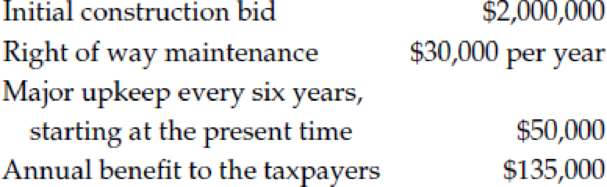

The Adams Construction Company is bidding on a project to install a large flood drainage culvert from Dandridge to a distant lake. If they bid $2,000,000 for the job, what is the benefit-cost ratio in view of the following data? The MARR is 6% per year, and the project’s life is 30 years.

Calculate the benefit cost ratio.

Explanation of Solution

Time period is denoted by n and interest rate (MARR) is denoted by i. Benefit cost ratio (BC) can be calculated as follows.

Benefit cost ratio is 0.72. Since the benefit cost ratio is less than 1, it is not acceptable 1. To make the acceptable project, the bid price need to decrease. The new maximum bid amount to accept the project (B) can be calculated as follows.

Maximum amount bid is $1,306,198.

Want to see more full solutions like this?

Chapter 10 Solutions

Engineering Economy (16th Edition) - Standalone book

- Engineering Economics Bawal gumamit ng excel( Don't use Excel) A small company has P20,000 in surplus capital that it wishes to invest in new revenue producing projects. Three independent sets of mutually exclusive projects have been developed. The useful life of each is five years and all market values are zero. You have been asked to perform an IRR analysis to select the best combination of projects. If the MARR is 12% per year, which combination of projects would you recommend?arrow_forwardUsing exactly the same information from Problem No. 1 above, calculate the Annual Worth of Project X at 8% per year interest rate. You can see the data in picture 1, please answer this problem asap. Thank you for your help.arrow_forwardA supermarket chain buys loaves of bread from its supplier at $0.50 per loaf. The chain is considering two options to bake its own bread. Neither machine has a market value at the end of seven years, and MARR is 12% per year. Use this information to answer (Select the closest answer), What is the minimum number of loaves that must be sold per year to justify installingMachine A instead of buying the loaves from the supplier? (a) 7,506 (b) 22,076 (c) 37,529 (d) 75,059 (e) 15,637.arrow_forward

- Required Information A government-funded wind-based electric power generation company In the southern part of the country has developed the following estimates (in $1000) for a new turbine farm. The MARR is 10% per year and the project life is 25 years. Benefits: $45,000 in year 0; $29,000 in year 3 Government savings: $2,000 In years 1 through 20 Cost: $52,000 in year O Disbenefits: $3000 in years 1 through 10 NOTE: This is a multi-part question. Once an answer is submitted, you will be unable to return to this part. Calculate the conventional B/C ratio. The conventional B/C ratio isarrow_forwardRequired information A government-funded wind-based electric power generation company in the southern part of the country has developed the following estimates (in $1000) for a new turbine farm. The MARR is 10% per year and the project life is 25 years. Benefits: $45,000 in year 0; $27,500 in year 3 Government savings: $2,000 in years 1 through 20 Cost: $50,000 in year O Disbenefits: $3000 in years 1 through 10 NOTE: This is a multi-part question. Once an answer is submitted, you will be unable to return to this part. Calculate the Pl value. The Pl value isarrow_forwardA government-funded wind-based electric power generation company in the southern part of the country has developed the following estimates (in $1000) for a new turbine farm. The MARR IS 10% per year and the project life is 25 years. Benefits: $45.000 in year 0, $28,000 in year 4 Government savings: $2,000 in years 1 through 20 Cost: $52.000 in year 0 Disbenefits: $3000 in years 1 through 10 NOTE: This is a multi-part question. Once an answer is submitted, you will be unable to return to this part Calculate the conventional B/C ratio. The conventional B/C ratio isarrow_forward

- Blue Whale Moving and Storage recently purchased a warehouse building in Santiago. The manager has two good options for moving palletsof stored goods in and around the facility. Alternative 1 includes a 4000-pound capacity, electric forklift (P = $-30,000; n = 12 years; AOC =$-1000 per year; S = $8000) and 500 new pallets at $10 each. The forklift operator’s annual salary and indirect benefits are estimated at $32,000.Alternative 2 uses two electric pallet movers (“walkies”) each with a 3000-pound capacity (for each mover, P = $-2000; n = 4 years; AOC = $-150 per year; no salvage) and 800 pallets at $10 each. The two operators’ salaries and benefits will total $55,000 per year. For both options, new palletsare purchased now and every two years that the equipment is in use. (a) If the MARR is 8% per year, use tabulated factors to determine which alternative is better. (b) Rework using a spreadsheet solution.arrow_forwardA drug store is looking into the possibility of installing a 24/7-automated refill system to increase its projected revenues by ₱800,000 per year over the next 5 years. Annual expenses to maintain the system are expected to be ₱200,000. The system will cost ₱2,000,000 and will have no market value at the end of the 5-year study period. The store’s MARR is 20% per year. Using the AW (annual worth) method, it can be concluded that this is not a good investment. True or False? Why?arrow_forwardBawal gumamit ng excel( Don't use Excel) A small company has P20,000 in surplus capital that it wishes to invest in new revenue producing projects. Three independent sets of mutually exclusive projects have been developed. The useful life of each is five years and all market values are zero. You have been asked to perform an IRR analysis to select the best combination of projects. If the MARR is 12% per year, which combination of projects would you recommend?arrow_forward

- Blue Whale Moving and Storage recently purchased a warehouse building in Santiago. The manager has two good options for moving pallets of stored goods in and around the facility. Alternative 1 includes a 4000-pound capacity, electric forklift (P = $-30,000; n = 12 years; AOC = $-1000 per year; S = $8000), and 500 new pallets at $10 each. The forklift operator's annual salary and indirect benefits are estimated at $32,000. Alternative 2 involves the use of two electric pallet movers ("walkies") each with a 3000-pound capacity (for each mover, P = $-2000; n = 4 years; AOC = $-150 per year; no salvage) and 800 pallets at $10 each. The two operators' salaries and benefits will total $55,000 per year. For both options, new pallets are purchased now and every 2 years that the equipment is in use. (a) If the MARR is 8% per year, select the better alternative.arrow_forwardA government-funded wind-based electric power generation company in the southern part of the country has developed the following estimates (in $1000) for a new turbine farm. The MARR is 10% per year and the project life is 25 years. Benefits: $45,000 in year 0; $30,000 in year 5 Government savings: $2,000 in years 1 through 20 Cost: $50,000 in year 0 Disbenefits: $3000 in years 1 through 10 What is the conventional B/C ratioarrow_forwardA government-funded wind-based electric power generation company in the southern part of the country has developed the following estimates (in $1000) for a new turbine farm. The MARR is 10% per year and the project life is 25 years. Benefits: $45,000 in year 0; $29,500 in year 5 Government savings: $2,000 in years 1 through 20 Cost: $58,000 in year 0 Disbenefits: $3000 in years 1 through 10 NOTE: This is a multi-part question. Once an answer is submitted, you will be unable to return to this part. Calculate the PI value. The PI value isarrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education