Concept explainers

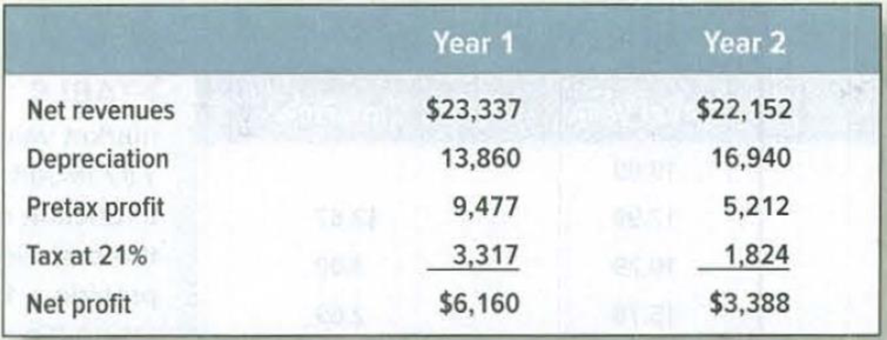

EVA Ohio Building Products (OBP) is considering the launch of a new product that would

require an initial investment in equipment of $30,800 (no investment in working capital is

required). The

No cash flows are forecast after year 2, and the equipment wi ll have no salvage value. The

cost of capital is 10%.

a. What is the project's

b. Calculate the expected EVA and the

c. Why does EVA decline between years 1 and 2, whereas the return on investment is

unchanged?

d. Calculate the present value of the economic value added. How does this figure compare

with the project NPV?

e. What would be the return on investment and EVA if OBP chooses instead to depreciate

the investment straight line? Do you think that this would provide a better standard for

measuring subsequent performance?

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

PRIN.OF CORPORATE FINANCE

- Falkland, Inc., is considering the purchase of a patent that has a cost of $50,000 and an estimated revenue producing life of 4 years. Falkland has a cost of capital of 8%. The patent is expected to generate the following amounts of annual income and cash flows: A. What is the NPV of the investment? B. What happens if the required rate of return increases?arrow_forwardGina Ripley, president of Dearing Company, is considering the purchase of a computer-aided manufacturing system. The annual net cash benefits and savings associated with the system are described as follows: The system will cost 9,000,000 and last 10 years. The companys cost of capital is 12 percent. Required: 1. Calculate the payback period for the system. Assume that the company has a policy of only accepting projects with a payback of five years or less. Would the system be acquired? 2. Calculate the NPV and IRR for the project. Should the system be purchasedeven if it does not meet the payback criterion? 3. The project manager reviewed the projected cash flows and pointed out that two items had been missed. First, the system would have a salvage value, net of any tax effects, of 1,000,000 at the end of 10 years. Second, the increased quality and delivery performance would allow the company to increase its market share by 20 percent. This would produce an additional annual net benefit of 300,000. Recalculate the payback period, NPV, and IRR given this new information. (For the IRR computation, initially ignore salvage value.) Does the decision change? Suppose that the salvage value is only half what is projected. Does this make a difference in the outcome? Does salvage value have any real bearing on the companys decision?arrow_forwardFriedman Company is considering installing a new IT system. The cost of the new system is estimated to be 2,250,000, but it would produce after-tax savings of 450,000 per year in labor costs. The estimated life of the new system is 10 years, with no salvage value expected. Intrigued by the possibility of saving 450,000 per year and having a more reliable information system, the president of Friedman has asked for an analysis of the projects economic viability. All capital projects are required to earn at least the firms cost of capital, which is 12 percent. Required: 1. Calculate the projects internal rate of return. Should the company acquire the new IT system? 2. Suppose that savings are less than claimed. Calculate the minimum annual cash savings that must be realized for the project to earn a rate equal to the firms cost of capital. Comment on the safety margin that exists, if any. 3. Suppose that the life of the IT system is overestimated by two years. Repeat Requirements 1 and 2 under this assumption. Comment on the usefulness of this information.arrow_forward

- OptiLux is considering investing in an automated manufacturing system. The system requires an initial investment of $6.0 million, has a 20-year life, and will have zero salvage value. If the system is implemented, the company will save $820,000 per year in direct labor costs. The company requires a 12% return from its investments.1. Compute the proposed investment’s net present value.2. Using your answer from part 1, is the investment’s internal rate of return higher or lower than 12%?arrow_forwardGlenora Inc. is considering the following project: The equipment has a 4-year project life. This equipment fall into class 43 with a CCA rate of 30% and would have zero salvage value. The firm has other assets in asset class 43. No new working capital would be required. Revenues and cash operating costs are expected to be constant over the project's 4-year life. What is the project's NPV? WACC Net investment cost Sales revenues, each year Cash operating costs Tax rate Oa. $16,284 O b. $23,401 O c. $28,499 d. $19,417 10.0% $65,000 $60,000 $25,000 35.0%arrow_forwardThe management of Digital Waves, Inc. is considering a project with a net cost of$115,000 and an annual net cash inflow estimated at $30,000 over the project's life of 5years. The company has a cost of capital of 6 percent. The project under considerationhas risk that is typical for the company.a. What is the project's payback period?b. What is the project's NPV?c. What is the project's IRR?d. What is the project’s PI?arrow_forward

- The management of Digital Waves, Inc. is considering a project with a net initial cost of $115,000 and an annual net cash inflow estimated at $30,000 over the project's life of 5 years. The company has a cost of capital of 6 percent. The project under consideration has risk that is typical for the company. a. What is the project's payback period? b. What is the project's NPV? c. What is the project's IRR? d. What is the project’s PI?arrow_forwardCalculate the net present value of a project which requires an initial investment of OMR 300,000 and it is expected to generate a cash inflow of OMR 60,000 each month for 12 months. Assume that the salvage value of the project is zero. The target rate of return is 12% per annum. Write any formula that you will use first. Is this even or uneven cash flow? What is your opinion about the project? Justify your answer. 2. You as a project manager were asked to develop an Inventory Control Management Information System. Apply the SWOT analysis mind mapping technique.arrow_forwardCarla Vista Company is considering a long-term investment project called ZIP. ZIP will require an investment of $118,665. It will have a useful life of 4 years and no salvage value. Annual cash inflows would increase by $81,000, and annual cash outflows would increase by $40,500. The company's required rate of return is 12%. Click here to view the factor table. Calculate the internal rate of return on this project. (Round answers to whole number (e.g., 15%).) Internal rate of return on this project is between Determine whether this project should be accepted? % and %. The project should be accepted.arrow_forward

- 3. Schultz Company is considering purchasing a machine that would cost $478,800 and have a useful life of 5 years. The machine would reduce cash operating costs by $114,000 per year. The machine would have a salvage value of $6,200. Schultz Company prefers a payback period of 3.5 years or less.Required: a. Compute the payback period for the machine. What does this mean? b. Compute the return on average investment (ROI)arrow_forwardCelestial Crane Cosmetics is analyzing a project that requires an initial investment of $3,225,000. The project's expected cash flows are: Year Cash Flow Year 1 $375,000 Year 2 -125,000 Year 3 500,000 Year 4 400,000 If the company's WACC is 8% and the project has the same risk as the firm's average project, what is the project's modified internal rate of return (MIRR)? Should you accept or reject this project?arrow_forwardTyler, Inc., is considering switching to a new production technology. The cost of the required equipment will be $3,529,783 . The discount rate is 13.99 percent. The cash flows that the firm expects the new technology to generate are as follows. a. Compute the payback and discounted payback periods for the project. b. What is the NPV for the project? Should the firm go ahead with the project? c. What is the IRR, and what would be the decision based on the IRR? Years CF 0 $(3,529,783) 1-2 0 3-5 $916,204 6-9 $1,590,056arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning