Concept explainers

MACRS stands for modified accelerated cost recovery system. Life of the asset will be classified as per the internal revenue code.

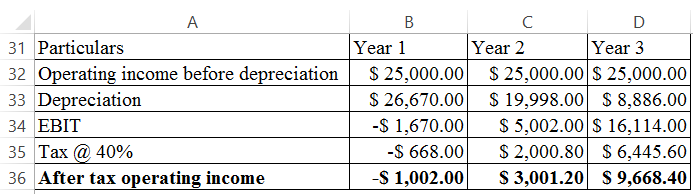

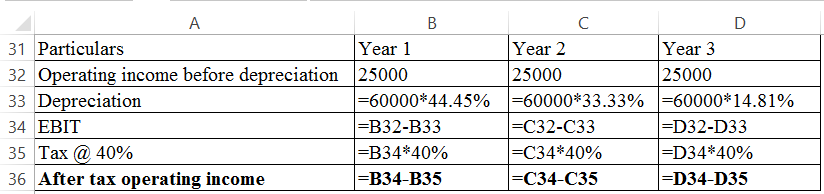

Three years MACRS rates, Year 1: 33.33%, Year 2: 44.45%, Year 3: 14.81% and Year 4: 7.41%.

CWC bought machine that is expected to generate $25,000 in operating income before depreciation expenses each year. The cost of machine is $600,000 falls under three years MACRS class.

Explanation of Solution

a.

Calculate the after tax operating income as follows:

Formulas:

b.

Calculate the operating cash flows for year 1 as follows:

Therefore, the operating cash flows in year 1 is

Calculate the operating cash flows for year 2 as follows:

Therefore, the operating cash flows in year 2 is

Want to see more full solutions like this?

- TXY Inc, recently purchased a new delivery truck. The new truck cost $25,000., and it is expected to generate net after-tax operating cash flows of $7, 500 per year. The truck has a 4-year expected life. The expected salvage values after tax adjustments for the truck are as follows. Year Annual Operating Cash Flow Salvage Value 0 25,000 25,000 17,500 19,500 2 7, 500 15,000 3 7,500 13,000 4 7,500 0 The company's cost of capital is 10%. Should the firm operate the truck until the end of its 4-year physical life? If not, then what is the optimal economic life? Make sure you show the NPV for various economic life? Please explain and use finance calculator to solvearrow_forwardThe Scampini Supplies Company recently purchased a new delivery truck. The new truck cost $22,500, and it is expected to generate net after-tax operating cash flows, including depreciation, of $6,250 per year. The truck has a 5-year expected life. The expected salvage values after tax adjustments for the truck are given below. The company's cost of capital is 10%. Year Annual Operating Salvage ValueCash Flow________________________________________________ 0 (22,500) 22,5001 6,250 17,5002 6,250 14,0003 6,250 11,0004 6,250 5,0005 6,250 0 a. Should the firm operate the truck until the end of its 5-year physical life, or, if not, what is its optimal economic life? b. Would the introduction of salvage values, in addition to operating cash flows, ever reduce the expected NPV and/or IRR of a project? Explainarrow_forwardThe Scampini Supplies Company recently purchased a new delivery truck. The new truck has an after-tax cost of $21,500, and it is expected to generate after-tax cash flows of $6,000 per year. The truck has a 5-year expected life. The expected year-end abandonment values (after-tax salvage values) for the truck are given below. The company's WACC is 11%. Year 0 1 2 3 Annual After-Tax Cash Flow ($21,500) 6,000 6,000 6,000 4 5 After-Tax Abandonment Value $17,500 15,000 13,000 7,000 0 6,000 6,000 a. What is the truck's optimal economic life? Round your answer to the nearest whole number. year(s) b. Would the introduction of abandonment values, in addition to operating cash flows, ever reduce the expected NPV and/or IRR of a project?arrow_forward

- The Scampini Supplies Company recently purchased a new delivery truck. The new truck cost $22,500, and it is expected to generate net after-tax operating cash flows, including depreciation, of $6,250 per year. The truck has a 5-year expected life. The expected salvage values after tax adjustments for the truck are given below. The company's cost of capital is 11 percent. Year Annual Operating Cash Flow Salvage Value 0 1 2 3 4 5 -$22,500 6,250 6,250 6,250 6,250 6,250 $22,500 17,500 14,000 11,000 5,000 0 a. What is the optimal number of years to operate the truck? Do not round intermediate calculations. Round your answers to the nearest whole number. years b. Would the introduction of salvage values, in addition to operating cash flows, ever reduce the expected NPV and/or IRR of a project? I. Salvage possibilities would have no effect on NPV and IRR. II. No. Salvage possibilities could only raise NPV and IRR. III. Yes. Salvage possibilities could only lower NPV and IRR. -Select-varrow_forwardBeam Company, which is planning to spend P135,000 for a new machine, to be depreciated on a straight line basis over 6 years with no salvage value. The related cash flow from operations, net of income taxes, is expected to be P25,000 a year for each of the first 3 years and P20,000 for the next 4 years. The payback period is yearsarrow_forwardThe NUBD Co. is planning to purchase a new machine. The payback period will be 6 years. The cash flow from operations, net of income taxes, will be P25,000 a year for each of the first three years of the payback period and P35,000 a year for each of the last three years of the payback period. Depreciation of P15,000 a year will be charged to income for each of the six years of the payback period. How much will the machine cost?arrow_forward

- A Company is considering a proposal of installing a drying equipment. The equipment would involve a Cash outlay of 6,00,000 and net Working Capital of 80,000. The expected life of the project is 5 years without any salvage value. Assume that the company is allowed to charge depreciation on straight-line basis for Income-tax purpose. The estimated before-tax cash inflows are given below: Year Before-tax Cash inflows ('000) 1 2 3 4 5 240 275 210 180 160 The applicable Income-tax rate to the Company is 35%. If the Company's opportunity Cost of Capital is 12%, calculate the equipment's discounted payback period, payback period, net present value and internal rate of return. The PV factors at 12%, 14% and 15% are: Year 1 2 3 4 5 PV factor at 12% 0.8929 0.7972 0.7118 0.6355 0.5674 PV factor at 14% 0.8772 0.7695 0.6750 0.5921 0.5194 PV factor at 15% 0.8696 0.7561 0.6575 0.5718 0.4972 10-22arrow_forwardFlorida Construction Equipment Rentals (FCER) purchases a new 10,000-pound-rated crane for rental to its customers. This crane costs $1,125,000 and is expected to last for 25 years, at which time it will have an expected salvage value of $147,000. FCER earns $195,000 before-tax cash flow each year in rental income from this crane, and its total taxable income each year is between $10M and $15M. If FCER uses straight-line depreciation and a MARR of 15%, what is the present worth of the after-tax cash flow for this equipment? Should the company invest in this crane?arrow_forwardWozo Ltd is to spend $60,000 on a machine which will have an economic life of ten years and no residual value. Depreciation is to be charged using the straight line method. Estimated operating cash flows are:Year 1: - 2 000Year 2: +13 000Year 3: +20 000Year 4-6: +25 000 per annumYear 7-20 +30 000 per annumRequired:Calculate the payback period and the Accounting Rate of Return (ARR); (using the initial investment base not the average investment base) (show all you calculations)arrow_forward

- Your firm, Agrico Products, is considering the purchase of a tractor that has a net cost of $72,000, will increase pretax operating cash flows before taking account of depreciation effects by $24,000 per year, and will be depreciated on a straight-line basis to $0 over five years at the rate of $14,400 per year, beginning the first year. (Annual cash flows will be $24,000 before taxes plus the tax savings that result from $14,400 of depreciation.) The board of directors is having a heated debate about whether the tractor actually will last five years. Specifically, Joan Lamm insists that she knows of some tractors have lasted only four years. Alan Grunewald agrees with Lamm, but he argues that most tractors do provide five years of service. Judy Maese says she has known some to last for as long as eight years. Given this discussion, the board asks you to prepare a scenario analysis to ascertain the importance of the uncertainty about the tractor’s life span. Assume a 40 percent…arrow_forwardA company plans to add an additional production line at an initial cost of $ 1,250,000 that will give gross savings of $ 1,000,000 per year for 6 years. The annual costs for operating this line would be $250,000 for the same period. For tax purposes the company uses sum-of-the-year-digits depreciation, a salvage value of $125,000 and a life of 6 years for evaluating the project... The debt ratio is 60% and the cost of debt is 12% and the debt obligation to be paid in 6 constant total yearly payment of interest and principal. The company’s tax rate is 40% and the minimum acceptable rate of return is 15% for total cash flows. On the basis of equity cash flows pls determine if the additional production line is viable? (Ignore investment tax credit and working capital)arrow_forwardHenerhiya Co. is planning to buy a machine costing P84,000 to be depreciated on the straight-line method basis over 10 degrees years life. The related cash flow from operations, net of income taxes, is expected to be P10,000 a year for each of the first 6 years and P12,000 for the next 4 years. It was also estimated that the salvage value of the project at the end of year 1 to be P60,000 and decreases by P5,000 each year thereafter, provided further that at the end of 10 years, the machine has no salvage value. Compute the payback bailout period in years.arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT