Concept explainers

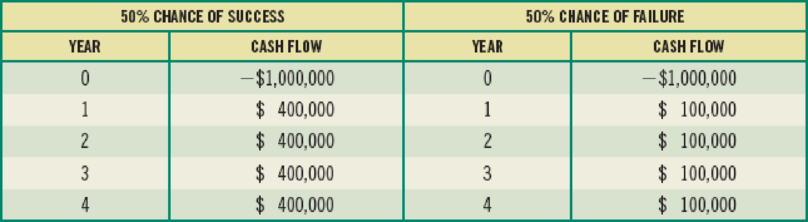

(Real options and capital budgeting) McDoogals Restaurants has come up with a new fast-food, casual restaurant combining some of the features of Chipotle, Panera, and Shake Shack, but it is not quite sure how the public will react to it. McDoogals feels that there is a 50–50 chance that consumers will like it and a 50–50 chance that they won’t. McDoogals is considering building one of these new restaurants; the cash flows if it succeeds and if it fails are given below.

The required

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

Foundations of Finance (9th Edition) (Pearson Series in Finance)

- A company is going to start a pop-up venture. The goal is to break-even and use the experience to learn about how consumers react to types of green products. The project will cost $2,000 to implement and will have after-tax cash flows of $200 at the end of Year 1 and $2,200 after Year 2. At that time the project will end. The $2,000 investment will be financed 50% debt and 50% equity. The before-tax cost of debt is 8%. The tax rate is 20%. The beta for the project is 1.2. The risk-free rate for computing the cost of equity is 5.2% and the market risk premium is 7%. Use this information to: Find the WACC for the project. Show that this is a zero NPV project. Show that debtholders and shareholders both earn their minimum required rates of return. Year Cash flow Present Value to Debt to Equity 0 -2000 1 200 2 2200arrow_forwardThe managers of Soup Inc. consider the opportunity to open a new soup restaurant in a small college town. As of today, the best estimate of the value of the future cash flows (in present value terms) generated by the soup store is $12,000. Moreover, to make the store fully operational and actually start selling soup, the firm needs to invest $15,000. Thus, it appears that the restaurant is a negative NPV project. However, the managers of Soup Inc. believe that the potential of the restaurant is uncertain and the current estimate of the value of its cash flows of $12,000 might be quite wrong. Therefore, they decide to invest in market research. They will study the market for 2 years and then decide whether to open the restaurant or not (at the end of year 2). Your task is to help the managers of Soup Inc. by providing answers to the following questions: (Part 1) Investing in market research creates an option. Briefly describe the underlying for the option and the key source of…arrow_forwardWhen McDonalds consider the new store, the management know that KFC might also considering opening a new store at the same place. McDonalds predicts that the future cash flow will be 630,000 with probability 50% if KFC does not open a new store, and 210,000 with probability 50% if KFC does. Should McDonalds undertakes the project?arrow_forward

- Bolton Fireworks, Inc. is considering researching and developing a new high-tech fireworks launcher to sell along side its collection of professional fireworks. If they go forward, a marketing analysis will be implemented immediately at a cost of $50,000 and take a year to complete. If its results are positive (80% probability) then Bolton will spend $100,000 to build a prototype launcher. If the marketing results are poor (20% probability), then it will abandon the project. It will take a year to build and evaluate the prototype launcher. If the prototype works as hoped (75% probability) then they will spend $500,000 on purchasing and installing manufacturing equipment. If the prototype doesn't work well (25% probability) then, of course, the prototype is trash and they will discard it and abandon the project. Once the manufacturing equipment is installed (it will take a year), then cash flows will either be $300,000 per year for 5 years (60% probability) or $50,000 per year for 5…arrow_forwardSuppose you are a panelist, and you must evaluate if the design is feasible or not. You look at the breakdown of expenses, possible revenues, etc. Here are some important chapters and discussions taken from a certain plant design. Chapter 3: Market Study This plant design, entitled “IIVSDROP: The First Ear Dropper Solution Manufacturing Plant in the Philippines” considers a 30-year period of study, starting 2021, after finishing its construction by 2020. All projections, and interest rates set by the company shall be evaluated within this 30-year period. The inflation rate shall not be included in the computation and a minimum attractive rate of return is set at 20%. Chapter 4: Products Our company produces ear dropper solution which can be sold for PHP. 125.00 per bottle. Annually, the company can produce 1000 pallets of the product. Each pallet is stacked with 14 layers and each layer consists of 8 boxes. A box contains 12 bottles of ear dropper for wholesale…arrow_forwardA franchise restaurant chain is considering a new store in an unserved part of town. Its finance group estimates an NPV of $10 million if the population growth is 10% (40% probability), and NPV of $4 million of the population does not grow (30% probability), and an NPV of -$4 million if the population shrinks 5% (30% probability). What is the expected value of NPV (to the nearest dollar) for the following situation? Group of answer choices $3.4 million. $4.0 million. $4.6 million. $5.2 million. None of the above.arrow_forward

- Frozen Pizza Co. is considering whether it should allocate funds for research on an instant freeze-dry process for home use. If the research is successful (and the R&D manager feels there is a 75% chance it will be), the firm could market the product at a PhP 4 million profit. However, if the research is unsuccessful, the, firm will incur a PhP 6 million loss. What is the expected monetary value (EMV)of proceeding with the research? *arrow_forwardLarry's Shop has asked you to make a recommendation for an investment proposal they have been looking at and trying to decide on. The investment is for new equipment with a total cost of $6,400,000 including $15,000 shipping costs and $35,000 testing. Larry is also planning to throw a big celebration if the investment is successful for $20,000. This new equipment will require an increase in inventory of $75,000 from day one of the proposal. All other assets are remaining the same. Sales will increase by $9,000,000 for each of the four years of the planning horizon, with COGS staying at 75% of sales. All other expenses are staying the same as before. Larry's Shop WACC is 13% and their marginal tax rate is 32%. The newequipment will have a CCA rate of 22% and there will be other assets in this class when the project ends in four years. The salvage value of the equipment will be $300,000 in four years. Assume the risk profile of the proposal is the same risk profile of Larry's Shop.…arrow_forwardHaving assessed the changing dietary needs of your town, you are considering investing in a new Italian restaurant which you plan to name Italian Valley Incorporated. The restaurant will feature live musicians, appetizers, and a stocked bar. You are trying to assess the likely profitability of this business venture. Your first step is to prepare a complete capital budgeting analysis for the 5 years you plan to operate the restaurant before you sell it. Having spoken with local vendors, other restaurant owners, bankers, and builders you collected the following data and information about the proposal. You plan to use a building currently owned by your family, however there will be need for some renovation and improvements to the property. Your parents have said that you can use the retail space in any way you wish for free. After checking on local lease rates you determine this space would lease for $75,500 per year. Your family also owns another restaurant downtown. You predict that…arrow_forward

- Tutor.com is considering a plan to develop an online finance tutoring package that has the cost and revenue projections shown below. One of Tutor's larger competitors, Online Professor (OP), is expected to do one of two things in Year 5: (1) develop its own competing program, which will put Tutor's program out of business, or (2) offer to buy Tutor's program if it decides that this would be less expensive than developing its own program. Tutor thinks there is a 35% probability that its program will be purchased for $5.6 million and a 65% probability that it won't be bought, and thus the program will simply be closed down with no salvage value. What is the estimated net present value of the project (in thousands) at a WACC = 9.5%, giving consideration to the potential future purchase? WACC = 9.5% 0 1 2 3 4 5 Original project: -$2,800 $550 $550 $550 $550 $550 Future Prob. Buys 35% $5,600,00 Doesn't buy 65% $0arrow_forwardou are considering setting up a firm to produce widgets. The cost of the project is $30 today. The demand for widgets is uncertain. It can be either high or low with equal probability. When the demand is high, cash flows in t = 1 are $66 and when the demand is low, cash flows in t = 1 are $34. The discount rate is 10%. What is the NPV of the project? Suppose you can commission a study that tells you whether the demand for widgets will be high or low. The study takes one year to complete. That is, if you commission the study you must decide in t = 1 whether to invest. If you invest the cash flows will arrive in t = 2. What is the maximum amount you are willing to pay for the study today?arrow_forwardParasite Engineering is developing a new product for the parasitic market that services parasites. The opportunity is estimated to be worth $1.0B measured in today’s dollars. The company will need to spend $500M today to begin the research. In five years, the company will have to make a decision as to whether to go into full scale production and begin selling the drug. At that time, the company estimates it will cost $1.5B to move forward. If the appropriate risk-free rate is 2.5%, how high must the annual volatility be to make the project worth beginning?arrow_forward

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College