1. a.

Prepare the

1. a.

Explanation of Solution

Prepare the journal entries to record the investment in shares transactions, classify the securities as equity securities.

Record the purchase of Company G’s shares on January 1, 2019.

Step 1: Determine the number of shares purchased.

Corporation S purchased 20% shares of Company G for

Step 2: Record the entry.

| Date | Account Title and Explanation | Debit | Credit |

| January 1, 2019 | Investment in Equity Securities | $160,000 | |

| Cash | $160,000 | ||

| (To record the purchase of 20% shares of Company G) |

Table (1)

Record the dividend income received on December 31, 2019.

Corporation S received

| Date | Account Title and Explanation | Debit | Credit |

| December 31, 2019 | Cash | $6,000 | |

| Dividend income | $6,000 | ||

| (To record the amount of dividend income received from investment) |

Table (2)

Record the unrealized gain or loss on equity securities, as on December 31, 2019.

Step 1: Determine the amount of unrealized holding loss or gain.

Step 2: Record the

| Date | Account Title and Explanation | Debit | Credit |

| December 31, 2019 | Unrealized holding gain or loss: Equity Securities | $8,000 | |

| Investment in equity securities | $8,000 | ||

| (To record the unrealized holding loss on investment) |

Table (3)

Record the dividend income received on December 31, 2020.

Corporation S received

| Date | Account Title and Explanation | Debit | Credit |

| December 31, 2020 | Cash | $7,000 | |

| Dividend income | $7,000 | ||

| (To record the amount of dividend income received from investment) |

Table (4)

Record the unrealized gain or loss on Equity Securities, as on December 31, 2020.

Step 1: Determine the amount of unrealized holding loss or gain.

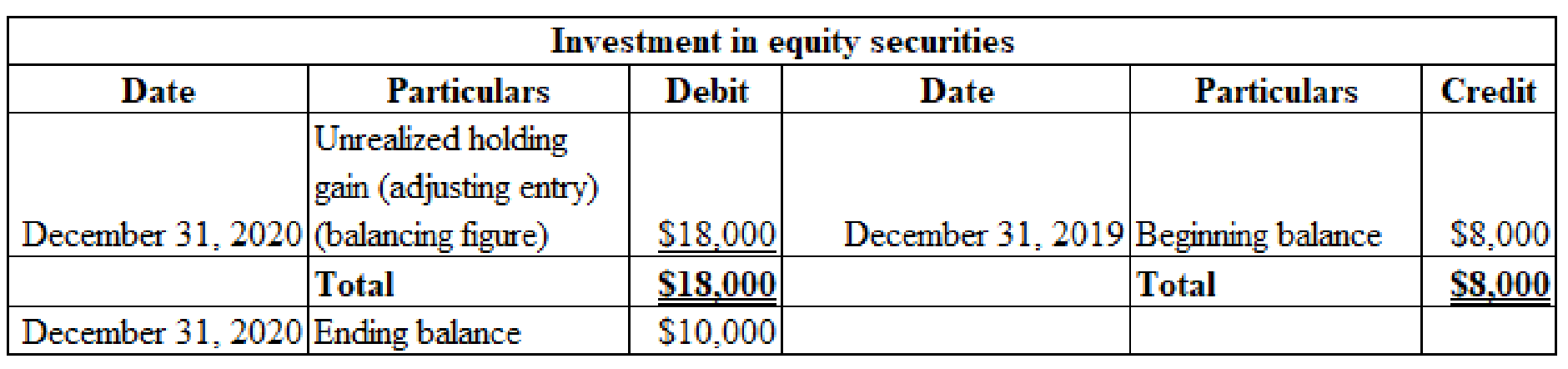

Step 2: Determine the amount of allowance to be adjusted to have $10,000 debit balance in allowance account at the end of the year 2020, using T-account.

Credit balance in allowance account on December 31, 2019 is $8,000.

Table (5)

Step 3: Record the adjusting entry.

| Date | Account Title and Explanation | Debit | Credit |

| December 31, 2020 | Investment in equity securities | $18,000 | |

|

Unrealized holding gain or loss: Equity Securities | $18,000 | ||

| (To adjust the unrealized holding gain on investment) |

Table (6)

1. b.

Prepare the journal entries to record the investment in shares transactions, using equity method.

1. b.

Explanation of Solution

Record the purchase of Company G’s 20% outstanding common stock:

| Date | Account Title and Explanation | Debit | Credit |

| January 1, 2019 | Investment in Stock: Company G | $160,000 | |

| Cash | $160,000 | ||

| (To record the purchase of 20% shares of Company G) |

Table (7)

Record the income from investment.

Step 1: Determine the amount of investment income.

Step 2: Record the entry.

| Date | Account Title and Explanation | Debit | Credit |

| December 31, 2019 | Investment in Stock: Company G | $16,000 | |

| Investment income | $16,000 | ||

| (To record the income earned from investment) |

Table (8)

Record the receipt of dividend.

Step 1: Determine the amount of cash received as dividend.

Step 2: Record the entry.

| Date | Account Title and Explanation | Debit | Credit |

| December 31, 2019 | Cash | $6,000 | |

| Investment in Stock: Company G | $6,000 | ||

| (To record the receipt of cash dividend) |

Table (9)

Record the income from investment.

Step 1: Determine the amount of investment income.

Step 2: Record the entry.

| Date | Account Title and Explanation | Debit | Credit |

| December 31, 2020 | Investment in Stock: Company G | $18,000 | |

| Investment income | $18,000 | ||

| (To record the income earned from investment) |

Table (10)

Record the receipt of dividend.

Step 1: Determine the amount of cash received as dividend.

Step 2: Record the entry.

| Date | Account Title and Explanation | Debit | Credit |

| December 31, 2020 | Cash | $7,000 | |

| Investment in Stock: Company G | $7,000 | ||

| (To record the receipt of cash dividend) |

Table (11)

Note: Under the equity method of recording the investment, no entry is required for recording the increase in the investee company’s market value.

2. a.

Prepare the journal entries to record the sale of 10,000 of Company G’s shares, assume that the company accounts for its investment as an Equity Securities.

2. a.

Explanation of Solution

Record the sale of 10,000 shares of Company G for $4.30 per share on January 4, 2021.

Corporation S sold Company G’s shares and received cash of $43,000

Determine the investment in equity securities balance on the date of partial sale of shares.

Determine the cost of investment in equity securities sold on January 4, 2021.

Record the entry.

| Date | Account Title and Explanation | Debit | Credit |

| January 4, 2021 | Cash | $43,000 | |

| Investment in equity securities | $42,500 | ||

| Gain on sale of investment | $500 | ||

| (To record the gain on sale of investment) |

Table (12)

2. b.

Prepare the journal entries to record the sale of 10,000 of Company G’s shares, using equity method.

2. b.

Explanation of Solution

Record the sale of 10,000 shares of Company G for $4.30 per share on January 4, 2021, under equity method.

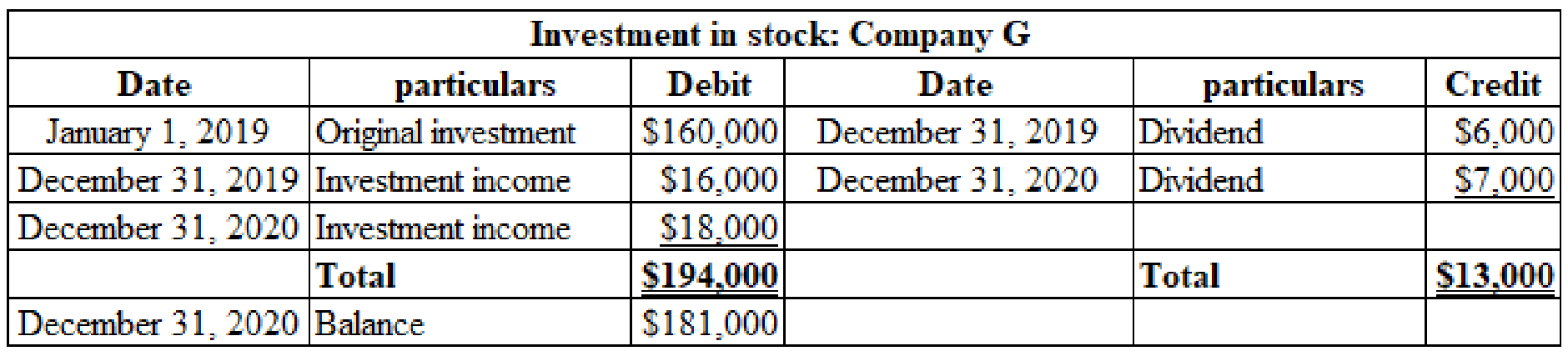

Determine the balance in Corporation S’s investment account on January 4, 2021.

Table (14)

Record the realized gain or loss from sale of 10,000 shares of Company G.

| Date | Account Title and Explanation | Debit | Credit |

| January 4, 2017 | Cash | $43,000 | |

| Loss on sale of equity investment | $2,250 | ||

| Investment in Stock: Company G | $45,250 | ||

| (To record the loss on sale of investment) |

Table (15)

Want to see more full solutions like this?

Chapter 13 Solutions

Intermediate Accounting: Reporting and Analysis (Looseleaf)

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning