Concept explainers

(a)

Calculate the forward rate of zero-coupon bond with 11% yield to maturity and 2 years maturity.

Answer to Problem 40PS

The forward rates obtained for 2nd year is 12.01% and for 3rd year is 14.035, the yield to maturity for 3rd year is 13.02% and the expected return for three year bond is 10%.

Explanation of Solution

Given Information:

| Maturity(years) | Y TM |

| 1 | 10% |

| 2 | 11% |

| 3 | 12% |

Implied forward rates refer to the expected future movement of the interest rates by the market.

the

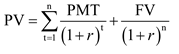

Yield to maturity of the bond can be calculated using the following formula:

The following information goes with all the parts of this question:

Table showing the current yield curve for zero-coupon bond:

| Maturity(years) | Y TM |

| 1 | 10% |

| 2 | 11% |

| 3 | 12% |

Calculate the forward rate of zero-coupon bond with 12% yield to maturity and 3 years maturity

Thus, the forward rates obtained for 2nd year is 12.01% and for 3rd year is 14.035

(b)

Calculate the YTM of the zero coupon bond 2nd years.

Answer to Problem 40PS

Theyield to maturity for 3rd year is 13.02%

Explanation of Solution

m:math>

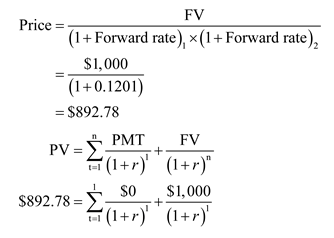

Using RATE function in excel, Calculate the effective yield to maturity.

Enter the corresponding value in the field as below:

Calculate the YTM of the zero coupon bond 3rd years.

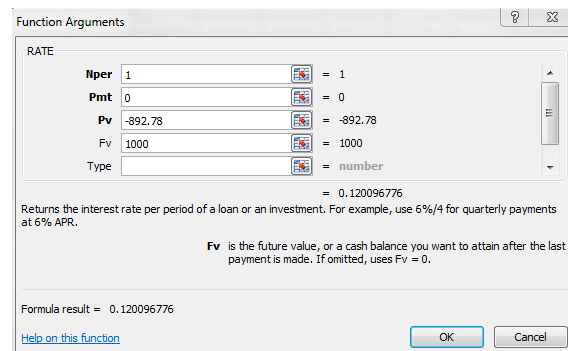

Using RATE function in excel, Calculate the effective yield to maturity.

Enter the corresponding value in the field as below:

Hence, the yield to maturity for 3rd year is 13.02%.

Thus, from the calculate it can be seen that the yieldcurve is increasing and upward sloping, and it implies that according to hypothesis expectationthere is a shift upward in the curve of the next year.

(c)

Calculate the price of the bond with 10% yield to maturity.

Answer to Problem 40PS

The expected return for three year bond is 10%.

Explanation of Solution

Calculate the price of the bond with 12% yield to maturity.

Calculate the price of the bond with 13% yield to maturity.

Calculate the total expected rate of return.

In the next year, the two year zero bond will be the one year zero bond, and thus it will sell for

In a similar manner the three year zero bond will become a two year bond and thus it will sell for $782.93 as calculate in part (b).

Expected return for two year bond is as below:

Thus, expected return for two year bond is 10%

Expected return for three year bond is as below:

Thus, expected return for three year bond is 10%.

Want to see more full solutions like this?

Chapter 10 Solutions

ESSEN.OF.INVESTMENTS+CONNECT

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education