Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

4th Edition

ISBN: 9780134083278

Author: Jonathan Berk, Peter DeMarzo

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 7P

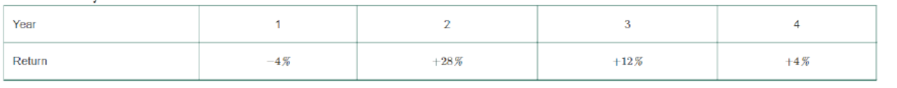

The last four years of returns for a stock are as follows:

- a. What is the average annual return?

- b. What is the variance of the stock’s returns?

- c. What is the standard deviation of the stock’s returns?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The last four years of returns for a stock are as shown here:

a. What is the average annual return?

b. What is the variance of the stock's returns?

c. What is the standard deviation of the stock's returns?

Note: Notice that the average return and standard deviation must be entered in percentage format. The variance must be entered in decimal

format.

The last four years of returns for a stock are as shown here: E

a. What is the average annual return?

b. What is the variance of the stock's returns?

c. What is the standard deviation of the stock's returns?

Note: Notice that the average return and standard deviation must be entered in percentage format. The variance must be entered in decimal format.

.....

Data table

(Click on the icon located on the top-right corner of the data table below in order to

copy its contents into a spreadsheet.)

Year

1

2

3

4

Return

- 4.3%

+ 27.9%

+ 12.3%

+ 3.6%

The last four years of returns for a stock are as shown here:

LOADING...

.

a. What is the average annual return?

b. What is the variance of the stock's returns?

c. What is the standard deviation of the stock's returns?

Note:

Notice that the average return and standard deviation must be entered in percentage format. The variance must be entered in decimal format.

Question content area bottom

Part 1

a. What is the average annual return?

The average return is

enter your response here%.

(Round to two decimal places.)

Part 2

b. What is the variance of the stock's returns?

The variance of the returns is

enter your response here.

(Round to five decimal places.)

Part 3

c. What is the standard deviation of the stock's returns?

The standard deviation is

enter your response here%.

(Round to two decimal places.)

figure

Year: 1, 2, 3, 4

Return: -4.2%, +27.9%, +11.8%, +3.8%

Chapter 10 Solutions

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Ch. 10.1 - For an investment horizon from 1926 to 2012, which...Ch. 10.1 - For an investment horizon of just one year, which...Ch. 10.2 - Prob. 1CCCh. 10.2 - Prob. 2CCCh. 10.3 - How do we estimate the average annual return of an...Ch. 10.3 - Prob. 2CCCh. 10.4 - Prob. 1CCCh. 10.4 - Do expected returns of well-diversified large...Ch. 10.4 - Do expected returns for Individual stocks appear...Ch. 10.5 - What is the difference between common risk and...

Ch. 10.5 - Prob. 2CCCh. 10.6 - Explain why the risk premium of diversifiable risk...Ch. 10.6 - Why is the risk premium of a security determined...Ch. 10.7 - What is the market portfolio?Ch. 10.7 - Define the beta of a security.Ch. 10.8 - Prob. 1CCCh. 10.8 - Prob. 2CCCh. 10 - The figure on page informalfigure shows the...Ch. 10 - Prob. 2PCh. 10 - Prob. 3PCh. 10 - Prob. 4PCh. 10 - Prob. 5PCh. 10 - Prob. 6PCh. 10 - The last four years of returns for a stock are as...Ch. 10 - Prob. 9PCh. 10 - Prob. 10PCh. 10 - Prob. 11PCh. 10 - How does the relationship between the average...Ch. 10 - Consider two local banks. Bank A has 100 loans...Ch. 10 - Prob. 21PCh. 10 - Prob. 22PCh. 10 - Consider an economy with two types of firms, S and...Ch. 10 - Prob. 24PCh. 10 - Explain why the risk premium of a stock does not...Ch. 10 - Prob. 26PCh. 10 - Prob. 27PCh. 10 - What is an efficient portfolio?Ch. 10 - What does the beta of a stock measure?Ch. 10 - Prob. 31PCh. 10 - Prob. 32PCh. 10 - Prob. 33PCh. 10 - Suppose the risk-free interest rate is 4%. a. i....Ch. 10 - Prob. 35PCh. 10 - Prob. 36PCh. 10 - Suppose the market risk premium is 6.5% and the...Ch. 10 - Prob. 38P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The last four years of returns for a stock are as shown here: a. What is the average annual return? b. What is the variance of the stock's returns? c. What is the standard deviation of the stock's returns? Note: Notice that the average return and standard deviation must be entered in percentage format. The variance must be entered in decimal format. Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Year 4 Return +3.51% 1 - 4.17% 2 +27.82% 3 + 11.88% Xarrow_forwardhe last four years of returns for a stock are as shown here: LOADING... . a. What is the average annual return? b. What is the variance of the stock's returns? c. What is the standard deviation of the stock's returns? Note: Notice that the average return and standard deviation must be entered in percentage format. The variance must be entered in decimal format. Question content area bottom Part 1 a. What is the average annual return? The average return is enter your response here%. (Round to two decimal places.) Part 2 b. What is the variance of the stock's returns? The variance of the returns is enter your response here. (Round to five decimal places.) Part 3 c. What is the standard deviation of the stock's returns? The standard deviation is enter your response here%. (Round to two decimal places.) Time Remaining: 00:26:16 pop-up content starts Data table (Click on the following icon in order…arrow_forwardThe last four years of returns for a stock are as follows: Year 1 2 3 4 Return 4.3% 28.1% 12.3% 3.9% a. What is the average annual return? b. What is the variance of the stock's returns? c. What is the standard deviation of the stock's returns?arrow_forward

- What is the average annual return? b. What is the variance of the stock's returns? c. What is the standard deviation of the stock's returns? Note: Notice that the average return and standard deviation must be entered in percentage format. The variance must be entered in decimal format. Year 1 2 3 4 Return (%) Year1: -4.1% Year2: 27.6% Year 3: 12.3% Year 4: 3.6%arrow_forwardThe last four years of returns for a stock are as follows: Year Return 1 - 4.3% 2 28.1% 3 11.6% a. What is the average annual return? b. What is the variance of the stock's returns? c. What is the standard deviation of the stock's returns? a. What is the average annual return? The average return is%. (Round to two decimal places.) 4 3.7%arrow_forwardHere are the returns on two stocks. A. Calculate the variance and standard deviation of each stock. Which stock is riskier if held on its own? B. Now calculate the returns in each month of a portfolio that invests an equal amount each month in the two stocks C. Is the variance more or less than halfway between the variance of the two Individual stocks?arrow_forward

- 6. The last four years of returns for a stock are as follows: Year Return 2 28.5% 1 - 4.2% a. What is the average annual return? b. What is the variance of the stock's returns? c. What is the standard deviation of the stock's returns? a. What is the average annual return? The average return is b. What is the variance of the stock's returns? The variance of the returns is 3 12.3% The standard deviation is %. (Round to two decimal places.) 3.6% c. What is the standard deviation of the stock's returns? (Round to five decimal places.) %. (Round to two decimal places.)arrow_forwardAssume these are the stock market and Treasury bill returns for a 5-year period: Required: a. What was the risk premium on common stock in each year? b. What was the average risk premium? c. What was the standard deviation of the risk premium? (Ignore that the estimation is from a sample of data.)arrow_forwardFrom the information attached below, calculate: a. the average stock return from 20x1- 20x3. b. The standard deviation over the same period.arrow_forward

- Two stock prices for six days are given below. Price A Price B 25 55 27 59 30 64 28 62 26 58 32 61 1. Calculate the Standard Deviation of Stock A? 2. Calculate the Mean Return of Stock A? 3. Calculate the Coefficient of Variation (CV) of Stock A?arrow_forwardThe last four years of returns for a stock are as follows: 2 28.5% Year Return 1 -3.7% a. What is the average annual return? b. What is the variance of the stock's returns? c. What is the standard deviation of the stock's returns? a. What is the average annual return? The average return is %. (Round to two decimal places.) CONS W P SOSIAN 3 11.7% P 20 4 4.3% ...arrow_forwardhow do you calculate a stocks average monthly return,its return variance ,standard deviation and beta? what is the formulaarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Chapter 8 Risk and Return; Author: Michael Nugent;https://www.youtube.com/watch?v=7n0ciQ54VAI;License: Standard Youtube License