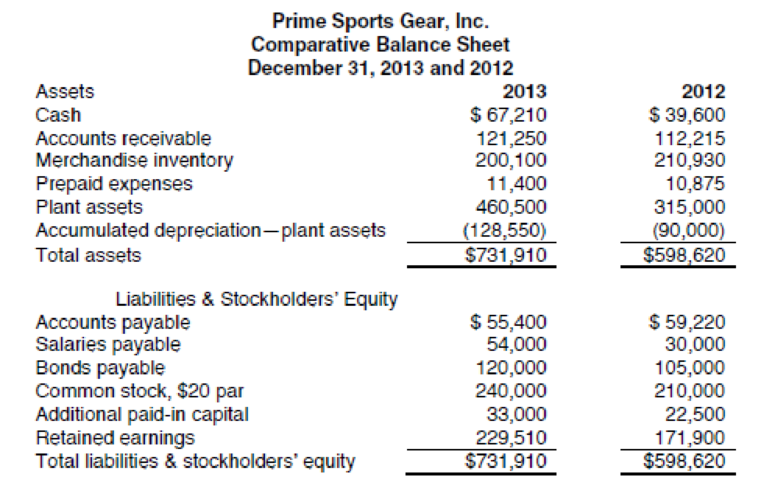

The comparative

Additional data obtained from the records of Prime Sports Gear are as follows:

- a. Net income for 2013 was $121,610.

- b.

Depreciation reported on income statement for 2013 was $46,500. - c. Purchased $165,000 of new equipment, putting $90,000 cash down and issuing $75,000 of bonds for the balance.

- d. Old equipment originally costing $19,500, with

accumulated depreciation of $7,950, was sold for $8,000. - e. Retired $60,000 of bonds.

- f. Declared cash dividends of $64,000.

- g. Issued 1,500 shares of common stock at $27 cash per share.

You have been asked to prepare a statement of

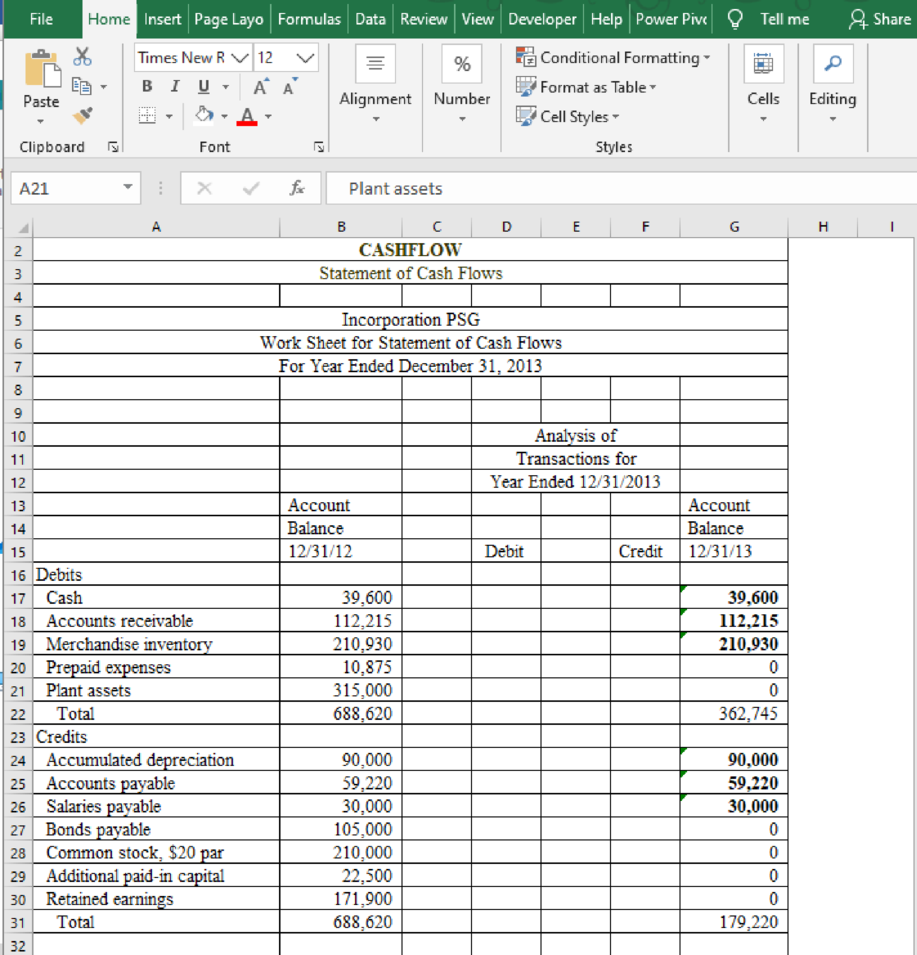

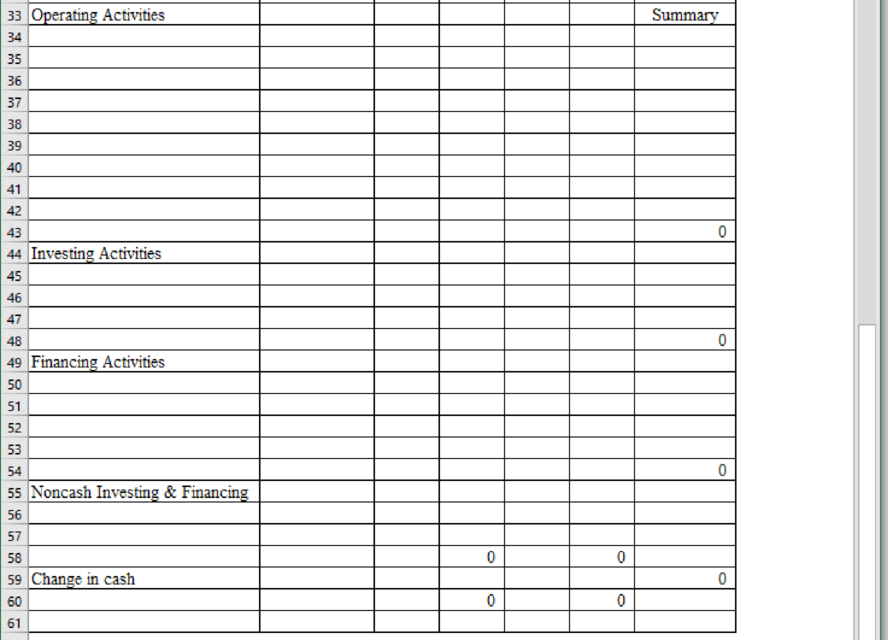

Prepare the statement of cash flow for Incorporation PSG and review the worksheet.

Explanation of Solution

Prepare the statement of cash flow for Incorporation PSG and review the worksheet.

Table (1)

Want to see more full solutions like this?

Chapter 14 Solutions

Excel Applications for Accounting Principles

- The fiscal 2013 financial statements for Day-Brite, Inc., report net sales of $72,217 million, net operating profit after tax of $2,478 million, net operating assets of $21,556 million. The 2012 balance sheet reports net operating assets of $21,465 million. Day-Brite's 2013 net operating asset turnover is: 3.92 11.5% 3.36 3.43%arrow_forwardJuroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Required: Note: Round answers to two decimal places. 1. Calculate the times-interest-earned ratio. 2. Calculate the debt ratio. 3. Calculate the debt-to-equity ratio.arrow_forwardSelected information from the comparative financial statements of Barcelona Company for the year ended December 31 appears below: 2017 2016 Accounts receivable (net) $200,000 175,000 Inventory 170,000 130,000 Total assets 1,100,000 800,000 Current liabilities 140,000 110,000 Long-term debt 300,000 410,000 Net credit sales 900,000 700,000 Cost of goods sold 530,000 600,000 Interest expense 40,000 25,000 Income tax expense 60,000 29,000 Net income 120,000 85,000 Net cash provided by operating activities 250,000 135,000 Instructions Answer the following questions relating to the year ended December 31, 2017. Show computations. 1. The inventory turnover for 2017 is 2. The number of times interest earned in 2017 is 3. The accounts receivable turnover for 2017 is 4. The return on assets for 2017 isarrow_forward

- Footfall Manufacturing Ltd. reports the following financial information at the end of the current year: Net Sales $100,000 Debtor’s turnover ratio (based on net sales) 2 Inventory turnover ratio 1.25 Fixed assets turnover ratio 0.8 Debt to assets ratio 0.6 Net profit margin 5% Gross profit margin 25% Return on investment 2% Use the given information to fill out the templates for income statement and balance sheet given below: Income Statement of Footfall Manufacturinf Ltd. for the year ending December 31, 20XX (in $) Sales 100,000 Cost of goods sold Gross profit Other expenses Earnings before tax Tax @50% Earnings after tax Balance Sheet of Footfall Manufacturing Ltd. as at December 31, 20XX (in $) Liabilities Assets Equity Net fixed assetsLong term debt 50,000 InventoryShort term debt Debtors…arrow_forwardPlease give me answer accounting....Bailey company reportsarrow_forwardPresented below is selected financial data for Teague Industries for the current year: Current assets: Current liabilities Cash and cash equivalents $3503 Accounts payable $5385 Short-term investments 1555 Other current liabilities 2892 Receivables, net 1811 Total current liabilities 8277 Merchandise inventories 6205 Noncurrent liabilities 5196 Other current assets 1975 Shareholders' Equity 6250 Total current assets 15,049 Total liabilities and shareholders' equity $19,723 Noncurrent assets 4674 Total assets $19,723 Revenues $50,826 Costs and Expenses 45,963 Operating Income 4,863 Other income/expense (including interest expense of $60) (36) Income before income tax 4827 Income tax expense (1449) Net income $3378 Previous Years' Financial Data Total Assets $17,020 Shareholders' Equity 4000 The financial leverage for Teague Industries is ________. (Round your answer to two decimal places, X.XX.)arrow_forward

- Super Grocers, Inc., provided the following financial information for the quarter ending September 30, 2006: Depreciation and amortization – $133,414 Net income – $341,463 Increase in receivables – $112,709 Increase in inventory – $81,336 Increase in accounts payables – $62,411 Decrease in marketable securities – $31,225 What is the cash flow from operating activities generated during this quarter by the firm? a. -$308,458 b. -$374,468 c. $308,458 d. $374,468arrow_forwardBlossom Company reports the following information (in millions) during a recent year: net sales, $23,575.2; net earnings, $653.6; total assets, ending, $9,055.2; and total assets, beginning, $8,933.4. Calculate the (1) return on assets, (2) asset turnover, and (3) profit margin ratios. (Round answers to 1 decimal place, e.g. 15.2% or 15.1.) (1) (2) (3) Return on assets Asset turnover Profit margin % times %arrow_forwardPractice Problem Below are the balance sheet and income statement for Major, Inc. December 31 2007 2006Cash $ 29,700 $ 10,200 Accounts receivable (net) 53,400 20,300 Inventory 39,000 42,000 Long-term investments 0 15,000 Plant Assets, net of depreciation 180,900 125,000 Total Assets $303,000 $212,500Accounts payable $ 16,000 $ 26,500 Accrued liabilities 28,000 17,000 Long-term notes payable 40,000 50,000 Common stock 150,000 90,000 Retained earnings 69,000 29,000 Total Liabilities and Owner’s Equity $303,000 $212,500Year ended December 31, 2007Sales Revenue $340,000 Cost of Goods Sold (200,000) Operating Expenses (58,400) Depreciation Expense (10,600) Gain on sale of investments 4,000Net Income $ 75,000Additional information: A) In 2007, Major, Inc didn’t sell plant asset and didn’t purchase additional investment.B) In 2007, no shares were repurchased and no new debt was issued. 1. Prepare the Statement of Cash Flows…arrow_forward

- In its income statement for the year ended December 31, 2022, Larkspur, Inc. reported the following condensed data. Operating expenses - $717,000 Cost of goods sold - 1,253,000 Interest expense - 68,000 Income tax expense - 42,000 Interest revenue - $31,000 Loss on disposal of plant assets - 14,000 Net sales - 2,197,000 Other comprehensive income (net of $1,200 tax) - 8,000 Prepare a comprehensive income statement:arrow_forwardThe 2021 Income statement of Anderson Medical Supply Company reported net sales of $12 million, cost of goods sold of $6.2 million, and net Income of $870,000. The following table shows the company's comparative balance sheets for 2021 and 2020: Assets Cash Accounts receivable Inventory Property, plant, and equipment (net) Total assets Liabilities and shareholders' equity Current liabilities Bonds payable Common stock Retained earnings Total liabilities and shareholders' equity Inventory turnover ratio Receivables turnover ratio Average collection period Asset turnover ratio ($ in thousands) 2821 2820 times times days times $ 588 $ 660 988 640 1,608 3,800 $ 6,960 1,010 3,520 $5,830 Required: 1. Calculate Anderson's turnover ratios for 2021. (Use 365 days a year. Round your answers to 2 decimal places.) $1,240 1,908 2,488 1,428 $ 6,968 $ 5,830 $1,110 1,900 2,400 420arrow_forwardPlease helparrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning