Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 17E

Reporting paid-in capital

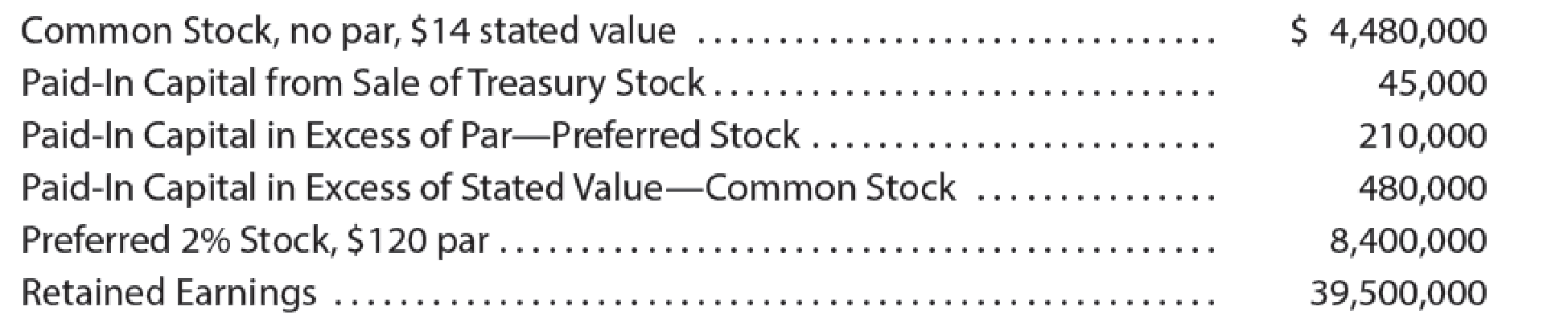

The following accounts and their balances were selected from the adjusted

Prepare the Paid-in capital portion of the “Stockholders’ Equity” section of the

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Financial Accounting

General accounting

expert of general accounting

Chapter 12 Solutions

Financial And Managerial Accounting

Ch. 12 - Of two corporations organized at approximately the...Ch. 12 - A stockbroker advises a client to buy preferred...Ch. 12 - A corporation with both preferred stock and common...Ch. 12 - Prob. 4DQCh. 12 - Prob. 5DQCh. 12 - Prob. 6DQCh. 12 - A corporation reacquires 60,000 shares of its own...Ch. 12 - Prob. 8DQCh. 12 - Prob. 9DQCh. 12 - Prob. 10DQ

Ch. 12 - Dividends per share Zero Calories Company has...Ch. 12 - Entries for issuing stock On January 22, Zentric...Ch. 12 - Entries for cash dividends The declaration,...Ch. 12 - Entries for stock dividends Alpine Energy...Ch. 12 - Entries for treasury stock On May 27, Hydro...Ch. 12 - Reporting stockholders equity Using the following...Ch. 12 - Statement of stockholders equity Noric Cruises...Ch. 12 - Earnings per share Financial statement data for...Ch. 12 - Dividends per share Seventy-Two Inc., a developer...Ch. 12 - Prob. 2ECh. 12 - Prob. 3ECh. 12 - Entries for issuing no-par stock On May 15, Helena...Ch. 12 - Issuing stock for assets other than cash On...Ch. 12 - Selected stock transactions Alpha Sounds Corp., an...Ch. 12 - Issuing stock Willow Creek Nursery, with an...Ch. 12 - Issuing stock Professional Products Inc., a...Ch. 12 - Entries for cash dividends The declaration,...Ch. 12 - Prob. 10ECh. 12 - Prob. 11ECh. 12 - Prob. 12ECh. 12 - Selected dividend transactions, stock split...Ch. 12 - Treasury stock transactions Mystic Lake Inc....Ch. 12 - Prob. 15ECh. 12 - Treasury stock transactions Biscayne Bay Water...Ch. 12 - Reporting paid-in capital The following accounts...Ch. 12 - Stockholders' Equity section of balance sheet The...Ch. 12 - Stockholders' Equity section of balance sheet...Ch. 12 - Retained earnings statement Sumter Pumps...Ch. 12 - Prob. 21ECh. 12 - Statement of stockholders equity The stockholders...Ch. 12 - Dividends on preferred and common stock Pecan...Ch. 12 - Stock transactions for corporate expansion On...Ch. 12 - Selected stock transactions The following selected...Ch. 12 - Entries for selected corporate transactions Morrow...Ch. 12 - Prob. 5PACh. 12 - Dividends on preferred and common stock Yosemite...Ch. 12 - Stock transaction for corporate expansion Pulsar...Ch. 12 - Selected stock transactions Diamondback Welding ...Ch. 12 - Entries for selected corporate transactions Nav-Go...Ch. 12 - Prob. 5PBCh. 12 - Selected transactions completed by Equinox...Ch. 12 - Analyze and compare Amazon.com and Wal-Mart...Ch. 12 - Analyze and compare Bank of America and Wells...Ch. 12 - Analyze Pacific Gas and Electric Company Pacific...Ch. 12 - Prob. 4MADCh. 12 - Prob. 5MADCh. 12 - Ethics in Action Tommy Gunn is a division manager...Ch. 12 - Prob. 2TIFCh. 12 - Communications Motion Designs Inc. has paid...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Stockholders Equity: How to Calculate?; Author: Accounting University;https://www.youtube.com/watch?v=2jZk1T5GIlw;License: Standard Youtube License