FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

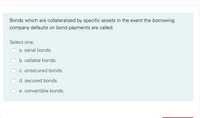

Transcribed Image Text:Bonds which are collateralized by specific assets in the event the borrowing

company defaults on bond payments are called:

Select one:

a. serial bonds.

b. callable bonds.

c. unsecured bonds.

d. secured bonds.

e. convertible bonds.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which of the following would NOT be included in the journal entry to show the conversion of bonds payable? O A credit to additional paid in capital O A debit to bonds payable O A debit to bond premium O A credit to gain on conversionarrow_forwardIf the carrying amount of bonds redeemed is more than the redemption price, the difference is recorded as a a. discount. b. premium. c. gain. loss. O d.arrow_forwardThe carrying value of Bonds Payable equalsa. Bonds Payable plus Discount on Bonds Payable.b. Bonds Payable minus Discount on Bonds Payable.c. Bonds Payable minus Premium on Bonds Payable.d. Bonds Payable plus Accrued Interest.arrow_forward

- Bonds that are issued on the general creditworthiness of the company are: Bonds that are issued on the general creditworthiness of the company are: 1. callable bonds 2. convertible bonds 3. secured bonds 4. debenture or unsecured bondsarrow_forwardDescribe the accounting for bonds payable, including bonds issued at face amount, bonds issued at a discount , nd bonds issued at a premium ?arrow_forwardWhat is the difference between serial bonds, term bonds, callable bonds, and convertible bonds.arrow_forward

- A bond that has only one payment, which occurs at maturity, defines which one of these types of bonds?arrow_forwardTo be effective issuing and investing in bonds, knowledge of their terminology, characteristics, and features is essential. For example: • A bond’s refers to the interest payment or payments paid by a bond. • A bond issuer is said to be in if it does not pay the interest or the principal in accordance with the terms of the indenture agreement or if it violates one or more of the issue’s restrictive covenants. • The contract that describes the terms of a borrowing arrangement between a firm that sells a bond issue and the investors who purchase the bonds is called . • A bond’s gives the issuer the right to call, or redeem, a bond at specific times and under specific conditions. Suppose you read an article about the Golden Gate Bridge and Highway District bonds. It includes the following information: Bridge Bonds Series A Dated 7-15-2005 4.375% Due 7-15-2055 @100.00 What is the issuing date of this bond? 7-15-2005 7-15-2055…arrow_forwardIn U.S. GAAP, bond issue costs are considered ________. Group of answer choices a period cost a cost of borrowing that reduces the effective interest expense an initial cost that is expensed when the bonds are issued an element in determining the carrying value of the bonds outstandingarrow_forward

- Which of the following would NOT be included in the journal entry to show the conversion of bonds payable? ( NIE 13) A credit to gain on conversion credit to additional paid in capital debit to bond premium debit to bonds payablearrow_forwardThe agreements and other terms of the contract between the issuer of the bonds and the one that lends the funds are established in: The surety contracts (bond indenture). Bond obligations (bond debenture). Registered bonds. Voucher coupon.arrow_forwardHow are the bonds issued, what is the appropriate journal entry? Provide example for issuing bonds. How do we determine the present value of a bond when market rate differs from its contract rate? How do we record the interest payment (provide examples for both premium and discount amortization), using the effective interest method? What is the difference between the effective interest method and the straight line method when amortizing either a discount or a premium? Cite and give credit to the author that you are citing.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education