FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

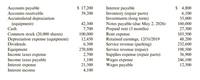

Income Statement and Balance Sheet

Ross Airport Auto Service provides parking and minor repair service at

the local airport while customers are away on business or pleasure trips,

The following account balances (except for

available for R055 Airport Auto Service at December 31, 2019.

Required:

Prepare a single-step income statement and a classified balance sheet

for the year ended December 31, 2019.

Transcribed Image Text:S 17,200

39,200

$ 4,800

6,100

35,000

Interest payable

Inventory (repair parts)

Investments (long term)

Notes payable (due May 2, 2026)

Prepaid rent (3 months)

Rent expense

Retained earnings, 12/31/2019

Service revenue (parking)

Service revenue (repair)

Supplies expense (repair parts)

Wages expense

Wages payable

Accounts payable

Accounts receivable

Accumulated depreciation

(equipment)

Cash

42,300

7,700

100,000

12,450

6,300

160,000

27,300

Common stock (20,000 shares)

Depreciation expense (equipment)

Dividends

103,500

48,200

232,600

Equipment

Income taxes expense

Income taxes payable

Interest expense

Interest income

270,800

2,700

1,100

21,300

4,100

198,500

36,900

246,100

12,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Closing entry post closing entry financial statement analysis H AND H TOOLS INC. december 2021arrow_forwardRecreational Active Club was established in 2021 to handle recreational activities for Taiping residents. The following information is related to the club: 1 Jan 2022 31 December 2022 1 Jan 31 Dec hbo Additional information: Chapter 1 Balance b/d Entrance fees Members fees: 2021 2022 2023 Contest fees Required: Prepare, Stationeries Accrual (RM) O 3,696 3,780 O Recreational Active Club Receipts and Payments Account for the year ended 31 December 2022 7,595 Stationeries 3,894 Salaries 462 Sport equipment Utilities Accrued Member Fees (RM) 16,860 663 4,686 34,160 462 546 On 1 January 2022, the club owned the following assets: Sports equipment RM9,000 Furniture RM2,970 O Office Equipment RM6,148 . Sports equipment in 1 January 2022 will be depreciated 10% per year. Utilities Payable (RM) 561 528 Rent Balance c/d 4,719 6,072 3,800 4,587 6,930 8,052 34,160 a. Income and expenditure account for the year ended 31 December 2022. b. Statement of financial position as at 31 December 2022. 17…arrow_forwardHespeler services financial accounting information for the year ending October 2019 is presented below , assume all accounts have a normal balancearrow_forward

- 22 Salaries Payable 55 Insurance Expense 23 Unearmed Fees 59 Miscellaneous Expense The post-dosing trial balance as of April 30, 2019 Required: Journalize each of the May transactions using Kelly Consulling's clhar of accounts. (Do not Insert the account rumbers in the Post. Ref. colt compound transaction, if an amount box does not require an entry, leave it blank, May 3. Receved.cash fromn clients as an advance payrment for servies to be provided and recorded it as unearned fees, s1.500. Post. Ref. 4,500 May 5: Received cash from dlients on account, $2,450. Post. Ref. Debit 2,450 May 9: Paid cash for a newspaper advertisement, $225. Post. Ref. Debit DOOdODS日 May 13: Paid Office Station Co. for part of the debt incurred on April 5, $640. Post. Ref. Debit 640 May 15: Provided services on accournt for the period May 1-15, $9,180. Description Post. Ref. Debit 9,180 9,180 May 16: Paid part-time receptionist for two weeks' salary induding the amount owed on April 30, $750. Description Post.…arrow_forwardFirst using cash accounting, and then accrual accounting, discuss what the balances of each account will be on May 31, 2019 at Hippie Hospital for the financial period below, taking into consideration the transactions listed. Then, discuss why/how you arrived at your answer for each ending account balance. Beginning account balances for May 2019: Assets = $1,400,000 Liabilities = $500,000 Net Assets = $890,900 Revenue = $25,000 Expenses = $15,900 Transaction #1 (May 4, 2019) - the hospital signed a purchase order for a $2,500 supply purchase, which will be delivered/completed in mid-June. Transaction #2 (May 15, 2019) - the hospital provided $15,000 in patient care services and billed patients' insurance plans. Transaction #3 (May 25, 2019) - the hospital took out a loan for $4,000 to meet future, unexpected payroll obligations.arrow_forwardBrothers Harry and Herman Hausyerday began operations of their machine shop (H & H Tool, Inc.) on January 1, 2016. The annual reporting period ends December 31. The trial balance on January 1, 2018, follows (the amounts are rounded to thousands of dollars to simplify): Debit Credit $ 3 Account Titles Cash Accounts Receivable Supplies Land 12 Equipment Accumulated Depreciation 52 $ 6 Sof tware 22 Accumulated Amortization 8. Accounts Payable Notes Payable (short-term) Salaries and Wages Payable Interest Payable Income Tax Payable Connon Stock 67 Retained Earnings Service Revenue Salaries and Wages Expense Depreciation Expense Armortization Expense Income Tax Expense Interest Expense Supplies Expense Totals $94 $94 Transactions and events during 2018 (summarized In thousands of dollars) follow: a. Borrowed $12 cash on March 1 using a short-term note. b. Purchased land on March 2 for future bullding site: pald cash, $9. c. Issued additional shares of common stock on April 3 for $32. d.…arrow_forward

- You are provided with the following information form the accounts of BBS Ltd for the year ending 30 June 2019Cash Sales950 000Cost of Goods Sold35 000Amount received in advance for services to be performed in August 20199 500Rent expenses for year ended 30 June 20199 000Rent Prepaid for two months to 31 August 20191 200Doubtful debts expenses1 200Amount provided in 2019 for employees’ long-service leave entitlements5 000Goodwill impairment expenses7 000Required:Calculate the taxable profit and accounting profit for the year ending 30 June 2019. my confusion : not sure if LSL will be 50%of or not?arrow_forwardSample Worksheet Work Sheet For the Month Ended January 31, 2020 Trial Balance Adjustments Adj. T/Balance Income Statement Balance Sheet Account Title Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. 13,200 22,000 5,400 29,250 22,000 5,400 Cash 20,000 b-h 3,950 29,250 22,000 a CD'S Other Securities 5,400 Loan Payable Owner' Equity 25,000 15,600 b 25,000 15,100 25,000 15,100 500 Revenue a 20,000 20,000 20,000 Interest Income Utilities expense Internet & Telephone Advertising Expense C 300 300 300 150 150 150 e 300 300 300 Rent Expense f 2,000 2,000 2,000 Supplies expense 450 450 450 Insurance expense 250 250 250 40,100 16,550 56,650 40,600 23,950 60,100 3,450 16,550 20,000 40,600 23,950 60,100 20,000 56,650 Net income 20,000 56,650 1. Cash is overstate by 500.00 and Owners Equity is overstated by $500.00. 2. Utilities Expense of $300.00 was paid on January 25. 3. Insurance expense of $250.00 was paid on January 27. 4. supplies for the month in the amount of $450.00 was purchased. 5. Rent for…arrow_forwardCurrent Attempt in Progress Cheyenne Corporation, in preparation of its December 31, 2025, financial statements, is attempting to determine the proper accounting treatment for each of the following situations. 1. 2. 3. No. 1. (a) Prepare the journal entries that should be recorded as of December 31, 2025, to recognize each of the situations above. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. List all debit entries before credit entries.) 2. As a result of uninsured accidents during the year, personal injury suits for $668,600 and $126,800 have been filed against the company. It is the judgment of Cheyenne's legal counsel that an unfavorable outcome is unlikely in the $126,800 case but that an unfavorable verdict approximating $550,000 (reliably estimated) will probably result in the $668,600 case. 3. Cheyenne owns a subsidiary in a foreign…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education