FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

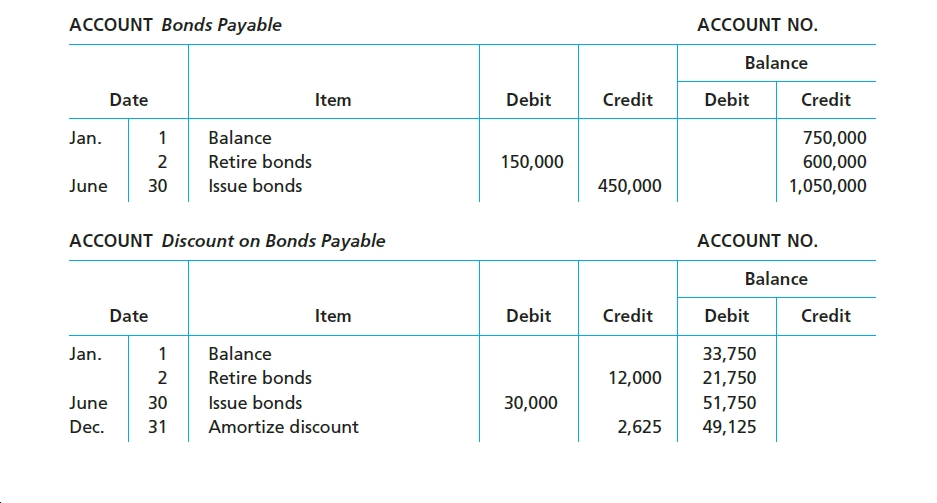

On the basis of the details of the following bonds payable and related discount accounts, indicate the items to be reported in the financing activities section of the statement of

Transcribed Image Text:ACCOUNT Bonds Payable

ACCOUNT NO.

Balance

Debit

Credit

Debit

Credit

Date

Item

Balance

Jan.

750,000

600,000

1,050,000

Retire bonds

2

150,000

June

30

Issue bonds

450,000

ACCOUNT Discount on Bonds Payable

ACCOUNT NO.

Balance

Debit

Credit

Debit

Credit

Date

Item

Balance

Jan.

33,750

21,750

51,750

Retire bonds

2

12,000

Issue bonds

June

30

30,000

31

Amortize discount

Dec.

2,625

49,125

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Specify the section of a classified balance sheet in which each of the following accounts would be found.Please tell me foll;owing the instructions above what part of the Balance Sheet and Section would these be found in1) Investment in XYZ2)Fund to Retire Bondsarrow_forwardThe carrying value of Bonds Payable equalsa. Bonds Payable plus Discount on Bonds Payable.b. Bonds Payable minus Discount on Bonds Payable.c. Bonds Payable minus Premium on Bonds Payable.d. Bonds Payable plus Accrued Interest.arrow_forwardThe journal entry a company makes for the issuance of bonds when the contract rate is less than the market rate would be Oa. debit Cash and Discount on Bonds Payable, credit Bonds Payable Ob. debit Cash, credit Bonds Payable Oc. debit Cash, credit Premium on Bonds Payable and Bonds Payable Od. debit Bonds Payable, credit Casharrow_forward

- When determining the amount of interest to be paid on a bond, which of the following information is not necessary? a. The length of the interest period, annually or semiannually b. The face rate of interest on the bonds c. The face amount of the bonds d. The selling price of the bondsarrow_forwardA $2,600 credit balance in the Premium on Bonds Payable account represents which of the following? Select one: a. An overpayment for a bond purchase b. An underpayment for a bond purchase c. The current amount of amortization expense d. The unamortized amount of premium earned on a bond issuearrow_forwardIf the sale of bonds falls between interest dates, interest accrued since the last interest payment would be O a. added to; debited to Interest Revenue O b. subtracted from; debited to Interest Revenue O c. subtracted from; credited to Interest Revenue O d. added to; credited to Interest Revenue the sale proceeds andarrow_forward

- SHOW STEPS IN CALCULATING BONDS PAYABLE DISCOUNTarrow_forwardWhich method involves the larger adjustment in the Cash Flow Statement (prepared under the indirect method) to net income in deriving funds provided by operations in the first year for a bond issued at more than par value Multiple Choice All the three statements about bonds are correct effective interest method of accounting for interest expense on bonds declining balance method of accounting for interest expense on bonds straight-line method of accounting for interest expense on bonds None of the other alternatives are correctarrow_forward2. The printing costs and accounting/legal fees associated with the issuance of bonds should: (A) Be expensed when incurred. (B) Be reported as a deduction from the face amount of the bonds payable on the balance sheet. (C) Be accumulated in a deferred charge account (unamortized asset) and amortized to expense over the life of the bonds. (D) Be recorded as an expense all in the year the bonds mature or are retired. (E) None of the above.arrow_forward

- Demonstrate how to identify and account for debt investments classified for reporting purposes as available-for-sale securities.arrow_forwardWhich of the following would NOT be included in the journal entry to show the conversion of bonds payable? ( NIE 13) A credit to gain on conversion credit to additional paid in capital debit to bond premium debit to bonds payablearrow_forwardThe balance in Unamortized Discount on Bonds Payable should be Oa. reported separately in the Current Liabilities section of the balance sheef Ob. added to the face amount of the related bonds payable on the balance sheet. O C. reported in the Paid-In Capital section of the balance sheet. Od. reported on the balance sheet as a deduction from the face amount of the related bonds payable.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education