Concept explainers

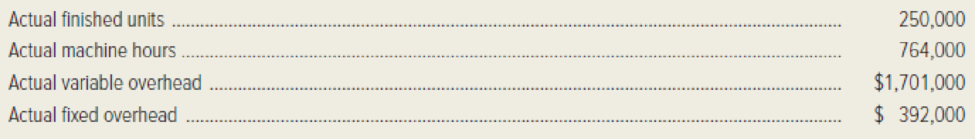

Montreal Scholastic Supply Company uses a standard-costing system. The firm estimates that it will operate its manufacturing facilities at 800,000 machine hours for the year. The estimate for total budgeted

Required:

- 1. Compute the following variances. Indicate whether each is favorable or unfavorable, where appropriate.

- a. Variable-overhead spending variance.

- b. Variable-overhead efficiency variance.

- c. Fixed-overhead

budget variance . - d. Fixed-overhead volume variance.

- 2. Prepare

journal entries to- Record the incurrence of actual variable overhead and actual fixed overhead.

- Add variable and fixed overhead to Work-in-Process Inventory.

- Close underapplied or overapplied overhead into Cost of Goods Sold.

1.

Calculate the given variances and indicate whether it is favorable or unfavorable of Company M.

Explanation of Solution

Flexible Budget: A flexible budget is a budget that is prepared for different levels of the output. In other words, it is a budget that adjusts according to the changes in the volume of the activity. The main purpose of preparing flexible budget is to determine the differences among standard and actual result.

Variance: Variance refers to the difference level in the actual cost incurred and standard cost. The total cost variance is subdivided into separate cost variances; this cost variance indicates that the amount of variance that is attributable to specific casual factors.

Calculate the given variances and indicate whether it is favorable or unfavorable of Company M as follows:

a. Variable overhead spending variance:

b. Variable overhead efficiency variance:

c. Fixed overhead budget variance:

d. Fixed overhead volume variance:

Working note (1):

Calculate the standard hour per unit.

Working note (2):

Calculate the standard hours for variable variance.

Working note (3):

Calculate the budgeted fixed overhead.

Working note (4):

Calculate the standard allowed hours.

2.

Prepare journal entries of company M for the given transaction.

Explanation of Solution

Prepare journal entry to record the actual variable and fixed overhead costs:

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| Production overhead (5) | 2,093,000 | ||

| Various Accounts | 2,093,000 | ||

| (To record the actual overhead costs) |

Table (1)

- Production overhead is an asset account and it increases the value of assets. Hence, debit the production overhead account with $2,093,000.

- A various account is an asset account, and it decreases the value of assets. Hence, credit the various account with $2,093,000.

Working note (5):

Calculate the production overheads.

Prepare journal entry to record the work-in-process inventory:

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| Work-in-Process Inventory (6) | 1,875,000 | ||

| Production overhead | 1,875,000 | ||

| (To record the applied production overhead) |

Table (2)

- Work-in-process inventory is an asset account, and it increases the value of asset. Hence, debit the work-in-process inventory account with $1,875,000.

- Production overhead is an assets account and it decreases the value of assets. Hence, credit the production overhead account with $1,875,000.

Working note (6):

Calculate the work-in process inventory.

Prepare journal entry to record the cost of goods sold:

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| Cost of goods sold (6) | 218,000 | ||

| Production Overhead | 218,000 | ||

| (To close the under-applied overhead cost into cost of goods sold) |

Table (3)

- Cost of goods sold is an expense account and it decreases the value of stockholder’s equity. Hence, debit the cost of goods sold account with $218,000.

- Production overhead is an assets account and it decreases the value of assets. Hence, credit the production overhead account with $218,000.

Working note (7):

Calculate the under applied overhead cost.

Want to see more full solutions like this?

Chapter 11 Solutions

Connect 1-Semester Access Card for Managerial Accounting: Creating Value in a Dynamic Business Environment (NEW!!)

- At the beginning of the year, Lopez Company had the following standard cost sheet for one of its chemical products: Lopez computes its overhead rates using practical volume, which is 80,000 units. The actual results for the year are as follows: (a) Units produced: 79,600; (b) Direct labor: 158,900 hours at 18.10; (c) FOH: 831,000; and (d) VOH: 112,400. Required: 1. Compute the variable overhead spending and efficiency variances. 2. Compute the fixed overhead spending and volume variances.arrow_forwardKavallia Company set a standard cost for one item at 328,000; allowable deviation is 14,500. Actual costs for the past six months are as follows: Required: 1. Calculate the variance from standard for each month. Which months should be investigated? 2. What if the company uses a two-part rule for investigating variances? The allowable deviation is the lesser of 4 percent of the standard amount or 14,500. Now which months should be investigated?arrow_forwardGeorgia Gasket Co. budgets 8,000 direct labor hours for the year. The total overhead budget is expected to amount to 20,000. The standard cost for a unit of the companys product estimates the variable overhead as follows: The actual data for the period follow: Using the four-variance method, calculate the overhead variances. (Hint: First compute the budgeted fixed overhead rate.)arrow_forward

- Fargo Co. manufactures products in batches of 100 units per batch. The company uses a standard cost system and prepares budgets that call for 500 of these batches per period. Budgeted fixed overhead is $60,000 per period. The standard costs per batch follow: During the period, 503 batches were manufactured, and the following costs were incurred: Required: Calculate the variances for materials, labor, and overhead. For overhead, use the two-variance method. (Hint: Please use the information given about the budgeted fixed overhead to compute the variable overhead rate.)arrow_forwardThe management of Golding Company has determined that the cost to investigate a variance produced by its standard cost system ranges from 2,000 to 3,000. If a problem is discovered, the average benefit from taking corrective action usually outweighs the cost of investigation. Past experience from the investigation of variances has revealed that corrective action is rarely needed for deviations within 8% of the standard cost. Golding produces a single product, which has the following standards for materials and labor: Actual production for the past 3 months follows, with the associated actual usage and costs for materials and labor. There were no beginning or ending raw materials inventories. Required: 1. What upper and lower control limits would you use for materials variances? For labor variances? 2. Compute the materials and labor variances for April, May, and June. Identify those that would require investigation by comparing each variance to the amount of the limit computed in Requirement 1. Compute the actual percentage deviation from standard. Round all unit costs to four decimal places. Round variances to the nearest dollar. Round variance rates to three decimal places so that percentages will show to one decimal place. 3. CONCEPTUAL CONNECTION Let the horizontal axis be time and the vertical axis be variances measured as a percentage deviation from standard. Draw horizontal lines that identify upper and lower control limits. Plot the labor and material variances for April, May, and June. Prepare a separate graph for each type of variance. Explain how you would use these graphs (called control charts) to assist your analysis of variances.arrow_forwardIn all of the exercises involving variances, use F and U to designate favorable and unfavorable variances, respectively. E8-1 through E8-5 use the following data: The standard operating capacity of Tecate Manufacturing Co. is 1,000 units. A detailed study of the manufacturing data relating to the standard production cost of one product revealed the following: 1. Two pounds of materials are needed to produce one unit. 2. Standard unit cost of materials is 8 per pound. 3. It takes one hour of labor to produce one unit. 4. Standard labor rate is 10 per hour. 5. Standard overhead (all variable) for this volume is 4,000. Each case in E8-1 through E8-5 requires the following: a. Set up a standard cost summary showing the standard unit cost. b. Analyze the variances for materials and labor. c. Make journal entries to record the transfer to Work in Process of: 1. Materials costs 2. Labor costs 3. Overhead costs (When making these entries, include the variances.) d. Prepare the journal entry to record the transfer of costs to the finished goods account. Standard unit cost; variance analysis; journal entries 1,000 units were started and finished. Case 1: All prices and quantities for the cost elements are standard, except for materials cost, which is 8.50 per pound. Case 2: All prices and quantities for the cost elements are standard, except that 1,900 lb of materials were used.arrow_forward

- Refer to Cornerstone Exercise 8.13. In March, Nashler Company produced 163,200 units and had the following actual costs: Required: 1. Prepare a performance report for Nashler Company comparing actual costs with the flexible budget for actual units produced. 2. What if Nashler Companys actual direct materials cost were 1,175,040? How would that affect the variance for direct materials? The total cost variance?arrow_forwardMarten Company has a cost-benefit policy to investigate any variance that is greater than 1,000 or 10% of budget, whichever is larger. Actual results for the previous month indicate the following: The company should investigate: a. neither the materials variance nor the labor variance. b. the materials variance only. c. the labor variance only. d. both the materials variance and the labor variance.arrow_forwardK Goldman, Inc. manufactures lead crystal glasses. The standard direct labor time is 0.2 hour per glass, at a cost of $13 per hour. The actual results for one month's production of 7,200 glasses were 0.4 hours per glass, at a cost of $14 per hour. Calculate the direct labor cost variance and the direct labor efficiency variance. Select the formula, then enter the amounts and compute the cost variance for direct labor and identify whether the variance is favorable (F) or unfavorable (U). × Direct Labor Cost Variance Select the formula, then enter the amounts and compute the efficiency variance for direct labor and identify whether the variance is favorable (F) or unfavorable (U). Direct Labor Efficiency × × = Variancearrow_forward

- Brookman, Inc. manufactures lead crystal glasses. The standard direct labor time is 0.5 hour per glass, at a cost of $11 per hour. The actual results for one month's production of 6,800 glasses were 0.4 hours per glass, at a cost of $10 per hour. Calculate the direct labor cost variance and the direct labor efficiency variance. Select the formula, then enter the amounts and compute the cost variance for direct labor and identify whether the variance is favorable (F) or unfavorable (U). ( Actual Cost - Standard Cost ) × Actual Quantity = Direct Labor Cost Variance ( $10 - $11 ) × 2,720 = $2,720 F Select the formula, then enter the amounts and compute the efficiency variance for direct labor and identify whether the variance is favorable (F) or unfavorable (U). ( Actual Quantity - Standard Quantity ) × Standard Cost = Direct Labor Efficiency Variance (…arrow_forwardKrueger Corporation in Washington, D.C., U.S., recently implemented a standard cost system. The company's cost accountant has gathered the following information needed to perform a variance analysis at the end of the month: Standard Cost Information+ Direct materials Quantity allowed per unit Direct labor rate.. Hours allowed per unit. Fixed overhead budgeted Normal level of production. Variable overhead application rate Fixed overhead application rate ($12,000 _ 1,200 units)... 10.00 per unit- Total overhead application rate. $5 per pound 100 pounds per unit $20.00 per hour ..2 hours per unit- $12,000 per month 1,200 units+ $2.00 per unit $12.00 per unit Actual Cost Information+ Cost of materials purchased and used. Pounds of materials purchased and used Cost of direct labor. Hours of direct labor Cost of variable overhead Cost of fixed overhead. Volume of production. $468,000- ..104,000 pounds- $46,480- ..2,240 hours- $2,352- $12,850- 1,000 units- Instructions Compute the direct…arrow_forwardKrueger Corporation in Washington, D.C., U.S., recently implemented a standard cost system. The company's cost accountant has gathered the following information needed to perform a variance analysis at the end of the month: Standard Cost Information Direct materials.... Quantity allowed per unit . Direct labor rate .... Hours allowed per unit.. Fixed overhead budgeted Normal level of production Variable overhead application rate Fixed overhead application rate ($12,000 _ 1,200 units) . .. 10.00 per unit Total overhead application rate.. $5 per pound .100 pounds per unit $20.00 per hour 2 hours per unit $12,000 per month . 1,200 units $ 2.00 per unit $12.00 per unit Actual Cost Information Cost of materials purchased and used .... Pounds of materials purchased and used. Cost of direct labor.... $468,000 .104,000 pounds $46,480 2,240 hours Hours of direct labor . anr$2,352 .$12,850 .1,000 units Cost of variable overhead . Cost of fixed overhead . Volume of production . Instructions 1.…arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,