MANAGERIAL ACCOUNTING FOR MANGER CONNEC

6th Edition

ISBN: 9781266809132

Author: Noreen

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 11, Problem 11.25P

Basic Transfer Pricing LO 11–3

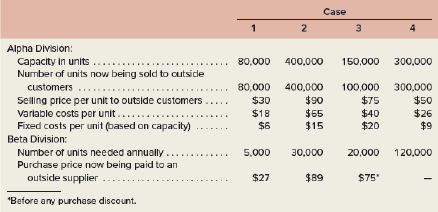

Alpha and Beta are divisions within the same company. The managers of both divisions are evaluated based on their own division’sreturn on investment (

Required:

- Refer to case 1 shown above. Alpha Division can avoid $2 per unit in commissions on any sales to Beta Division.

- What is Alpha Divisions’s lowest acceptable transfer price?

- What is Beta Division’s highest acceptable transfer price?

- What is the range of acceptable transfer prices (if any) between the two divisions? Will the managers probably agree to a transfer? Explain.

- Refer to case 2 shown above. A study indicates Alpha Division can avoid $5 per unit in shipping costs on any sales to Beta Division.

- What is Alpha Divisions’s lowest acceptable transfer price?

- What is Beta Division’s highest acceptable transfer price?

- What is the range of acceptable transfer prices (if any) between the two divisions? Would you expect any disagreement between the two divisional managers over what the exact transfer price should be? Explain.

- Assume Alpha Division offers to sell 30,000 units to Beta Division for $88 per unit and that Beta Division refuses this price. What will be the loss in potential profits for the company as a whole?

- Refer to case 3 shown above. Assume Beta Division is now receiving an 8% price discount from the outside supplier.

- What is Alpha Divisions’s lowest acceptable transfer price?

- What is Beta Division’s highest acceptable transfer price?

- What is the range of acceptable transfer prices (if any) between the two divisions? Will the managers probably agree to a transfer? Explain.

- Assume Beta Division offers to purchase 20,000 units from Alpha Division at $60 per unit. If Alpha Division accepts this price, would you expect its ROI to increase, decrease, or remain unchanged? Why?

- Refer to case 4 shown above. Assume Beta Division wants Alpha Division to provide it with 120,000 units of a different product from the one Alpha Division is producing now. The new product would require $21 per unit in variable costs and would require that Alpha Division cut back production of its present product by 45,000 units annually. What is Alpha Division’s lowest acceptable transfer price?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

MANAGERIAL ACCOUNTING FOR MANGER CONNEC

Ch. 11 - Prob. 11.1QCh. 11 - Prob. 11.2QCh. 11 - Prob. 11.3QCh. 11 - Prob. 11.4QCh. 11 - Prob. 11.5QCh. 11 - Prob. 11.6QCh. 11 - Prob. 11.7QCh. 11 - Prob. 11.8QCh. 11 - Prob. 11.9QCh. 11 - Why is using sales dollars as an allocation base...

Ch. 11 - Prob. 1AECh. 11 - Prob. 1TF15Ch. 11 - Prob. 11.1ECh. 11 - Prob. 11.2ECh. 11 - Prob. 11.3ECh. 11 - Prob. 11.4ECh. 11 - Prob. 11.5ECh. 11 - Prob. 11.6ECh. 11 - Prob. 11.7ECh. 11 - Prob. 11.8ECh. 11 - Prob. 11.9ECh. 11 - Prob. 11.10ECh. 11 - Prob. 11.11ECh. 11 - Prob. 11.12ECh. 11 - Prob. 11.13ECh. 11 - Prob. 11.14ECh. 11 - Prob. 11.15ECh. 11 - Prob. 11.16ECh. 11 - Prob. 11.17PCh. 11 - Prob. 11.18PCh. 11 - Prob. 11.19PCh. 11 - Prob. 11.20PCh. 11 - Prob. 11.21PCh. 11 - Service Department Charges LO 11–4 Sharp Motor...Ch. 11 - Prob. 11.23PCh. 11 - Prob. 11.24PCh. 11 - Basic Transfer Pricing LO 11–3 Alpha and Beta...Ch. 11 - Prob. 11.26C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

What is Transfer Pricing for Small Businesses?; Author: Nomad Capitalist;https://www.youtube.com/watch?v=_Q6nN3s1Xjs;License: Standard Youtube License