College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 10, Problem 10SPB

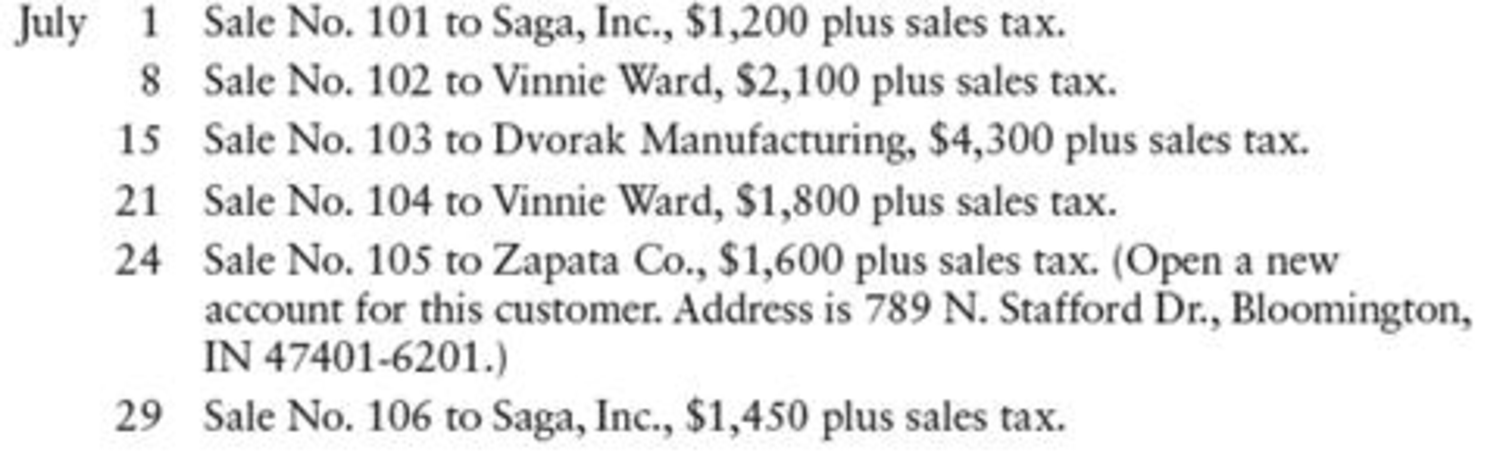

SALES TRANSACTIONS T. M. Maxwell owns a retail business and made the following sales on account during the month of July 20--. There is a 5% sales tax on all sales.

REQUIRED

- 1. Record the transactions starting on page 15 of a general journal.

- 2. Post from the journal to the general ledger and

accounts receivable ledger accounts. Use account numbers as shown in the chapter.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please given correct answer general Accounting

Hii ticher please given correct answer general Accounting

None

Chapter 10 Solutions

College Accounting, Chapters 1-27

Ch. 10 - Prob. 1TFCh. 10 - All sales, for cash or on credit, can be recorded...Ch. 10 - Sales Tax Payable is a liability account that is...Ch. 10 - Prob. 4TFCh. 10 - Prob. 5TFCh. 10 - A credit sale of 250 plus a 6% sales tax would...Ch. 10 - When 25 of merchandise is returned for a credit on...Ch. 10 - Prob. 3MCCh. 10 - Prob. 4MCCh. 10 - Prob. 5MC

Ch. 10 - Prob. 1CECh. 10 - Prepare journal entries for the following sales...Ch. 10 - Prob. 3CECh. 10 - On March 24, MS Companys Accounts Receivable...Ch. 10 - Prob. 1RQCh. 10 - What is the purpose of a credit memo?Ch. 10 - Prob. 3RQCh. 10 - Prob. 4RQCh. 10 - Prob. 5RQCh. 10 - Prob. 6RQCh. 10 - What steps are followed in posting cash receipts...Ch. 10 - What steps are followed in posting cash receipts...Ch. 10 - Prob. 9RQCh. 10 - Prob. 1SEACh. 10 - SALES TRANSACTIONS AND T ACCOUNTS Using T accounts...Ch. 10 - Prob. 3SEACh. 10 - SALES RETURNS AND ALLOWANCES ADJUSTMENT At the end...Ch. 10 - Prob. 5SEACh. 10 - JOURNALIZING SALES TRANSACTIONS Enter the...Ch. 10 - Prob. 7SEACh. 10 - JOURNALIZING CASH RECEIPTS Enter the following...Ch. 10 - SCHEDULE OF ACCOUNTS RECEIVABLE From the accounts...Ch. 10 - SALES TRANSACTIONS J. K. Bijan owns a retail...Ch. 10 - Prob. 11SPACh. 10 - SALES AND CASH RECEIPTS TRANSACTIONS Sourk...Ch. 10 - SCHEDULE OF ACCOUNTS RECEIVABLE Based on the...Ch. 10 - Prob. 1SEBCh. 10 - SALES TRANSACTIONS AND T ACCOUNTS Using T accounts...Ch. 10 - Prob. 3SEBCh. 10 - SALES RETURNS AND ALLOWANCES ADJUSTMENT At the end...Ch. 10 - Prob. 5SEBCh. 10 - JOURNALIZING SALES TRANSACTIONS Enter the...Ch. 10 - JOURNALIZING SALES RETURNS AND ALLOWANCES Enter...Ch. 10 - JOURNALIZING CASH RECEIPTS Enter the following...Ch. 10 - SCHEDULE OF ACCOUNTS RECEIVABLE From the accounts...Ch. 10 - SALES TRANSACTIONS T. M. Maxwell owns a retail...Ch. 10 - CASH RECEIPTS TRANSACTIONS Color Florists, a...Ch. 10 - SALES AND CASH RECEIPTS TRANSACTIONS Paul Jackson...Ch. 10 - SCHEDULE OF ACCOUNTS RECEIVABLE Based on the...Ch. 10 - You and your spouse have separate charge accounts...Ch. 10 - Prob. 1ECCh. 10 - Geoff and Sandy Harland own and operate Wayward...Ch. 10 - Enter the following transactions in a general...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Subject: general Accountingarrow_forwardHow much will you accumulated after 35 year?arrow_forwardOn a particular date, FedEx has a stock price of $89.27 and an EPS of $7.11. Its competitor, UPS, had an EPS of $0.38. What would be the expected price of UPS stock on this date, if estimated using the method of comparables? A) $4.77 B) $7.16 C) $9.54 D) $10.50arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:CengagePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:CengagePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY