1.

Prepare a segmented income statement for Company S.

1.

Explanation of Solution

Segment reporting: Segment reporting refers to the process of preparing accounting report by segment and for the entire organization. Several organizations prepare segmented income statements to show the income for major segments and for the enterprise as a whole.

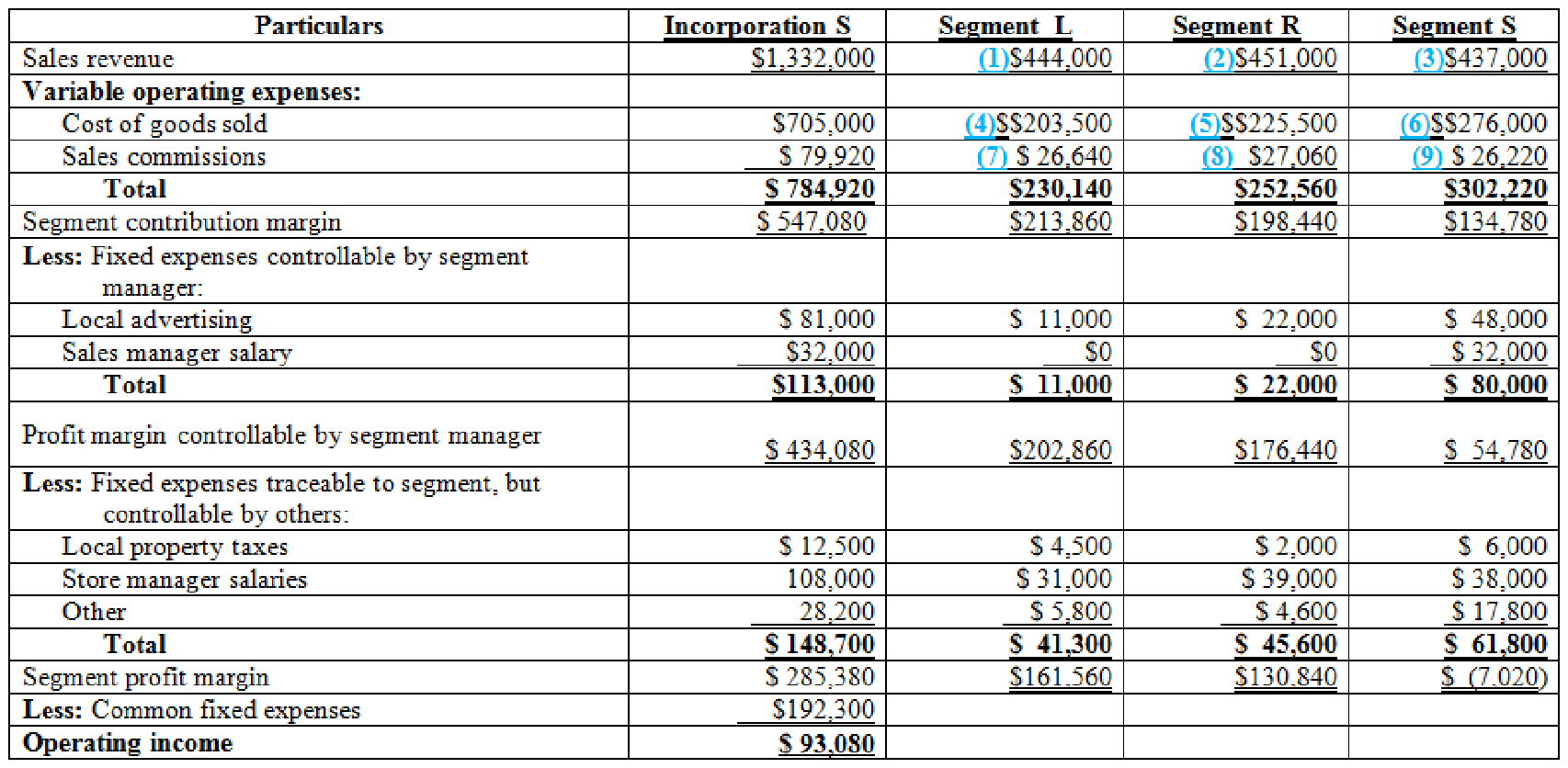

Prepare a segmented income statement:

Figure (1)

Working notes:

(1)Calculate the sales revenue for Segment L:

(2)Calculate the sales revenue for Segment R:

(3)Calculate the sales revenue for Segment S:

(4)Calculate the cost of goods sold for Segment L:

(5)Calculate the cost of goods sold for Segment R:

(6)Calculate the cost of goods sold for Segment S:

(7)Sales commissions for Segment L:

(8)Sales commissions for Segment R:

(9)Sales commissions for Segment S:

2.

Find out the weakest-performing store and present an analysis of the probable causes of poor performance.

2.

Explanation of Solution

- Segment S is the weakest segment due to the several factors.

- Segment L and Segment R has greater markups on cost 118% and 100% correspondingly. However, markups on cost for Segment S are only 58%.

- Segment S is the only store which has a sales manager and spends more on advertising than segment L and segment R.

- Segment S is having the lowest gross dollar sales while compared to the other two stores and Segment R’s return on these outlays seems inadequate.

- Segment S’s “other” non-controllable costs are much higher than Segment L and Segment R.

3.

Explain whether CEO should use a store’s segment contribution margin, identify whether the profit margin is controllable by the store manager or a stores’ segment profit margin while evaluation the performance of store manager.

3.

Explanation of Solution

- Incorporation S uses responsibility accounting system wherein, the managers and centers are measured on the basis of items under their control.

- Decision should be made by studying the profit margin controllable by the store, since this is a personnel type of decision making.

- The contribution margin of the segment not include fixed costs under the control of the store manager, in contrast , a profit margin of the segment reflects all traceable costs whether controllable or not.

Want to see more full solutions like this?

Chapter 12 Solutions

MANAGERIAL ACCOUNTING-ACCESS

- Project A has an IRR of 15 percent. Project B has an IRR of 18 percent. Both projects have the same risk. Which of the following statements is most correct? a. If the WACC is 10 percent, both projects will have a positive NPV, and the NPV of Project B will exceed the NPV of Project A. b. If the WACC is 15 percent, the NPV of Project B will exceed the NPV of Project A. c. If the WACC is less than 18 percent, Project B will always have a shorter payback than Project A. d. If the WACC is greater than 18 percent, Project B will always have a shorter payback than Project A. e. If the WACC increases, the IRR of both projects will decline.arrow_forwardOne of our client companies, EA Community Laundry Chain, asked us for a consultation on their company's operations. Based on the accounting information provided by them, please use your professional knowledge to assist them in the preparation of five financial statement based on the information below (Income statement, financial position statement, retained earnings statement, comprehensive income statement, cash flow statement). Sales revenue: $555,080- Inventory: $102,000- Cost of goods sold: $210,000+ Bonds payable: $78,000– Financing Costs: $10,000- Notes payable (due in 5 months): $24,400- Selling and administrative expenses: $75,000 Buildings: $80,400< Share capital: $60,000+ Gain on sale of plant assets: $45,000+ Accumulated depreciation-equipment: $10,000- Unrealized gain on non-trading securities: $15,000 # Prepaid advertising: $5,000- Loss on discontinued operations: $20,000+ Supplies: $1860- Dividends declared and paid: $50,400** Taxes payable: $3000€ Allocation to…arrow_forwardCintas designs, manufactures, and implements corporate identity uniform programs that it rents or sells to customers throughout the United States and Canada. The company’s stock is traded on the NASDAQ and has provided investors with significant returns over the past few years. Selected information from the company’s balance sheet follows. For 2012, the company reported sales revenue of $3,707,900 and cost of goods sold of $1,517,415.arrow_forward

- The general merchandise retail industry has a number of segments represented by the following companies: For a recent year, the following cost of goods sold and beginning and ending inventories are provided from corporate annual reports (in millions) for these three companies: a. Determine the inventory turnover ratio for all three companies. Round all calculations to one decimal place. b. Determine the number of days sales in inventory for all three companies. Use 365 days and round all calculations to one decimal place. c. Interpret these results based on each companys merchandising concept.arrow_forwardSafa traders is a wholesale business unit based in Salala. The company is dealing with disposable tableware in large quantities. The business has a separate stores department which maintains a full-fledged stores register which will be updated on a day to day basis with all the stock movements. At the end of the previous month, the company management has called for a strategic meeting to discuss the future plans to improve the performance of the business. One of the partner has raised his concern about the increasing total cost of the business and he suggested to use any appropriate Inventory control technique to reduce the overall cost of the company. The management accountant is considering to implement EOQ purchase in the business to reduce the overall cost of the company. Upon request, the stores department has provided with the following information to estimate the EOQ. Annual demand for the tableware is given as 5000 Units and the business has to spend OMR 20 per order in order…arrow_forwardYou have been asked by a client to review the records of Sheffield Company, a small manufacturer of precision tools and machines. Your client is interested in buying the business, and arrangements have been made for you to review the accounting records. Your examination reveals the following information.1. Sheffield Company commenced business on April 1, 2018, and has been reporting on a fiscal year ending March 31. The company has never been audited, but the annual statements prepared by the bookkeeper reflect the following income before closing and before deducting income taxes. Year EndedMarch 31 IncomeBefore Taxes 2019 $83,772 2020 130,338 2021 121,189 2. A relatively small number of machines have been shipped on consignment. These transactions have been recorded as ordinary sales and billed as such. On March 31 of each year, machines billed and in the hands of consignees amounted to: 2019 $7,605 2020 none 2021 6,540 Sales price was…arrow_forward

- Select from the following list the qualitative characteristic of useful information that best describes each of the following items: 1. 2. 3. 4. 5. In order to keep the financial statements simple, Carlaw Consulting shows three items on its income statement: Revenue, Expenses and Net income. The financial statements of Belbach Industries are audited on an annual basis by public accountants. Rydell Corporation is contemplating an investment in Fryan Ltd. Rydell has requested a copy of the company's year-end financial statements to assist them in their investment decision. Chemical Reaction Inc. operates in both the US and Canada and restates its US financial statements according to Canadian GAAP for its Canadian investors. The Controller for Location Inc. emphasizes that factual and unbiased information prevails in the preparation of the company financial statements. Predictive value Confirmatory value Materiality Completeness Neutrality Freedom from error Verifiability Comparability 2arrow_forwardSwain Athletic Gear (SAG) operates six retail outlets in a large Midwest city. One is in the center of the city on Cornwall Street and the others are scattered around the perimeter of the city. Management at SAG is concerned about declining sales and profitability of the Cornwall store and believes that outlet has been a drag on profits in recent years. The most recent income statement for the Cornwall store follows. SWAIN ATHLETIC GEAR Cornwall Street Store Income Statement For the Year Ending February 28 Sales revenue $ 12,300,000 Costs Cost of goods sold $ 5,289,000 Advertising 1,421,000 Store administrative salaries 975,000 Sales commissions 1,056,000 Leases and utilities 2,100,000 Allocated corporate support 1,622,000 Total costs $ 12,463,000 Net loss before tax benefit $ (163,000) Tax benefit at 25% (40,750) Net loss $ (122,250) The CFO at SAG has asked for your advice on closing the Cornwall Street store. If the Cornwall Street store is…arrow_forwardFor the purpose of process analysis, which of the following measures would be considered an appropriate flow unit for analyzing the main operation of a local accountingfirm? Instructions: You may select more than one answer.a. Number of accountants working each weekb. Number of tax returns completed each weekc. Number of customers with past-due invoicesd. Number of reams of paper received from suppliersarrow_forward

- In connection with your examination of the financial statements of Camry Products Co, a limited liability company, for the year ended 31 March 20X9, you are reviewing the plans for a physical inventory count at the company's warehouse on 31 March 20X9. The company assembles domestic appliances, and inventory of finished appliances, unassembled parts and sundry inventory are stored in the warehouse which is adjacent to the company's assembly plant. The plant will continue to produce goods during the inventory count until 5pm on 31 March 20X9. On 30 March 20X9, the warehouse staff will deliver the estimated quantities of unassembled parts and sundry inventory which will be required for production for 31 March 20X9; however, emergency requisitions by the factory will be filled on 31 March. During the inventory count, the warehouse staff will continue to receive parts and sundry inventory, and to dispatch finished appliances. Appliances which are completed on 31 March 20X9 will remain in…arrow_forwardHarrison and Company is a leading retailer of casual apparel for men, women, and children. Assume that you are employed as a stock analyst and your boss has just completed a review of the new Harrison annual report. She provided you with her notes, but they are missing some information that you need. Her notes show that the ending inventory for Harrison in the current and previous years was $272,472,000 and $233,103,000, respectively. Net sales for the current year were $2,540,266,000. Cost of goods sold was $178,524,000. Income before taxes was $172,335,000. Required: Determine the amount of purchases for the year. (Hint: Use the cost of goods sold equation or the inventory T-account to solve for the needed value.) Amount of purchasesarrow_forwardMiss Maria has recently joined the accounting department of SISHGC Limited as an assistant accountant. During her first meeting with the accounting department, the head of the department has elaborated her the responsibilities related to the general ledger and subsidiary ledger. Miss Maria uses the source documents such as purchase orders, sales invoices, and suppliers’ invoices to prepare journal vouchers for general ledger entries. At the end of each working day, she posts the journal vouchers to the general ledger and the related subsidiary ledgers. At the end of each month, Miss Maria reconciles the subsidiary accounts to their control accounts in the general ledger to ensure that there is no difference in these accounts. Required: Discuss the internal control weaknesses and risks associated with the above process.arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub