(a)

To calculate:

The implied one-year forward rates when yield to maturity for

Introduction:

The implied forward rate is the rate which helps in determining the movements of the interest rate.

The yield to maturity is the rate which provides the amount of expected return on a bond held till its maturity.

Answer to Problem 40PS

The implied one-year forward rate for

Given:

The yield to maturity for

Explanation:

The formula for computing forward rate as follows:

For computing forward rate of zero-coupon bond with

For computing forward rate of zero-coupon bond with

Thus, the implied one-year forward rate for

Explanation of Solution

Given:

The yield to maturity for

The formula for computing forward rate as follows:

For computing forward rate of zero-coupon bond with

For computing forward rate of zero-coupon bond with

Thus, the implied one-year forward rate for

(b)

To calculate:

The yield to maturity of a zero-coupon bond having maturity of one year for the next year i.e.

Introduction:

The implied forward rate is the rate which helps in determining the movements of the interest rate.

The yield to maturity is the rate which provides the amount of expected return on a bond held till its maturity.

Answer to Problem 40PS

The yield to maturity of zero-coupon bond for

Explanation:

The formula for computing yield to maturity as follows:

Here,

PV is Current price of the bond

FV is Face value of the bond

For computing Price of the bond

For computing yield to maturity:

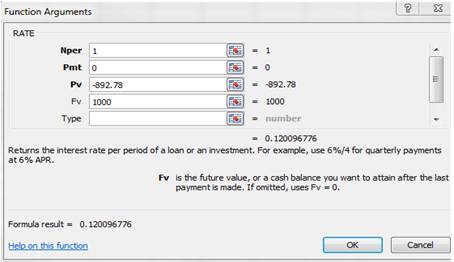

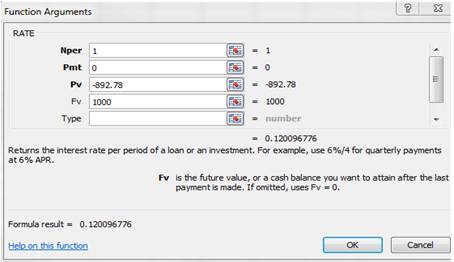

Using function in excel, effective yield is calculated.

Enter the data as shown below:

Thus, the yield to maturity of zero-coupon bond for

Explanation of Solution

The formula for computing yield to maturity as follows:

Here,

PV is Current price of the bond

FV is Face value of the bond

For computing Price of the bond

For computing yield to maturity:

Using function in excel, effective yield is calculated.

Enter the data as shown below:

Thus, the yield to maturity of zero-coupon bond for

(c)

To calculate:

The yield to maturity of a zero-coupon bond having maturity of two year for the next year i.e.

Introduction:

The implied forward rate is the rate which helps in determining the movements of the interest rate.

The yield to maturity is the rate which provides the amount of expected return on a bond held till its maturity.

Answer to Problem 40PS

The yield to maturity of zero-coupon bond for

Explanation:

The formula for computing yield to maturity as follows:

Here,

PV is Current price of the bond

FV is Face value of the bond

For computing Price of the bond

For computing yield to maturity:

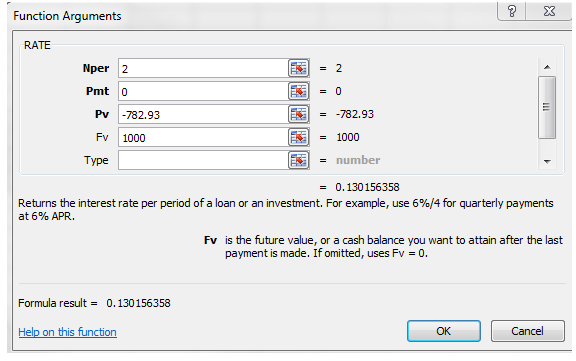

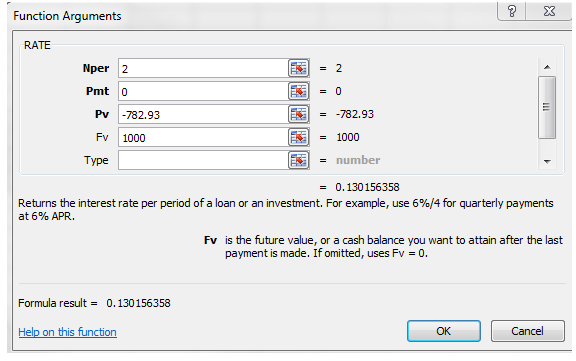

Using function in excel, effective yield is calculated.

Enter the data as shown below:

Thus, the yield to maturity of zero-coupon bond for

Explanation of Solution

The formula for computing yield to maturity as follows:

Here,

PV is Current price of the bond

FV is Face value of the bond

For computing Price of the bond

For computing yield to maturity:

Using function in excel, effective yield is calculated.

Enter the data as shown below:

Thus, the yield to maturity of zero-coupon bond for

(d)

To calculate:

The expected total

Introduction:

The expected rate of return is used to determine the total expected return on the bond for the holding period.

The yield to maturity is the rate which provides the amount of expected return on a bond held till its maturity.

Answer to Problem 40PS

The expected rate of return for two year bond is

Explanation:

The formula for computing price of the bond as follows:

For computing price of the bond with

For computing price of the bond with

Price at which the bond will sell in the next year:

The expected rate of return for two-year bond is as follows:

Thus, the expected rate of return for two-year bond is

Explanation of Solution

The formula for computing price of the bond as follows:

For computing price of the bond with

For computing price of the bond with

Price at which the bond will sell in the next year:

The expected rate of return for two-year bond is as follows:

Thus, the expected rate of return for two-year bond is

(e)

To calculate:

The expected total rate of return over the next year when purchase of a three-year zero-coupon bond on current day.

Introduction:

The expected rate of return is used to determine the total expected return on the bond for the holding period.

The yield to maturity is the rate which provides the amount of expected return on a bond held till its maturity.

Answer to Problem 40PS

The expected rate of return for three-year bond is

Explanation:

The formula for computing price of the bond as follows:

For computing price of the bond with

Price at which the bond will sell in the next year:

The expected rate of return for two-year bond is as follows:

Thus, the expected rate of return for three-year bond is

Explanation of Solution

The formula for computing price of the bond as follows:

For computing price of the bond with

Price at which the bond will sell in the next year:

The expected rate of return for two-year bond is as follows:

Thus, the expected rate of return for three-year bond is

Want to see more full solutions like this?

Chapter 10 Solutions

CONNECT WITH LEARNSMART FOR BODIE: ESSE

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education