FUND.OF COST ACCT >CUSTOM<

6th Edition

ISBN: 9781307515565

Author: LANEN

Publisher: MCG/CREATE

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 45P

Cost Data for Managerial Purposes

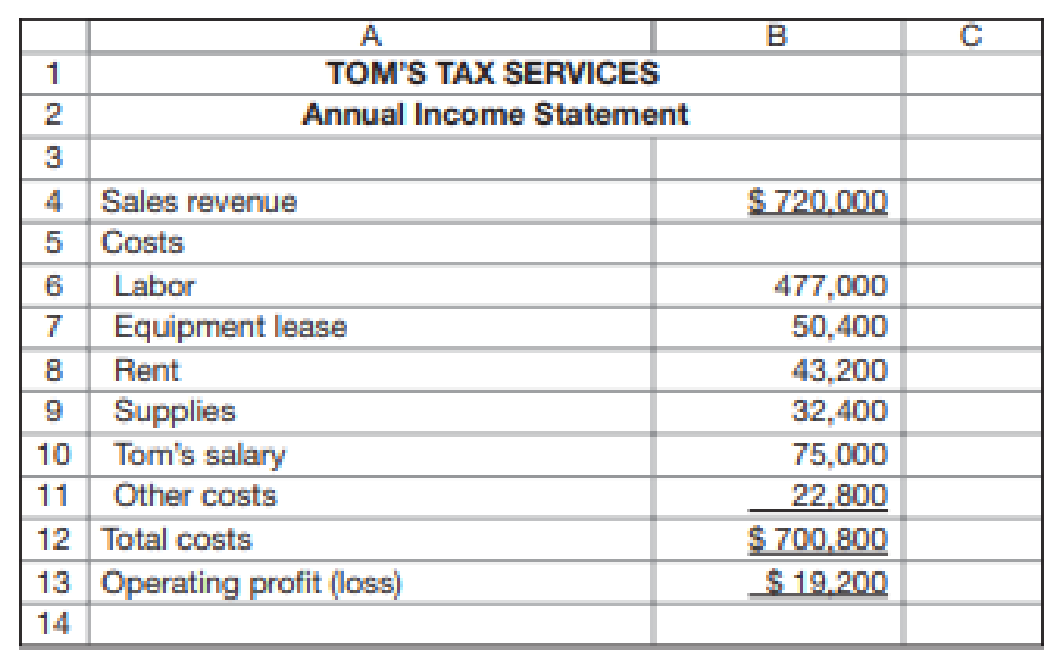

Tom’s Tax Services is a small accounting firm that offers tax services to small businesses and individuals. A local store owner has approached Tom about doing his taxes but is concerned about the fees Tom normally charges. The costs and revenues at Tom’s Tax Services follow.

If Tom gets the store’s business, he will incur an additional $60,000 in labor costs. Tom also estimates that he will have to increase equipment leases by about 10 percent, supplies by 5 percent, and other costs by 15 percent.

Required

- a. What are the differential costs that would be incurred as a result of adding this new client?

- b. Tom would normally charge about $75,000 in fees for the services the store would require. How much could he offer to charge and still not lose money on this client?

- c. What considerations, other than costs, are necessary before making this decision?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Jace and Associates provides professional consulting services to a variety of clientele in an effort to help them improve the operating

effectiveness and profitability of their businesses. At the start of the year, budgeted MOH costs were $250,000; budgeted direct labor

hours, its allocation base, were 100,000. The company is considering doing work for a new client that is estimated to take around 45

hours.

How much should Jace bid on this job if the company incurs a direct labor rate of $30/hour and charges a 60% mark-up above job

costs? (Round answer to 2 decimal places, e.g. 5,275.25.)

Bid price

$

Tom’s Tax Services is a small accounting firm that offers tax services to small businesses and individuals. A local store owner has approached Tom about doing his taxes but is concerned about the fees Tom normally charges. The costs and revenues at Tom’s Tax Services follow:

Tom’s Tax Services

Annual Income Statement

Sales Revenue 724,000

Costs

Labor 457,000

Equipment Lease 48,000

Rent 42,500

Supplies 31,300

Tom’s Salary 73,800

Other Costs 21,400

Total Costs 674,900

Operating Profit (Loss) 49,100

If Tom gets the store’s business, he will incur an additional $59,200 in labor costs. Tom also estimates that he will have to increase equipment leases by about 5 percent, supplies by 5 percent, and other costs by 15 percent.

Required:

What are the differential costs that would be incurred as…

Hannah Ortega is considering expanding her business. She plans to hire a salesperson to cover trade shows. Because of

compensation, travel expenses, and booth rental, fixed costs for a trade show are expected to be $10,780. The booth will be

open 22 hours during the trade show. Ms. Ortega also plans to add a new product line, ProOffice, which will cost $180 per

package. She will continue to sell the existing product, EZRecords, which costs $94 per package. Ms. Ortega believes that

the salesperson will spend approximately 12 hours selling EZRecords and 10 hours marketing ProOffice.

Required

a. Determine the estimated total cost and cost per unit of each product, assuming that the salesperson is able to sell 78

units of EZRecords and 59 units of ProOffice.

b. Determine the estimated total cost and cost per unit of each product, assuming that the salesperson is able to sell 205

units of EZRecords and 110 units of ProOffice.

Note: For all requirements, round "Cost per unit" to 2 decimal…

Chapter 1 Solutions

FUND.OF COST ACCT >CUSTOM<

Ch. 1 - Explain why it is important to consider the...Ch. 1 - Explain the differences between financial...Ch. 1 - Place the letter of the appropriate accounting...Ch. 1 - Distinguish among the value chain, the supply...Ch. 1 - Who are the customers of cost accounting?Ch. 1 - How can cost accounting information together with...Ch. 1 - Prob. 7RQCh. 1 - Does the passage of Sarbanes-Oxley mean that codes...Ch. 1 - Prob. 9CADQCh. 1 - Prob. 10CADQ

Ch. 1 - Prob. 11CADQCh. 1 - Its not the job of accounting to determine...Ch. 1 - Prob. 13CADQCh. 1 - How would cost accounting information help...Ch. 1 - Airlines are well known for using complex pricing...Ch. 1 - Hostess Brands makes a variety of baked goods just...Ch. 1 - What potential conflicts might arise between...Ch. 1 - Refer to the Business Application discussion of...Ch. 1 - Prob. 19CADQCh. 1 - Why does a cost accountant need to be familiar...Ch. 1 - Will studying cost accounting increase the chances...Ch. 1 - Prob. 22CADQCh. 1 - Value Chain and Classification of Costs Apple...Ch. 1 - Pfizer Inc., a pharmaceutical firm, incurs many...Ch. 1 - Tesla, Inc., incurs many types of costs in its...Ch. 1 - Prob. 26ECh. 1 - Accounting Systems McDonalds is a major company in...Ch. 1 - Accounting Systems Ford Motor Company manufactures...Ch. 1 - Cost Data for Managerial Purposes As an analyst at...Ch. 1 - Prob. 30ECh. 1 - Prob. 31ECh. 1 - Refer to the information in Exercise 1-31. The...Ch. 1 - Refer to Exhibit 1.5, which shows budgeted versus...Ch. 1 - Trends in Cost Accounting Required For each cost...Ch. 1 - Prob. 35ECh. 1 - Prob. 36ECh. 1 - Refer to the information in Exercise 1-32. Jon...Ch. 1 - Prob. 38PCh. 1 - Cost Data for Managerial Purposes Imperial Devices...Ch. 1 - Cost Data for Managerial Purposes You have been...Ch. 1 - Prob. 41PCh. 1 - Cost Data for Managerial Purposes Campus Package...Ch. 1 - Cost Data for Managerial Purposes KC Services...Ch. 1 - Cost Data for Managerial Purposes B-You is a...Ch. 1 - Cost Data for Managerial Purposes Toms Tax...Ch. 1 - Gilman’s Café is a popular restaurant in a local...Ch. 1 - Prob. 47PCh. 1 - Prob. 48PCh. 1 - Refer to Exhibit 1.5, which shows budgeted versus...Ch. 1 - Cost Data for Managerial PurposesFinding Unknowns...Ch. 1 - Prob. 51PCh. 1 - Prob. 52PCh. 1 - Prob. 53ICCh. 1 - Miller Cereals is a small milling company that...Ch. 1 - Before Miller Cereals can introduce the new...Ch. 1 - The following story is true except that all names...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Variety Artisans has a bottleneck in their production that occurs within the engraving department. Arjun Naipul, the COO, is considering hiring an extra worker, whose salary will be $45,000 per year, to solve the problem. With this extra worker, the company could produce and sell 3,500 more units per year. Currently, the selling price per unit is $18 and the cost per unit is $5.85. Using the information provided, calculate the annual financial impact of hiring the extra worker.arrow_forwardAt Stardust Gems, a faux gem and jewelry company, the setting department is a bottleneck. The company is considering hiring an extra worker, whose salary will be $67,000 per year, to ease the problem. Using the extra worker, the company will be able to produce and sell 9,000 more units per year. The selling price per unit is $20. The cost per unit currently is $15.85 as shown: What is the annual financial impact of hiring the extra worker for the bottleneck process?arrow_forwardHannah Ortega is considering expanding her business. She plans to hire a salesperson to cover trade shows. Because of compensation, travel expenses, and booth rental, fixed costs for a trade show are expected to be $12,690. The booth will be open 27 hours during the trade show. Ms. Ortega also plans to add a new product line, ProOffice, which will cost $180 per package. She will continue to sell the existing product, EZRecords, which costs $103 per package. Ms. Ortega believes that the salesperson will spend approximately 17 hours selling EZRecords and 10 hours marketing ProOffice. Required a. Determine the estimated total cost and cost per unit of each product, assuming that the salesperson is able to sell 72 units of EZRecords and 45 units of ProOffice. b. Determine the estimated total cost and cost per unit of each product, assuming that the salesperson is able to sell 202 units of EZRecords and 101 units of ProOffice. Note: For all requirements, round "Cost per unit" to 2 decimal…arrow_forward

- Hannah Ortega is considering expanding her business. She plans to hire a salesperson to cover trade shows. Because of compensation, travel expenses, and booth rental, fixed costs for a trade show are expected to be $10,660. The booth will be open 26 hours during the trade show. Ms. Ortega also plans to add a new product line, ProOffice, which will cost $190 per package. She will continue to sell the existing product, EZRecords, which costs $103 per package. Ms. Ortega believes that the salesperson will spend approximately 16 hours selling EZRecords and 10 hours marketing ProOffice. Required a. Determine the estimated total cost and cost per unit of each product, assuming that the salesperson is able to sell 73 units of EZRecords and 59 units of ProOffice.arrow_forwardThe sales manager is deciding between two possible compensation structures for sales staff. Under one plan, salespeople would receive a base compensation of $80,000 per year plus a 1% commission on all sales to their customers. Under the other plan, the base compensation would drop to $40,000 per year, but the commission rate would increase to 5%. What are the advantages and disadvantages, to the company of both plans? As the accounting manager, would you have a preference? Why or why not? (answer in text form please (without image), Note: .Every entry should have narration please)arrow_forwardSuppose that you have been given a summer job as an intern at Issac Aircams, a company that man- ufactures sophisticated spy cameras for remote-controlled military reconnaissance aircraft. The company, which is privately owned, has approached a bank for a loan to help it finance its growth. The bank requires financial statements before approving such a loan. You have been asked to help prepare the financial statements and were given the following list of costs: Depreciation on salespersons’ cars. Rent on equipment used in the factory. Lubricants used for machine maintenance. Salaries of personnel who work in the finished goods warehouse. Soap and paper towels used by factory workers at the end of a shift. Factory supervisors’ salaries. Heat, water, and power consumed in the factory. Materials used for boxing products for shipment overseas. (Units are not normally boxed.) Advertising costs. Workers’ compensation insurance for factory employees. Depreciation on…arrow_forward

- Check my work Gallatin Carpet Cleaning is a small, family-owned business operating out of Bozeman, Montana. For its services, the company has always charged a flat fee per hundred square feet of carpet cleaned. The current fee is $23.60 per hundred square feet. However, there is some question about whether the company is actually making any money on jobs for some customers-particularly those located on remote ranches that require considerable travel time. The owner's daughter, home for the summer from college, has suggested investigating this question using activity-based costing. After some discussion, she designed a simple system consisting of four activity cost pools. The activity cost pools and their activity measures appear below: Activity Cost Pool Cleaning carpets Travel to jobs Job support Other (organization-sustaining costs and idle capacity costs) Activity Measure Square feet cleaned (00s) Activity for the Year 14, 500 hundred square feet Miles driven 308,000 miles Number of…arrow_forwardList the types of costs incurred when employees are laid off. What costs are difficult to estimate in monetary terms? Suppose that a firm is facing a downturn in business, each employee has skills valued at $40,000 per year, and it costs $100,000 to lay off an employee. If business is expected to improve in one year, are layoffs financially justified? What is the “payback” period for the layoff decision?arrow_forwardGallatin Carpet Cleaning is a small, family-owned business operating out of Bozeman, Montana. For its services, the company has always charged a flat fee per hundred square feet of carpet cleaned. The current fee is $23.45 per hundred square feet. However, there is some question about whether the company is actually making any money on jobs for some customers—particularly those located on remote ranches that require considerable travel time. The owner’s daughter, home for the summer from college, has suggested investigating this question using activity-based costing. After some discussion, she designed a simple system consisting of four activity cost pools. The activity cost pools and their activity measures appear below: Activity Cost Pool Activity Measure Activity for the Year Cleaning carpets Square feet cleaned (00s) 12,000 hundred square feet Travel to jobs Miles driven 404,000 miles Job support Number of jobs 2,000 jobs Other (organization-sustaining costs and idle…arrow_forward

- Gallatin Carpet Cleaning is a small, family-owned business operating out of Bozeman, Montana. For its services, the company has always charged a flat fee per hundred square feet of carpet cleaned. The current fee is $23.45 per hundred square feet. However, there is some question about whether the company is actually making any money on jobs for some customers—particularly those located on remote ranches that require considerable travel time. The owner’s daughter, home for the summer from college, has suggested investigating this question using activity-based costing. After some discussion, she designed a simple system consisting of four activity cost pools. The activity cost pools and their activity measures appear below: Activity Cost Pool Activity Measure Activity for the Year Cleaning carpets Square feet cleaned (00s) 12,000 hundred square feet Travel to jobs Miles driven 404,000 miles Job support Number of jobs 2,000 jobs Other (organization-sustaining costs and idle…arrow_forwardGallatin Carpet Cleaning is a small, family-owned business operating out of Bozeman, Montana. For its services, the company has always charged a flat fee per hundred square feet of carpet cleaned. The current fee is $23.10 per hundred square feet. However, there is some question about whether the company is actually making any money on jobs for some customers—particularly those located on remote ranches that require considerable travel time. The owner’s daughter, home for the summer from college, has suggested investigating this question using activity-based costing. After some discussion, she designed a simple system consisting of four activity cost pools. The activity cost pools and their activity measures appear below: Activity Cost Pool Activity Measure Activity for the Year Cleaning carpets Square feet cleaned (00s) 8,000 hundred square feet Travel to jobs Miles driven 131,500 miles Job support Number of jobs 2,100 jobs Other (organization-sustaining costs and idle…arrow_forwardGallatin Carpet Cleaning is a small, family-owned business operating out of Bozeman, Montana. For its services, the company has always charged a flat fee per hundred square feet of carpet cleaned. The current fee is $22.30 per hundred square feet. However, there is some question about whether the company is actually making any money on jobs for some customers—particularly those located on remote ranches that require considerable travel time. The owner’s daughter, home for the summer from college, has suggested investigating this question using activity-based costing. After some discussion, she designed a simple system consisting of four activity cost pools. The activity cost pools and their activity measures appear below: Activity Cost Pool Activity Measure Activity for the Year Cleaning carpets Square feet cleaned (00s) 9,500 hundred square feet Travel to jobs Miles driven 292,000 miles Job support Number of jobs 2,000 jobs Other (organization-sustaining costs and idle…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY