Concept explainers

Calculating the WACC In the previous problem, suppose the company’s stock has a beta of 1.15. The risk-free rate is 3.7 percent, and the market risk premium is 7 percent. Assume that the overall cost of debt is the weighted average implied by the two outstanding debt issues. Both bonds make semiannual payments. The tax rate is 35 percent. What is the company’s WACC?

To determine: The WACC of the Company.

Introduction: The WACC (Weighted Average Cost of Capital) is the total rate of return for a company which anticipates reimbursing all their investors. It is considered as a financing resource in the target capital structure of a company and it measured in terms of weights of fractions.

Answer to Problem 9QP

The WACC of the Company is 9.87%

Explanation of Solution

Determine the Cost of Equity using CAPM

Therefore the Cost of Equity is 11.75%

Determine the Yield to Maturity for First Bond Issue

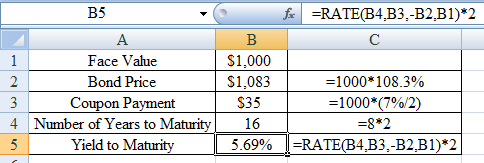

Using excel function =rate we calculate the yield to maturity as,

Excel Spreadsheet:

Therefore the Yield to Maturity for First Bond Issue is 5.69%

Determine the Yield to Maturity for Second Bond Issue

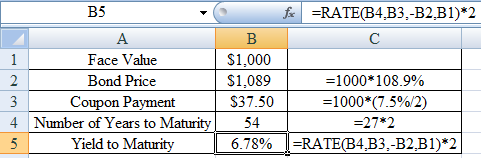

Using excel function =rate we calculate the yield to maturity as,

Excel Spreadsheet:

Therefore the Yield to Maturity for Second Bond Issue is 6.78%

Determine the Total Market Value of Debt

Therefore the Total Market Value of Debt is $141,150,000

Determine the Market Value of Equity

Therefore the Total Market Value of Equity is $439,900,000

Determine the Total Market Value of Company

Therefore the Total Market Value of Company is $581,050,000

Determine the Market Value Weights of Debt

Therefore the Market Value Weights of Debt is 75.71%

Determine the Market Value Weights of Equity

Therefore the Market Value Weights of Equity is 24.29%

Determine the Weight of First Bond Issue

Therefore the Weight of First Bond Issue is 53.71%

Determine the Weight of Second Bond Issue

Therefore the Weight of Second Bond Issue is 46.29%

Determine the Weighted Average After-tax for both the bond issues

Therefore the Weighted Average After-tax for both the bond issues is 4.03%

Determine the WACC of the Company

Therefore the WACC of the Company is 9.87%.

Want to see more full solutions like this?

Chapter 13 Solutions

Corporate Finance (The Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

- Assume that the risk-free rate (i.e., Rf) is 2.8%. If, for a particular company bond issue, the default risk premium (i.e., DP) is 3.1%, the maturity risk premium ( i.e., MP) is 0.9%, and the market risk premium ( i.e., MRP) for that company's stock is 12.9% what is the required rate of return for the company's fixed income securities ? Record your answer as a percent , rounded to one decimal place , but do not include a percent sign in your answer . For example , enter 0.1578658 = 15.78625% as 15.8 .arrow_forwardInfosystems, Inc. has a debt/equity ratio = 2. The firm has a cost of equity of 12% and a cost of debt of 6%. Calculate the firm’s equity’s beta (β) after the target debt/equity ratio changes to 1.5. Assume that the cost of debt does not change. Ignore taxes and other market imperfections. The risk-free interest rate is 2% and the market risk premium is 7%.arrow_forwardSuppose SnowWhite's common stock has a beta of 1.37, the risk-free rate is 3.4 percent, and the market risk premium is 8.2 percent. SnowWhite has equity with a market value of $1 million and debt with a market value of $ 0.45 million. The cost of debt is 7.6 percent. What is the WACC if the tax rate is 23 percent and all interest is tax deductible?arrow_forward

- Consider a two-date binomial model. A company has both debt and equity in its capital structure. The value of the company is 100 at Date 0. At Date 1, it is equally like that the value of the company increases by 20% or decreases by 10%. The total promised amount to the debtholders is 100 at Date 1. The riskfree interest rate is 10%. a. What is the value of the debt at Date 0? What is the value of the equity at Date 0? b. Suppose the government announces that it guarantees the company’s payment to the debtholders. How much is the government guarantee worth?arrow_forwardA) For questions A, B, and C, use the following information: Consider a firm whose debt has a market value of $35 million and whose stock has a market value of $55 million. The firm pays a 7 percent rate of interest on its new debt and has a beta of 1.23. The corporate tax rate is 21%. Assume that the security market line holds, that the risk premium on the market is 10.5 percent, and that the current Treasury bill is rate is 1 percent. What is the aftertax cost of debt? Format as a percentage and round to two places past the decimal point as "X.XX B) Consider a firm whose debt has a market value of $35 million and whose stock has a market value of $55 million. The firm pays a 7 percent rate of interest on its new debt and has a beta of 1.23. The corporate tax rate is 21%. Assume that the security market line holds, that the risk premium on the market is 10.5 percent, and that the current Treasury bill is rate is 1 percent. Using the pretax cost of debt from Question 7, what is the…arrow_forwardYou have the following information on a company on which to base your calculations and discussion: Cost of equity capital (rE) = 18.55% Cost of debt (rD) = 7.85% Expected market premium (rM –rF) = 8.35% Risk-free rate (rF) = 5.95% Inflation = 0% Corporate tax rate (TC) = 35% Current long-term and target debt-equity ratio (D:E) = 2:5 a. What are the equity beta (bE) and debt beta (bD) of the firm described above?[Hint: Assume that the above costs of capital have been generated by an appropriate equilibrium model.] b. What is the weighted-average cost of capital (WACC) for this firm at the current debt-equity ratio? c. What would the company’s cost of equity capital become if you unlevered the capital structure (i.e. reduced gearing until there is no debt)arrow_forward

- Consider a firm whose debt has a market value of $35 million and whose stock has a market value of $55 million. The firm pays a 7 percent rate of interest on its new debt and has a beta of 1.23. The corporate tax rate is 21%. Assume that the security market line holds, that the risk premium on the market is 10.5 percent, and that the current Treasury bill is rate is 1 percent. Using the pretax cost of debt from Question 7, what is the cost of equity, RS?arrow_forwardThe yield on a firms bond is 8.75% and your economist believes that the cost of common can be estimated using a risk premium of 3.85% over firms own cost of debt. What is the firms cost of common from reinvested earnings?arrow_forwardYour firm has a target debt ratio of 30%. Cost of debt (Rb) is 6%. The risk-free rate is 3% and the expected market risk premium is 6%. Your firm's unlevered (asset) beta is 1. What is the appropriate rate to discount the interest tax shields associated with your debt? Only typed answerarrow_forward

- If the estimated return on a corporate bond is 8%, while the return on US Treasury bond is 3%. How much is the risk premium in this case? Hint: The risk premium is the compensation investors required to hold the risky asset. It equals the expected return on the risky investment minus the risk-free return.arrow_forwardSuppose there is a large probability that L will default on its debt. For the purpose of this example, assume that the value of Ls operations is 4 million (the value of its debt plus equity). Assume also that its debt consists of 1-year, zero coupon bonds with a face value of 2 million. Finally, assume that Ls volatility, , is 0.60 and that the risk-free rate rRF is 6%.arrow_forwardWhat happens to ROE for Firm U and Firm L if EBIT falls to $1,600? What happens if EBIT falls to $1,200? What is the after-tax cost of debt? What does this imply about the impact of leverage on risk and return?arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning