Concept explainers

Calculating the WACC In the previous problem, suppose the company’s stock has a beta of 1.15. The risk-free rate is 3.7 percent, and the market risk premium is 7 percent. Assume that the overall cost of debt is the weighted average implied by the two outstanding debt issues. Both bonds make semiannual payments. The tax rate is 35 percent. What is the company’s WACC?

To determine: The WACC of the Company.

Introduction: The WACC (Weighted Average Cost of Capital) is the total rate of return for a company which anticipates reimbursing all their investors. It is considered as a financing resource in the target capital structure of a company and it measured in terms of weights of fractions.

Answer to Problem 9QP

The WACC of the Company is 9.87%

Explanation of Solution

Determine the Cost of Equity using CAPM

Therefore the Cost of Equity is 11.75%

Determine the Yield to Maturity for First Bond Issue

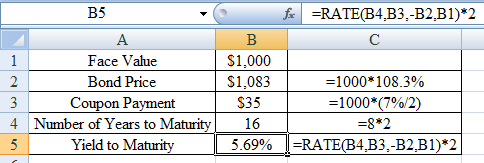

Using excel function =rate we calculate the yield to maturity as,

Excel Spreadsheet:

Therefore the Yield to Maturity for First Bond Issue is 5.69%

Determine the Yield to Maturity for Second Bond Issue

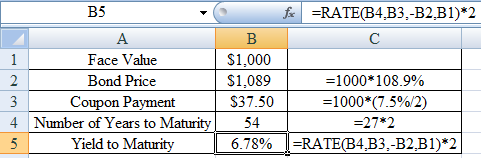

Using excel function =rate we calculate the yield to maturity as,

Excel Spreadsheet:

Therefore the Yield to Maturity for Second Bond Issue is 6.78%

Determine the Total Market Value of Debt

Therefore the Total Market Value of Debt is $141,150,000

Determine the Market Value of Equity

Therefore the Total Market Value of Equity is $439,900,000

Determine the Total Market Value of Company

Therefore the Total Market Value of Company is $581,050,000

Determine the Market Value Weights of Debt

Therefore the Market Value Weights of Debt is 75.71%

Determine the Market Value Weights of Equity

Therefore the Market Value Weights of Equity is 24.29%

Determine the Weight of First Bond Issue

Therefore the Weight of First Bond Issue is 53.71%

Determine the Weight of Second Bond Issue

Therefore the Weight of Second Bond Issue is 46.29%

Determine the Weighted Average After-tax for both the bond issues

Therefore the Weighted Average After-tax for both the bond issues is 4.03%

Determine the WACC of the Company

Therefore the WACC of the Company is 9.87%.

Want to see more full solutions like this?

Chapter 13 Solutions

EBK CORPORATE FINANCE

- You have the following information on a company on which to base your calculations and discussion: Cost of equity capital (rE) = 18.55% Cost of debt (rD) = 7.85% Expected market premium (rM –rF) = 8.35% Risk-free rate (rF) = 5.95% Inflation = 0% Corporate tax rate (TC) = 35% Current long-term and target debt-equity ratio (D:E) = 2:5 a. What are the equity beta (bE) and debt beta (bD) of the firm described above?[Hint: Assume that the above costs of capital have been generated by an appropriate equilibrium model.] b. What is the weighted-average cost of capital (WACC) for this firm at the current debt-equity ratio? c. What would the company’s cost of equity capital become if you unlevered the capital structure (i.e. reduced gearing until there is no debt)arrow_forwardYou have the following initial information on which to base your calculations and discussion: Debt yield = 2.5% Required Rate of Return on Equity = 13% Expected return on S&P500 = 8% Risk-free rate (rF) = 1.5% Inflation = 2.5% Corporate tax rate (TC) = 30% Current long-term and target debt-equity ratio (D:E) = 1:3 a. What is the unlevered cost of equity (rE*) for this firm? Assume that the management of the firm is considering a leveraged buyout of the above company. They believe that they can gear the company to a higher level due to their ability to extract efficiencies from the firm’s operations. Thus, they wish to use a target debt-equity ratio of 3:1 in their valuation calculations. b. What would the levered cost of equity equal for this firm at a debt-equity ratio (D:E) of 3:1? c. What would the required rate of return for the company equal if it were to be acquired under the leveraged buyout structure (i.e., what would the estimated firm WACC equal to under a…arrow_forwardYou have the following initial information on which to base your calculations and discussion: Debt yield = 2.5% Required Rate of Return on Equity = 13% Expected return on S&P500 = 8% Risk-free rate (rF) = 1.5% Inflation = 2.5% Corporate tax rate (TC) = 30% Current long-term and target debt-equity ratio (D:E) = 1:3 a. What is the unlevered cost of equity (rE*) for this firm? Assume that the management of the firm is considering a leveraged buyout of the above company. They believe that they can gear the company to a higher level due to their ability to extract efficiencies from the firm’s operations. Thus, they wish to use a target debt-equity ratio of 3:1 in their valuation calculations.arrow_forward

- Your firm has a target debt ratio of 30%. Cost of debt (Rb) is 6%. The risk-free rate is 3% and the expected market risk premium is 6%. Your firm's unlevered (asset) beta is 1. What is the appropriate rate to discount the interest tax shields associated with your debt? Only typed answerarrow_forwardConsider a two-date binomial model. A company has both debt and equity in its capital structure. The value of the company is 100 at Date 0. At Date 1, it is equally like that the value of the company increases by 20% or decreases by 10%. The total promised amount to the debtholders is 100 at Date 1. The riskfree interest rate is 10%. a. What are the possible payoffs to the equityholders at date 1? What kind of financial product has the same payoffs? Please describe the detailed characteristics of the financial product. b. What are the possible payoffs to the bondholders at date 1? Are they riskfree? What kind of financial product/portfolio has the same payoffs? Please describe the detailed characteristics of the financial product/portfolio.arrow_forwardThe yield on a firms bond is 8.75% and your economist believes that the cost of common can be estimated using a risk premium of 3.85% over firms own cost of debt. What is the firms cost of common from reinvested earnings?arrow_forward

- If the estimated return on a corporate bond is 8%, while the return on US Treasury bond is 3%. How much is the risk premium in this case? Hint: The risk premium is the compensation investors required to hold the risky asset. It equals the expected return on the risky investment minus the risk-free return.arrow_forwardSuppose there is a large probability that L will default on its debt. For the purpose of this example, assume that the value of Ls operations is 4 million (the value of its debt plus equity). Assume also that its debt consists of 1-year, zero coupon bonds with a face value of 2 million. Finally, assume that Ls volatility, , is 0.60 and that the risk-free rate rRF is 6%.arrow_forwardWhat happens to ROE for Firm U and Firm L if EBIT falls to $1,600? What happens if EBIT falls to $1,200? What is the after-tax cost of debt? What does this imply about the impact of leverage on risk and return?arrow_forward

- You have the following initial information on Financeur Co. on which to base your calculations and discussion for question 2): • Current long-term and target debt-equity ratio (D:E) = 1:3 • Corporate tax rate (TC) = 30% • Expected Inflation = 1.55% • Equity beta (E) = 1.6325 • Debt beta (D) = 0.203 • Expected market premium (rM – rF) = 6.00% • Risk-free rate (rF) =2.05% 2) Assume now a firm that is an existing customer of Financeur Co. is considering a buyout of Financeur Co. to allow them to integrate production activities. The potential acquiring firm’s management has approached an investment bank for advice. The bank believes that the firm can gear Financeur Co. to a higher level, given that its existing management has been highly conservative in its use of debt. It also notes that the customer’s firm has the same cost of debt as that of Financeur Co. Thus, it has suggested use of a target debtequity ratio of 2:3 when undertaking valuation calculations. a) What would the required…arrow_forwardThe following were gathered for estimating the cost of equity of KKK Corporation: Return on Treasury Bonds = 4%; Return on the Market = 10%; Return on KKK Bonds = 6%. Upon analysis, you determined that the beta of KKK shares relating to the market return is 1.2 while a risk premium of 4% should be given to KKK's investors over its creditors. How much is the cost of equity using the capital asset pricing model?arrow_forwardYour firm has a target debt ratio of 30%. Cost of debt (RB) is 6%. The risk-free rate is 3% and the expected market risk premium is 6%. Your firm's unlevered (asset) beta is 1. What is the appropriate rate to discount the interest tax shields associated with your debt? 10.00% 11.57% 6.00% 9.00% 4.00%arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning