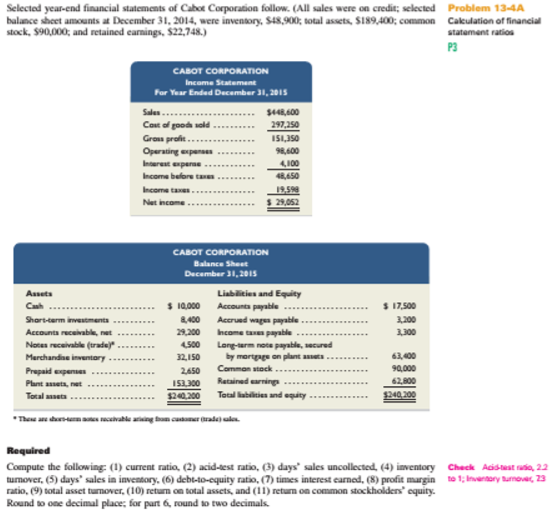

Selected year-end and financial statement of Cobalt Corporation follow. (All sales were on credit; Selected balance sheet amount at December 31, 2014, inventory,$48,900, total assets &189,400; common stock &90,000; and retrained earning, $22,748.)

Required

Compute the following; (1)

Round to one decimal places; for part 6, round to two decimals.

(1)

Introduction:

Liquidity or short-term ratios determines the ability of a firm to pay its current obligations. A good liquidity ration states that the company has liquid assets which can be easily convertible into cash. It includes current ratio, quick ratio etc.

To calculate:

Current ratio.

Answer to Problem 4PSA

Current ratio is 3.62:1

Explanation of Solution

= $86,900

= $24,000

= 3.62:1

(2)

Introduction:

Liquidity or short-term ratios determines the ability of a firm to pay its current obligations. A good liquidity ration states that the company has liquid assets which can be easily convertible into cash. It includes current ratio, quick ratio etc.

To calculate:

Acid-test ratio.

Answer to Problem 4PSA

Acid-test ratio is 2.2:1

Explanation of Solution

= 2.2:1

(3)

Introduction:

Days sales uncollected ratio helps the creditors and investors to measure the time in which company collects its account receivable.

To calculate:

Days sales uncollected.

Answer to Problem 4PSA

Days sales uncollected = 24 days

Explanation of Solution

= 24 days

(4)

Introduction:

Inventory turnover ratio measures how many times inventory is sold during a period.

To calculate:

Inventory turnover ratio.

Answer to Problem 4PSA

Inventory-turnover ratio is 7.3 times.

Explanation of Solution

= $40,525

= 7.3 times

(5)

Introduction:

Days sales in inventory calculates the time period which company takes to convert its inventory into sales.

To calculate:

Days sales in inventory.

Answer to Problem 4PSA

Days sales in inventory = 50 days

Explanation of Solution

= 50 days.

(6)

Introduction:

Debt-equity ratio measures the proportion of debt and equity in the capital structure.

To calculate:

Debt to equity ratio.

Answer to Problem 4PSA

Debt to equity ratio is 1.7:1

Explanation of Solution

= $87,400:

= $152,800

= 1.7:1

(7)

Introduction:

Time interest earned ratio measures the amount of income that will be required for for covering the interest expenses in the future.

To calculate:

Time interest earned.

Answer to Problem 4PSA

Time interest earned= 11.8

Explanation of Solution

= 11.8

(8)

Introduction:

Profit margin ratio is calculated by dividing net income by the net sales.

To calculate:

Profit margin ratio.

Answer to Problem 4PSA

Profit margin ratio is 6.4%

Explanation of Solution

= 6.4%

(9)

Introduction:

Asset turnover ratio calculates the ability of a company to generate sales with the total assets.

To calculate:

Asset-turnover ratio.

Answer to Problem 4PSA

Asset-turnover ratio = 1.8

Explanation of Solution

= 1.8:

(10)

Introduction:

Return on total asset is a ratio that calculated by dividing earning before income tax by total assets.

To calculate:

Return on total asset.

Answer to Problem 4PSA

Return on total asset is $0.18

Explanation of Solution

= $0.18

= $44,550

(11)

Introduction:

Return on common stockholder’s equity is calculated by dividing net income by shareholder’s equity. It helps in measuring the financial performance of a company.

To calculate:

Return on common stockholder’s equity.

Answer to Problem 4PSA

Return on common stockholder’s equity is $0.19

Explanation of Solution

= $0.19:

Want to see more full solutions like this?

Chapter 13 Solutions

MANAGERIAL ACCOUNTING FUND. W/CONNECT

- Juroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Required: Note: Round answers to two decimal places. 1. Calculate the times-interest-earned ratio. 2. Calculate the debt ratio. 3. Calculate the debt-to-equity ratio.arrow_forwardSelected current year-end financial statements of Overton Corporation follow. (All sales were on credit; selected balance sheet amounts at December 31 of the prior year were inventory, $17,400; total assets, $94,900; common stock, $35,500; and retained earnings, $18,800.) Required Compute the following: (1) current ratio, (2) acid-test ratio, (3) days’ sales uncollected, (4) inventory turnover, (5) days’ sales in inventory, (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return on common stockholders’ equity. Round to one decimal place; for part 6, round to two decimals.arrow_forwardAccess the February 21, 2017, filing of the December 31, 2016, 10-K report of The Hershey Company (ticker: HSY) at SEC.gov and complete the following requirements. Required Compute or identify the following profitability ratios of Hershey for its years ending December 31, 2016, and December 31, 2015. Interpret its profitability using the results obtained for these two years. 1. Profit margin ratio (round the percent to one decimal). 2. Gross profit ratio (round the percent to one decimal). 3. Return on total assets (round the percent to one decimal). (Total assets at year-end 2014 were $5,622,870 in thousands.) 4. Return on common stockholders’ equity (round the percent to one decimal). (Total shareholders’ equity at year-end 2014 was $1,519,530 in thousands.) 5. Basic net income per common share (round to the nearest cent).arrow_forward

- The comparative financial statements of Bettancort Inc. are as follows. The market price of Bettancort Inc. common stock was $71.25 on December 31, 2014. InstructionsDetermine the following measures for 2014, rounding to one decimal place:1. a.Working capital b. Current ratio c. Quick ratiod. Accounts receivable turnovere. Number of days' sales in receivablesf. Inventory turnoverg. Number of days' sales in inventoryh. Ratio of fixed assets to long-term liabilitiesi. Ratio of liabilities to stockholders’ equityj. Number of times interest charges are earnedk. Number of times preferred dividends are earned2. a. Ratio of net sales to assetsb. Rate earned on total assetsc. Rate earned on stockholders' equityd. Rate earned on common stockholders' equitye. Earnings per share on common stockf. Price-earnings ratiog. Dividends per share of common stockh. Dividend yieldarrow_forward(Ratio Computations and Analysis) Prior Company’s condensed financial statements provide the following information. Check the below image for information. Instructions(a) Determine the following for 2017.(1) Current ratio at December 31.(2) Acid-test ratio at December 31.(3) Accounts receivable turnover.(4) Inventory turnover.(5) Return on assets.(6) Profit margin on sales.(b) Prepare a brief evaluation of the financial condition of Prior Company and of the adequacy of its profits.arrow_forwardUsing these data from the comparative balance sheet of Sheridan Company, perform vertical analysis. (Round percentages to 1 decimal place, e.g. 12.5%.) Dec. 31, 2017Dec. 31, 2016AmountPercentageAmountPercentageAccounts receivable$ 540,000 Enter percentages % $ 363,000 Enter percentages %Inventory$ 783,000 Enter percentages % $ 642,000 Enter percentages %Total assets$3,120,000 Enter percentages % $2,704,000 Enter percentages %arrow_forward

- Selected current year-end financial statements of Cabot Corporation follow. (All sales were on credit; selected balance sheet amounts at December 31 of the prior year were inventory, $50,900; total assets, $199,400; common stock, $81,000; and retained earnings, $48,724.) CABOT CORPORATION Balance Sheet December 31 of current year Liabilities and Equity Assets Cash Short-term investments Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net $ 16,000 Accounts payable 8,200 Accrued wages payable 30,600 Income taxes payable 40,150 Long-term note payable, secured by mortgage on plant assets 3,050 Common stock 153,300 Retained earnings $ 251, 300 Total liabilities and equity $ 18,500 4,400 3,000 63,400 81,000 81,000 $ 251, 300 Total assets CABOT CORPORATION Income Statement For Current Year Ended December 31 $ 454,600 297,150 157,450 99,100 4,300 54,050 21,774 Sales Cost of goods sold Gross profit Operating expenses Interest expense Income before taxes Income tax…arrow_forwardSelected current year-end financial statements of Cabot Corporation follow. (All sales were on credit; selected balance sheet amounts at December 31 of the prior year were inventory, $48,900; total assets, $189,400; common stock, $90,000; and retained earnings, $33,748.) Assets Cash Short-term investments Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Sales Cost of goods sold Gross profit $ 10,000 8,400 CABOT CORPORATION Income Statement For Current Year Ended December 31 Operating expenses Interest expense Income before taxes Income tax expense Net income 33,700 32,150 2,650 153,300 $ 240, 200 $448,600 297,250 151,350 98,600 4,100 48,650 19,598 $ 29,052 CABOT CORPORATION Balance Sheet December 31 of current year Liabilities and Equity Accounts payable Accrued wages payable Income taxes payable. Long-term note payable, secured by mortgage on plant assets Common stock Retained earnings Total liabilities and equity $ 17,500 3,200 3,300…arrow_forwardThe condensed financial statements of Ivanhoe Company for the years 2020-2021 are presented below: (See Images) Compute the following financial ratios by placing the proper amounts for numerators and denominators. (Round per unit answers to 2 decimal places, e.g. 52.75.) (a) Current ratio at 12/31/21 $ $ (b) Acid test ratio at 12/31/21 $ $ (c) Accounts receivable turnover in 2021 $ $ (d) Inventory turnover in 2021 $ $ (e) Profit margin on sales in 2021 $ $ (f) Earnings per share in 2021 $ (g) Return on common stockholders’ equity in 2021 $ $ (h) Price earnings ratio at 12/31/21 $ $ (i) Debt to assets at 12/31/21 $ $ (j) Book value per share at 12/31/21 $arrow_forward

- The Cullumber Supply Company reported the following information for 2017. Prepare a common-size income statement for the year ended June 30, 2017. (Round answers to 1 decimal place, e.g. 52.7%.) Cullumber Supply CompanyIncome Statement for the Fiscal Year Ended June 30, 2017($ thousands) % of Net Sales Net sales $2,111,000 enter percentages of net sales % Cost of goods sold 1,464,000 enter percentages of net sales % Selling and administrative expenses 312,200 enter percentages of net sales % Nonrecurring expenses 27,600 enter percentages of net sales % Earnings before interest, taxes, depreciation, and amortization (EBITDA) $307,200 enter percentages of net sales % Depreciation 117,000 enter percentages of net sales % Earnings before interest and taxes (EBIT) 190,200 enter percentages of net sales % Interest expense 118,600 enter percentages of net sales % Earnings before taxes (EBT)…arrow_forwardThe comparative statements of Dubai Company are presented below. All sales were on account. The allowance for doubtful accounts was $3,200 on December 31, 2017, and $3,000 on December 31, 2020. Required: Compute the following ratios for 2021. (Weighted average common shares in 2021 were 62,500.) Current. Acid-test. Accounts receivable turnover. Inventory turnover.arrow_forwardSelected current year-end financial statements of Cabot Corporation follow. (All sales were on credit; selected balance sheet amounts at December 31 of the prior year were inventory, $46,900; total assets, $179,400; common stock, $88,000; and retained earnings, $31,286.) Assets Cash Short-term investments Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets CABOT CORPORATION Income Statement Cost of goods sold Gross profit For Current Year Ended December 31 Sales Operating expenses Interest expense Income before taxes Income tax expense Net income $ 18,000 9,000 33,800 Req 1 and 2 Reg 3 Req 4 Compute the debt-to-equity ratio. Numerator: $ 455,600 298,150 157,450 98,500 4,000 54,950 22,136 $ 32,814 30,150 3,050 154,300 Retained earnings $ 248,300 Total liabilities and equity 1 CABOT CORPORATION Balance Sheet December 31 of current year Liabilities and Equity Accounts payable Accrued wages payable Income taxes payable Complete this question by…arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning