Concept explainers

Payroll accounts and year-end entries

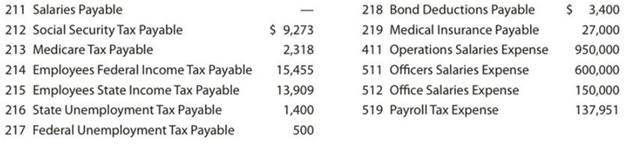

The following accounts, with the balances indicated, appear in the ledger of Garcon Co. on December 1 of the current year:

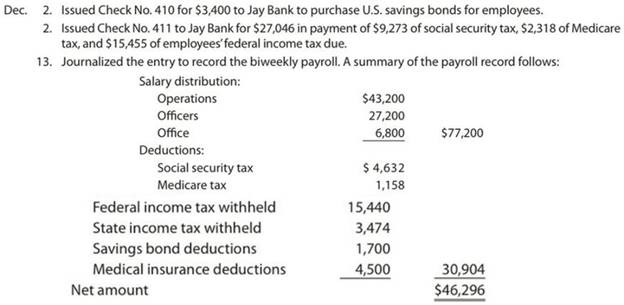

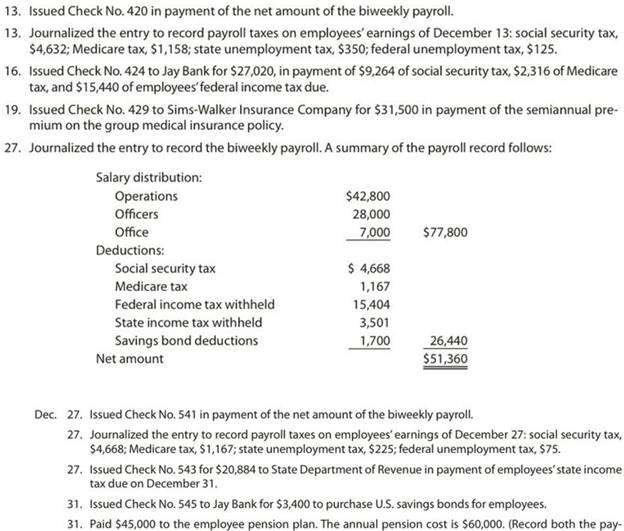

The following transactions relating to payroll, payroll deductions, and payroll taxes occurred during December:

Instructions

1. Journalize the transactions.

2. Journalize the following

A. Salaries accrued: operations salaries, $8,560; officers salaries, $5,600; office salaries, $1,400. The payroll taxes are immaterial and are not accrued.

B. Vacation pay, $15,000.

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

Financial & Managerial Accounting

Additional Business Textbook Solutions

Intermediate Accounting (2nd Edition)

Horngren's Accounting (12th Edition)

Financial Accounting, Student Value Edition (5th Edition)

Understanding Business

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Essentials of MIS (13th Edition)

- What is the tax liability that appears on the balance sheet for this year of this financial accounting question?arrow_forwardA company can sell all the units it can produce of either Product X or Product Y but not both. Product X has a unit contribution margin of $18 and takes four machine hours to make, while Product Y has a unit contribution margin of $25 and takes five machine hours to make. If there are 6,000 machine hours available to manufacture a product, income will be: A. $6,000 more if Product X is made B. $6,000 less if Product Y is made C. $6,000 less if Product X is made D. the same if either product is made. Need answerarrow_forwardWhat is the yield to maturity of the bond on these financial accounting question?arrow_forward

- Financial Accounting 5.2arrow_forwardMorgan & Co. is currently an all-equity firm with 100,000 shares of stock outstanding at a market price of $30 per share. The company's earnings before interest and taxes are $120,000. Morgan & Co. has decided to add leverage to its financial operations by issuing $750,000 of debt at an 8% interest rate. This $750,000 will be used to repurchase shares of stock. You own 2,500 shares of Morgan & Co. stock. You also loan out funds at an 8% interest rate. How many of your shares of stock in Morgan & Co. must you sell to offset the leverage that the firm is assuming? Assume that you loan out all of the funds you receive from the sale of your stock.arrow_forwardSolve this financial accounting problemarrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning