Concept explainers

a.

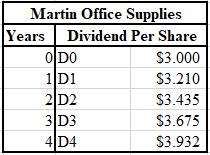

To calculate: The estimated value of dividend for Martin Office Supplies in the next four years.

Introduction:

Dividends:

It refers to the distribution of profits to the shareholders of a company and can be paid in terms of cash and stock.

a.

Answer to Problem 34P

The calculation of the next four anticipated values of dividend is shown below.

Explanation of Solution

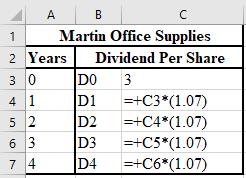

The formulae used for the calculation of the anticipated values of dividend are shown below.

b.

To calculate: The summation of the present values of the four anticipated values of dividend discounted at the rate of 14% of Martin Office Supplies.

Introduction:

Present value (PV):

The current value of an investment or an asset is termed as its PV. It is calculated by discounting the

b.

Answer to Problem 34P

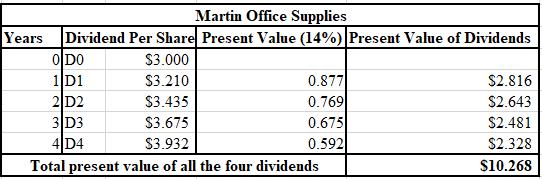

The calculation of the PV of the next four values of dividend is shown below.

Hence, the sum of the PV of the next four anticipated values of dividend is $10.268.

Explanation of Solution

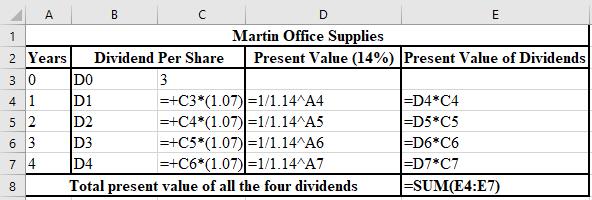

The formulae used for the calculation of the PV of the anticipated values of dividend are shown below.

c.

To calculate: The price of the stock at the end of fourth year (P4) of Martin Office Supplies.

Introduction:

Share Price:

The highest price of one share of a company that an investor is willing to pay is termed as share price. It is the current price used for the trading of such shares.

c.

Answer to Problem 34P

The price of the stock at the end of fourth year (P4) of Martin Office Supplies will be $60.10.

Explanation of Solution

Calculation of the stock price:

Working note:

Calculation of the expected dividend in the fifth year:

d.

To calculate: The PV of P4 at a discount rate of 14% for Martin Office Supplies.

Introduction:

Present value (PV):

The current value of an investment or an asset is termed as its PV. It is calculated by discounting the future value of the investment or asset.

d.

Answer to Problem 34P

The PV of P4 discounted at 14% is $35.579.

Explanation of Solution

Calculation of the present value of the stock price calculated in part (c):

e.

To calculate: The current value of the stock of Martin Office Supplies.

Introduction:

Present value (PV):

The current value of an investment or an asset is termed as its present value. It is calculated by discounting the future value of the investment or asset.

Share Price:

The highest price of one share of a company that an investor is willing to pay is termed as share price. It is the current price used for the trading of such shares.

e.

Answer to Problem 34P

The current value of the stock is $45.845.

Explanation of Solution

Calculation of the current price of stock:

f.

To calculate: The current value of the stock of Martin Office Supplies.

Introduction:

Share Price:

The highest price of one share of a company that an investor is willing to pay is termed as share price. It is the current price used for the trading of such shares.

f.

Answer to Problem 34P

The price of the stock is the same as that computed in part (e), that is, $45.857.

Explanation of Solution

Calculation of the stock price by using formula 10-8:

g.

To calculate: The current value of the stock of Trump Office Supplies if EPS is $5.32 and the P/E ratio is 1.1, which is higher than the industry average.

Introduction:

Share Price:

The highest price of one share of a company that an investor is willing to pay is termed as share price. It is the current price used for the trading of such shares.

g.

Answer to Problem 34P

The current value of the stock of Trump Office Supplies is $46.816 if EPS is $5.32 and the P/E ratio is 1.1, which is higher than the industry average.

Explanation of Solution

Calculation of the price of the stock:

Working Note:

Calculation of the P/E ratio of the firm:

h.

To calculate: The difference between the stock prices calculated in parts (g) and (f) for Martin Office Supplies.

Introduction:

Share Price:

The highest price of one share of a company that an investor is willing to pay is termed as share price. It is the current price used for the trading of such shares.

h.

Answer to Problem 34P

The dollar difference between the stock prices in parts (g) and (f) is $0.959.

Explanation of Solution

Calculation of the difference between the stock prices in parts (g) and (f):

i.

To calculate: The effect of changing variables on the stock price if dividend increases, Ke increases, and g decreases of Martin Office Supplies.

Introduction:

Share Price:

The highest price of one share of a company that an investor is willing to pay is termed as share price. It is the current price used for the trading of such shares.

i.

Answer to Problem 34P

The price of the stock will increase in the 1st and 3rd parts, and decrease in the 2nd part.

Explanation of Solution

(1) If D1 increases, the stock price will go up. The stock price and amount of dividend are positively related to one another.

(2) If the required

(3) If the growth rate (g) increases, the price of the stock will also increase. They have a positive relationship.

Want to see more full solutions like this?

Chapter 10 Solutions

FOUND.OF FINANCIAL MANAGEMENT-ACCESS

- Ten annual returns are listed in the following table (Click on the following icon in order to copy its contents into a spreadsheet.) 19.9% 18.0% 1.2% - 16.5% 45.6% 16.6% a. What is the arithmetic average return over the 10-year period? b. What is the geometric average return over the 10-year period? c. If you invested $100 at the beginning, how much would you have at the end? 50.0% 43.3% a. What is the arithmetic average return over the 10-year period? The arithmetic average return over the 10-year period is% (Round to two decimal places.) 45.2% -3.0%arrow_forwardWhen an initial amount of P dollars is invested at r% annual interest compounded n times per year, the value of the account (4) after years is given by the equation nt A=P(1 + =)** n Write an equation that represents the value in an account that starts out with an initial investment of $5000 and pays 10% interest compound monthly. Then use that equation to fill the table and use the table to graph the equation. Years (1) Value (4) 0 5 10 15 20 oo → KIarrow_forwardYou initially invest $400 in a savings account that pays a yearly interest rate of 3%. (a) Write a formula for an exponential function giving the balance in your account as a function of the time since your initial investment. (Let B be the account balance in dollars and t be the number of years since the initial investment.) 8(t)= dollars (b) What monthly interest rate best represents this account? Round your answer to three decimal places. % (c) Calculate the decade growth factor. (Round your answer to two decimal places.) (d) Use the formula you found in part (a) to determine how long it will take for the account to reach $536. (Round your answer to the nearest whole number.) yr Explain how this is consistent with your answer to part (c), At the end of one decade, there will be $ where the account reaches $536 at the end of This --Select-- o the answer found above years,arrow_forward

- Suppose that $10,000 is deposited into a saving account that earns 6% interest, compounded annually.a) Assuming that no additional deposits or withdrawals are made, use the appropriate compound interestfactors to determine how much the account will be worth:i) After 5 years;ii) After 20 years. b) Verify that your answers in part (a) are correct by constructing a table or spreadsheet that shows howthe initial deposit will grow each year over 20 years. At a minimum, your table or spreadsheet shouldinclude a row for each year and show: the amount of money in the savings account at the start of each year. the amount of interest earned each year; and the amount of money in the savings account at the end of each year, after interest is paid.Be sure to briefly explain how your table or spreadsheet verifies your results from part (a). c) Again assuming that no additional deposits or withdrawals are made, how many years will it take untilthere is at least $50,000 in the account?arrow_forwardSuppose that an investor opens an account by investing $1,000. At the beginning of each of the next four years, he deposits an additional $1,000 each year, and he then liquidates the account at the end of the total five-year period. Suppose that the yearly returns in this account, beginning in year 1, are as follows: −9 percent, 17 percent, 9 percent, 14 percent, and −4 percent. Determine what the investor’s actual dollar-weighted average return was for this five-year period. I know the calculation of Arithmetic returns is 5.40% and Geometric returns 4.90%.arrow_forwardSuppose you receive $100 at the end of each year for the next three years. a. If the interest rate is 8%, what is the present value of these cash flows? b. What is the future value in three years of the present value you computed in (a)? c. Suppose you deposit the cash flows in a bank account that pays 8% interest per year. What is the balance in the account at the end of each of the next three years (after your deposit is made)? How does the final bank balance compare with your answer in (b)? a. If the interest rate is 8%, what is the present value of these cash flows? The present value of these cash flows is $ |. (Round to the nearest cent.) b. What is the future value in three years of the present value you computed in (a)? The future value in three years is $ (Round to the nearest cent.) c. Suppose you deposit the cash flows in a bank account that pays 8% interest per year. What is the balance in the account at the end of each of the next three years (after your deposit is made)?…arrow_forward

- You invested $2m today in an account that is expected to earn 15% annually for the next five years. As a result of this investment, the account will pay you the same amount $Y per year for the next five years, after which you will have $0 in the account. At the end of year 1, what is the balance in the account after the withdrawal of the first $Y?arrow_forwardAn investment account offers a 12% annual return. If $50,000 is placed in the account for two years, by how much will the investment grow if interest is compounded (a) annually, (b) semiannually, (c) quarterly, or (d) monthly? (FV of $1, PV of $1, FVA of $1, and PVA of $1) (Use tables, Excel, or a financial calculator. Round your answers to 2 decimal places.)arrow_forwardSuppose the Omega Graphics Company wishes to set aside an equal, annual, end-of-year amount in a “sinking fund account” earning 8.5 percent per annum over the next six years. The firm wants to have $5 million in the account at the end of six years to retire (pay off ) $5 million in outstanding bonds. How much must be deposited in the account at the end of each year? Hint: Use the math formula.arrow_forward

- 3) What is the future value at the end of year 20 of a series of 16 deposits? The first deposit occurs at the end of year 5 and is $800. The remaining deposits increase by $150/year (so the last deposit will be $3,050 and will occur at the end of year 20). Assume i = 9% annual rate compounded annually. Answer 4) Your business is expected to generate a $40,000 profit at the end of year 1, and profit will increase by 7% per year through year 10. If you can earn 10% annual interest compounded annually, what is the present value of all your profits over the next 10 years? Answerarrow_forwardSuppose that you make 35 annual deposits of $2,544 in an account paying 9% APR with daily compounding. Assuming that the first deposit will occur six years from now and that each of the remaining deposit will occur exactly one year apart, how much money will be in the account 40 years from now? Round your final answer to two decimals. Don't table usearrow_forwardAssume that at the beginning of the year, you purchase an investment for $6,500 that pays $95 annual income. Also assume the investment's value has increased to $7,050 by the end of the year. a. What is the rate of return for this investment? Note: Input the amount as a positive value. Enter your answer as a percent rounded to 2 decimal places.arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education