FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

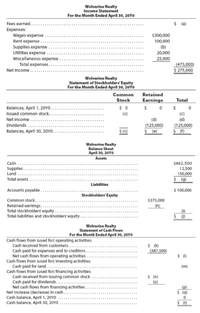

Missing amounts from financial statements

The financial statements at the end of Wolverine Realty's first month of

operations are as attached:

Instructions

By analyzing the interrelationships among the four financial statements,

determine the proper amounts for (a) through (r).

Transcribed Image Text:Wolverine Realty

Income Statement

For the Month Ended April 30, 20YO

$ (a)

Fees earned..

Expenses:

Wages expense

Rent expense...

$300,000

100,000

(b)

20,000

Supplies expense

Utilities expense

Miscellaneous expense.

Total expenses..

Net income.

25,000

_(475,000)

S 275,000

Wolverine Realty

Statement of Stockholders' Equity

For the Month Ended April 30, 20YO

Common

Stock

Retained

Earnings

Total

Balances, April 1, 20Y0..

Issued common stock..

(c)

(c)

(d)

(125,000)

$ (e)

(d)

(125,000)

Net income..

Dividends

Balances, April 30, 20Y0.

$ (c)

Wolverine Realty

Balance Sheet

April 30, 20YO

Assets

Cash

Supplies.

Land

$462,500

12,500

150,000

Total assets

$ (g)

Liabilities

Accounts payable.

$ 100,000

Stockholders' Equity

Common stock.

Retained earnings..

Total stockholders'equity

$375,000

(h)

(1)

Total labilittes and stockholders equity..

Wolverine Realty

Statement of Cash Flows

For the Month Ended April 30, 20YO

Cash flows from (used for) operating activities:

Cash received from customers...

Cash paid for expenses and to creditors.

Net cash flows from operating activities

Cash flows from (used for) Investing activities:

Cash pald for land...

Cash flows from (used for) financing activities:

Cash received from issuing common stock

Cash pald for dividends....

Net cash flows from financing activities.

Net Increase (decrease) in cash

Cash balance, April 1, 20YO

Cash balance, April 30, 20YO

$ (k)

(387,500)

(m)

$ (n)

(0)

............

(p)

$ ()

.....

....................

...............

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Rainey Enterprises loaned $35,000 to Small Company on June 1, Year 1, for one year at 8 percent interest. Required a. Record these general journal entries for Rainey Enterprises: (1) The loan to Small Company. (2) The adjusting entry at December 31, Year 1. (3) The adjusting entry and collection of the note on June 1, Year 2. b. Show the effects of the three given transactions in a horizontal statements model.arrow_forwardWeatarrow_forwardUnder accrual basis accounting, expenses are recognized when incurred, which means the activity giving rise to the expense has occurred. Required: Assume the following transactions occurred in January. For each of the transactions, if an expense is to be recognized in January, indicate the amount. a b. At the beginning of January, Turnboldt Construction Company pays $4,650 in rent for February to April C d. e Transaction Gateway pays its computer service technicians $91,000 in salary for work done in January. Answer from Gateway's standpoint f Assume that McGraw-Hill Education-publisher of this textbook-uses $1,050 worth of electricity and natural gas in January for which it has not yet been billed. Pooler Company receives and pays in January a $1,550 invoice from a consulting firm for services received in January The campus bookstore receives consulting services at a cost of $5,100. The terms indicate that payment is due within thirty days of the consultation. Schergevitch…arrow_forward

- Epping Ltd. is a listed company based in Essex County. The company prepares its financial statements as at 31 December each year. The following trial balance is for the period ending 31 December 2019: Required: Prepare the following financial statements for Epping Ltd. for the year ended 31 December 2019 in accordance with IAS 1, Preparation of Financial Statements. Show all workings. 1)A statement of comprehensive income for the year ending 31 December 2019. 2)A statement of changes in equity for the year ending 31 December 2019. 3)A statement of financial position as at 31 December 2019.arrow_forwardPlease Answer In Excel Sheet....!arrow_forwardList the two primary types of accounts found in the income statement. Provide the following information for each of the two accounts: Norm (normal) balance – debit or credit Balance at the beginning of the year Balance at the end of the year after the accounts are closedarrow_forward

- Reviewing insurance policies revealed that a single policy was purchased on August 1, for oneyear’s coverage, in the amount of $6,000. There was no previous balance in the Prepaid Insurance account atthat time. Based on the information provided:A. Make the December 31 adjusting journal entry to bring the balances to correct.B. Show the impact that these transactions had.arrow_forwardA fiscal period is any period of time covering a complete accounting cycle. A fiscal year consists of 12 consecutive months. The accounting cycle represents the sequence of steps in the accounting process completed during the fiscal period. Which of the following would be considered a fiscal year? (Select "Yes" for the items that are applicable and "No" for the items that do not apply) August 1, 20-- to November 30, 20-- January 1, 20-- to December 31, 20-- May 1, 20-- to April 30, 20-- July 1, 20-- to June 30, 20--arrow_forwardOn November 30, 2019, Davis Company and the following account balances: 1. Prepare general journal entries to record preceding transactions. 2. Post to general ledger T-accou11ts. 3. Prepare a year-end trial balance on a worksheet and complete the worksheet using the following information: (a) accrued salaries at year-end total $1,200; (b ) for simplicity, the building and equipment are being depreciated using the stright-line method over an estimated life of 20 years with no residual all c) supplies on hand at the end of the year total $630; (d ) bad debts expense for the year totals $830; and (e ) the income tax rate is 30%; income taxes are payable in the first quarter of 2020. 4. Prepare company's financial statements for 2019 . 5. Prepare 2019 (a) adjusting and (b) closing entries in the general journal.arrow_forward

- The following is a list of alphabetically arranged accounts and balances, in highly simplified form, of VILLEGAS Company for the month of July 2018. Accounts Payable P 8,000Accounts Receivable 14,000Accumulated Depreciation 2,000Cash 8,000Equipment 16,000Prepaid Insurance 4,000VILLEGAS, Capital 24,000VILLEGAS, Drawings 12,000Rent Income 46,000Supplies 8,000Unearned Rent 6,000Utility Expense 4,000Wages Expense 20,000 Required:1. Prepare a 10-column work sheet.2. Data for adjustment:a. Expired…arrow_forwardThe prepaid insurance account had a beginning balance of $3,755 and was debited for $6,755 of premiums paid during the year. Journalize the adjusting entry required at the end of the year, assuming the amount of unexpired insurance related to future periods is $2,640. Refer to the Chart of Accounts for exact wording of account titles.arrow_forwardUse the following selected accounts and amounts with normal balances from Juan Company's adjusted trial balance to prepare its classified balance sheet at December 31. Wages payable Building Cash Interest payable L. Juan, Capital $ 1,160 Accounts receivable 116,000 Accumulated depreciation-Building 20,880 Notes payable (due in 5 years) 2,320 Notes receivable (due in 14 years) 58,000 Accounts payable JUAN COMPANY Balance Sheet December 31 $ 8,120 34,800 59,160 23,200 12,760arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education