Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN: 9781337902571

Author: Eugene F. Brigham, Joel F. Houston

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 1TCL

CALCULATING 3M’S COST OF CAPITAL

Use online resources to work on this chapter’s questions. Please note that website information changes over time, and these changes may limit your ability to answer some of these questions.

In this chapter, we described how to estimate a company’s WACC, which is the weighted average of its costs of debt,

DISCUSSION QUESTIONS

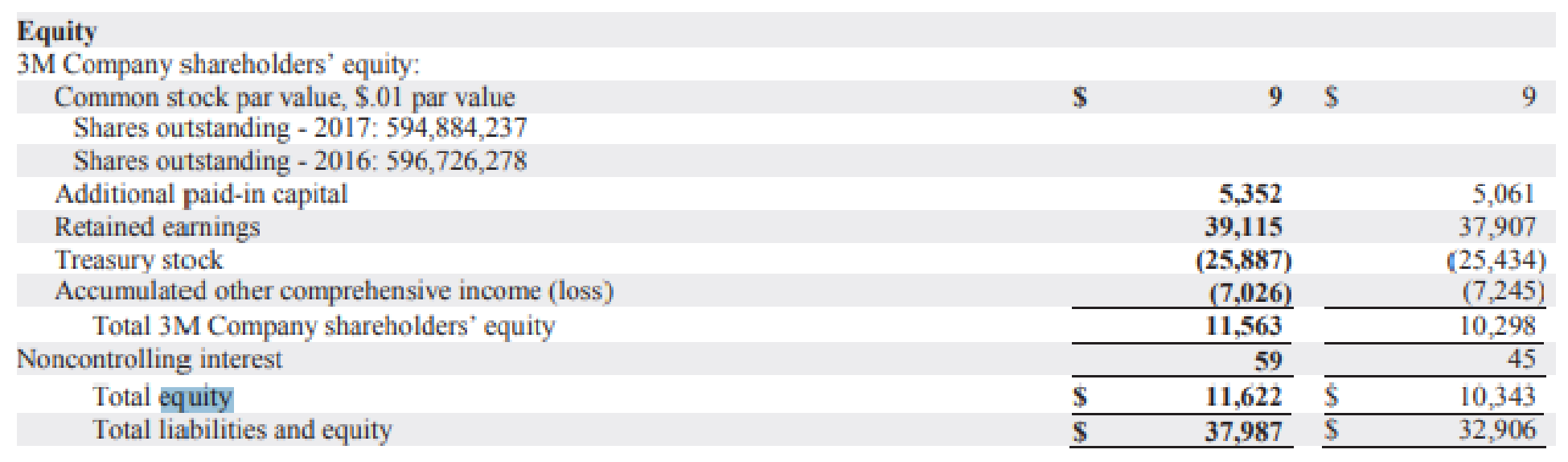

- 1. As a first step, we need to estimate what percentage of MMM’s capital comes from debt, preferred stock, and common equity This information can be found on the firm’s latest annual balance sheet. (As of year end 2017, МММ had no preferred stock.) Total debt includes all interest-bearing debt and is the sum of short-term debt and long-term debt.

- a. Recall that the weights used in the WACC are based on the company’s target capital structure. If we assume that the company wants to maintain the same mix of capital that it currently has on its balance sheet, what weights should you use to estimate the WACC for МММ?

- b. Find MMM’s market capitalization, which is the market value of its common equity. Using the sum of its short-term debt and long-term debt from the balance sheet (we assume that the market value of its debt equals its book value) and its market capitalization, recalculate the firm’s debt and common equity weights to be used in the WACC equation. These weights are approximations of market-value weights. Be sure not to include accruals in the debt calculation.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Using this link: https://massygroup.com/wp-content/uploads/2022/11/MASSY-DIGITAL-ANNUALREPORT-2022-updated.pdf answer the following questions

Working Capital Management: a) Assess the company’s working capital position by analyzing its current assets and liabilities using common methods and measures.

b) Evaluate the efficiency of the company’s working capital management strategies, including inventory management, accounts receivable, and accounts payable.

c) Based on your assessment and evaluation above, provide brief recommendations in point form for improving the company’s working capital management practices.

Corporate Finance Application Complete both parts of this assignment. You will work on some of these pieces earlier in the course when you submit the Module 3: Portfolio Milestone and the Module 5 Portfolio Milestone. Part One: Ratio Analysis Pick one debt ratio and one profitability ratio, which you did not analyze, from the week three portfolio milestone. Research a publicly traded technology company and access the financial statements needed to calculate those two ratios. Provide a cross-sectional analysis comparing the results from TechnoTCL Download TechnoTCLand your chosen company for the two ratios. Prepare a presentation (maximum of 4 slides – no speaker notes required) with the following information: Slide One: Analyze the two ratios including how the ratio is calculated and how it is used. Slide Two: Introduce the public company chosen, describe the information used for the ratios and calculate the two selected ratios. Slide Three: Show the two ratios for the two companies…

Working capital management includes which one of the following?

OA. Deciding which new projects to accept

B. Deciding whether to purchase a new machine or fix a currently owned machine

OC. Determining which customers will be granted credit

OD. Determining how many new shares of stock should be issued

OE. Establishing the target debt-equity ratio

Chapter 10 Solutions

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

Ch. 10 - Prob. 1QCh. 10 - Assume that the risk-free rate increases, but the...Ch. 10 - How should the capital structure weights used to...Ch. 10 - Suppose a firm estimates its WACC to be 10%....Ch. 10 - The WACC is a weighted average of the costs of...Ch. 10 - AFTER-TAX COST OF DEBT The Holmes Companys...Ch. 10 - COST OF PREFERRED STOCK Torch Industries can issue...Ch. 10 - COST OF COMMON EQUITY Pearson Motors has a target...Ch. 10 - COST OF EQUITY WITH AND WITHOUT FLOTATION Jarett ...Ch. 10 - PROJECT SELECTION Midwest Water Works estimates...

Ch. 10 - COST OF COMMON EQUITY The future earnings,...Ch. 10 - COST OF COMMON EQUITY WITH AND WITHOUT FLOTATION...Ch. 10 - COST OF COMMON EQUITY AND WACC Palencia Paints...Ch. 10 - WACC The Paulson Companys year-end balance sheet...Ch. 10 - WACC Olsen Outfitters Inc. believes that its...Ch. 10 - Prob. 11PCh. 10 - WACC Empire Electric Company (EEC) uses only debt...Ch. 10 - COST OF COMMON EQUITY WITH FLOTATION Banyan Co.s...Ch. 10 - Prob. 14PCh. 10 - WACC AND COST OF COMMON EQUITY Kahn Inc. has a...Ch. 10 - COST OF COMMON EQUITY The Bouchard Companys EPS...Ch. 10 - Prob. 17PCh. 10 - Prob. 18PCh. 10 - ADJUSTING COST OF CAPITAL FOR RISK Ziege Systems...Ch. 10 - WACC The following table gives Foust Companys...Ch. 10 - CALCULATING THE WACC Here is the condensed 2019...Ch. 10 - COST OF CAPITAL Coleman Technologies is...Ch. 10 - CALCULATING 3MS COST OF CAPITAL Use online...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Exploring the Capital Structures for Four Restaurant Companies Use online resources to work on this chapter's questions. Please note that website information changes over time, and these changes may limit your ability to answer some of these questions. This chapter provides an overview of the effects of leverage and describes the process that firms use to determine their optimal capital structure. The chapter also indicates that capital structures tend to vary across industries and across countries. If you are interested in explonng these differences in more detail, the Momingstar website provides information about the capital structures of each of the companies it follows. The following discussion questions demonstrate how we can use this information to evaluate the capital structures for four restaurant companies: Cheesecake Factory (CAKE), Chipotle Mexican Grill (CMG), Ruby Tuesday (RT), and Darden Restaurants Inc. (DR1). 2. Repeat this procedure for the other three companies. Do you find similar capital structures for each of the four companies? Do you find that the capital structures have moved in the same direction over the past 5 years, or have the different companies changed their capital structures in different ways over the past 5 years?arrow_forwardCALCULATING 3Ms COST OF CAPITAL In this chapter, we described how to estimate a companys WACC, which is the weighted average of its costs of debt, preferred stock, and common equity. Most of the data we need to do this can be found from various data sources on the Internet. Here we walk through the steps used to calculate Minnesota Mining Manufacturings (MMM) WACC. 3. Next, we need to calculate MMMs cost of debt. We can use different approaches to estimate it. One approach is to take the companys interest expense and divide it by total debt (which is the sum of short-term debt and long-term debt). This approach only works if the historical cost of debt equals the yield to maturity in todays market (i.e., if MMMs outstanding bonds are trading at close to par). This approach may produce misleading estimates in years in which MMM issues a significant amount of new debt. For example, if a company issues a great deal of debt at the end of the year, the full amount of debt will appear on the year-end balance sheet, yet we still may not see a sharp increase in annual interest expense because the debt was outstanding for only a small portion of the entire year. When this situation occurs, the estimated cost of debt will likely understate the true cost of debt. Another approach is to try to find this number in the notes to the companys annual report by accessing the companys home page and its Investor Relations section. Alternatively, you can go to other external sources, such as bondsonline.com, for corporate bond spreads, which can be used to find estimates of the cost of debt. Remember that you need the after-tax cost of debt to calculate a firms WACC, so you will need MMMs tax rate (which has averaged around 30% in recent years). What is your estimate of MMMs after-tax cost of debt?arrow_forwardplease help...i need it now... Enumerate at least 3 roles of accounting information system in the capital expenditure cycle. How can AIS help to effectively manage capital expenditures?arrow_forward

- I uploaded pictures for problem 17-4B. I am trying to figure out the: 11. Asset Turnover 13. Return on Stockholders Equity 14. Return on Common Stockholders Equityarrow_forwardWhich one of the following is a capital structure decision? Group of answer choices Determining the level of accounts receivables. Determining how many shares of stock to issue. Determining how much inventory to keep on hand. Deciding whether or not to purchase a new machine for the production line. Determining how much money should be kept in the checking account.arrow_forwardhow companies can get and record funding. There are three ways: from Liabilities, from issuing Stocks, or from Profitable Operations. Describe each of these three ways and indicate where on the financial statements you could find the information about each. Hint: It might be in more than one place. Give the advantages and disadvantages for each. Give an example for each and show how you would record the transaction in the accounting. Support your answers with examples and research and citearrow_forward

- how companies can get and record funding. There are three ways: from Liabilities, from issuing Stocks, or from Profitable Operations. Describe each of these three ways and indicate where on the financial statements you could find the information about each. Hint: It might be in more than one place. Give the advantages and disadvantages for each. Give an example for each and show how you would record the transaction in the accounting. research and cite your sourcearrow_forwardThe followings are the instructions for this case. Provide the excel file where the computations are done. GIVE ANSWERS PLEASE. I WILL UPVOTE! You have to use the following equation: WACC = Wd*Rd*(1-t)+We*Re. Where WACC stands for the Weighed average cost of capital, Wd is the weight of debt in the capital could be either market value weight or book value weight and it is calculated in the following way: Wd=D/(E+D), where D is either the book value of debt or the market value of debt, E is the book value of equity or the market value of equity. So keep in mind if you want Wd on book value basis, then both E and D must be on book value basis, if you want Wd on a market value basis, then both E and D must be on market value basis. Rd is the cost of debt (percentage cost of debt), t is the tax rate, We is the weight of equity in the capital could be either market value weight or book value weight, We = E/(E+D), as I explained Wd, it could be either on a book value or book value basis. Re…arrow_forwardI've found out the EVA for each one as you can see but don't know how to calculate ROC. I think it's operating income/capital charge. Anyways I wanted to ask how I would solve part B which is telling me to examine. Can you tell me what you would do for Barrow_forward

- Complete the Analyzing Stock Market Sectors exercise (Chapter 3 DA Exercise 2) before answering this question. Click on the Sector Data worksheet. Which tab on the ribbon do you use when you want to create a PivotTable? Developer Formulas Home Insert Data Viewarrow_forwardHi there, How do i calculate the IRR for each of these projects? Can you please show me in steps using a formula or financial calculator. Not using excel. Thank youarrow_forwardtor Subject Quiz - Course Hero x coursehero.com (-quiz/Finance/ Course Hero Find Browse Find study resources Ask Study Resources v Textbook Solutions Expert Tutors K Exit Test Finance Knowledge Test (10 questions) 1. Which of the following are acceptable criteria for determining the weights in the weighted average cost of capital? O Market value of the capital structure and historical costs of financing Market value of the capital structure and the target mix of debt and equity Using the after-tax cost of debt and the market value of the capital structure Using the book value of the capital structure and the prior level of debt and equity 2. When a company increases its degree of financial leverage, the equity beta of the company falls the systematic risk of the company falls the unsystematic risk of the company falls the standard deviation of returns on the equity of the company rises 3. Calculate the degree of financial leverage for a firm with EBIT of $6,000,000, fixed cost of…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781285867977

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...

Finance

ISBN:9781305635937

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

FIN 300 Lab 1 (Ryerson)- The most Important decision a Financial Manager makes (Managerial Finance); Author: AllThingsMathematics;https://www.youtube.com/watch?v=MGPGMWofQp8;License: Standard YouTube License, CC-BY

Working Capital Management Policy; Author: DevTech Finance;https://www.youtube.com/watch?v=yj-XbIabmFE;License: Standard Youtube Licence