Principles of Financial Accounting.

24th Edition

ISBN: 9781260158601

Author: Wild

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 13, Problem 20E

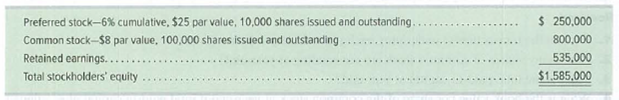

The equity section of Cyril Corporation’s balance sheet shows the following.

Determine the book value per share of common stock under two separate situations.

- 1. No preferred dividends are in arrears at the current date.

- 2. Three years of preferred dividends are in arrears at the current date.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Calgate Company had the following shares outstanding and retained earnings at the end of the current year:

Preferred shares, 4% (par value $15; outstanding, 10,300 shares)

Common shares (outstanding, 33,000 shares)

Retained earnings

The board of directors is considering the distribution of a cash dividend to both groups of shareholders. No dividends were declared

during the previous two years. Three independent cases are assumed:

Case A: The preferred shares are non-cumulative; the total amount of dividends is $51,600.

Case B: The preferred shares are cumulative; the total amount of dividends is $63,000.

Case C: Same as case B, except the amount is $97,500.

Required:

1. Compute the amount of dividends, in total and per share, that would be payable to each class of shareholders for each case. (Round

"Per share" to 2 decimal places.)

Case A:

Total

Per share

Case B:

Total

Per share

$ 154,500

615,000

296,000

Case C:

Total

Per share

Preferred

Shares

Common

Shares

The following information from the financial statements of Dresden plc for last year is available:

£m

Issue of ordinary shares

80

Retained earnings (profits from previous years)

100

Increase of capital reserves due revaluation of non-current assets

152

Share Capital and Capital reserves at the start of the year

305

Profit for the year

50

Dividends of the year

23

What figure should appear in the statement of financial position for equity at the end of the period ?

Required information

[The following information applies to the questions displayed below]

Markus Company's common stock sold for $5.25 per share at the end of this year. The company paid a common stock

dividend of $0.63 per share this year. It also provided the following data excerpts from this year's financial statements.

Cash

Accounts receivable

Inventory

Current assets

Total assets

Current liabilities

Total liabilities

Common stock, $1 par value

Total stockholders' equity

Total liabilities and stockholders' equity

Sales (all on account)

Cost of goods sold

Gross margin

Net operating income

Interest expense

Net Income

This Year

$ 1,095,000

$ 635,100

$ 459,900

$313,875

$ 15,500

$ 208,862

Ending Balance

$ 49,000

$ 92,000

$76,300

$ 217,300

$ 801,000

$ 85,500

$206,000

$ 165,000

$ 595,000

$ 801,000

Beginning

Balance:

$ 44,200

$ 68,700

$ 92,000

$ 204,900

$ 875,400

$ 90,000

$ 185,400

$ 165,000

$ 690,000

$ 875,400

Chapter 13 Solutions

Principles of Financial Accounting.

Ch. 13 - A corporation issues 6,000 shares of 5 par value...Ch. 13 - A company reports net income of 75,000. Its...Ch. 13 - A company has 5,000 shares of 100 par preferred...Ch. 13 - A company paid cash dividends of 0.81 per share....Ch. 13 - Prob. 5MCQCh. 13 - What are organization expenses? Provide examples.Ch. 13 - How are organization expenses reported?Ch. 13 - Prob. 3DQCh. 13 - What is the difference between authorized shares...Ch. 13 - Prob. 5DQ

Ch. 13 - List the general rights of common stockholders.Ch. 13 - What is the difference between the market value...Ch. 13 - Identify and explain the importance of the three...Ch. 13 - Prob. 9DQCh. 13 - How does declaring a stock dividend affect the...Ch. 13 - What is the difference between a stock dividend...Ch. 13 - Prob. 12DQCh. 13 - Prob. 13DQCh. 13 - How is book value per share computed for a...Ch. 13 - Prob. 15DQCh. 13 - Prob. 16DQCh. 13 - Prob. 17DQCh. 13 - Prob. 1QSCh. 13 - Issuance of common stock Prepare the journal entry...Ch. 13 - Issuance of par and stated value common stock...Ch. 13 - Issuance of no-par common stock Prepare the...Ch. 13 - Prob. 5QSCh. 13 - Accounting for cash dividends Prepare journal...Ch. 13 - Prob. 7QSCh. 13 - Accounting for small stock dividend The...Ch. 13 - Prob. 9QSCh. 13 - Accounting for dividends For each of the following...Ch. 13 - Preferred stock issuance and dividends 1. Prepare...Ch. 13 - Dividend allocation between classes of...Ch. 13 - Prob. 13QSCh. 13 - Prob. 14QSCh. 13 - Purchase and sale of treasury stock On May 3,...Ch. 13 - Prob. 16QSCh. 13 - Prob. 17QSCh. 13 - For each situation, identify whether it is treated...Ch. 13 - Prob. 19QSCh. 13 - Basic earnings per share Murray Company reports...Ch. 13 - Epic Company earned net income of 900,000 this...Ch. 13 - Price-earnings ratio Compute Topp Companys...Ch. 13 - Prob. 23QSCh. 13 - Book value per common share The stockholders...Ch. 13 - Prob. 1ECh. 13 - Prob. 2ECh. 13 - Accounting for par, stated, and no-par stock...Ch. 13 - Recording stock issuances Prepare journal entries...Ch. 13 - Stock issuance for noncash assets Sudoku Company...Ch. 13 - On June 30, Sharper Corporations stockholders...Ch. 13 - Prob. 7ECh. 13 - The stockholders equity section of TVX Company on...Ch. 13 - Prob. 9ECh. 13 - Yorks outstanding stock consists of 80,000 shares...Ch. 13 - Prob. 11ECh. 13 - Prob. 12ECh. 13 - In Draco Corporations first year of business, the...Ch. 13 - Prob. 14ECh. 13 - Prob. 15ECh. 13 - Prob. 16ECh. 13 - Prob. 17ECh. 13 - Price-earnings ratio computation and...Ch. 13 - Prob. 19ECh. 13 - The equity section of Cyril Corporations balance...Ch. 13 - Prob. 21ECh. 13 - Stockholders equity transactions and analysis...Ch. 13 - Prob. 2APCh. 13 - Prob. 3APCh. 13 - The equity sections for Atticus Group at the...Ch. 13 - Prob. 5APCh. 13 - Stockholders equity transactions and analysis...Ch. 13 - Balthus Corp. reports the following components of...Ch. 13 - Prob. 3BPCh. 13 - Prob. 4BPCh. 13 - Prob. 5BPCh. 13 - Santana Rey created Business Solutions on October...Ch. 13 - Prob. 1AACh. 13 - Use the following comparative figures for Apple...Ch. 13 - Prob. 3AACh. 13 - Prob. 1BTNCh. 13 - Access the March 1, 2017, fi ling of the 2016...Ch. 13 - Prob. 5BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assume that as of January 1, 20Y8, Sylvester Con- suiting has total assets of $500,000 and total assets of $150,000. As of December 31, 20Y8, Sylvester has total liabilities of $200,000 and total stockholders’ equity of $400,000. (a) What was Sylvester’s stockholders’ equity as of January 1, 20Y8? (b) Assume that Sylvester did not pay any dividends during 20Y8. What was the amount of net income for 20Y8?arrow_forwardAt the market close of a recent year, Sherman Corporation had a closing stock price of $200. In addition, Sherman's Corporation had a dividend per share of $8.4 during the previous year. Determine Sherman Corporation's dividend yield. Round to one decimal place.arrow_forwardRequired 1. Explain the transaction(s) underlying each journal entry (a) through (d). 2. How many shares of common stock are outstanding at year-end? 3. What is the total paid-in capital at year-end? 4. What is the book value per share of the common stock at year-end if total paid-in capital plus retained earnings equals $695,000?arrow_forward

- Aqua has correctly calculated its basic earnings per share (EPS) for the current year. Which of the following items need to be additionally considered when calculating Aqua's diluted EPS for the year? (i) A 1 for 5 rights issue of equity shares during the year at R1-20 when the market price of the equity shares was R2.00 (ii) The issue during the year of a convertible (to equity shares) loan note (iii) The granting during the year of directors' share options exercisable in three years' time (iv) Equity shares issued during the year as the purchase consideration for the acquisition of a new subsidiary company Select one: O a. All four O b. (i) and (ii) only c. (iii) and (iv) only d. (ii) and (iii) onlyarrow_forwardMarkus Company’s common stock sold for $2.75 per share at the end of this year. The company paid a common stock dividend of $0.55 per share this year. It also provided the following from this year’s financial statements:data excerpts Required: 1. What is the earnings per share? 2. What is the price-earnings ratio? 3. What is the dividend payout ratio and the dividend yield ratio? 4. What is the return on total assets (assuming a 30% tax rate)? 5. What is the return on equity? 6. What is the book value per share at the end of this year? 7. What is the amount of working capital and the current ratio at the end of this year? 8. What is the acid-test ratio at the end of this year? 9. What is the accounts receivable turnover and the average collection period? 10. What is the inventory turnover and the average sale period? 11. What is the company’s operating cycle? 12. What is the total asset turnover? 13. What is the times interest earned ratio? 14. What is the debt-to-equity ratio at the…arrow_forwardCalculating the Average Common Stockholders’ Equity andthe Return on Stockholders’ EquityRefer to the information for Somerville Company on the previous pages.Required:Note: Round answers to four decimal places.1. Calculate the average common stockholders’ equity.2. Calculate the return on stockholders’ equityarrow_forward

- 1. Compute Tidepool's EPS for the year. 2. Assume Tidepool's market price of a share of common stock is $ 7 per share Compute Tidepool's price / earnings ratio Tidepool Corp. earned net income of $133,340 and paid the minimum dividend to preferred stockholders for 2018. Assume that there are no changes in common shares outstanding during 2018. Tidepool's books include the following figuresarrow_forwardThe table below shows the market performance for a share of common stock in a multi-national corporation. Date Price Dividends Paid January 24, 2005 P60.00 P5.00 January 24, 2006 63.00 5.50 January 24, 2007 67.00 6.05 January 24, 2008 74.00 7.49 a) If an investor purchased shares on January 24, 2005, determine the rate of return realized for a two year holding period. (Ans. 15%) b) the holding period is until January 24, 2008. (Ans. 17%)arrow_forwardIn computations of weighted average of shares outstanding, when a stock dividend or stock split occurs, the additional shares are a. considered outstanding at the beginning of the reporting period b. weighted by the number of months outstanding. c. considered outstanding at the payment date. d. weighted by the number of days outstanding.arrow_forward

- Beacon Corporation issued a 3 percent stock dividend on 37,000 shares of its $7 par common stock. At the time of the dividend, the market value of the stock was $26 per share. Required a. Compute the amount of the stock dividend. b. Show the effects of the stock dividend on the financial statements using a horizontal statements model. In the Cash Flow column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). If an element was not affected by the event, leave the cell blank. Complete this question by entering your answers in the tabs below. Required A Required B Compute the amount of the stock dividend. Stock dividend Required >arrow_forwardA company declares a 5% stock dividend. The debit to Retained Earnings is anamount equal toa. the market value of the shares to be issued.b. the par value of the shares to be issued.c. the book value of the shares to be issued.d. the excess of the market price over the original issue price of the shares to be issued.arrow_forwardBeacon Corporation issued a 8 percent stock dividend on 35,000 shares of its $7 par common stock. At the time of the dividend, the market value of the stock was $30 per share. Required a. Compute the amount of the stock dividend. b. Show the effects of the stock dividend on the financial statements using a horizontal statements model. In the Cash Flow column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). If an element was not affected by the event, leave the cell blank. Complete this question by entering your answers in the tabs below. Required A Required B Show the effects of the stock dividend on the financial statements using a horizontal statements model. In the Cash Flow column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). If an element was not affected by the event, leave the cell blank. (Enter any decreases to account balances with a minus sign.)…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Financial instruments products; Author: fi-compass;https://www.youtube.com/watch?v=gvxozM3TUIg;License: Standard Youtube License