Concept explainers

Using the

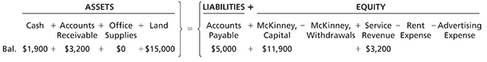

Meg McKinney opened a public relations firm called Solid Gold on August 1,2018. The following amounts summarize her business on August 31,2018:

Learning Objective 4

Cash $13,600

During September 2018, the business completed the following transactions:

a. Meg McKinney contributed $17,000 cash in exchange for capital.

b. Performed service for a client and received cash of $800.

c. Paid off the beginning balance of accounts payable.

d. Purchased office supplies from OfficeMax on account, $1,200.

e. Collected cash from a customer on account, $2,000.

f. McKinney withdrew $1,600.

g. Consulted for a new band and billed the client for services rendered, $4,500.

h. Recorded the following business expenses for the month:

Paid office rent: $1,000.

Paid advertising: $500.

Analyze the effects of the transactions on the accounting equation of Solid Gold using the format presented in Exhibit 1-5.

Want to see the full answer?

Check out a sample textbook solution

Chapter 1 Solutions

Horngren's Accounting (12th Edition)

- Zombie Corparrow_forwardWhat is the gross profit? ? Financial accounting questionarrow_forwardAs part of your Portfolio Project due in Module 8, your job is to identify new opportunities for your company. Describe the company and the products and services created by this company. Part of your employment responsibility includes completing the following two reports to support your recommendation for an international expansion: Conduct a Market Intelligence Assessment: This is a broad overview of the target country. The overview should include information about its political, legal, cultural, economic, and technological characteristics. Provide supporting statistics and indicators for each component of the macroenvironment. Conduct a Business Environment Analysis: To do so, determine key national characteristics that will affect the marketing of the product. Comment on any potential ethical implications.arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College