MyLab Accounting with Pearson eText -- Access Card -- for Financial Accounting

12th Edition

ISBN: 9780134727677

Author: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 12, Problem 12.47Q

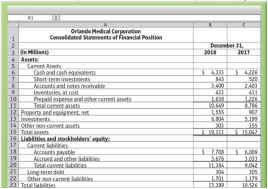

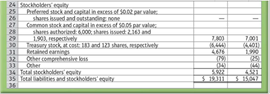

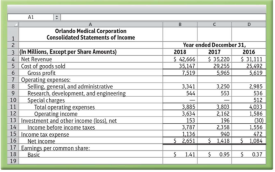

Use the Orlando Medical Corporation financial statements that follow to answer question.

Q12-47. Orlando Medical's common-size income statement for 2018 would report cost of goods sold as

- a. 82.4%.

- b. $35,147 million.

- c. up by 20 1%.

- d. 137.9%.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Rousseau Corporation has the following Statement of Income for the year ended May 31, 2020:

Sales...

$1,675,200

Cost of goods sold..

887,600

Gross margin...

787,600

Selling & administrative expense..

241,200

Interest expense.

65,000

Income before income taxes.

481,400

192,500

$288,900

Income taxes..

Net income....

Calculate the interest-coverage ratio for Rousseau Corporation for May31, 2020 (place answer at up to 2

decimal places in the space below).

신

The following are the financial statement JNC Ltd. for the year ended 31 March 2020:

JNC Ltd.

Income statement

For the year ended 31 March 2020

$”M”

Revenue

1276.50

Cost of sales

(907.00)

369.50

Distribution costs

(62.50)

Administrative expenses

(132.00)

175.00

Interest received

12.50

Interest paid

(37.50)

150.00

Tax

(70.00)

Profit after tax

80.00

JNC Ltd.

Statement of financial position as at 31 March

2020

2019

$”M”

$”M”

ASSETS:

Non- current assets:

Property, plant and equipment

190

152.5

Intangible assets

125

100

Investments

12.5

Current assets:

Inventories

75

51

Receivables

195

157.5

Short-term investment

25

Cash in hand

1

0.5

Total assets

611

474

Equity and liabilities:

Equity:

Share capital

(10 million ordinary shares of $ 10 per value)

100

75

Share premium

80

75

Revolution reserve

50

45.5

Retained earnings

130

90

Non-current liabilities:

Loan

85

25…

Given the income statement below, Mega Trade Inc. wants to find the resulting net income for the year 2018 (in million). What is the right amount?

Income Statement ($ Million)

YEAR END

YEAR END

YEAR END

YEAR END

2015

2016

2017

2018

Sales

1,234.90

1,251.70

1,300.40

1,334.40

Cost Sales

-679.1

-659

-681.3

-667

Gross Operating Income

Selling & Administration

-339.7

-348.6

-351.2

-373.3

Depreciation

-47.5

-52

-55.9

-75.2

Other Income/Expenses

11.8

7.6

7

8.2

Earnings Before Interest and Taxes

Interest Income

1.3

1.4

1.7

2

Interest Expense

-16.2

-15.1

-20.5

-23.7

Pre Tax Income

Income Taxes

-56.8

-64.2

-67.5

-72.6

Net Income

Dividends

-38.3

-38.7

-39.8

-40.1

Addition to Retained Earnings

Chapter 12 Solutions

MyLab Accounting with Pearson eText -- Access Card -- for Financial Accounting

Ch. 12 - Prob. 1QCCh. 12 - Prob. 2QCCh. 12 - Prob. 3QCCh. 12 - Prob. 4QCCh. 12 - Expressing accounts receivable as a percentage of...Ch. 12 - Kincaid Company reported the following data (in...Ch. 12 - Prob. 7QCCh. 12 - Ratios that measure liquidity include all of the...Ch. 12 - Verba Corporation has an inventory turnover of 15...Ch. 12 - The measure of a companys ability to collect cash...

Ch. 12 - A ratio that measures a companys profitability is...Ch. 12 - Prob. 12QCCh. 12 - Prob. 13QCCh. 12 - Prob. 14QCCh. 12 - Prob. 12.1ECCh. 12 - Prob. 12.1SCh. 12 - Prob. 12.2SCh. 12 - Prob. 12.3SCh. 12 - Prob. 12.4SCh. 12 - Prob. 12.5SCh. 12 - (Learning Objective 4: Evaluate a companys quick...Ch. 12 - Prob. 12.7SCh. 12 - (Learning Objective 4: Measure ability to pay...Ch. 12 - (Learning Objective 4: Measure profitability using...Ch. 12 - Prob. 12.10SCh. 12 - (Learning Objective 4: Use ratio data to...Ch. 12 - Prob. 12.12SCh. 12 - (Learning Objective 4: Analyze a company based on...Ch. 12 - Prob. 12.14SCh. 12 - Prob. 12.15SCh. 12 - Prob. 12.16AECh. 12 - Prob. 12.17AECh. 12 - Prob. 12.18AECh. 12 - Prob. 12.19AECh. 12 - Prob. 12.20AECh. 12 - Prob. 12.21AECh. 12 - Prob. 12.22AECh. 12 - Prob. 12.23AECh. 12 - Prob. 12.24AECh. 12 - Prob. 12.25AECh. 12 - Prob. 12.26AECh. 12 - Prob. 12.27BECh. 12 - Prob. 12.28BECh. 12 - Prob. 12.29BECh. 12 - Prob. 12.30BECh. 12 - Prob. 12.31BECh. 12 - LO 4 (Learning Objective 4: Calculate ratios;...Ch. 12 - Prob. 12.33BECh. 12 - Prob. 12.34BECh. 12 - Prob. 12.35BECh. 12 - Prob. 12.36BECh. 12 - Prob. 12.37BECh. 12 - Prob. 12.38QCh. 12 - Prob. 12.39QCh. 12 - Prob. 12.40QCh. 12 - Prob. 12.41QCh. 12 - Prob. 12.42QCh. 12 - Prob. 12.43QCh. 12 - Prob. 12.44QCh. 12 - Use the Orlando Medical Corporation financial...Ch. 12 - Prob. 12.46QCh. 12 - Use the Orlando Medical Corporation financial...Ch. 12 - Prob. 12.48QCh. 12 - Prob. 12.49QCh. 12 - Prob. 12.50QCh. 12 - Prob. 12.51QCh. 12 - Prob. 12.52QCh. 12 - Prob. 12.53QCh. 12 - Prob. 12.54QCh. 12 - Prob. 12.55QCh. 12 - LO 1, 2, 4 (Learning Objectives 1, 2, 4: Calculate...Ch. 12 - Prob. 12.57APCh. 12 - Prob. 12.58APCh. 12 - LO 4 (Learning Objective 4: Use ratios to evaluate...Ch. 12 - Prob. 12.60APCh. 12 - LO 2, 4, 5 (Learning Objectives 2, 4, 5: Analyze...Ch. 12 - Group B LO 1, 2, 4 (Learning Objectives 1, 2, 4:...Ch. 12 - Prob. 12.63BPCh. 12 - Prob. 12.64BPCh. 12 - LO 4 (Learning Objective 4: Use ratios to evaluate...Ch. 12 - Prob. 12.66BPCh. 12 - LO 2, 4, 5 (Learning Objectives 2, 4, 5: Analyze...Ch. 12 - Prob. 12.68CEPCh. 12 - Prob. 12.69CEPCh. 12 - (Learning Objectives 2, 3.4: Use trend...Ch. 12 - (Learning Objectives 4, 5: Calculate and analyze...Ch. 12 - Prob. 12.72DCCh. 12 - Prob. 12.73DCCh. 12 - Prob. 12.74EICCh. 12 - Focus on Financials Apple Inc. LO 1, 2, 3, 4, 5...Ch. 12 - Comprehensive Financial Statement Analysis Project...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following information is available for Cooke Company for the current year: The gross margin is 40% of net sales. What is the cost of goods available for sale? a. 5840,000 b. 960,000 c. 1,200,000 d. 1,220,000arrow_forwardsalamagundi, inc. has the following income statement: For the year ended December 31, 2021 net sales: $160 Cost of goods sold: $100 gross profit: $60 Operating expenses: $40 Net income: $20 Using vertical analysis, what percentage is assigned to operating expenses? a. 25% b. 40% c. 66.7% d. 200%arrow_forwardOrlando Medical’s common-size income statement for 2018 would report cost ofgoods sold asa. 82.4%.b. $35,147 million.c. up by 20.1%.d. 137.9%.arrow_forward

- In the income statement below, ABC Trade Inc. wants to find the resulting net income for the year 2018 (in million). What is the right amount? Income Statement ($ Million) Year End 2015 2016 2017 2018 Sales 1,234.90 1,251.70 1,300.40 1,334.40 Cost of Sales (679.10) (659.00) (681.30) (667.00) Gross Operating Income Selling & Administration (339.70) (348.60) (351.20) (373.30) Depreciation (47.50) (52.00) (55.90) (75.20) Other Income/Expenses 11.80 7.60 7.00 8.20 Earnings Before Interest and Taxes Interest Income 1.30 1.40 1.70 2.00 Interest Expense (16.20) (15.10) (20.50) (23.70) Pre Tax Income Income Taxes (56.80) (64.20) (67.50) (72.60) Net Income Dividends (38.30) (38.70) (39.80) (40.10) Addition to Retained Earnings Group of answer choices 121.8 108.7 132.7 132.8 No choice givenarrow_forwardColeman, Inc. provides the following data from its Income Statement for 2018: Net Sales $ 560,000.00 Cost of Goods Sold $ (160,000.00) Gross Profit $ 400,000.00 Calculate the gross profit percentage. (round your answer to two decimal places) A 71.43% B 25.00% C 100.00% D 28.57%arrow_forwardYou are given the following extract of an income statement: Particulars 2018 (OMR) 2019(OMR) Net sales 120,000 180,000 Cost of goods sold 108,000 120,000 Gross profit 12,000 60,000 Administrative expenses 2,500 3,800 What is the percentage change in administrative expenses if a common size statement is preparedarrow_forward

- ASSESSMENT: Problem #1: On June 30, 2020, PSA Trading Co. has the following informatign: revenue from sales is Po8,760; sales return is P35,50o; cost of goods sold is P8.490: salaries cost P 14,600; rent is P8,090; light and water expenses are P7.550 and miscellaneous expenses are Po,520.Generate an income statement and find: a. Gross Profit b. Net Profit or Loss Problem #2: AMA 6operative store had the following activities for year ended 2021: gross sales amounting to Po4,653, the cost of goods sold was P48,923, the operating expensés were, P8,723.15, and refunds for defective goods amounted to P26,497.15. Generate an income slatemeni and find: a. Net Sales b. Gross Profit c. Net Profit Problem #3: AMA cooperative store had the following activities for year ended 2021: gross sales amounting to P94,653, the cost of goods sold was P48,923, the operating expenses were, P8,723.15, and refunds for defective goods amounted to P26,497.15. Generate an income statement and find: a. Net Sales…arrow_forwardGiven the income statement below, Mega Trade Inc. wants to find the resulting net income for the year 2018 (in million). What is the right amount? Income Statement ($ Million) Year End 2015 2016 2017 2018 Sales 1,234.90 1,251.70 1,300.40 1,334.40 Cost of Sales -679.1 -659 -681.3 -667 Selling & Administration -339.7 -348.6 -351.2 -373.3 Depreciation -47.5 -52 -55.9 -75.2 Other Income/Expenses 11.8 7.6 7 8.2 Interest Income 1.3 1.4 1.7 2 Interest Expense -16.2 -15.1 -20.5 -23.7 Income Taxes -56.8 -64.2 -67.5 -72.6 Dividends -38.3 -38.7 -39.8 -40.1 CHOICES: A. 108.7B. 132.7C. No choice givenD. 132.8E. 121.8arrow_forwardZebra Company reports the following figures for the years ending December 31, 2019 and 2018: 2019 2018 Net Sales $65,000 $40,000 Cost of Goods Sold 42,000 31,000 Gross Profit $23,000 $9,000 What are the percentage changes from 2018 to 2019 for Net Sales, Cost of Goods Sold and Gross Profit, respectively? (Round your final answers to one decimal place, X.X%) A. 100%, 155.6%, 35.5% B. 62.5%, 35.5%, 155.6% C. 100%, 0.7%, 0.4% D. 155.6%, 62.5%, 35.5%arrow_forward

- Shelcal, Inc. provides the following data for the year 2019: Net Sales Revenue, $437,690; Cost of Goods Sold, $255,000. O The gross profit as a percentage of net sales is (Round your answer to two decimal places.) OA) 37.96% OB) 39.80% OC) 60.20% OD) 40.8%arrow_forwardFill in thr blanks on the table below and show the formulas used for each value Dayton, Inc. Annual Income Statement (Values in Millions) Common Size 2019 2018 2019 2018 Sales $ 178,909 $ 187,510 100.0% 100.0% Cost of Sales 111,631 59.5% Gross Operating Profit $ 75,879 40.5% Selling, General & Admin. Expense 12,900 6.9% Other Expenses 33,377 17.8% EBITDA $ 29,602 15.8% Depreciation & Amortization 7,944 4.2% EBIT $ 21,658 11.6% Other Income, Net 3,323 1.8% Earnings Before Interest and Taxes $ 24,981 13.3% Interest Expense 293 0.2% Earnings Before Taxes $ 24,688 13.2% Income Taxes 5,184 0.21 tax rate Net Income Available to Common $ 19,504 10.4% Dividends per share $ 1.15 $ 0.91 EPS…arrow_forwardYou have the following information about Al- Farah Company: 2020: Net Sales 11,396.9, Gross profit 6,205.0 Selling expenses 3,920.8, Administrative expenses 69.2, interest expenses 136.0, income tax 727.6 2019: Net Sales 10,584.2, Cost of Goods Sold 4,747.2, Selling expenses? Administrative expenses 90.3, Income from operation 2122.1, interest expenses 119.7, and income tax 675.3 Required: prepare an income statement and conduct a horizontal analysis Sol: A worksheet for the compared income statement For the period ending 12/31/2020 2020 2019 Variances % Net Sales Cost of Goods Sold Gross profit Operating Expenses:- uan Selling expenses Administrative expenses Total Operating Expenses Income from operation Other expenses and losses:- Interest expenses Income before income tax Income tax Net incomearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License