Concept explainers

Payback Period and Simple

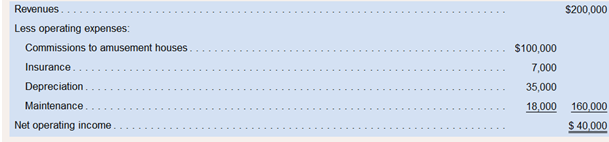

Nicks Novelties, Inc., is considering the purchase of Dew electronic games to place in its amusement houses. The games would cost a total of $300,000, have an eight-year useful life, and have a total salvage value of $20,000. The company estimates that annual revenues and expenses associated with the games would be as follows:

Required:

1. What is the payback period for the new electronic games? Assume that Nicks Novelties, Inc., il1 not purchase new games unless they provide a payback period of fire years or less. Would the company purchase the new games?

2. What is the simple rate of return promised by the games? If the company requires a simple rate of return of at least 12%, will the games be purchased?

Concept Introduction: When the Payback Period is computed after discounting the cash flows by a pre-determined rate (cut-off rate), it is called as the discounted payback period.

Concept of simple Rate of return:

Simple Rate of Return is also known as Accounting (or) Average rate of return (ARR) Means the average annual yield on the project. In this method, Profit After Tax (PAT) instead of (FAT) is used for evaluation.

1. Payback period for the new electronic games. 2. Simple rate of interest.

Explanation of Solution

Calculation of cash flows after Tax

Here, the payback period is 3 years 7 months. So, Neck’s Novelties, Inc., would purchase the new games.

2. Simple rate of return

Want to see more full solutions like this?

Chapter 12 Solutions

INTRO.TO MGRL.ACCT.(LL)W/CONNECT>IP<

- Mason, Inc., is considering the purchase of a patent that has a cost of $85000 and an estimated revenue producing lite of 4 years. Mason has a required rate of return that is 12% and a cost of capital of 11%. The patent is expected to generate the following amounts of annual income and cash flows: A. What is the NPV of the investment? B. What happens if the required rate of return increases?arrow_forwardFalkland, Inc., is considering the purchase of a patent that has a cost of $50,000 and an estimated revenue producing life of 4 years. Falkland has a cost of capital of 8%. The patent is expected to generate the following amounts of annual income and cash flows: A. What is the NPV of the investment? B. What happens if the required rate of return increases?arrow_forwardGina Ripley, president of Dearing Company, is considering the purchase of a computer-aided manufacturing system. The annual net cash benefits and savings associated with the system are described as follows: The system will cost 9,000,000 and last 10 years. The companys cost of capital is 12 percent. Required: 1. Calculate the payback period for the system. Assume that the company has a policy of only accepting projects with a payback of five years or less. Would the system be acquired? 2. Calculate the NPV and IRR for the project. Should the system be purchasedeven if it does not meet the payback criterion? 3. The project manager reviewed the projected cash flows and pointed out that two items had been missed. First, the system would have a salvage value, net of any tax effects, of 1,000,000 at the end of 10 years. Second, the increased quality and delivery performance would allow the company to increase its market share by 20 percent. This would produce an additional annual net benefit of 300,000. Recalculate the payback period, NPV, and IRR given this new information. (For the IRR computation, initially ignore salvage value.) Does the decision change? Suppose that the salvage value is only half what is projected. Does this make a difference in the outcome? Does salvage value have any real bearing on the companys decision?arrow_forward

- Dauten is offered a replacement machine which has a cost of 8,000, an estimated useful life of 6 years, and an estimated salvage value of 800. The replacement machine is eligible for 100% bonus depreciation at the time of purchase- The replacement machine would permit an output expansion, so sales would rise by 1,000 per year; even so, the new machines much greater efficiency would cause operating expenses to decline by 1,500 per year The new machine would require that inventories be increased by 2,000, but accounts payable would simultaneously increase by 500. Dautens marginal federal-plus-state tax rate is 25%, and its WACC is 11%. Should it replace the old machine?arrow_forwardGardner Denver Company is considering the purchase of a new piece of factory equipment that will cost $420,000 and will generate $95,000 per year for 5 years. Calculate the IRR for this piece of equipment. For further Instructions on internal rate of return in Excel, see Appendix C.arrow_forwardGallant Sports s considering the purchase of a new rock-climbing facility. The company estimates that the construction will require an initial outlay of $350,000. Other cash flows are estimated as follows: Assuming the company limits its analysis to four years due to economic uncertainties, determine the net present value of the rock-climbing facility. Should the company develop the facility if the required rate of return is 6%?arrow_forward

- Caduceus Company is considering the purchase of a new piece of factory equipment that will cost $565,000 and will generate $135,000 per year for 5 years. Calculate the IRR for this piece of equipment. For further instructions on internal rate of return In Excel, see Appendix C.arrow_forwardHI Corporation is considering the purchase of a machine that promises to reduce operating costs by the same amount for every year of its 6-year useful life. The machine will cost $208,780 and has no salvage value. The machine has a 14% internal rate of return. (Ignore income taxes.) Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided. Required: What are the annual cost savings promised by the machine? (Round your intermediate calculations and final answer to the nearest whole dollar amount.) Annual cost savings 2$ 53,685arrow_forwardFM company considers the purchase of two different types of machines, Machine A and Machine B, to manufacture ball bearings, of the many products it produces for the car market. Each machine will cost P750,000; will have five years economic life with zero salvage value. Both machines will meet the capacity of the projected demand. The operating after-tax cash flow per year of each machine is as follows: Machine Period A B 0 (P750,000) (P750,000) 1 100,000 250,000 2 200,000 250,000 3 200,000 250,000 4…arrow_forward

- You are considering purchasing a new punch press machine. This machine will have an estimated service life of 10 years. The expected after-tax salvage value at the end of service life will be 10% of the purchase cost. Its annual after-tax operating cash flows are estimated to be $60,000. If you can purchase the machine at $308,758, what is the expected rate of return on this investment? Answer in Excelarrow_forwardA company is considering purchasing a machine for P210,000. The machine will generate an after-tax net income of P20,000 per year. Annual depreciation expense would be P15,000. What is the payback period for the new machine? Group of answer choices 10.5 years. 6 years. 42 years. 4 years. 14 years.arrow_forwardSome equipment is needed for a 4-year project. It can be leased for $15,000 annually, or it can be purchased for $60,000 at the beginning and sold for $35,000 at the end. What is the rate of return for owning the equipment rather than leasing it?arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning  Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning