Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

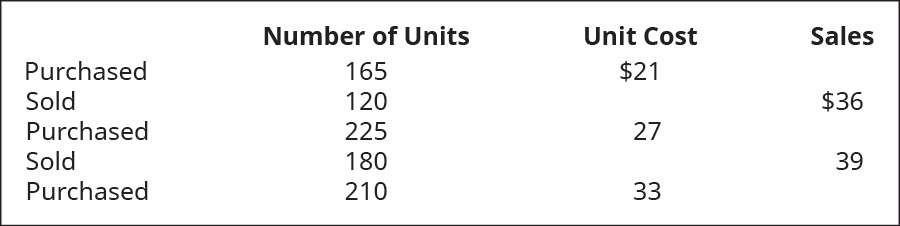

Chapter 10, Problem 8PA

Prepare

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

On May 1, Dark Horizons Inc. had a beginning cash balance of $200. April sales were $500, and May sales were $600. During May, the firm had cash expenses of $150 and payments on accounts payable of $300. The firm's accounts receivable period is 30 days. What is Dark Horizons Inc.'s beginning cash balance on June 1?

What is correct answer?

Sales reported on the income statement were $310,500. The accounts receivable balance declined by $18,700 over the year. Determine the amount of cash received from customers. Right answer

Chapter 10 Solutions

Principles of Accounting Volume 1

Ch. 10 - If a company has four lots of products for sale,...Ch. 10 - If a company has three lots of products for sale,...Ch. 10 - When inventory items are highly specialized, the...Ch. 10 - If goods are shipped FOB destination, which of the...Ch. 10 - On which financial statement would the merchandise...Ch. 10 - When would using the FIFO inventory costing method...Ch. 10 - Which accounting rule serves as the primary basis...Ch. 10 - Which type or types of inventory timing system...Ch. 10 - Which of these statements is false? A. If cost of...Ch. 10 - Which inventory costing method is almost always...

Ch. 10 - Which of the following describes features of a...Ch. 10 - Which of the following financial statements would...Ch. 10 - Which of the following would cause periodic ending...Ch. 10 - Which of the following indicates a positive trend...Ch. 10 - What is meant by the term gross margin?Ch. 10 - Can a business change from one inventory costing...Ch. 10 - Why do consignment arrangements present a...Ch. 10 - Explain the difference between the terms FOB...Ch. 10 - When would a company use the specific...Ch. 10 - Explain why a company might want to utilize the...Ch. 10 - Describe the goal of the lower-of-cost-or-market...Ch. 10 - Describe two separate and distinct ways to...Ch. 10 - Describe costing inventory using first-in,...Ch. 10 - Describe costing inventory using last-in,...Ch. 10 - Describe costing inventory using weighted average....Ch. 10 - How long does it take an inventory error affecting...Ch. 10 - What type of issues would arise that might cause...Ch. 10 - Explain the difference between the flow of cost...Ch. 10 - What insights can be gained from inventory ratio...Ch. 10 - Calculate the goods available for sale for...Ch. 10 - Company accepts goods on consignment from R...Ch. 10 - The following information is taken from a companys...Ch. 10 - Complete the missing piece of information...Ch. 10 - Akira Company had the following transactions for...Ch. 10 - Akira Company had the following transactions for...Ch. 10 - Prepare journal entries to record the following...Ch. 10 - Calculate the cost of goods sold dollar value for...Ch. 10 - Calculate the cost of goods sold dollar value for...Ch. 10 - Calculate the cost of goods sold dollar value for...Ch. 10 - Prepare journal entries to record the following...Ch. 10 - Prepare Journal entries to record the following...Ch. 10 - If a group of inventory items costing $15,000 had...Ch. 10 - If Wakowski Companys ending inventory was actually...Ch. 10 - Shetland Company reported net income on the...Ch. 10 - Compute Altoona Companys (a) inventory turnover...Ch. 10 - Complete the missing pieces of McCarthy Companys...Ch. 10 - Calculate the goods available for sale for Soros...Ch. 10 - X Company accepts goods on consignment from C...Ch. 10 - Considering the following information, and...Ch. 10 - Complete the missing piece of information...Ch. 10 - Bleistine Company had the following transactions...Ch. 10 - Bleistine Company had the following transactions...Ch. 10 - Prepare journal entries to record the following...Ch. 10 - Calculate the cost of goods sold dollar value for...Ch. 10 - Calculate the cost of goods sold dollar value for...Ch. 10 - Calculate the cost of goods sold dollar value for...Ch. 10 - Prepare journal entries to record the following...Ch. 10 - Prepare journal entries to record the following...Ch. 10 - If a group of inventory items costing $3,200 had...Ch. 10 - If Barcelona Companys ending inventory was...Ch. 10 - Tanke Company reported net income on the year-end...Ch. 10 - Compute Westtown Companys (A) inventory turnover...Ch. 10 - Complete the missing pieces of Delgado Companys...Ch. 10 - When prices are rising (inflation), which costing...Ch. 10 - Trini Company had the following transactions for...Ch. 10 - Trini Company had the following transactions for...Ch. 10 - Calculate the cost of goods sold dollar value for...Ch. 10 - Use the first-in, first-out (FIFO) cost allocation...Ch. 10 - Use the last-in, first-out (LIFO) cost allocation...Ch. 10 - Use the weighted-average (AVG) cost allocation...Ch. 10 - Prepare journal entries to record the following...Ch. 10 - Calculate a) cost of goods sold, b) ending...Ch. 10 - Calculate a) cost of goods sold, b) ending...Ch. 10 - Calculate a) cost of goods sold, b) ending...Ch. 10 - Compare the calculations for gross margin for A76...Ch. 10 - Company Elmira reported the following cost of...Ch. 10 - Assuming a companys year-end inventory were...Ch. 10 - Use the following information relating to Shana...Ch. 10 - Use the following information relating to Clover...Ch. 10 - When prices are falling (deflation), which costing...Ch. 10 - DeForest Company had the following transactions...Ch. 10 - DeForest Company had the following transactions...Ch. 10 - Calculate the cost of goods sold dollar value for...Ch. 10 - Use the first-in, first-out method (FIFO) cost...Ch. 10 - Use the last-in, first-out method (LIFO) cost...Ch. 10 - Use the weighted-average (AVG) cost allocation...Ch. 10 - Prepare journal entries to record the following...Ch. 10 - Calculate a) cost of goods sold, b) ending...Ch. 10 - Calculate a) cost of goods sold, b) ending...Ch. 10 - Calculate a) cost of goods sold, b) ending...Ch. 10 - Compare the calculations for gross margin for B76...Ch. 10 - Company Edgar reported the following cost of goods...Ch. 10 - Assuming a companys year-end inventory were...Ch. 10 - Use the following information relating to Singh...Ch. 10 - Use the following information relating to Medinas...Ch. 10 - Assume your company uses the periodic inventory...Ch. 10 - Consider the dilemma you might someday face if you...Ch. 10 - Use a spreadsheet and the following excerpts from...

Additional Business Textbook Solutions

Find more solutions based on key concepts

(Future and present value using a calculator) In 2016 Bill Gates was worth about $82 billion. Let’s see what Bi...

Foundations Of Finance

5. Which inventory costing method results in the lowest net income during a period of rising inventory costs?

W...

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

Ratio that measures a firm’s degree of indebtedness and ratio that assesses a firm’s ability to service debts. ...

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Depreciation Methods, Disposal. Kurtis Koal Company, Inc. purchased a new mining machine at a total cost of 900...

Intermediate Accounting (2nd Edition)

Tennessee Tool Works (TTW) is considering investment in five independent projects, Any profitable combination o...

Engineering Economy (17th Edition)

1-13. Identify a product, either a good or a service, that will take advantage of this opportunity. Although yo...

Business Essentials (12th Edition) (What's New in Intro to Business)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I want answer with all working formatarrow_forwardThe total manufacturing cost for Octoberarrow_forwardDuring April, the production department of a process operations system completed and transferred to finished goods a total of 65,000 units of product. At the end of March, 15,000 additional units were in process in the production department and were 80% complete with respect to materials. The beginning inventory included a materials cost of $57,500 and the production department incurred a direct materials cost of $183,000 during April. Compute the direct materials cost per equivalent unit for the department using the weighted-average method. Questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub  Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Chapter 6 Merchandise Inventory; Author: Vicki Stewart;https://www.youtube.com/watch?v=DnrcQLD2yKU;License: Standard YouTube License, CC-BY

Accounting for Merchandising Operations Recording Purchases of Merchandise; Author: Socrat Ghadban;https://www.youtube.com/watch?v=iQp5UoYpG20;License: Standard Youtube License