Accounting For Governmental & Nonprofit Entities

18th Edition

ISBN: 9781259917059

Author: RECK, Jacqueline L., Lowensohn, Suzanne L., NEELY, Daniel G.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 19EP

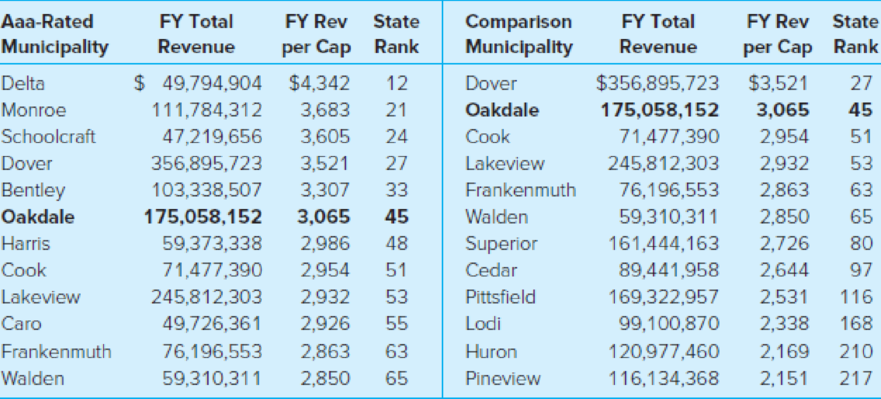

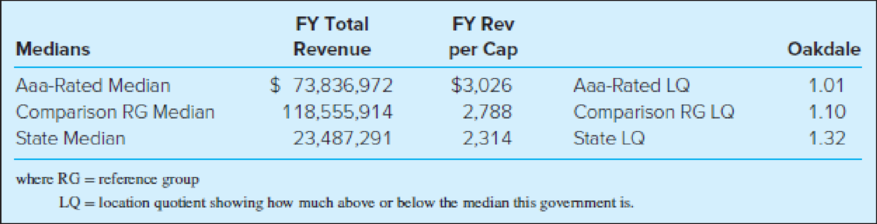

Examine the following tables from the Financial Trend Monitoring Report for the Town of Oakdale for the most recent fiscal year-end. The performance indicators selected are total revenue and revenue per capita. The town provides three reference groups with which to compare Oakdale: Aaa-rated municipalities, comparison municipalities, and the state median. Because local government budgeting in this state is driven by the property tax levy cap, this is a key variable in comparing municipalities.

Required

- a. Prepare a histogram or bar graph that shows Oakdale in relation to the three reference groups: Aaa-rated median, comparison reference group, and state median for FY total revenue and a separate graph for FY revenue per capita.

- b. Evaluate the financial performance of Oakdale for the fiscal year. Use information from the tables and the graph you prepared for part a to support your analysis.

- c. What other performance measures would you like to see before you conclude the town is in good or bad shape for the fiscal year shown?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What are the signals of the financial distress that we can look for in the Annual Comprehensive Financial Report of the County?

The dual objectives of assessing interperiod equity and ensuring budgetary compliance may necessitate different accounting practices.

A city engages in the transactions that follow. For each transaction, indicate the amount of revenue or expenditure that it should report in 2020. Assume first that the main objective of the financial statements is to enable users to assess budgetary compliance. Then calculate the amounts, assuming that the main objective is to assess interperiod equity. The city prepares its budget on a “modified” cash basis (that is, it expands the definition of cash to include short‐term marketable securities), and its fiscal year ends on December 31.

Employees earned $128,000 in salaries and wages for the last five days in December 2020. They were paid on January 5, 2021.

A consulting actuary calculated that per an accepted actuarial cost method, the city should contribute $225,000 to its firefighters' pension fund for benefits earned in 2020. However, the city…

Property taxes levied on the citizens of the Hill County would most appropriately be budgeted in which of the following budgets?

Select one :-

a.

expenditures budget

b.

Capital budget.

c.

Flexible budget.

d.

Operating budget.

Unreserved Fund Balance in Governmental entities is equal to which of the following in commercial entities:

Select one :

a.

Capital Stock

b.

Bond sinking Fund

c.

Unearned revenue

d.

Retained earnings

Chapter 10 Solutions

Accounting For Governmental & Nonprofit Entities

Ch. 10 - The GASB indicates that economic condition is...Ch. 10 - What is the Financial Trend Monitoring System and...Ch. 10 - The International City/County Management...Ch. 10 - Prob. 4QCh. 10 - Prob. 5QCh. 10 - Prob. 6QCh. 10 - Prob. 7QCh. 10 - Illustration 104, adapted front Crawford and...Ch. 10 - What is EMMA and when would someone want to use...Ch. 10 - Prob. 10Q

Ch. 10 - Prob. 11QCh. 10 - Prob. 17.1EPCh. 10 - Which of the following terms or concepts focuses...Ch. 10 - Prob. 17.3EPCh. 10 - Prob. 17.4EPCh. 10 - Prob. 17.5EPCh. 10 - Prob. 17.6EPCh. 10 - Prob. 17.7EPCh. 10 - Prob. 17.8EPCh. 10 - Prob. 17.9EPCh. 10 - Prob. 17.10EPCh. 10 - Prob. 17.11EPCh. 10 - Which of the following would be considered a sign...Ch. 10 - Prob. 17.13EPCh. 10 - Prob. 17.14EPCh. 10 - What is Electronic Municipal Market Access, or...Ch. 10 - Prob. 18EPCh. 10 - Examine the following tables from the Financial...Ch. 10 - Prob. 20EPCh. 10 - Prob. 21EP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Most cities publish their budgets and financial projects on their websites for citizens to view. Look at the local budget statements for your town of las vegas, nv or another nearby city. What did you learn by viewing these statements from your city and what do you think about your chosen city’s current financial position? Did you notice any areas where you believe there should be improvements to the budget numbers? Make sure you include a link to the financial information from your chosen city.arrow_forwardBecause of high tuition costs at state and private universities, enrollments at community colleges have increased dramatically in recent years. The following data show the enrollment for Jefferson Community College for the nine most recent years: Construct a time series plot. What type of pattern exists in the data? Use simple linear regression analysis to find the parameters for the line that minimizes MSE for this time series. What is the forecast for year 10?arrow_forwardc. Non-Financial Performance Many city and county governments are discovering that you can control only what you measure. As a result, many municipal governments are introducing non-financial performance measures to help improve municipal services. Use the Google search engine to perform a search for "municipal government performance measurement." Google will provide a list of Internet sites that outline various city efforts in using nonfinancial performance measures. a. Report on the types of measures used by one of the cities you found in your search. Provide a summary of what your research found.arrow_forward

- In the recording of a city’s budget, which one of the following accounts is debited? a. Appropriations b. Estimated Revenues c. Estimated Other Financing Uses d. Encumbrancesarrow_forwardA county has an external investment pool for cities in the county to invest excess resources. The city makes a distribution to participants in the pool-that is, the cities that have invested in the pool-in the amount of $20,000. Which account should be debited when the cash distribution is made? Select one: a. Accounts payable b. Deductions-distributions to pool participants c. Due to other governments d. Investment in pool-citiesarrow_forwardThe GASB identifies one of the broadest objectives of government financial reporting as: A. assisting users in assessing profitability of the government B. assisting users in making economic, social, and political decisions. C. fairly presenting government financial condition and operating results D. providing information about the inflows and outflows of cash 2. The 60-day limit on the period after the end of the fiscal year that is used for governmental fund revenue recognition cutoff purposes: A. is optional for property taxes, but required for most other governmental fund revenues B. must be applied to all revenue sources except charges for licenses and permits C. must be applied to property taxes, but cannot be applied to other governmental fund revenue sources D. must be applied to property taxes, but may also be applied to other revenue sourcesarrow_forward

- Question: The city of San Fernando operates on a calendar year basis. John Perez, the governor, is particularly proud of his reputation for making sure the state lives within its means. He knows that revenues in 2018 are coming in at a slower pace than anticipated, and he fears that expenditures may exceed revenues for the first time in his tenure as governor. He seeks advice from his budget director, who says: “No problem. I’ll just tell the agencies not to send invoices for utilities, travel expenses, and professional services to the comptroller during November and December for payment. Because the state uses the modified accrual basis of accounting, the comptroller won’t charge the bills to 2018.” The elected state comptroller is responsible not only for paying the bills but also for preparing financial statements in accordance with GAAP. What should the comptroller do when he learns about the budget director’s idea?arrow_forwardControl account is a summary account whose balance is equal to the total of the individual balances of its subsidiary accounts. a. True b. False In approving the budget of the City of Troy, the city council appropriated an amount less than expected revenues, what will be the result of this action a. An increase in outstanding encumbrances by the of the fiscal year b. A necessity for compensatory offsetting action in the debt service fund c. A debit to budgetary fund balance d. A credit to budgetary fund balancearrow_forwardTopic Please research an annual comprehensive financial report of any local municipality of your choice that had a general government capital construction project that was financed. Discuss the project and type of financing that the local government used, and opine on the other various financing options that the government could have used. In your opinion, did the local government use the most effective financing option? Why or why not? Note: Please provide a link to the referenced material used. This can be attached as a website link or a document (PDF/Word). Make sure to reference your source (using APA 7th edition).arrow_forward

- You have developed a self-study certification system for those who need credit hours for recertification by your state’s social welfare office. The system operates at virtually no cost, i.e., there is no marginal cost. A marketing research team has assembled the following sales information. You are researching the options for pricing the courses. Your goal is to achieve maximum revenue to establish funding to maintain and update the system to reflect annual policy changes in licensing requirements. Complete the calculations for Total Revenue by determining how many customers will purchase at each of the segment prices. Online Self Certifications for Social Work License Certification in Online Counseling Certification as a Group Home Counselor Bundle Customers TR Counseling TR Group Home TR Bundle Segment 1 1000 $190 a $70 e $260 4a Segment 2 1000 $150 b $90 f $240 4b…arrow_forwardPlease make explain each method and formula used, and please break down the steps and formula in Excel to answer each question below. Sam Strother and Shawna Tibbs are vice-presidents of Mutual of Seattle Insurance Company and co-directors of the company's pension fund management division. A major new client, the Northwestern Municipal Alliance, has requested that Mutual of Seattle present an investment seminar to the mayors of the represented cities, and Strother and Tibbs, who will make the actual presentation, have asked you to help them by answering the following questions. 1. How is the value of a bond determined? What is the value of a 10-year, $1,000 par value bond with a 10 percent annual coupon if its required rate of return is 10 percent? Does the bond sell at par? 2. What would be the value of the bond described in Part a. if, just after it had been issued, the expected inflation rate rose by 1 percentage point, causing investors to require an 11 percent return? Would we…arrow_forwardThe lead consultant in your firm has asked you to conduct this review. The following were found during your review:•The main source of funds for the Council are the grants received from the central government and levies from local businesses operating in the parish.•The Council maintains financial records and prepares financial statements annually which are subject to audit by the Office of the Auditor General.•The Council received a grant of US$25 million for the construction of ten community centers, one each in the ten communities under the control of the Council. This is part of a grant from a donor received by the Ministry. The Council as a sub- recipient signed an agreement in which it committed to adhering to the grant conditions.•The principal grant conditions were:-the maximum amount to be spent on each center is US$2 million-all ten community Centres should be completed .-Contracts to be awarded must be through competitive bidding.-The project should be completed in four…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Essentials Of Business Analytics

Statistics

ISBN:9781285187273

Author:Camm, Jeff.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

What is Business Analysis?; Author: WolvesAndFinance;https://www.youtube.com/watch?v=gG2WpW3sr6k;License: Standard Youtube License