Concept explainers

Prepare a Statement of

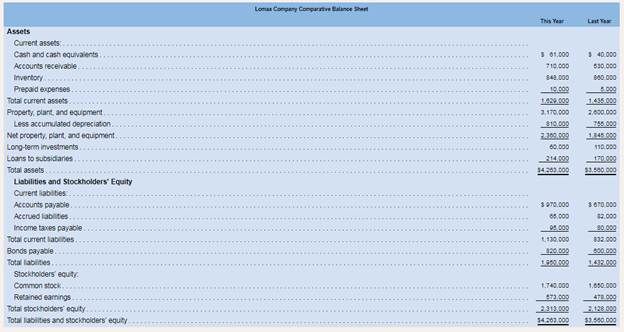

A comparative

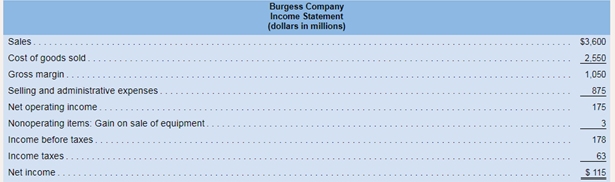

Burgess also provided the following information:

1. The company sold equipment that had an original cost of S13 million and

2. The company did not issue any new bonds during" the year.

3. The company paid a cash dividend during the year.

4. The company did not complete any common stock transactions during the year.

Required:

1. Using the indirect method, prepare a statement of cash flows for the year.

2. Assume that Burgess had sales of $3,800 net income of $135, and net cash provided by operating activities of $150 in the prior year (all numbers are stated in millions). Prepare a memo that summarizes your interpretations of Burgess's financial performance

Want to see the full answer?

Check out a sample textbook solution

Chapter 13 Solutions

Introduction To Managerial Accounting

- Solpoder Corporation has the following comparative financial statements: Dividends of 17,100 were paid. No equipment was purchased or retired during the current year. Required: Prepare a statement of cash flows using the direct method.arrow_forwardCurwen Inc. reported net cash flow from operating activities of $357,500 on its statement of cash flows for a recent year ended December 31. The following information was reported in the Cash flows from operating activities section of the statement of cash flows, using the indirect method: Decrease in income taxes payable $ 7,700Decrease in inventories 19,140Depreciation 29,480Gain on sale of investments 13,200Increase in accounts payable 5,280Increase in prepaid expenses 2,970Increase in accounts receivable 14,300a. Determine the net income reported by Curwen Inc. for the year ended December 31.b. Briefly explain why Curwen’s net income is different from net cash flow from operating activities.arrow_forwardBurgess also provided the following information: 1. The company sold equipment for $8 million that originally cost $13 million with accumulated depreciation of $8 million. The gain on the sale was $3 million. 2. The company did not issue any new bonds, pay a dividend, or complete any common stock transactions during the year. Required: 1. Using the indirect method, prepare a statement of cash flows. Note: Enter your answers in millions not in dollars. List any deduction in cash and cash outflows as negative amounts. Operating activities: Investing activities: Financing activities: Burgess Company Statement of Cash Flowsarrow_forward

- A company made a profit for the year of $18,750, after accounting for depreciation of $1,250. During the year, non-current assets were purchased for $8,000, receivables increased by $1,000, inventory decreased by $1,800 and payables increased by $350. The increase in cash and bank balances during the year was ........................................arrow_forwardThe following information relates to Elsa Corporation for last year: Net income $64,000 Net decrease in all current assets except cash $7,000 Net increase in current liabilities $16,000 Dividends paid on common stock $10,000 Depreciation expense $8,000 Loss on sale of machinery $5,000 What is Elsa's net cash provided (used) by operating activities for last year on the statement of cash flows? (Assume that current liabilities do not contain any notes payable.) * $68,000 $58,000 $100,000 $54,000arrow_forwardCurwen Inc. reported net cash flows from operating activities of $357,500 on its statement of cash flows for a recent year ended December 31. The following information was reported in the Cash Flows from (used for) Operating Activities section of the statement of cash flows, using the indirect method: Decrease in income taxes payable $7,700 Decrease in inventories 19,140 Depreciation 29,480 Gain on sale of investments 13,200 Increase in accounts payable 5,280 Increase in prepaid expenses 2,970 Increase in accounts receivable 14,300 a. Determine the net income reported by Curwen Inc. for the year ended December 31.$fill in the blank 1 b. Curwen’s net income differed from net cash flows from operations because of the following: Depreciation expense, which has no effect on cash flows from operating activities. Gain on the sale of investments is reported in investing activities section of the cash flow statement. Changes in current operating assets and liabilities that…arrow_forward

- Flora Inc. reported the following information: Net income: $640,000 Depreciation expense: $79,000 Increase in accounts receivable: $25,000 Decrease in inventory: $14,000 Dividends paid: $8,000 Flora should report cash provided by operating activities of:arrow_forwardD Ltd has an operating profit of $12m, which includes a depreciation charge of $1m. During the year the trading stock has increased by $4m, trade debtors have increased by $3m and trade creditors have increased by $5m. Prepare a statement of cash flow from operations. Write your answer clearly in the following table given. Cash flows from operating activities $m $m Profit before taxation Adjustment for items not involving a flow of cash Depreciation, amortization, gain or loss on disposal of non- current assets, etc Adjusted profit Increase/decrease in cash due to increase/decrease in current assets Increase/decrease in cash due to working capital changes Cash generated from operationsarrow_forwardNorbury Corporation's net income last year was $36,000. The company did not sell or retire any property, plant, and equipment last year. Changes in selected balance sheet accounts for the year appear below: Asset and Contra-Asset Accounts: Accounts receivable Inventory Prepaid expenses Accumulated depreciation Liability Accounts: Accounts payable Accrued liabilities Income taxes payable Multiple Choice $53,600 Based solely on this information, the net cash provided by (used in) operating activities under the indirect method on the statement of cash flows would be: $47,500 $24,500 Increases (Decreases) $81,700 $ 12,500 $ (3,400) $ 8,000 $ 22,000 $ 12,000 $ (7,900) $ 2,500arrow_forward

- A Co made a profit for the year of $18,750, after accounting for depreciation of $1,250. During the year, non-current assets were purchased for $8,000, receivables increased by $1,000, inventories decreased by $1,800 and payables increased by $350. What was A Co's increase in cash and bank balances during the year? A $10,650 В $10,850 C $12,450 $13,150arrow_forwardBrandon Inc. reported the following items in its statement of financial position and statement of earnings: net income, $81,500; gain on disposal of equipment, $14,600; increase in accounts receivable, $17,400; decrease in accounts payable, $27,900, and increase in common shares, $50,000. Required: Compute the net cash flows from operating activities using the indirect method.arrow_forwardHi-Tech, Inc., reports net income of $70 million. Included in that number are depreciation expense of $6 million and a loss on the sale of equipment of $2 million. Records reveal increases in accounts receivable, accounts payable, and inventory of $3 million, $4 million, and $5 million, respectively. What are Hi-Tech’s net cash flows from operating activities?arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning