To find: The

Introduction:

The variation between the present value of the cash outflows and the present value of the cash inflows are known as the net present value. In capital budgeting the net present value is utilized to analyze the profitability of a project or investment. The rate of return which equates the initial investment and the present value of net cash inflows are referred to as internal rate of return. This is also called as actual rate of return.

Answer to Problem 32QP

The net present value is $4,725,575.74 and the internal

Explanation of Solution

Given information:

Company A projects the unit sale for the new 7 octave voice emulation implant as follows:

- The year 1 unit sales is 84,000

- The year 2 unit sales is 98,000

- The year 3 unit sales is 113,000

- The year 4 unit sales is 106,000

- The year 5 unit sales is 79,000

The production implant needs $1,500,000 in the net working capital to begin their production activities. The extra net working capital investment for every year is equivalent to the 15% of the sales that is projected has to rise for the following year. The total fixed cost is $3,400,000 for a year, the unit price is $395, and the variable production cost is $265. The installation cost of the equipment is $17,000,000.

The equipment is qualified in the 7 Year MACRS

MACRS depreciation table for year 7:

| MACRS Depreciation table for seven year | |

| Year | Seven year |

| 1 | 14.29% |

| 2 | 24.49% |

| 3 | 17.49% |

| 4 | 12.49% |

| 5 | 8.93% |

| 6 | 8.92% |

| 7 | 8.93% |

| 8 | 4.46% |

Computation of the net present value:

Computation of the

Table showing the cash inflows:

| Year | 1 | 2 | 3 | 4 | 5 |

| Ending book value | $14,570,700 | $10,407,400 | $7,434,100 | $5,310,800 | $3,792,700 |

| Sales | $33,180,000 | $38,710,000 | $44,635,000 | $41,870,000 | $31,205,000 |

| Less: Variable costs | -$22,260,000 | -$25,970,000 | -$29,945,000 | -$28,090,000 | -$20,935,000 |

| Fixed costs | -$3,400,000 | -$3,400,000 | -$3,400,000 | -$3,400,000 | -$3,400,000 |

| Depreciation | -$2,429,300 | -$4,163,300 | -$2,973,300 | -$2,123,300 | -$1,518,100 |

| EBIT | $5,090,700 | $5,176,700 | $8,316,700 | $8,256,700 | $5,351,900 |

| Less: Taxes | -$1,781,745 | -$1,811,845 | -$2,910,845 | -$2,889,845 | -$1,873,165 |

| Net income | $3,308,955 | $3,364,855 | $5,405,855 | $5,366,855 | $3,478,735 |

| Add: Depreciation | $2,429,300 | $4,163,300 | $2,973,300 | $2,123,300 | $1,518,100 |

| Operating cash flow | $5,738,255 | $7,528,155 | $8,379,155 | $7,490,155 | $4,996,835 |

| Net cash inflows: | |||||

| Operating cash flow | $5,738,255 | $7,528,155 | $8,379,155 | $7,490,155 | $4,996,835 |

| Change in net working capital | –829,500 | –888,750 | $414,750 | $1,599,750 | $1,203,750 |

| Capital spending | $0 | $0 | $0 | $0 | $3,537,445 |

| Total cash inflows | $4,908,755 | $6,639,405 | $8,793,905 | $9,089,905 | $9,738,030 |

Computations for the above table:

Formula to calculate the ending book value:

Computation of the ending book value for year 1:

Formula to calculate the sales:

Computation of the sales:

Computation of the depreciation:

The depreciation amount is calculated by using the MACRS depreciation table for seven years.

Formula to calculate depreciation:

Computation of the depreciation:

Formula to calculate the taxes:

Computation of the taxes:

Formula to calculate the net working capital:

Computation of the net working capital:

Computation of the net working capital for the year 5:

Computation of the ending book value:

Formula to calculate the after-tax salvage value:

Computation of the after-tax salvage value:

Formula to calculate the net present value:

Computation of the net present value:

Hence, the net present value is $4,725,575.74.

Computation of the internal rate of return:

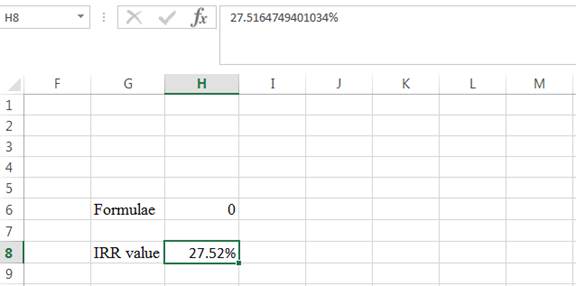

The internal rate of return is calculated by the spreadsheet method.

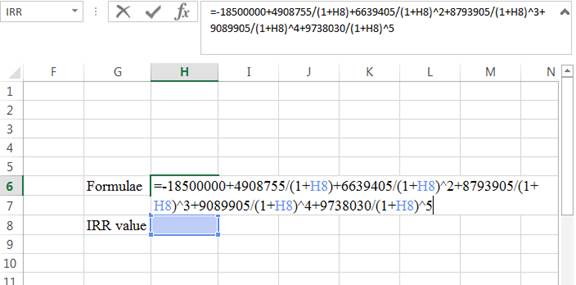

Step 1:

- Type the formulae of the internal rate of return in H6 in the spreadsheet and consider the IRR value as H8

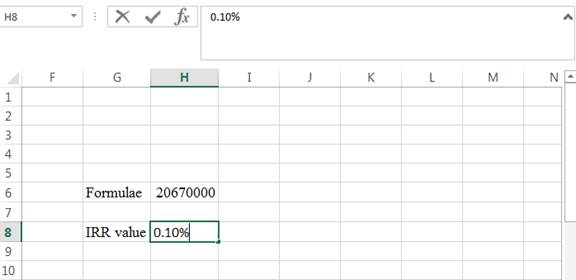

Step 2:

- Assume the IRR value as 0.10%

Step 3:

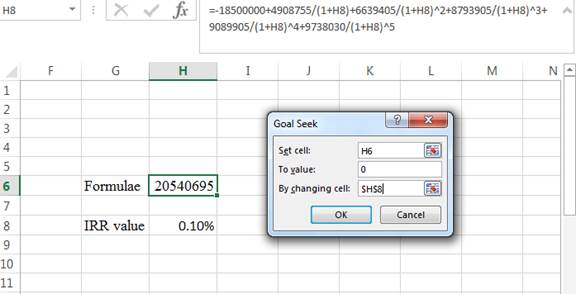

- In the spreadsheet go to data and select the what-if analysis.

- In what-if analysis select goal seek

- In set cell select H6 (the formulae)

- The To value is considered as 0

- The H8 cell is selected for the by changing cell.

Step 4:

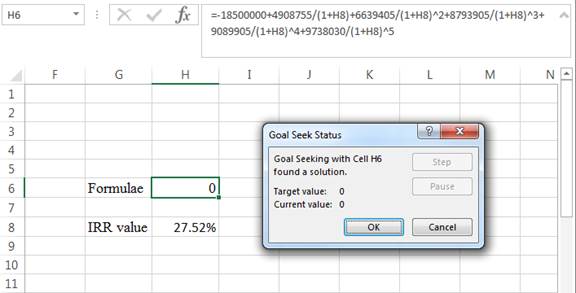

- Following the previous step click OK in the goal seek. The goal seek status appears

Step 5:

- The IRR value appears to be 27.5164749401034%

Hence, the internal rate of return is 27.52%.

Want to see more full solutions like this?

Chapter 10 Solutions

Fundamentals of Corporate Finance with Connect Access Card

- Aylmer-in-You (AIY) Inc. projects unit sales for a new opera tenor emulation implant as follows: Year Unit Sales 1 109,000 2 125,000 3 136,000 4 158,000 5 97,000 Production of the implants will require $812,000 in net working capital to start and additional net working capital investments each year equal to 20% of the projected sales increase for the following year. (Because sales are expected to fall in Year 5, there is no NWC cash flow occurring for Year 4.) Total fixed costs are $194,000 per year, variable production costs are $290 per unit, and the units are priced at $400 each. The equipment needed to begin production has an installed cost of $21.5 million. Because the implants are intended for professional singers, this equipment is considered industrial machinery and thus falls into Class 8 for tax purposes (20%). In five years, this equipment can be sold for about 25% of its acquisition cost. AIY is in the 40% marginal tax bracket and has a required…arrow_forwardAylmer-in-You (AIY) Inc. projects unit sales for a new opera tenor emulation implant as follows: Unit Sales 102,000 116,000 126,000 146,000 91,000 Year 1 2 3 4 5 Production of the implants will require $761,000 in net working capital to start and additional net working capital investments each year equal to 25% of the projected sales increase for the following year. (Because sales are expected to fall in Year 5, there is no NWC cash flow occurring for Year 4.) Total fixed costs are $178,000 per year, variable production costs are $306 per unit, and the units are priced at $360 each. The equipment needed to begin production has an installed cost of $11.0 million. Because the implants are intended for professional singers, this equipment is considered industrial machinery and thus falls into Class 8 for tax purposes (20%). In five years, this equipment can be sold for about 30% of its acquisition cost. AlY is in the 40% marginal tax bracket and has a required return on all its projects…arrow_forwardPayback Period Payson Manufacturing is considering an investment in a new automated manufacturing system. The new system requires an investment of $1,200,000 and either has: a. Even cash flows of $400,000 per year or b. The following expected annual cash flows: $150,000, $150,000, $400,000, $400,000, and $100,000. Required: Calculate the payback period for each case. Round your answer to one decimal place. a. years b. yearsarrow_forward

- Urgent need pls Your firm is considering a project with a discount rate of 12%. If you start the project today, your firm will incur an initial cost of $480 and will receive cash inflows of $320 per year for 3 years with the first cashflow occurring one year from today. If you instead wait one year to start the project, the initial cost one year from today will rise to $520 and the cash flows will increase to $375 a year for the following 3 years with the first positive cashflow occurring two years from today. Would your firm be better off starting the project now or waiting to start the project in one year? What is the VALUE of the option to wait? Explain your answer clearly, including the NPVs of the two choices.arrow_forwardGiven a project with cash outlay today of $100,000. The project is expected to generate cash flows of $25,000 per year for 7 years, starting in year 3, as well as an additional $50,000 in the final year. Given a WACC of 6%, what is the IRR? A 7.24% B 13.24% C 13.59% D 11.57% E 21.28% You are given opportunity to purchase product for $42, 000. The product will have annual operating expenses of $4,000, and a salvage value of $20,000 at the end of its useful life of 6 years. Assuming a discount rate of 9.0%, what is the minimum acceptable revenue to justify taking this project? A 1.01% B $333 C $2704 D $767 E $10704arrow_forwardRevenues generated by a new fad product are forecast as follows Year 1 - $56000 Year 2 - $40000 Year 3 - 30000 Year 4 - 20000 thereafter 0 Expenses are expected to be 50% of revenues, and the working capital required each year is expected to be 20% of revenues in the following year. the product requires an immediate investment of $60000 in plant and equipment 1. What is the initial investment in the product? remember working capital 2. If the plant and equipment are depreciated over 4 years to a salvage value of zero using straight-line depreciation and the firm's tax rate is 40% what is the project each flows in each year? assume the plant and equipment are worthless at the end of 4 years 3. If the opportunity cost of capital is 12% what is the project's NPV What is the project IRR?arrow_forward

- Payback Period Abbey Manufacturing is considering an investment in a new automated manufacturing system. The new system requires an investment of $1,200,000 and either has: a. Even cash flows of $600,000 per year or b. The following expected annual cash flows: $150,000, $150,000, $400,000, $400,000, and $100,000. Required: Calculate the payback period for each case. Round your answer to one decimal place. a. years b. yearsarrow_forwardNew-Project Analysis The Campbell Company is considering adding a robotic paint sprayer to its production line. The sprayer’s base price is $1,080,000, and it would cost another $22,500 to install it. The machine falls into the MACRS 3-year class, and it would be sold after 3 years for $605,000. The MACRS rates for the first 3 years are 0.3333, 0.4445, and 0.1481. The machine would require an increase in net working capital (inventory) of $15,500. The sprayer would not change revenues, but it is expected to save the firm $380,000 per year in before-tax operating costs, mainly labor. Campbell’s marginal tax rate is 35%. What is the Year-0 cash flow? What are the net operating cash flows in Years 1, 2, and 3? What is the additional Year-3 cash flow (i.e., the after-tax salvage and the return of working capital)? If the project’s cost of capital is 12%, should the machine be purchased?arrow_forwardRedbird Company is considering a project with an initial investment of $265,000 in new equipment that will yield annual net cash flows of $45,800 each year over its seven-year life. The companys minimum required rate of return is 8%. What is the internal rate of return? Should Redbird accept the project based on IRR?arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,