Fundamentals Of Financial Accounting

6th Edition

ISBN: 9781259864230

Author: PHILLIPS, Fred, Libby, Robert, Patricia A.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 1, Problem 4E

Completing a

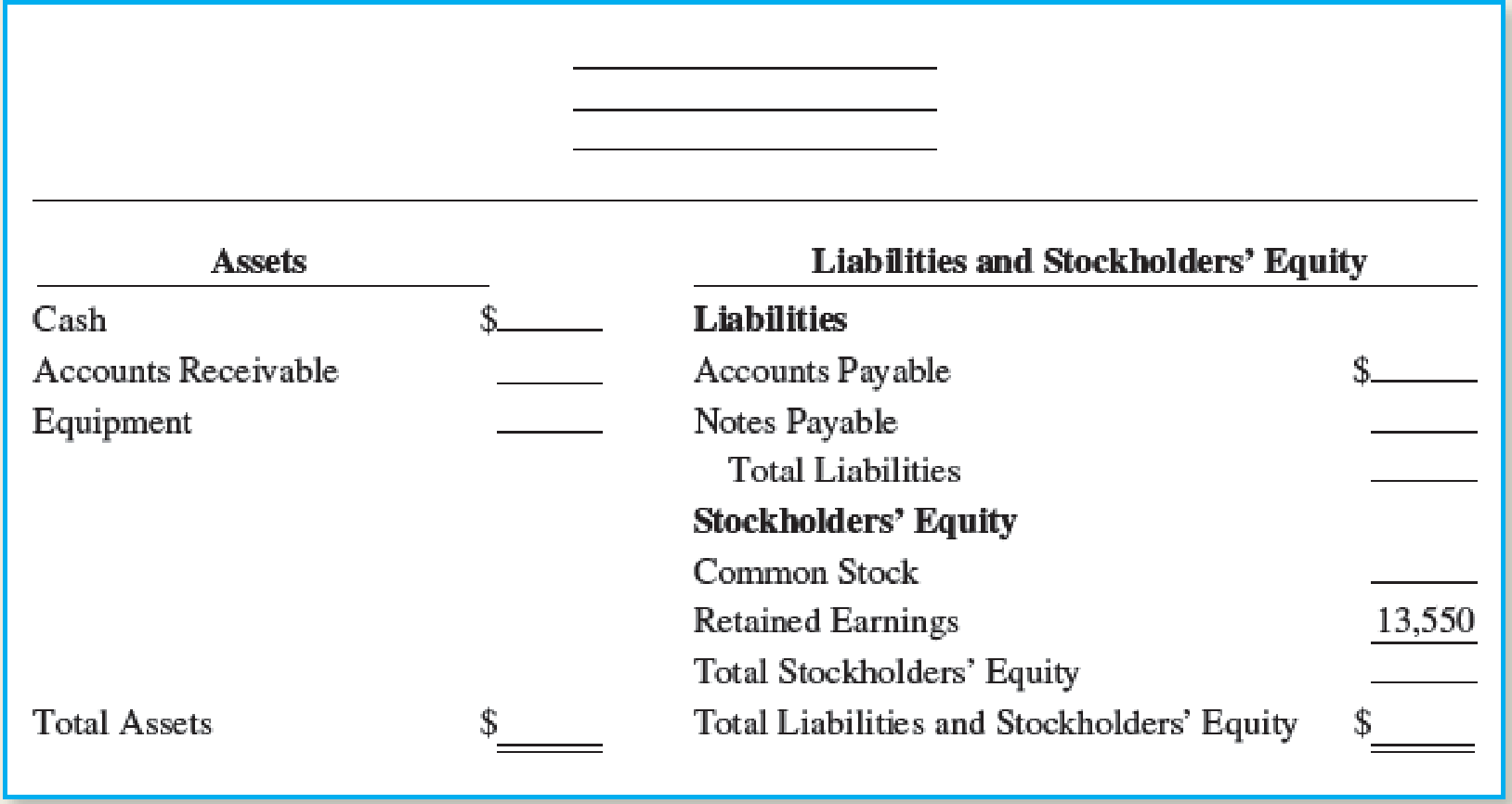

Ken Young and Kim Sherwood organized Reader Direct as a corporation; each contributed $49,000 cash to start the business and received 4,000 shares of stock. The store completed its first year of operations on December 31, 2017. On that date, the following financial items for the year were determined: cash on hand and in the bank, $47,500; amounts due from customers from sales of books, $26,900; equipment, $48,000; amounts owed to publishers for books purchased, $8,000; one-year notes payable to a local bank for $2,850. No dividends were declared or paid to the stockholders during the year.

Required:

- 1. Complete the following balance sheet at December 31, 2017.

- 2. Using the

retained earnings equation and an opening balance of $0, work backwards to compute the amount of net income for the year ended December 31, 2017. - 3. As of December 31, 2017, did most of the financing for assets come from creditors or stockholders?

- 4. Assuming that Reader Direct generates net income of $3,000 and pays dividends of $2,000 in 2018, what would be the ending Retained Earnings balance at December 31, 2018?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please provide solution this financial accounting question

Provide calculation with answer sub. General accounting

Granville Corporation has two divisions: The Beta Division and the Delta Division. The Beta Division has sales of $375,000, variable expenses of $182,500, and traceable fixed expenses of $84,200. The Delta Division has sales of $580,000, variable expenses of $312,700, and traceable fixed expenses of $128,600. The total amount of common fixed expenses not traceable to the individual divisions is $145,500. What is the company's net operating income (NOI)? Please provide answer

Chapter 1 Solutions

Fundamentals Of Financial Accounting

Ch. 1 - Define accounting.Ch. 1 - Prob. 2QCh. 1 - Briefly distinguish financial accounting from...Ch. 1 - The accounting process generates financial reports...Ch. 1 - Explain what the separate entity assumption means...Ch. 1 - List the three main types of business activities...Ch. 1 - What information should be included in the heading...Ch. 1 - What are the purposes of (a) the balance sheet,...Ch. 1 - Explain why the income statement, statement of...Ch. 1 - Briefly explain the difference between net income...

Ch. 1 - Describe the basic accounting equation that...Ch. 1 - Describe the equation that provides the structure...Ch. 1 - Describe the equation that provides the structure...Ch. 1 - Prob. 14QCh. 1 - Prob. 15QCh. 1 - Prob. 16QCh. 1 - Briefly define what an ethical dilemma is and...Ch. 1 - Prob. 18QCh. 1 - Prob. 1MCCh. 1 - Which of the following is true regarding the...Ch. 1 - Which of the following is false regarding the...Ch. 1 - Which of the following regarding retained earnings...Ch. 1 - Prob. 5MCCh. 1 - Which of the following statements regarding the...Ch. 1 - Prob. 7MCCh. 1 - Which of the following is true? a. FASB creates...Ch. 1 - Which of the following would not be a goal of...Ch. 1 - Prob. 10MCCh. 1 - Prob. 1MECh. 1 - Matching Definitions with Terms or Abbreviations...Ch. 1 - Matching Definitions with Terms Match each...Ch. 1 - Matching Financial Statement Items to Balance...Ch. 1 - Matching Financial Statement Items to Balance...Ch. 1 - Matching Financial Statement Items to Balance...Ch. 1 - Matching Financial Statement Items to Balance...Ch. 1 - Matching Financial Statement Items to the Basic...Ch. 1 - Matching Financial Statement Items to the Four...Ch. 1 - Reporting Amounts on the Statement of Cash Flows...Ch. 1 - Prob. 11MECh. 1 - Preparing a Statement of Retained Earnings Stone...Ch. 1 - Relationships among Financial Statements Items...Ch. 1 - Prob. 14MECh. 1 - Relationships among Financial Statements Items...Ch. 1 - Preparing an Income Statement, Statement of...Ch. 1 - Reporting Amounts on the Four Basic Financial...Ch. 1 - Reporting Amounts on the Four Basic Financial...Ch. 1 - Preparing a Balance Sheet DSW, Inc., is a designer...Ch. 1 - Completing a Balance Sheet and Inferring Net...Ch. 1 - Labeling and Classifying Business Transactions The...Ch. 1 - Preparing an Income Statement and Inferring...Ch. 1 - Preparing an Income Statement Home Realty,...Ch. 1 - Prob. 8ECh. 1 - Preparing an Income Statement and Balance Sheet...Ch. 1 - Analyzing and Interpreting an Income Statement...Ch. 1 - Prob. 11ECh. 1 - Matching Cash Flow Statement Items to Business...Ch. 1 - Preparing an Income Statement. Statement of...Ch. 1 - Interpreting the Financial Statements Refer to...Ch. 1 - Reporting Amounts on the Four Basic Financial...Ch. 1 - Evaluating Financial Statements Refer to CP1-3....Ch. 1 - Preparing an Income Statement, Statement of...Ch. 1 - Prob. 2PACh. 1 - Reporting Amounts on the Four Basic Financial...Ch. 1 - Evaluating Financial Statements Refer to PA1-3....Ch. 1 - Preparing an Income Statement and Balance Sheet...Ch. 1 - Interpreting the Financial Statements Refer to PB...Ch. 1 - Reporting Amounts on the Four Basic Financial...Ch. 1 - Evaluating Financial Statements Refer to PB1-3....Ch. 1 - Finding Financial Information Answer the following...Ch. 1 - Comparing Financial Information Refer to the...Ch. 1 - Prob. 5SDCCh. 1 - Prob. 6SDCCh. 1 - Prob. 1CC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

IAS 29 Financial Reporting in Hyperinflationary Economies: Summary 2021; Author: Silvia of CPDbox;https://www.youtube.com/watch?v=55luVuTYLY8;License: Standard Youtube License