Concept explainers

PROBLEM 10-15 Comprehensive Variance Analysis LO10-1, LO10-2, LO10-3

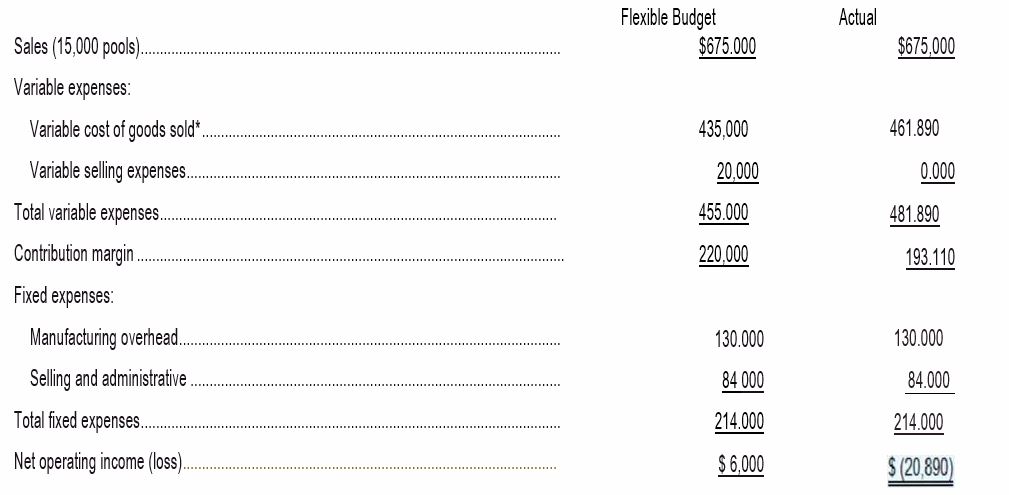

Miller Toy Company manufactures a plastic swimming pool at its Westwood Plant. The plant has been experiencing problems as shown by its June contribution format income statement below:

Flexible Budget

Actual

‘Contains direct materials, direct labor, and variable manufacturing

Janet Dunn, who has just been appointed general manager of the Westwood Plant, has been given instructions to “get things under control? Upon reviewing the plant’s income statement, Ms. Dunn has concluded that the major problem lies in the variable cost of goods sold. She has been provided with the following

| Standard Quantity or Hours | Standard Price or Rate | Standard Cost | |

| Direct materials | 3.0 pounds |

$5.00 per pound | $15.00 |

| Direct labor | 0.8 hours |

$16.00 per hour | 12.80 |

| Variable manufacturing overhead | 0.4 hours' |

$3.00 per hour | 1.20 |

| Total standard cost per unit | $29.00 |

'Based on machine-hours.

During June the plant produced 15:000 pools and incurred the following costs:

- Purchased 60:000 pounds of materials at a cost of $4.95 per pound.

- Used 49,200 pounds of materials in production. (Finished goods and work in process inventories are insignificant and can be ignored.)

- Worked 11,800 direct labor-hours at a cost of SI7.00 per hour.

- Incurred variable

manufacturing overhead cost totaling S18,290 for the month. A total of 5,900 machine-hours was recorded. It is the company’s policy to close all variances to cost of goods sold on a monthly basis.

Required:

- Compute the following variances for June: a Materials price and quantitv variances.

- Labor rate and efficiency variances.

- Variable overhead rate and efficiency variances.

- Summarize the variances that you computed in (1) above by showing the net overall fas orable or unfavorable variance for the month. What impact did this figure have on the company’s income statement9 Show computations.

- Pick out the two most significant variances that you computed in (1) above. Explain to Ms. Dunn possible causes of these variances.

Trending nowThis is a popular solution!

Chapter 10 Solutions

Managerial Accounting

- 1 Book References Problem 9-18 (Algo) Activity and Spending Variances (LO9-1, LO9-2, LO9-3) You have just been hired by FAB Corporation, the manufacturer of a revolutionary new garage door opening device. The president has asked that you review the company's costing system and "do what you can to help us get better control of our manufacturing overhead costs" You find that the company has never used a flexible budget, and you suggest that preparing such a budget would be an excellent first step in overhead planning and control. After much effort and analysis, you determined the following cost formulas and gathered the following actual cost data for March: Utilities Maintenance Supplies Indirect labor Depreciation Cost Formula $16,500 $0.12 per nachine-hour $30,000+ 81.40 per machine-hour 50.70 per machine-hour $94,100 $1.70 per machine-hour $67,800 Actual Cost in March $ 21,180 $ 66,200 $ 16,600 $ 135,800 $ 69,500 During March, the company worked 22,000 machine-hours and produced…arrow_forwardCritique a Variance Report The Terminator Inc. provides on-site residential pest extermination services. The company bas several mobile teams who are dispatched from a central location in company-owned trucks. The company uses the number of jobs to measure activity. At the beginning of April, the company budgeted for 100 jobs, but the actual number of jobs turned out to be 105. A report comparing the budgeted revenues and costs to the actual revenues and costs appears below: Required: Is the above variance report useful for evaluating how well revenues and costs were controlled during April? Why or Why not?arrow_forwardProblem 9-24 (Algo) Comprehensive Variance Analysis [LO9-4, LO9-5, LO9-6] Marvel Parts, Incorporated, manufactures auto accessories. One of the company's products is a set of seat covers that can be adjusted to fit nearly any small car. The company uses a standard cost system for all of its products. According to the standards that have been set for the seat covers, the factory should work 1,040 hours each month to produce 2,080 sets of covers. The standard costs associated with this level of production are: Direct materials Direct labor Variable manufacturing overhead (based on direct labor-hours) Direct materials (5,000 yards) Direct labor Variable manufacturing overhead During August, the factory worked only 600 direct labor-hours and produced 1,800 sets of covers. The following actual costs were recorded during the month: Total $ 40,560 $ 7,280 $ 4,160 E R Total $ 34,200 $ 6,660 $ 4,140 < Prev Per Set of Covers $19.50 3.50 At standard, each set of covers should require 2.5 yards of…arrow_forward

- Refer to Exercise 8.27. At the end of the year, Meliore, Inc., actually produced 310,000 units of the standard model and 115,000 of the deluxe model. The actual overhead costs incurred were: Required: Prepare a performance report for the period. In an attempt to improve budgeting, the controller for Meliore, Inc., has developed a flexible budget for overhead costs. Meliore, Inc., makes two types of products, the standard model and the deluxe model. Meliore expects to produce 300,000 units of the standard model and 120,000 units of the deluxe model during the coming year. The standard model requires 0.05 direct labor hour per unit, and the deluxe model requires 0.08. The controller has developed the following cost formulas for each of the four overhead items: Required: 1. Prepare an overhead budget for the expected activity level for the coming year. 2. Prepare an overhead budget that reflects production that is 10 percent higher than expected (for both products) and a budget for production that is 20 percent lower than expected.arrow_forward(Appendix) Overhead variances—four variance Mobile Manufacturing Inc. manufactures a small electric motor that is a replacement part for the more popular gas furnaces. The standard cost card shows the product requirements as follows: Factory overhead rates are based on normal 100% capacity and the following flexible budgets: The company produced 3,500 units, using 18,375 direct labor hours and incurring the following overhead costs: Required: Calculate the factory overhead: variable-spending, variable-efficiency, fixed-spending, and production-volume variances. Does the net variance represent under- or overapplied factory overhead?arrow_forwardRefer to the data in Problem 9.34. Vet-Pro, Inc., also uses two different types of direct labor in producing the anti-anxiety mixture: mixing and drum-filling labor (the completed product is placed into 50-gallon drums). For each batch of 20,000 gallons of direct materials input, the following standards have been developed for direct labor: The actual direct labor hours used for the output produced in March are also provided: Required: 1. Compute the direct labor mix and yield variances. (Round standard price of yield to four significant digits.) 2. Compute the total direct labor efficiency variance. Show that the total direct labor efficiency variance is equal to the sum of the direct labor mix and yield variances. Vet-Pro, Inc., produces a veterinary grade anti-anxiety mixture for pets with behavioral problems. Two chemical solutions, Aranol and Lendyl, are mixed and heated to produce a chemical that is sold to companies that produce the anti-anxiety pills. The mixture is produced in batches and has the following standards: During March, the following actual production information was provided: Required: 1. Compute the direct materials mix and yield variances. 2. Compute the total direct materials usage variance for Aranol and Lendyl. Show that the total direct materials usage variance is equal to the sum of the direct materials mix and yield variances.arrow_forward

- Variance interpretation Vanadium Audio Inc. is a small manufacturer of electronic musical instruments. The plant manager received the following variable factory overhead report for the past month of operations: Actual units produced: 15,000 (90% of practical capacity) The plant manager is not pleased with the 12,320 unfavorable variable factory overhead controllable variance and has come to discuss the matter with the controller. The following discussion occurred: Plant Manager: I just received this factory report for the latest month of operations. Im not very pleased with these figures. Before these numbers go to headquarters, you and I need to reach an understanding. Controller: Go ahead. Whats the problem? Plant Manager: Whats the problem? Well, everything. Look at the variance. Its too large. If I understand the accounting approach being used here, you are assuming that my costs are variable to the units produced. Thus, as the production volume declines, so should these costs. Well, I dont believe these costs are variable at all. I think they are fixed costs. As a result, when we operate below capacity, the costs really dont go down. Im being penalized for costs I have no control over. I need this report to be redone to reflect this fact. If anything, the difference between actual and budget is essentially a volume variance. Listen, I know that youre a team player. You really need to reconsider your assumptions on this one. Assume you are the controller. Write a memo responding to the plant manager.arrow_forwardCalculating factory overhead: two variances Munoz Manufacturing Co. normally produces 10,000 units of product X each month. Each unit requires 2 hours of direct labor, and factory overhead is applied on a direct labor hour basis. Fixed costs and variable costs in factory overhead at the normal capacity are 2.50 and 1.50 per direct labor hour, respectively. Cost and production data for May follow: a. Calculate the flexible-budget variance. b. Calculate the production-volume variance. c. Was the total factory overhead under- or overapplied? By what amount?arrow_forwardUchdorf Manufacturing just completed a study of its purchasing activity with the objective of improving its efficiency. The driver for the activity is number of purchase orders. The following data pertain to the activity for the most recent year: Activity supply: five purchasing agents capable of processing 2,400 orders per year (12,000 orders) Purchasing agent cost (salary): 45,600 per year Actual usage: 10,600 orders per year Value-added quantity: 7,000 orders per year Required: 1. Calculate the volume variance and explain its significance. 2. Calculate the unused capacity variance and explain its use. 3. What if the actual usage drops to 9,000 orders? What effect will this have on capacity management? What will be the level of spending reduction if the value-added standard is met?arrow_forward

- Budgeted unit sales for the entire countertop oven industry were 2,500,000 (of all model types), and actual unit sales for the industry were 2,550,000. Recall from Cornerstone Exercise 18.6 that Iliff, Inc., provided the following information: Required: 1. Calculate the market share variance (take percentages out to four significant digits). 2. Calculate the market size variance. 3. What if Iliff actually sold a total of 41,000 units (in total of the two models)? How would that affect the market share variance? The market size variance?arrow_forwardDirect labor time variance Maywood City Police uses variance analysis to monitor police staffing. The following table identifies three common police activities, the standard time to perform each activity, and their actual frequency to establish the expected cost to serve these activities. The police are paid 25 per hour. The actual amount of hours per activity for the year were as follows: A. Determine the total budgeted cost to perform the three police activities. B. Determine the total actual cost to perform the three police activities. C. Determine the direct labor time variance. D. What does the time variance suggest?arrow_forwardRefer to Cornerstone Exercise 8.13. In March, Nashler Company produced 163,200 units and had the following actual costs: Required: 1. Prepare a performance report for Nashler Company comparing actual costs with the flexible budget for actual units produced. 2. What if Nashler Companys actual direct materials cost were 1,175,040? How would that affect the variance for direct materials? The total cost variance?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub